As businesses and accounting professionals tackle their finances, they have to deal with invoices. Invoices and receipts come in all formats. The way they organize information differs from one supplier, company, and service provider.

Luckily, in this blog, we’ll talk about the best invoice data extraction software that you can have for your business and accounting practice.

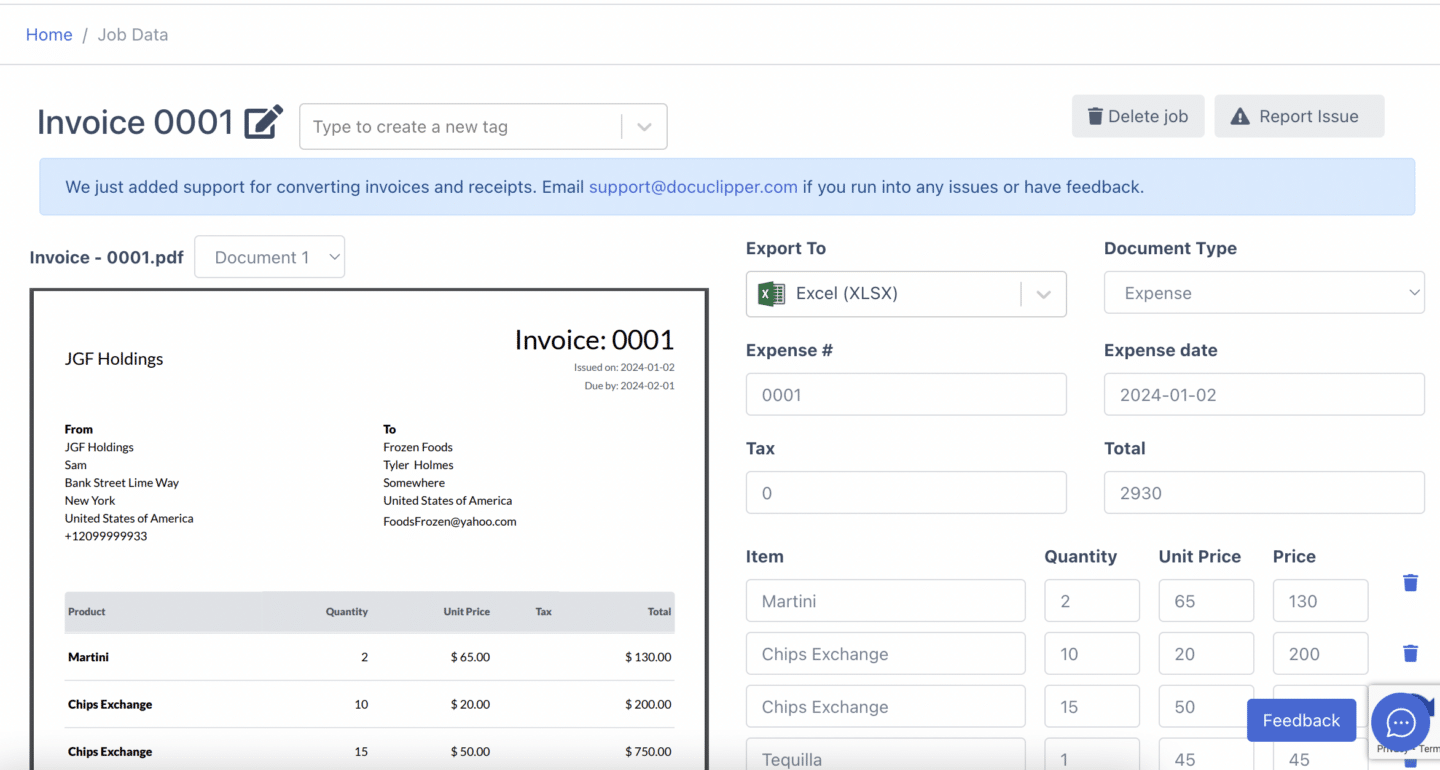

1. DocuClipper

DocuClipper is a specialized web-based tool designed for converting invoices into structured data formats like Excel, CSV, and QBO with an impressive accuracy rate of 97%.

Using advanced OCR technology and a custom-built algorithm for invoice data extraction, this invoice scanning software excels in streamlining the invoice scanning process.

It supports batch processing, enhancing the efficiency of file conversion, and offers API functionality for seamless integration with leading accounting platforms such as QuickBooks, Xero, Sage, and other accounting and ERP software.

Pros

- Universal Invoice OCR Software: DocuClipper’s advanced Invoice OCR algorithm effortlessly handles all invoice types, ensuring smooth processing regardless of the source or layout.

- Highly Accurate: Achieve a remarkable 97% accuracy rate in extracting information from PDF invoices, ensuring reliable and precise data conversion.

- Seamless Integrations: DocuClipper seamlessly integrates with leading accounting software like QuickBooks, Excel, and Google Sheets, streamlining your financial workflows.

- Quick Processing: Capable of processing hundreds of invoices swiftly, often within a few seconds, DocuClipper enhances efficiency and saves valuable time.

- Secure: Ensuring data security is a top priority for DocuClipper, which features SOC 2 compliance, utilizes Amazon’s secure servers, and protects data with AES 256-bit SSL encryption.

Cons

- Limited Financial Analysis: While DocuClipper provides basic financial analysis tools, they may not fully meet the needs of businesses requiring more detailed and comprehensive financial insights.

