With manual data entry being tedious and prone to errors, data entry accounting software is becoming a must-have for modern businesses and it allows you to automate the data entry process saving time and money while improving accuracy.

This article will cover the 8 best data entry accounting software options in 2025 to help you choose the right solution for eliminating repetitive administrative work and boosting efficiency.

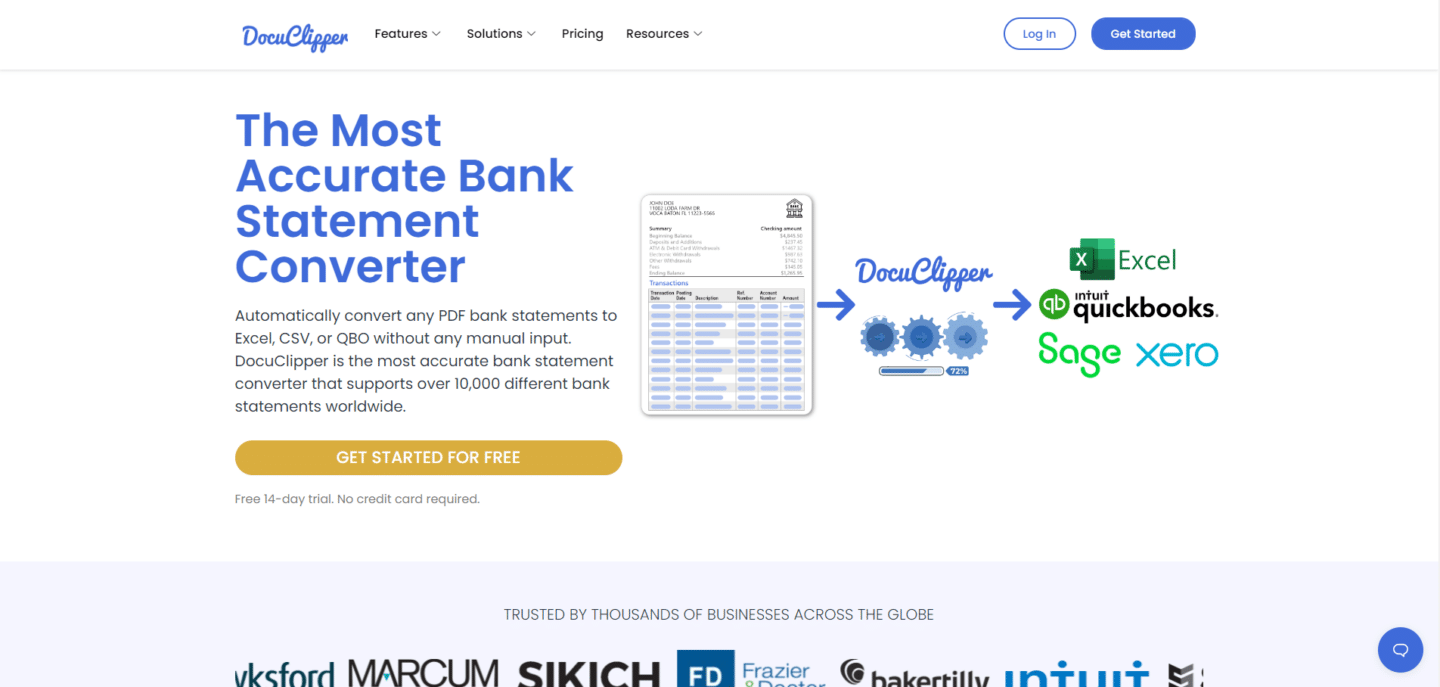

1. DocuClipper

Best for converting PDF bank statements to Excel, CSV, or QBO

DocuClipper is a financial data extraction software that automates data extraction from receipts, invoices, checks, bank, credit card, and brokerage statements.

The extracted data can be downloaded as an Excel, or CSV spreadsheet or directly imported into accounting software such as QuickBooks Online/Desktop, Sage, and Xero.

Furthermore, DocuClipper is the best PDF to QBO converter allowing businesses to easily upload financial information into QuickBooks as well as you can convert PDF to CSV for Xero.

Top Features

- Wide Format Support: Supports all invoices, receipts, and bank statements.

- Automatic Extraction: Automatically extract data from provided financial documents without the need to create parsing templates.

