Banks send you various reports on your money and debts every month or quarter, such as bank and credit card statements, and asset reports. This can be a lot to manage for the average person and business owners without accounting backgrounds.

In this blog, we’ll simplify by focusing on bank statements vs credit card statements, explaining their purposes, differences, and how they can help you make better financial decisions.

Make smarter accounting decisions with AI – Download our eBook today!

Key Takeaways:

- Bank Statements: Monthly summaries tracking deposits, withdrawals, fees, and interest, essential for monitoring account accuracy and preventing unauthorized use.

- Credit Card Statements: Detail monthly spending, payments, fees, and interest charges, highlighting owed amounts, due dates, and minimum payments to manage credit effectively.

- Differences: Bank statements focus on account transactions and balance, while credit card statements detail purchases, payments, and credit management, with credit cards often offering rewards.

- Reconciliation Importance: Regular review of statements ensures accuracy, detects unauthorized transactions, and verifies charges and payments, aiding in financial management and planning.

- Purpose and Utility: Both types of statements are critical for financial oversight, with bank statements aiding in everyday money management and credit card statements in credit usage and rewards maximization.

What is a Bank Statement?

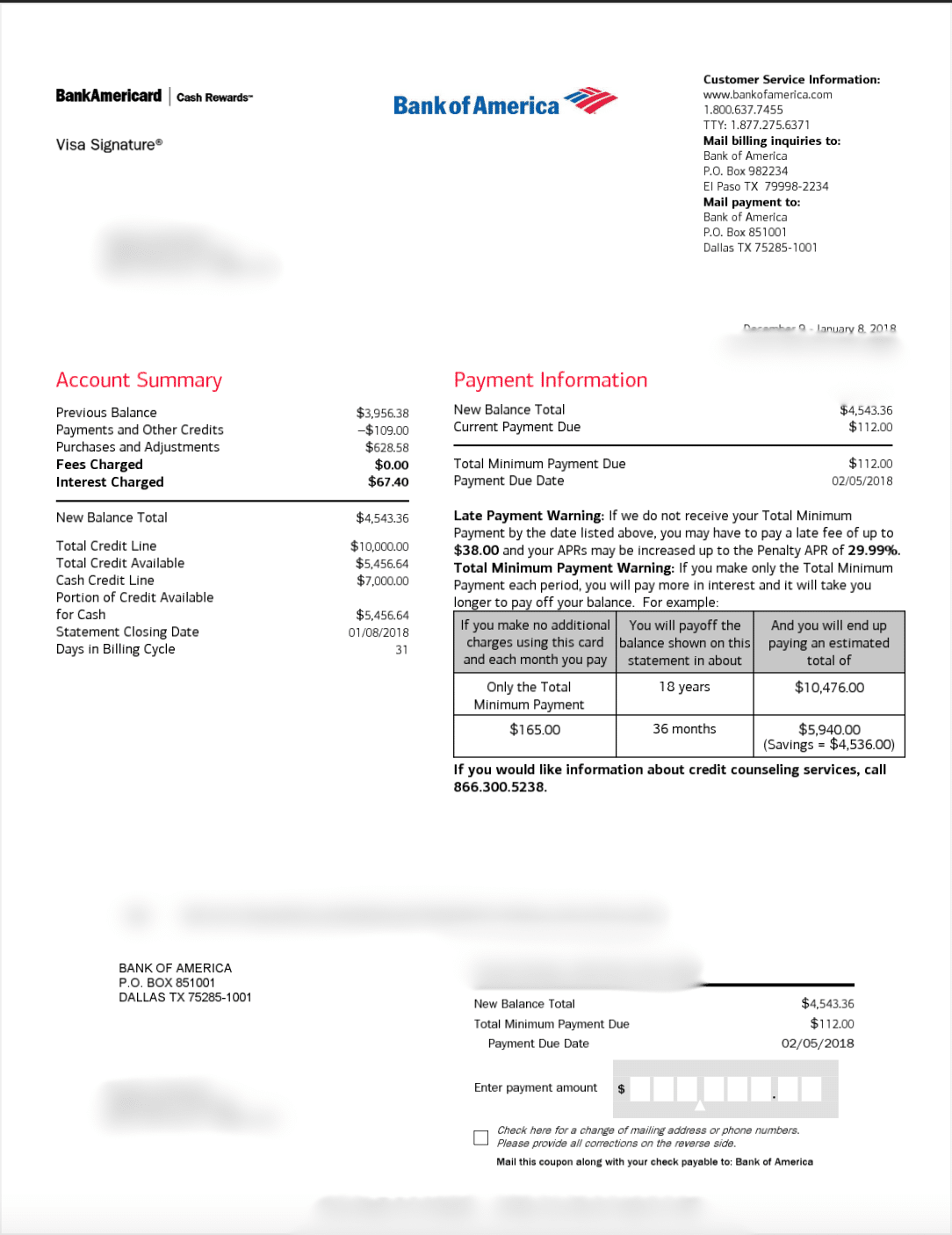

A bank statement is essentially a monthly summary from your bank that tracks every transaction in your account. This includes every time you deposit money, withdraw cash, or any fees the bank might have charged you, as well as any interest you’ve earned on your balance.

Think of it as a monthly check-up for your bank account, showing you how much money you started with, what was added or taken away, and what you ended up with at the end of the month.

It’s a useful tool to make sure all the bank transactions are correct and that no one else has been using your account without your knowledge.

What is a Credit Card Statement?

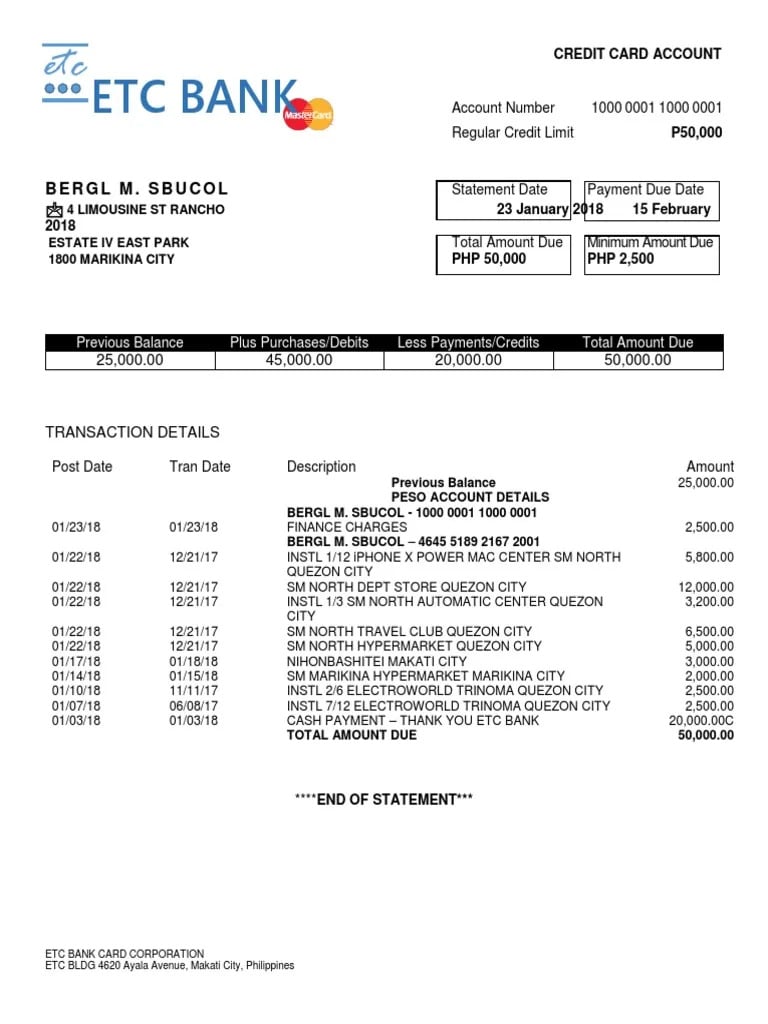

A credit card statement is a detailed note you receive from your credit card issuer every month, listing all the purchases you’ve made with your card. It also includes any payments you’ve made towards your credit card bill, along with any fees or interest charges if you carry a balance.

This statement tells you exactly how much you owe, the minimum payment required, and when you need to pay it to avoid late fees.

It’s a handy way to keep an eye on your spending, make sure you’re not being charged for things you didn’t buy, and help you plan your finances by knowing how much you need to pay off.