Pricing

- DocuClipper Starter: Priced at $39.00 per month, or $27 per month when paid annually, this plan is ideal for small teams. It includes 200 pages per month, unlimited users, features like bank reconciliation and batch processing, accounting integrations, 30 days of data retention, and basic customer support.

- DocuClipper Professional: Available at $74.00 per month, or $52 per month with annual payment. This plan builds on the Starter by offering 500 pages per month, 1-year data retention, and transaction categorization.

- DocuClipper Business: This plan costs $159.00 per month, or $111.00 per month if paid annually. It is designed for larger businesses, providing 2,000 pages per month, 2 years of data retention, dedicated customer support, and features such as file inventory, transfer detection, flow of funds, dedicated queues, and API access.

- DocuClipper Enterprise: Pricing is custom. Tailored for enterprise needs, this plan includes a customizable number of pages, 5 years of data retention, single sign-on, dedicated API keys and access, and dedicated queues. For pricing, contact DocuClipper directly.

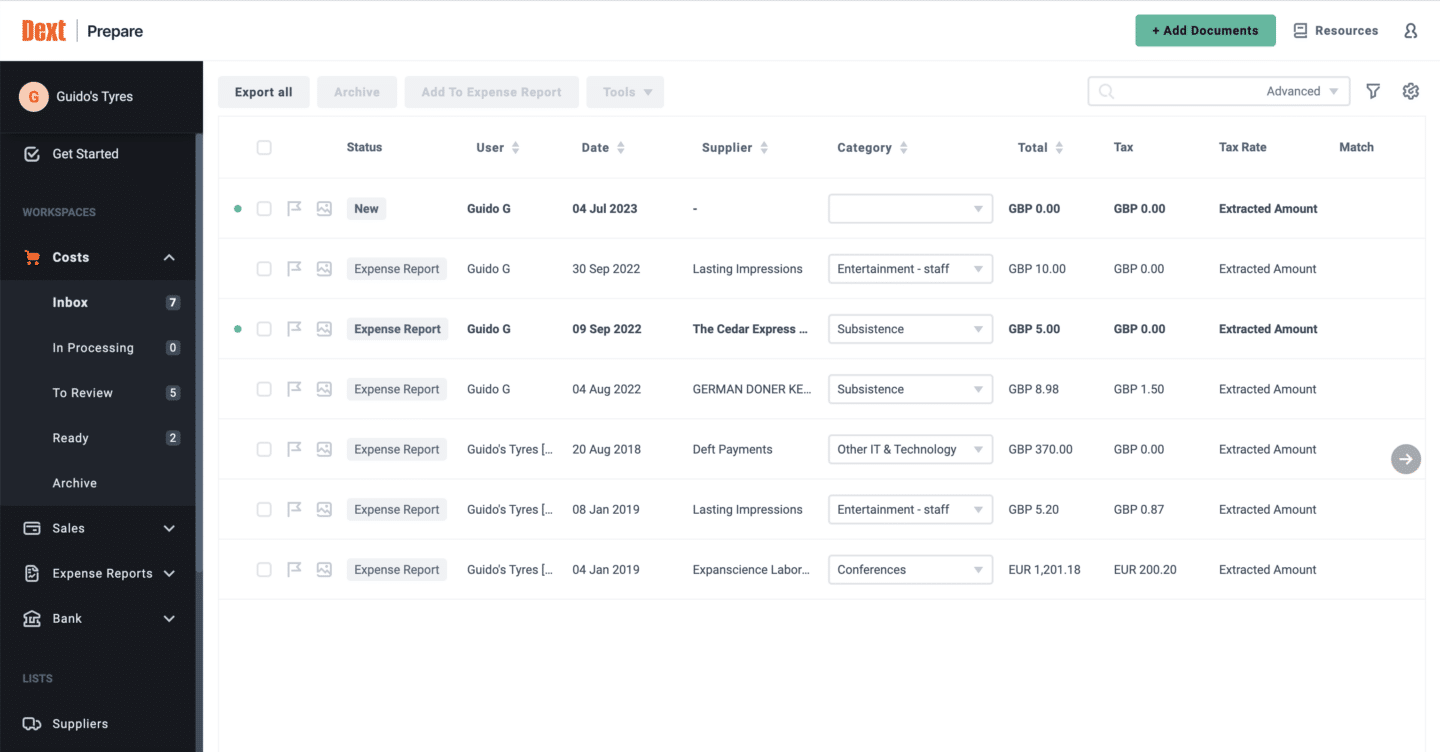

2. Dext Prepare

Dext Prepare another popular invoice parser that boosts the productivity and profitability of accountants and businesses through enhanced data management and insightful analytics.

It provides robust tools that efficiently prepare, sort, and automatically publish invoices and receipts, streamlining financial operations and minimizing manual data entry.

Pros

- User-Friendly Interface: Dext Prepare features an intuitively designed web platform and mobile app, complemented by comprehensive training resources to assist users in navigating the system effortlessly.

- High Efficiency: With accurate data recognition and predefined supplier rules, the platform effectively streamlines the review and posting of bulk expenses, enhancing overall efficiency.

- Accessible to Non-Financial Users: Dext Prepare simplifies accounting processes to minimize errors, making it accessible and easy to manage for individuals without a financial background.

Cons

- Limited Suitability for Large Businesses: Dext Prepare may not fully meet the needs of larger businesses due to its lack of support for multi-level approval processes in expense reporting, which could be a significant drawback for complex organizational structures.

- Processing Delays: The platform occasionally experiences delays in processing documents, invoices, and receipts, which may impact timely financial management.