- Batch Processing: Process hundreds of financial documents at once.

- Security Measures: DocuClipper features SOC 2 compliance, Amazon’s robust servers, and AES 256-Bit SSL encryption, ensuring your data remains protected.

- Customizable Output for bank and credit card statements: Download spreadsheets in the format you need. You can select dates, descriptions, credit, debit, balance, account names, and many other fields.

- Transaction Categorization: Automatically categorize transactions using keywords, simplifying data analysis and interpretation.

- Financial Analysis: Analyze your cash-flow, spending patterns, P&L statements, and quickly identify any fraudulent transactions.

Pros

- The most accurate bank statement converter.

- Fastest bank statement extraction software.

- Widest support of bank statements, invoices, and receipts.

- Excellent and highly responsive customer service.

- Can request to improve support for your bank statement within 2 days.

- Very affordable.

- Very easy to use.

Cons

- Devices: No mobile app is available to scan paper documents directly.

Pricing

DocuClipper offers various pricing plans catering to different business needs.

- The Starter plan at $39/mo is ideal for freelancers and small businesses, providing 200 pages/month and basic conversion features.

- The Professional plan, at $74/mo, suits growing businesses with 500 pages/month and additional features like transaction categorization.

- The Business plan, at $159/mo, is best for larger firms, offering 2,000 pages/month, advanced reporting, and premium support.

- The Enterprise plan is customizable for large firms with unique needs. All plans include unlimited users, accounting integrations, and customizable output.

Overall DocuClipper is considered one of the best bank statement converter software and the best way to automate your bookkeeping.