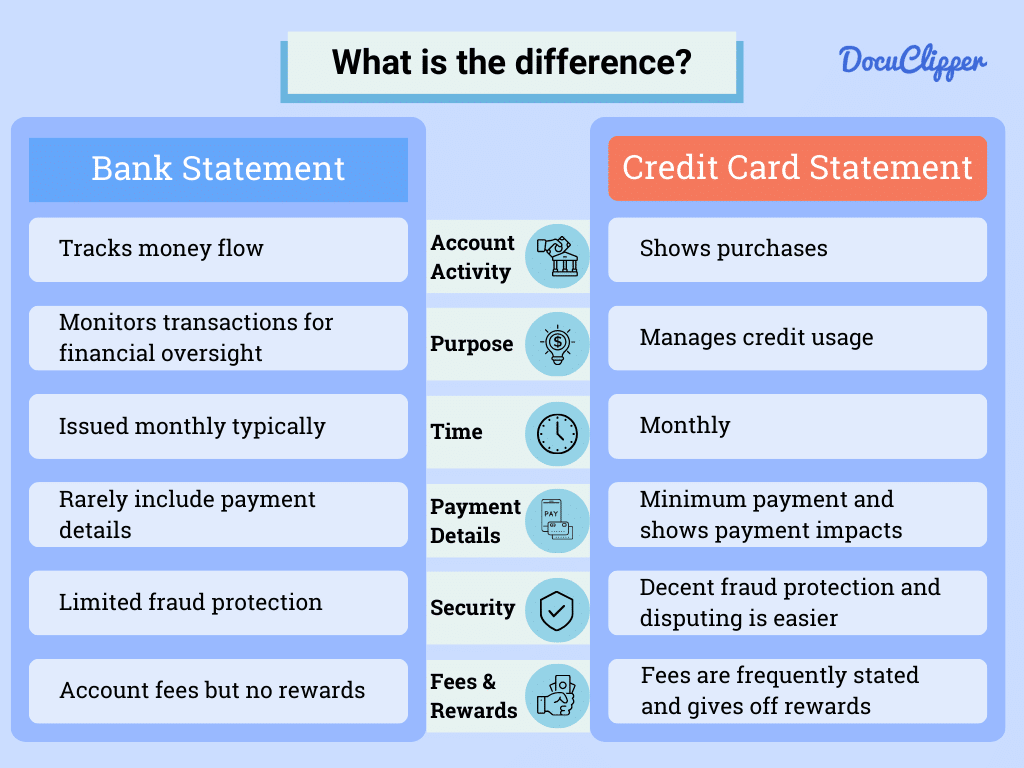

Key Differences Between Bank Statement & Credit Card Statement

Despite both being sent by the bank and are records of financial activity, here are their notable differences:

| Differences | Bank Statement | Credit Card Statement |

| Account Activity | Tracks deposits, withdrawals | Shows purchases, cash advances |

| Purpose | Monitors account transactions | Manages credit usage |

| Statement Balance | Current account balance | Total owed at billing end |

| Frequency of Issuance | Usually monthly | Monthly, per billing cycle |

| Minimum Payment Due | Not applicable | Required minimum payment |

| Interest and Fees | Includes account fees | Details interest, various fees, late payment fees |

| Payment Information | Rarely includes payment details | Shows payment impacts |

| Security & Insurance | Limited fraud protection | Stronger fraud protection, easier to get money back |

| Importance | Essential for financial oversight | Crucial for credit management |

| Promotions & Rewards | Rarely includes rewards | Often includes rewards, offers, gifts, discounts, and points |

Account Activity

Bank Statement: This tracks everything happening in your bank account, like when you put money in (deposits), take money out (withdrawals), move money between accounts (transfers), and any charges the bank applies (fees).

Credit Card Statement: This lists all the actions on your credit card, including buying things (purchases), getting cash out (cash advances), paying off your card (payments), charges for services (fees), and extra costs for borrowing money (interest charges).

Purpose

Bank Statement: It gives you a full picture of your bank account activity. This is handy for watching your spending, seeing what you’ve saved, and checking for unexpected charges.

Credit Card Statement: It’s all about your credit card use, showing what you’ve spent, and interest on what you owe, and helps you keep an eye on how much of your credit you’re using.

Frequency of Issuance

Bank Statement: This usually comes every month, but you can ask for it more or less often depending on what you need or the type of account you have.