- Customer Support and Billing Issues: Users have reported concerns regarding misleading sales tactics, billing problems, and unresponsive customer service, indicating areas where Dext Prepare could improve to enhance user satisfaction.

Pricing

Dext Prepare offers both monthly and annual subscription options, with a 13% savings for those opting for the annual subscriptions. Plans are customizable, and tailored to specific business needs to ensure optimal alignment with different organizational requirements.

- $199.99/month (annual subscription billed monthly): This plan supports up to 10 clients and offers unlimited user access, ideal for small to medium-sized businesses looking for comprehensive data management.

- $214.99/month (annual subscription billed monthly): Includes all the features of the previous plan along with additional features and enhanced support, catering to businesses that require extra capabilities and prioritized assistance.

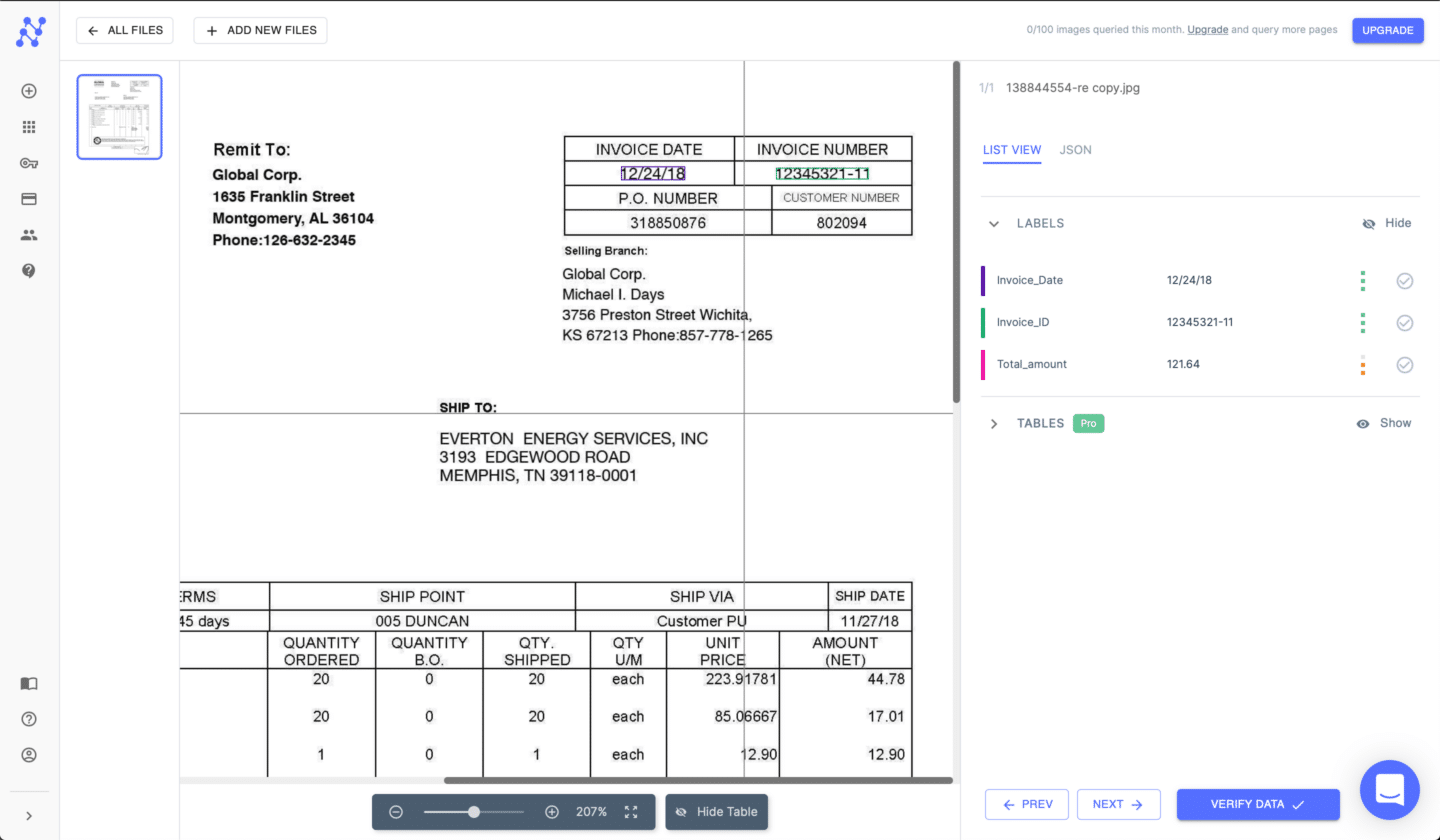

3. Nanonets

Nanonets is an AI-driven automation platform designed to streamline complex business processes across a range of sectors including finance, accounting, supply chain, operations, sales, HR, and more.

It offers a no-code solution that efficiently transforms invoices and receipts from various sources such as documents, emails, tickets, or databases into actionable insights, enhancing decision-making and operational efficiency.

The platform uses AI technology to extract and convert valuable information from invoices and receipts, turning them into practical insights for better business management.

Pros

- User Interface: Nanonets offers a user-friendly, customizable interface that significantly enhances the overall user experience. This is complemented by responsive customer support, ensuring users can effectively navigate and utilize the platform.

- Adaptive Tools: The platform is equipped to handle a broad spectrum of document types and data. Featuring advanced zero-shot models, Nanonets excels in versatile data conversion capabilities, adapting easily to various data input sources.