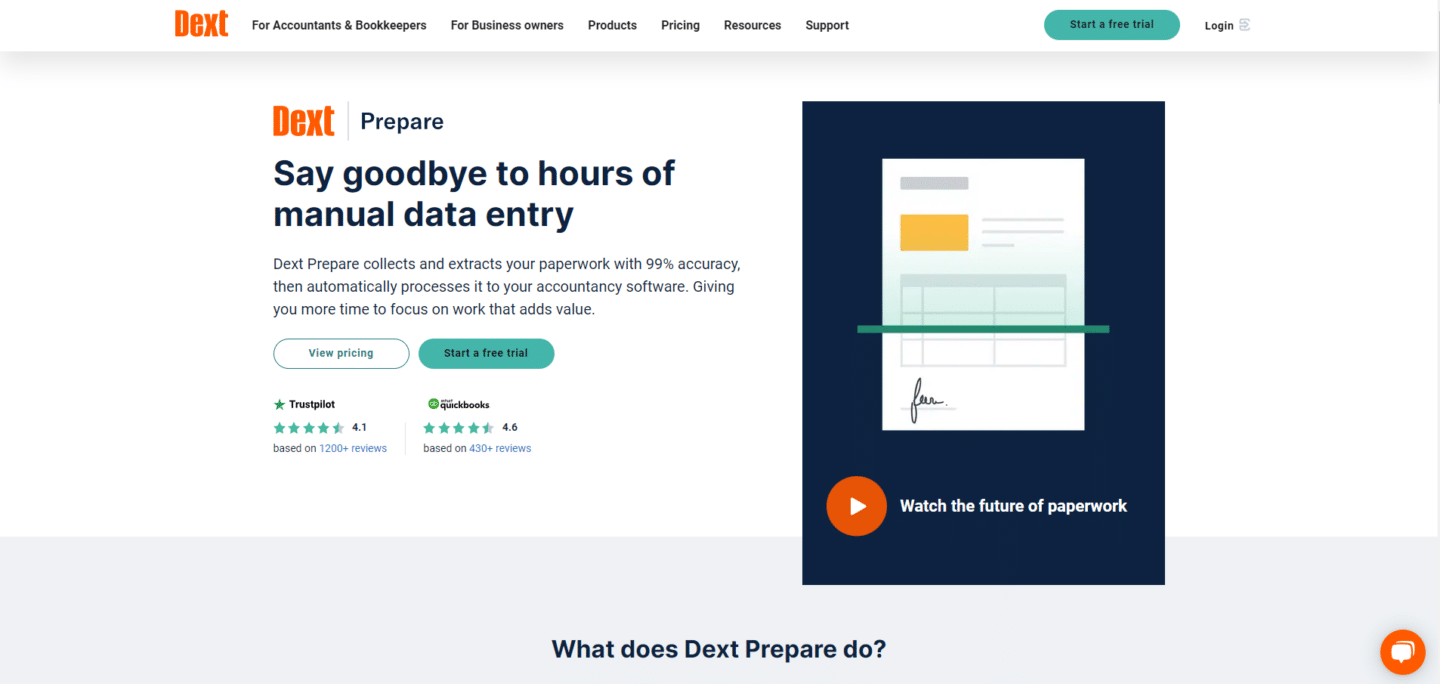

2. Dext Prepare

Best for automated data extraction and importing solutions for a variety of documents.

Dext Prepare is a cloud-based accounting software platform that helps businesses automate their document processing and bookkeeping workflows. It uses optical character recognition (OCR) technology to extract key data from receipts, invoices, and other financial documents, which can then be published directly to accounting software such as Xero, QuickBooks, and Sage.

Top Features

- Supplier Rules and Auto-Categorisation: Dext Prepare’s Supplier Rules help you to establish routine behaviors that take effect whenever documents from specific suppliers or customers are uploaded into the app.

- Line Item Extraction: This feature extracts each of the individual purchases that are listed on your receipts, bills, and invoices.

- Direct Import: Dext prepare is one of a few tools that can automatically import data into QuickBooks, Xero, or Sage.

- Sales Workspace: The Sales Workspace houses all financial documents, including invoices, that your business provides to its clients for billing purposes.

- Mobile Expense Reports: This feature allows you to create and add items to an existing expense report on the go using the Dext Prepare mobile app.

Pros

- Automatic data import into accounting software.

- Highly accurate OCR technology for receipts, bank statements, and invoices.

- Wide range of features for bookkeeping and accounting data entry automation.

- Convenient mobile app to support some workflows.

Cons

- Expensive.

- Limited bank statement support.

- Very limited mobile app.

- Relatively limited in customization.

- There isn’t a way to manually match a record against an existing QBO transaction.

Pricing

Dext pricing varies depending on the size of your business and the features you need. There are four main pricing plans for Dext Prepare, Dext’s accounting software platform:

- Streamline 10: This plan is for businesses with up to 10 clients and costs $218.49 per month.

- Streamline 20: This plan is for businesses with up to 20 clients and costs $366.84 per month.

- Streamline 50: This plan is for businesses with up to 50 clients and costs $757.8 per month.

- Enterprise: This plan is for businesses with more than 50 clients and requires a custom quote.

For more information about Dext Prepare visit:

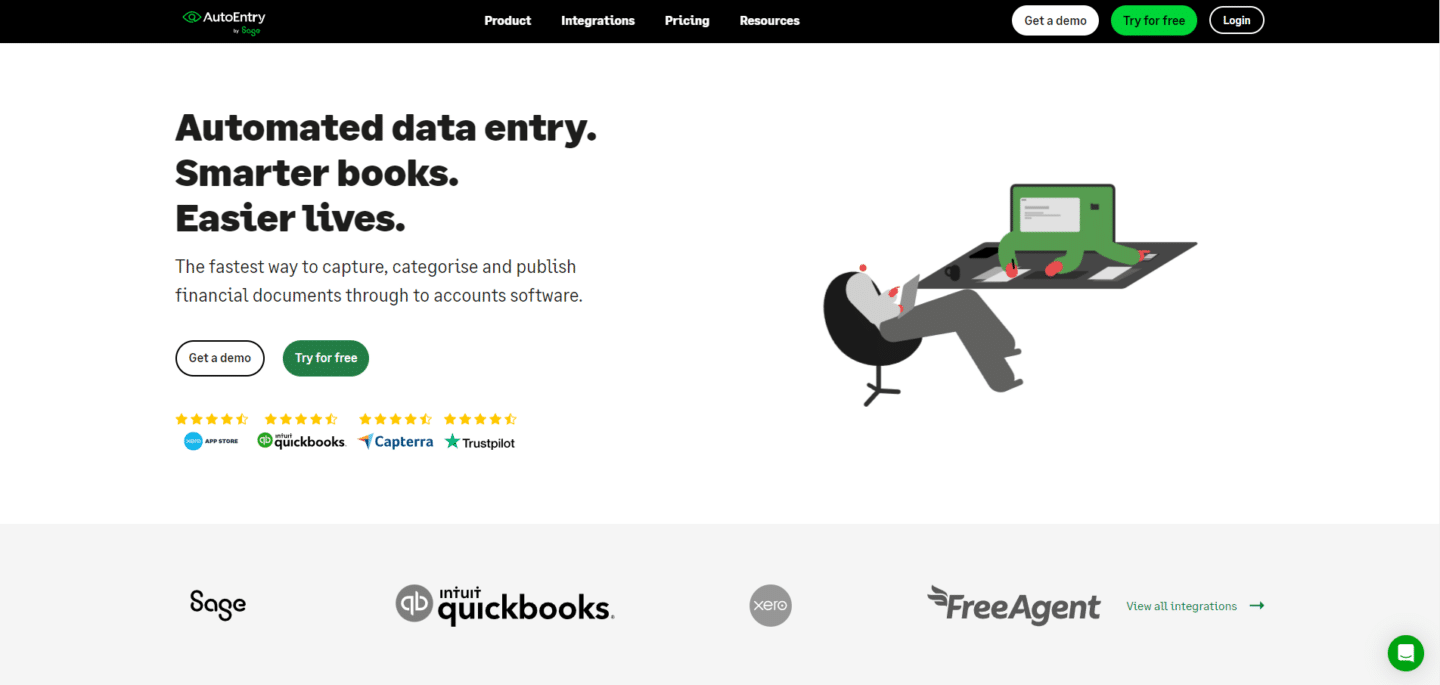

3. AutoEntry

Best for affordable data entry accounting software for invoices and receipts.

AutoEntry is a cloud-based application that automates data entry for accounting software. It uses optical character recognition (OCR) technology to extract key information from invoices, receipts, bank statements, and other financial documents. This information is then automatically converted into bank extract that can be imported into accounting software such as QuickBooks Online, Xero, and Sage.

Top Features

- Document Email Forwarding: You can forward files to the unique email addresses assigned to an account, and AutoEntry will convert them.

- Mobile App: Have an invoice, receipt, or expense in paper format in front of you? Simply take a picture and it will be sent directly to your AutoEntry account for extraction.

- Rules: Once you have categorized a document once, you can teach this as a ‘rule’ to AutoEntry, meaning the same categorization can be applied to the document by AutoEntry each subsequent time, without any human intervention.

- Automatic Sage Integration: AutoEntry is a Sage product and customers can enjoy seamless integration with Sage.

Pros

- Affordable data extraction solution.

- Easy to use.

- Great Sage integration.

- Great overall accuracy for bank statements, invoices, and receipts.

Cons

- Limited bank statement support.

- Support is sometimes not responsive.

- Basic features in terms of data conversion.

Pricing

AutoEntry offers flexible pricing with no contracts, ranging from $12 to $450 per month, based on credits needed. All plans include unlimited users and access to all features. Credits are used for various document types, with prices per document ranging from 1 to 3 credits.

For more information about AutoEntry visit best AutoEntry alternatives and DocuClipper vs AutoEntry.

4. SaasAnt

Best for QuickBooks automation.

SaasAnt is a cloud-based accounting automation tool that helps businesses and accountants save time and improve accuracy by automating the bulk import, export, and deletion of transactions and lists in QuickBooks Online and Desktop.

Top Features

- Automatic Integrations: Integrate email, FTP/SFTP, or Zapier to easily receive files to QuickBooks and sync your transactions.

- Bulk Import: Easily import as many transactions into QuickBooks in a matter of seconds.

- Export Data: Download your complete accounting data with all hidden details with 100% accuracy, supporting seamless migration, backup solutions, and detailed analytics as part of a robust cloud migration strategy.

- Batch Transactions: Create multiple transactions in QuickBooks without moving to multiple pages.

Pros

- Excellent QuickBooks import automation software.

- Great customer support.

- A large number of integrations to import data from multiple sources to QuickBooks.

- Easy to use.

- Affordable

Cons

- Mapping fields can be challenging.

- Cannot convert any PDF files.

- Only works great with QuickBooks.