Credit Card Statement: Comes once a month, matching up with your credit card’s billing cycle.

Statement Balance

Bank Statement: This shows your account’s final balance after adding deposits and subtracting withdrawals up to the statement’s end date.

Credit Card Statement: This shows everything you owe at the end of the billing period, including buys, cash advances, charges, and interest.

Minimum Payment Due

Bank Statement: Not relevant, since it’s about a deposit account.

Credit Card Statement: This shows the smallest amount you can pay by a certain date to avoid late charges and keep your account in good standing.

Interest and Fees

Bank Statement: It might have charges for things like account maintenance or using an ATM that’s not from your bank. It could also show interest you’ve earned, but this is not frequent.

Credit Card Statement: Lists charges for interest on the amount you owe and fees for things like paying late, using your card abroad, or the card’s yearly fee.

Payment Information

Bank Statement: Doesn’t usually have details about payments unless it’s for specific loans or services managed by the bank.

Credit Card Statement: This tells you how long it would take to clear your balance if you only make the minimum payments and how much you could save on interest by paying more than the minimum.

Security & Insurance

Bank Statement: Offers limited protection against fraud. If someone takes money from your account, getting it back can take time.

Credit Card Statement: Provides strong protection against fraud, with no cost to you for unauthorized transactions, making it a secure way to spend.

Importance

Bank Account: It’s essential for everyday money management and financial planning. This can also help in tax returns, audits, and financial investigations.

Credit Card: Offers more flexibility with your finances and helps build your credit score. It can help you acquire hefty loans depending on the credit score that you have.

Promotions & Rewards

Bank Statement: Rarely includes any special deals or rewards.

Credit Card Statement: Often comes with perks like rewards points, flight miles, cashback, and special offers.

Summary of Differences Between Bank and Credit Card Statements

Bank statements and credit card statements differ primarily in their focus and the details they provide.

Bank statements track the flow of money in and out of your bank account, showing your financial health and activity over a period. They help you keep an eye on your balance and any fees you might incur.

Credit card statements detail your credit usage, including what you’ve spent, the minimum payment due, and any interest or fees. They’re key for managing credit card debt, understanding your spending patterns, and taking advantage of rewards and offers tied to your card.

However, when you are processing both documents, you can easily use a bank statement converter to extract data.

Do Banks Shows Credit Card Transactions on a Bank Statement?

No, banks do not include credit card transactions on a bank statement. Think of your bank account and your credit card account as two separate entities.

Your bank statement reflects the activity in your bank account, including deposits and withdrawals. It provides a comprehensive view of your cash flow within that specific account.

Credit card statements are dedicated solely to showing the activity on your credit card. This includes all the transactions you’ve made with the credit card, such as purchases, as well as payments you’ve made to pay off your credit card balance.

How Do You Reconcile Credit Card Statements?