- Efficient Learning Models: Nanonets utilizes AI with a self-learning feature that facilitates continuous enhancement of the system. This progressive learning increases efficiency over time, continuously improving its performance and accuracy.

Cons

- Initial Setup Complexity: Setting up your account on Nanonets, particularly when dealing with invoices and receipts, can initially be complex. The process might require significant time and effort to configure correctly.

- Minor Bugs: Some users have reported encountering minor bugs and user interface issues, which can occasionally hinder the smooth operation of the platform.

- Learning Curve: Learning how to train custom models and familiarize oneself with the system on Nanonets can be demanding and somewhat non-intuitive initially. This requires a dedicated effort to fully understand and leverage the platform’s capabilities effectively.

Pricing

- Starter Plan: Sign up for free with pay-as-you-go options. Enjoy the first 500 pages free, then pay $0.30 per page. This plan includes 3 starter workflows, limited fields, and auto-capture capabilities for tables (line items).

- Pro Plan: Priced at $999 per month per workflow. It includes 10,000 pages per month, with additional pages at $0.10 each. Features include auto-capture for line items, up to 20 customizable fields, the ability to add team members, custom data capture AI, annotation services, and integration with enterprise platforms like MS Dynamics, Salesforce, and SAP.

- Enterprise Plan: Offers custom pricing tailored to the specific needs of large organizations. For more detailed information and pricing, contact the Nanonets sales team.

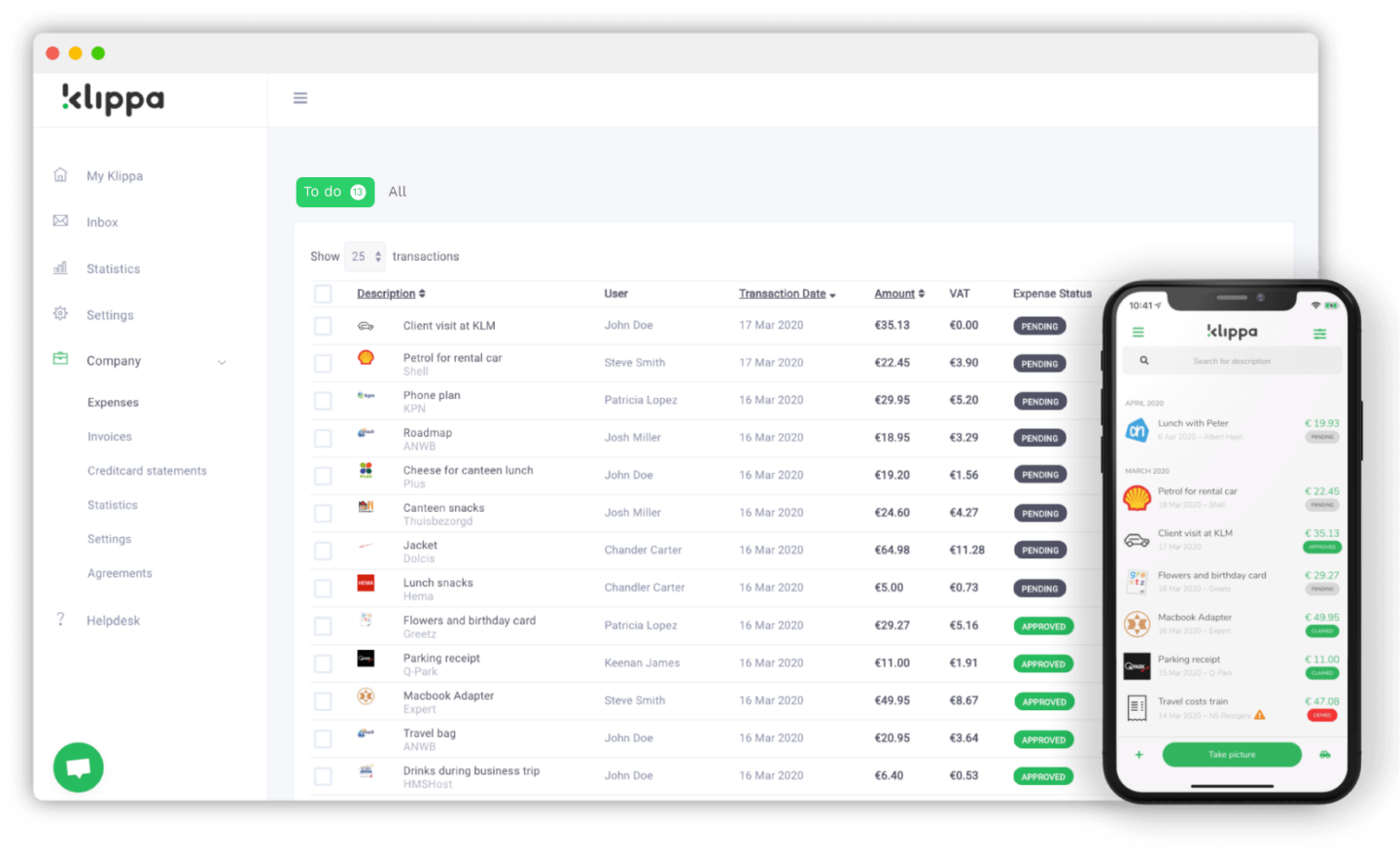

4. Klippa

Klippa is a comprehensive expense management solution designed to optimize how businesses handle their expenses. It streamlines the submission and processing of business expenses, including invoices and receipts, by automating these tasks.