Pricing

SaasAnt offers a range of pricing plans from $15 to $100 per month, with significant annual savings. Plans vary in monthly credits, user limits, and features, catering to different business needs. All plans include a 30-day free trial, with advanced features and priority support available in higher-tier plans.

5. Docsumo

Best for a wide variety of document processing.

Docsumo is an Intelligent Document Processing (IDP) platform that helps businesses automate data entry and document workflow.

It uses artificial intelligence (AI) to extract data from unstructured documents, such as invoices, receipts, and contracts, and convert it into structured data that can be easily integrated with other software systems.

Learn more about the OCR vs IDP differences.

Top Features

- Pre-Trained APIs: Docsumo comes with pre-trained APIs so you needn’t train ML models yourself.

- Auto-classify documents: Distinguish between different documents before processing them to push data into a correct database.

- Categorize data automatically: Proprietary NLP-based classification framework that categorizes key-value pairs and line items.

- Industry-agnostic solution: Works seamlessly for industries like commercial real estate, insurance, logistics, and more.

Pros

- Can parse many different document types.

- Very easy to use.

- Use of artificial intelligence to process documents.

- A large number of features for many different use cases.

- Great customer support.

Cons

- Struggle to convert PDF bank statements with limited support.

- Most of the bulk processing features are only via API.

- Relatively long processing times.

Pricing

Docsumo offers usage-based pricing with three plans.

- The Growth plan starts at $500+/mo for startups needing automation for a few document types, including 3 users and basic features.

- The Business plan provides advanced features, catering to businesses capturing specific data points from documents, with custom pricing. T

- The Enterprise plan is for enterprises requiring processing of multiple document types, unlimited users, and custom workflows, also with custom pricing.

All plans include a 14-day free trial and machine learning capabilities, with more advanced features available in higher-tier plans.

For more information visit DocuClipper vs Docsumo and Docsumo best alternatives.

6. Klippa

Best for accounting and ERP integrations.

Klippa is a cloud-based document processing platform that helps businesses of all sizes automate their document workflows and extract data from documents such as invoices, receipts, contracts, and other financial documents.

It uses artificial intelligence (AI) to recognize and extract key data from documents, which can then be used to populate accounting systems, ERP systems, and other business applications.

Top Features

- Verify the authenticity of documents.

- Catch fraudulent documents.

- Anonymize or mask sensitive data.

- Verify the identity of your customers.

- Cross-check documents and data points.

Pros

- Can process more than 50+ document types.

- A wide range of data fields for extracting.

- Highly secure.

- Many integration options.

- Wide use case options

Cons

- Limited customization.

- Struggle with accuracy sometimes.

- Not transparent pricing.

- Needs to be implemented.

- Expensive

Pricing

Klippa offers tailored pricing for its DocHorizon Intelligent Document Processing platform, dependent on various factors. Interested parties can request a personalized quote by filling out a form, and providing details about their use case and document processing needs.

7. Docparser

Best for easy parsing of your business documents.

Docparser is a cloud-based document data extraction solution that helps businesses of all sizes retrieve data from PDFs, Word docs, and image files. It uses a combination of optical character recognition (OCR), natural language processing (NLP), and machine learning to extract key data points from documents, such as purchase order numbers, invoice totals, shipping addresses, and more.

Top Features

- Smart Layout Data-Specific Rules: Use our pre-built rules to extract formatted data like dates, email addresses, invoice numbers, purchase order numbers, and more.

- Document-Specific Filters: We have specific rules for common document types. Invoices, Purchase Orders, Bills of Lading, Bank Statements, Work Orders & more.

- Custom Parsing Rules: Create parsing rules that are 100% tailored to your use case.

- Image Pre-processing: Advanced image preprocessing options will help clean up your document to make it easier for our system to read. We can even rotate pages to the proper orientation.

Pros

- Very easy-to-use tool.

- Great customer support.

- Support a wide range of documents to process.

- Great integration options.

- Great custom parsing options.

Cons

- Struggle with bulk processing.

- Longer learning curve.

- Struggle with bank statements.

- Accuracy is not the highest.

Pricing

Docparser offers tiered pricing:

- Starting at $39/month for the Starter plan, suitable for individuals, providing 100 parsing credits and basic features.

- The Professional plan at $74/month includes 250 credits, and additional features, and is popular among professionals.