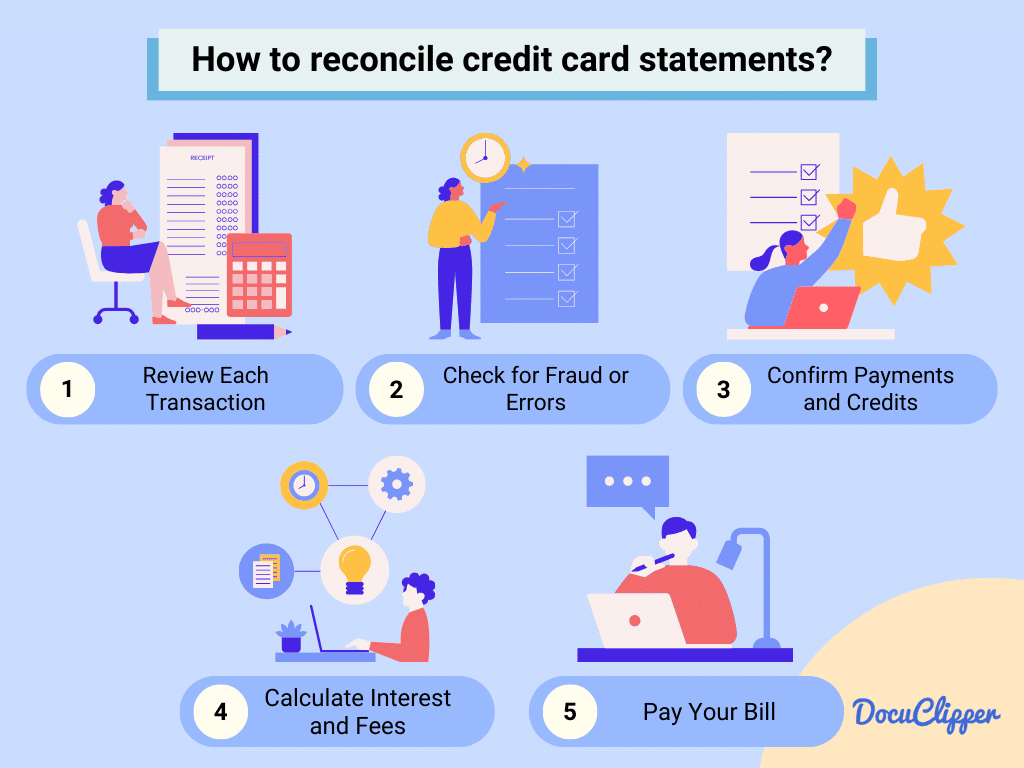

Reconciling your credit card is a must before paying to your bank. As disputes and refunds are quite problematic and time-consuming to handle. Here are the steps in reconciliation:

- Review Each Transaction: Start by comparing each transaction listed on your credit card statement with your records (receipts or personal finance software). This ensures that all charges are accurate and authorized.

- Check for Fraud or Errors: If you find any discrepancies, unauthorized charges, or errors, report them to your credit card issuer immediately. This can include charges you don’t recognize, double charges, or incorrect charge amounts.

- Confirm Payments and Credits: Make sure that any payments you’ve made towards your credit card balance are accurately reflected on the statement. This includes checking that the payment amount is correct and that it has been applied to your account.

- Calculate Interest and Fees: Understand how your credit card issuer calculates interest and fees to ensure these charges are correct. If you carry a balance, check that the interest charged matches your expectations based on your APR and outstanding balance.

- Pay Your Bill: Finally, after reviewing your statement and ensuring all the information is correct, make at least the minimum payment by the due date. To avoid interest charges, consider paying the full balance.

If you’re planning on reconciling your bank statements, here are some articles you can explore:

Conclusion

Understanding the differences between bank statements and credit card statements is key to managing your finances effectively.

While both provide crucial information about your financial activities, they serve distinct purposes and track different types of transactions.

FAQs about Bank Statement vs Credit Card Statement

Here are some frequently asked questions that people ask about bank statements and credit card statements:

Can a credit card statement count as a bank statement?

No, a credit card statement cannot count as a bank statement. They are issued for different accounts – one for your bank account activities and the other for your credit card transactions. Each serves a unique purpose in financial tracking and management.

How do I get a bank or credit card statement?

You can obtain both bank and credit card statements either electronically through online banking or mobile apps, or in paper form via mail. Most financial institutions allow you to access your statements by logging into your account online.

What is the monthly bank or credit card statement?

A monthly bank or credit card statement is a summary of all transactions that occurred in your account during a specific billing cycle. It includes deposits, withdrawals, transfers, purchases, fees, and interest, depending on the type of account.

Can I use a credit card as a bank statement?

No, you cannot use a credit card statement in place of a bank statement. They document different financial activities and are used for distinct purposes, such as proving your income or spending habits.

Can I get a bank statement without going to the bank?

Yes, you can obtain a bank statement without going to the bank by accessing your account online through internet banking or a mobile banking app. Most banks also offer the option to receive statements via email.

Do credit card companies need bank statements?

Credit card companies may request bank statements during the application process for a new credit card or loan to verify your income and assess your financial stability. However, this requirement varies by lender and specific circumstances.

Can a credit card statement count as a bank statement?

Reiterating for clarity: a credit card statement does not replace a bank statement. They are distinct documents reflecting different financial activities and cannot be used interchangeably for financial verification or record-keeping purposes.

Related Articles

- Purchase Order vs Invoice: What are the Differences

- Bank Statement vs Bank Reconciliation: What’s the Difference & What They Mean in Accounting?

- How to Manually Import Credit Card Transactions into QuickBooks Online

- How to Convert Bank Statements to Excel, CSV or QBO

- Bank Statement vs Bank Certificate: Definition, Differences, Purpose, & Role