This functionality helps reduce the time and effort typically required to manage financial transactions, enhancing overall efficiency and accuracy in expense reporting.

Pros

- Ease of Use: Klippa simplifies the expense management process by allowing users to submit expenses through the web, mobile app, or via email. This versatility ensures that managing and reporting expenses is convenient and user-friendly.

- Mobile Accessibility: With its mobile app, Klippa enables users to manage their expenses on the go, significantly enhancing flexibility and convenience. This feature is ideal for professionals who are frequently traveling or out of the office.

- Language Flexibility: Klippa supports multiple languages, including English, German, Dutch, French, Spanish, and Portuguese. This multilingual capability makes it a versatile tool for international use, accommodating a diverse user base across various regions.

Cons

- Learning Curve: New users of Klippa may require some time to become accustomed to setting up and training the model. Initial familiarization with the system’s features and capabilities is necessary to fully leverage its potential.

- Customization Limitations: While Klippa offers white label options, these do not allow for extensive customization, such as altering color schemes.

- Technical Issues: Users may encounter minor bugs and occasional processing delays, which can affect the overall user experience. However, these issues are typically addressed and resolved quickly by Klippa’s support team, ensuring minimal disruption

Pricing

- Effective Plan: Priced at €5.00 per month per active user, this plan is ideal for those new to digital expense management. It offers basic features such as OCR technology, various submission methods, and integration with accounting systems, making it a great starter option.

- Premium Plan (Most Popular): At €6.00 per month per active user, this plan builds on the Effective plan by adding features such as fraud detection, a dedicated account manager, and additional compliance tools. It’s designed for businesses seeking enhanced functionality and support.

- Custom Plan: Offers tailored pricing to meet the specific needs of businesses. This plan includes advanced API access and custom service agreements, providing a fully customized solution for organizations with unique requirements.

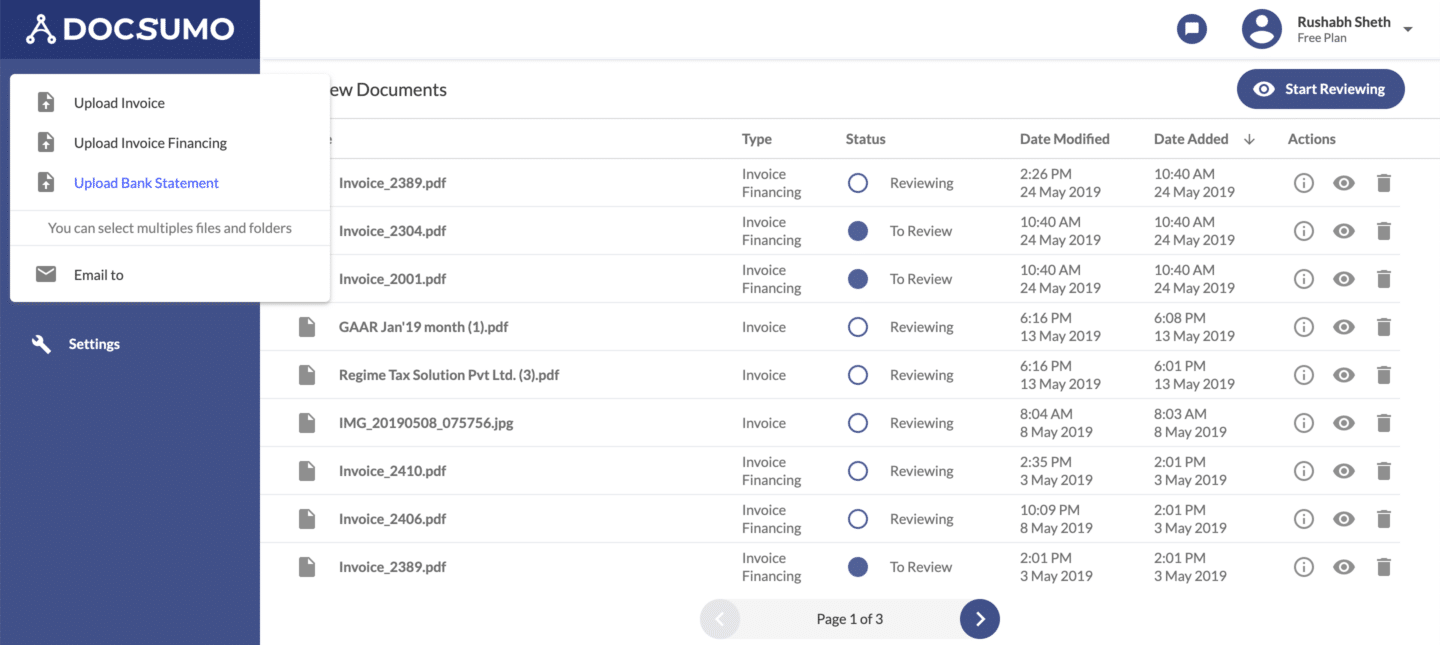

5. Docsumo

Docsumo is a leading Intelligent Document Processing (IDP) solution that specializes in handling financial documents. Initially launched with a focus on automating invoice processing.

Docsumo has since evolved into a comprehensive OCR data extraction platform made for the financial sector across the USA. This expansion allows for end-to-end processing capabilities, significantly enhancing the efficiency and accuracy of data management within the industry.