- The Business plan, at $159/month, offers 1000 credits, and advanced features, and is designed for automating business processes.

- The Enterprise plan is customizable and requires direct contact for a quote.

All plans offer integration options, with more advanced features and support available in higher-tier plans.

For more information visit DocuClipper vs Docparser and best Docparser alternatives.

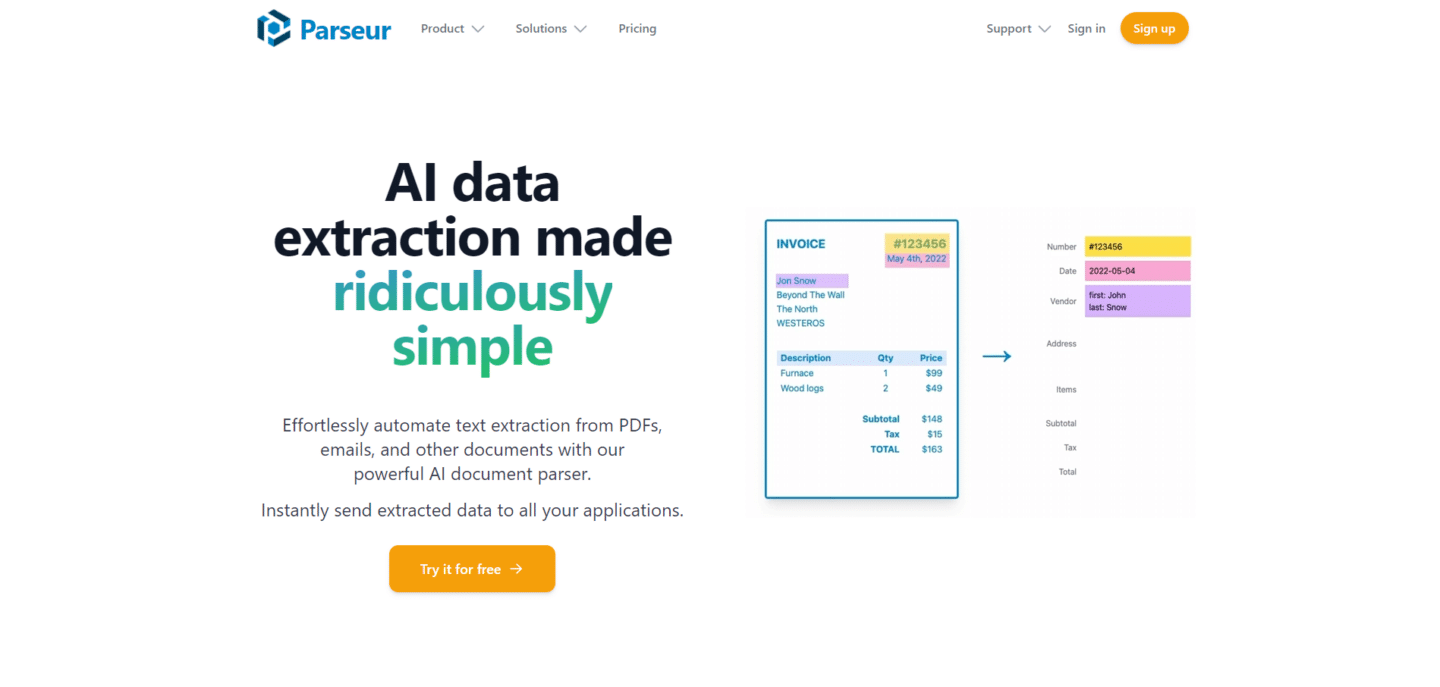

8. Parseur

Best for invoice parsing.

Parseur is a cloud-based document processing software that helps businesses of all sizes extract text from emails, PDFs, spreadsheets, attachments, and documents. It can also extract metadata, normalize parsed data, and extract data from documents in multiple languages.

Top Features

- AI-based data extraction: Simply list the data fields you need to extract and Parseur will find them automatically in all your documents. Our OCR and AI engine understands documents in most languages.

- Dynamic OCR: With Dynamic OCR, easily extract text from fields that move horizontally, vertically, or change size from one document to the next.

- Automatic layout detection: Do you have documents from multiple sources with different layouts? Create a template for each layout and Parseur will automatically pick the right one every time.