Pros

- Responsive Support: Docsumo is highly regarded for its responsive and solution-oriented support team. The platform offers an efficient onboarding process, and the support staff is known for their flexibility, helping users navigate and maximize the software effectively.

- High Efficiency: Docsumo significantly enhances the efficiency of invoice and receipt extraction processes. It offers notable improvements in both accuracy and speed, which directly benefits customer outcomes by streamlining financial operations and reducing processing time.

Cons

- Model Retraining: Minor changes in financial document processing workflows necessitate retraining of Docsumo’s models, which can be time-consuming. This retraining is essential to maintain accuracy but can temporarily impact productivity.

- Timezone Challenges: While Docsumo’s team is flexible, coordination across different time zones can complicate the scheduling of meetings, potentially delaying communication and support.

- Interface and System Limitations: Users might encounter occasional formatting issues and system timeouts, especially when processing large batches of files or if running out of processing credits. This can halt operations until credits are replenished, affecting workflow continuity.

- Data Conversion Limitations: There are challenges in accurately converting invoices that involve multiple accounts, particularly when credits are depleted. This can limit the platform’s effectiveness in managing complex invoice data without sufficient credits.

Pricing

- Start-ups and Businesses Plan: Priced at $500+ per month, this plan is geared towards start-ups and small businesses. It includes API access for processing invoices, purchase orders, and ID cards, and supports up to 3 users.

- Business Plan: Offers custom pricing to cater to businesses needing specific data capture from documents like bank statements and insurance forms. It supports up to 10 users and includes features like email parsing, basic validation, and custom machine learning model training.

- Enterprise Plan: Also with custom pricing, this plan is suited for large organizations with extensive data processing needs. It supports unlimited users and includes multiple document types and custom workflows.

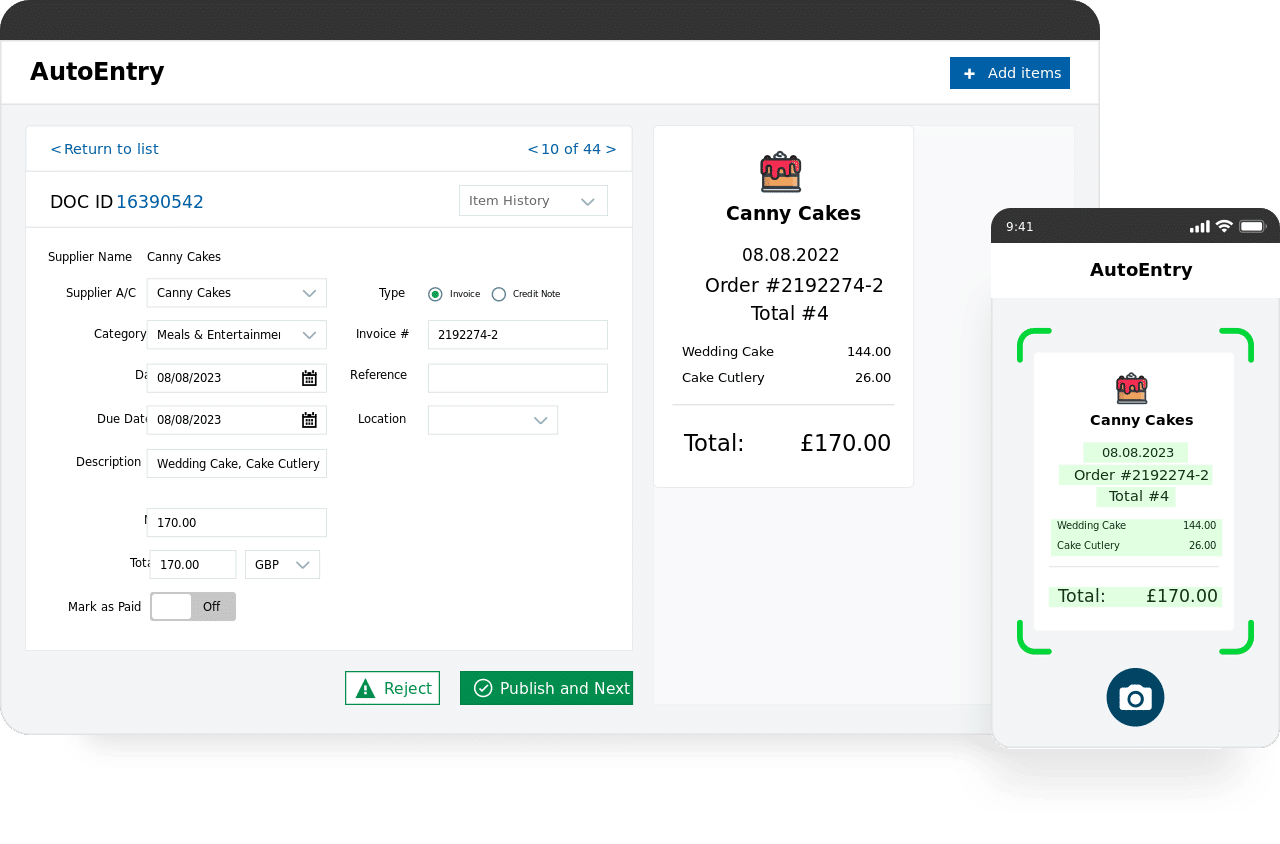

6. AutoEntry

AutoEntry is a specialized invoice automation tool designed specifically to streamline accounting processes. It automates the extraction and publication of data directly into major accounting software platforms, and is also capable of scanning invoices for accounting purposes.

This tool offers flexible access without requiring a contractual commitment, making it accessible and appealing to businesses worldwide.

Pros

- Ease of Use: AutoEntry offers users versatile options for submitting their documents, including the ability to scan or email receipts and invoices, or use its mobile app to quickly capture images. This flexibility ensures that managing financial documents is convenient and efficient.

- Mobile Accessibility: The mobile app significantly enhances the convenience of using AutoEntry, allowing users to capture invoices on the go. This mobile functionality automates the invoice data entry process, making it easier and faster to keep financial records up-to-date even when away from the office.

- Scalability: AutoEntry is designed to grow with your business. From the outset, it supports an unlimited number of companies and users, and all features are immediately available. This scalability ensures that as your business needs expand, AutoEntry can continue to meet them without requiring upgrades or additional investments.

Cons

- Integration Issues: Some users have encountered difficulties when integrating AutoEntry with accounting software platforms such as Xero, particularly issues related to publishing invoices. These challenges can complicate the process of syncing data seamlessly across systems.

- Customer Service: The customer support at AutoEntry has faced criticism for slow response times and unresolved issues, especially in billing matters, even after service cancellation. This has been a point of frustration for users seeking timely and effective assistance.

- Software Reliability: Users have reported occasional glitches and software disruptions that impair the performance of AutoEntry, leading to user frustration. These technical issues can disrupt the smooth functioning of the tool, affecting its reliability and the overall user experience.

Pricing

- Bronze: $15/month for 50 credits.

- Silver: $26/month for 100 credits.

- Gold: $48/month for 200 credits.

- Platinum: $112/month for 500 credits.

- Diamond: $315/month for 1500 credits.

- Sapphire: $494/month for 2500 credits.

Each plan offers unlimited cloud storage, unlimited users, and a partner portal for accountants and bookkeepers, with the flexibility to cancel up to 24 hours before the monthly renewal. A free trial is also available, allowing potential users to evaluate the service before committing.

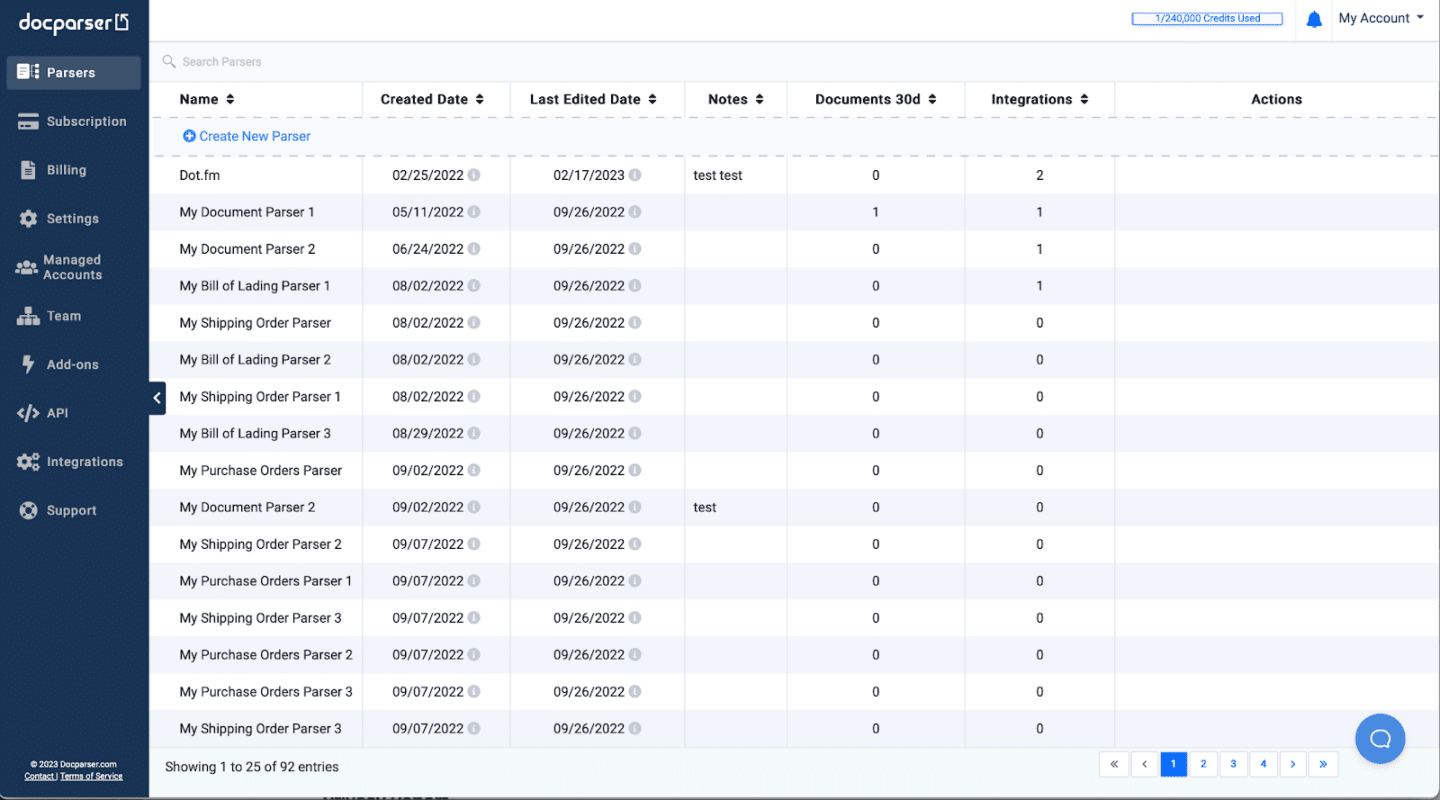

7. DocParser

Docparser is a powerful invoice parser tool that automates the process of pulling invoice data from a variety of document formats, including PDFs, MS Word (DOCX), JPGs, TIFFs, and PNGs.