- Built-in library of templates: Leverage our built-in library of templates to automatically parse documents such as Food orders, Real Estate leads, Job Applications, and Google Alerts.

Pros

- Highly customizable.

- Affordable pricing.

- Very easy-to-use parsing tool.

- Fast in processing.

- Great workflow automation options.

Cons

- Cannot automatically recognize changes in documents.

- Struggle with PDF statements.

- Mostly works great with invoices.

Pricing

Parseur offers a variety of pricing plans based on document processing volume, starting with a free plan that includes 20 credits per month. Subscription plans range from $39 for 100 credits to $9,999 for 1,000,000 credits per month, with per-page costs decreasing as volume increases. Enterprise plans for up to 10 million credits are available upon request. Users can upgrade, downgrade, or cancel at any time, and additional plans are available for intermediate credit volumes.

What is Data Entry Accounting Software?

Data entry accounting software is used to automatically extract key information from financial documents like invoices, receipts, bills, purchase orders, and bank statements.

It uses technologies like optical character recognition (OCR), machine learning, and artificial intelligence to identify and extract relevant data from both digital and scanned paper documents.

This extracted data can then be used to automatically update accounting systems like QuickBooks and Xero, eliminating the need for manual data entry, reducing errors, increasing efficiency, and improving business processes.

Data entry accounting software has a wide range of use cases used by businesses and they’re becoming increasingly popular among accounting firms, forensic accounting companies, business owners, lenders, and others.

Why Businesses Need Data Entry Accounting Software

Data entry accounting systems can be used for many different needs and use cases. But there are several key reasons your business should consider using data entry accounting software:

- It eliminates slow and tedious manual data entry work.

- It improves the accuracy of data in the accounting system by reducing human errors.

- It allows accountants to be more productive by freeing them from mundane tasks.

- It ensures seamless integration of financial data from different document types and sources.

- It enables faster invoice processing, approvals, and payments.

- It streamlines receipt data entry and processing for expense management.

- It saves both time and money associated with manual processes.

These are the most common reasons why our customers are using data entry accounting software such as DocuClipper and others.

Overall when we compare manual data entry vs automated data entry it’s a no brainer you would want a system that streamlines your workflows, while saving you costs.

How to Choose the Right Data Entry Accounting Software for Your Business

Choosing the right data entry accounting software comes directly from your needs and budget as it depends on what exactly you’re looking for.

For example, if you need to process only bank, credit card, and brokerage statements, then DocuClipper is the best option as they provide the best accuracy, speed, and pricing.

Whereas if you’re looking to process many different document types, then using software such as Docsumo or Klippa can be a better option for you.

With that, here are some important factors to consider when selecting data entry accounting software:

- Integrations with your existing accounting platform and other business systems.

- Accuracy of the OCR and data extraction technology.

- Ability to handle your specific document types like invoices, bills, receipts, etc.

- Ease of use and training required.

- Automation capabilities for approvals, coding, etc.

- Scalability to support your changing business needs.

- Security of your sensitive financial data.

- Customer support responsiveness.

- Pricing model suiting your budget.

- Reviews and reputation of the software vendor.

Frequently Asked Questions about Data Entry Accounting Software

In this section, we’re going to answer commonly asked questions about data entry accounting software:

Which software is most used for data entry?

DocuClipper is most used for data entry, especially for converting invoices, receipts, checks, brokerage statements, and bank statements into various formats like Excel, CSV, or QBO. Docsumo is often used for a wide range of different documents, whereas AutoEntry is considered more towards OCR software for accounts payable.

What is data entry accounting?

Data entry accounting involves inputting financial transactions and information into accounting systems. It automates the extraction and processing of data from documents like invoices and receipts, reducing manual effort, enhancing accuracy, and streamlining financial workflows. This practice is crucial for maintaining accurate financial records, ensuring compliance, and enabling timely decision-making.

What are the main benefits of data entry accounting software?

The main benefits include time and cost savings, improved accuracy, faster processes, and eliminating tedious manual tasks.

What types of documents can it extract data from?

Most solutions handle PDF or scanned documents like invoices, bills, bank statements, purchase orders, receipts, and credit card statements.

How accurate is the data extraction?

Advanced OCR and AI deliver high accuracy for most document types, generally over 90% or more.