This platform streamlines document processing workflows for both invoices and receipts. Docparser enables rapid and precise extraction of critical data, such as customer details from sales invoices and shipping information from delivery receipts.

Its intuitive interface, coupled with cloud-based processing, makes it highly accessible and scalable, suitable for companies of all sizes looking to enhance their document management systems.

Pros

- Custom Parsing Rules: Docparser allows users to create custom rules that tailor the parsing process to meet specific data extraction needs for invoices. This feature ensures that the data extracted is accurate and relevant to the unique requirements of each business.

- Easy Integration: Docparser offers seamless integration with a wide range of third-party tools, including Zapier, Google Sheets, and Microsoft Power Automate. This connectivity facilitates the automation of workflows and the easy transfer of data across various platforms.

- Routing Functionality: The platform includes a routing functionality that automatically directs incoming receipts to the appropriate set of parsing rules for efficient processing. This ensures that documents are handled correctly and swiftly.

Cons

- User Interface Complexity: Some users have reported that the workflows for setting up parsing rules in Docparser can be confusing, and they find the user interface less intuitive.

- Cost Concerns: The cost per form processed by Docparser may be perceived as high by some users, particularly for small businesses or those with a high volume of documents to process.

- JSON Structuring Challenges: Users without a strong background in JSON may encounter difficulties in structuring the data extracted by Docparser.

Pricing

- Starter Plan: Priced at $39.00 per month, this plan offers 100 credits and is ideal for individuals who need to manage manual data extraction. It’s a cost-effective option for those just starting with document parsing.

- Professional Plan: At $74.00 per month, this plan provides 250 credits and includes additional features such as multifactor authentication and team management capabilities, making it suitable for small teams looking to enhance security and collaboration.

- Business Plan: For $159.00 per month, this plan offers 1,000 credits and is tailored for businesses aiming to automate entire business processes. It’s designed for mid-sized companies seeking significant efficiency improvements in their operations.

- Enterprise Plan: This plan offers custom pricing for users with extensive and potentially unlimited parsing needs. Features include extended document retention and white-labeling licenses, catering to large organizations or those requiring a highly customized solution.

8. Tungsten Automation

Tungsten Network is a global e-invoicing platform designed to streamline the entire procure-to-pay process. It assists businesses in processing invoices more efficiently, reducing operating costs, enhancing cash flow, and minimizing the risks of fraud.

Additionally, Tungsten Network has the capability to read invoices and extract data from invoices, further simplifying the management of financial transactions.

Pros

- Automated Invoice Generation: Tungsten Network enables users to automatically generate and send invoices in various formats, significantly simplifying the invoice management process.

- Cloud-Based: As a cloud-based platform, Tungsten Network allows for easy access and management of invoicing processes from any location. This flexibility ensures that users can handle their invoicing needs on the go.

Cons

- Connectivity Requirement: Tungsten Network’s performance heavily relies on stable internet connectivity. This dependence means that any disruptions in the internet service can affect access to the platform and the timely processing of invoices.

- User Experience Issues: Users have reported that Tungsten Network can be maintenance-intensive and challenging to use. It is also described as coding-intensive, which may not be ideal for users with limited technical skills. Additionally, the platform is seen as not very user-friendly, with limited capabilities in automating complex tasks beyond simple file transfers.

Pricing

- Power PDF Standard for Windows and Mac: $129

- Power PDF Advanced for Windows: $179

9. HyperScience

Hyperscience is a leading technology provider specializing in AI-driven back-office operations and intelligent document processing. The platform is renowned for its focus on hyper-automation, delivering impressive accuracy rates of 99.5% and automation rates of 98%.

Hyperscience employs proprietary machine learning models to efficiently process a wide range of content types, from structured invoices to receipts.

Pros

- Efficient Data Extraction: Hyperscience is particularly known for its ability to efficiently extract structured data. The platform offers high levels of automation and accuracy, especially with its finely tuned production models.

- Document Mapping and Addition: The platform enables quick addition of new structured documents to the system using just a blank sample. This feature greatly simplifies the expansion of the document library.

- Handwritten Text Recognition: Hyperscience excels in recognizing handwritten text, which is highly beneficial in sectors like insurance where handwritten invoices and receipts are common.

Cons

- Limited Document Types: Hyperscience is primarily not designed for processing invoices and financial documents, which limits its applicability in sectors heavily reliant on these document types.

- Challenges with Semi-Structured Data: The platform can face difficulties in efficiently extracting semi-structured data. This process often requires human intervention for accurate field classification and transcription.

- Sample Requirement for Training: Training the platform for semi-structured data extraction requires a substantial number of samples, typically at least 400. This high sample requirement can be challenging to meet.

- High Infrastructure Requirements: Hyperscience demands significant infrastructure and configuration for installation. This high requirement can be a barrier for smaller businesses or those with limited IT resources.

Pricing

Hyperscience Platform – Intelligent Document Processing (IDP) – SaaS

Platform Fee:

- 12 Months: $210,000

- 24 Months: $390,000

- 36 Months: $570,000

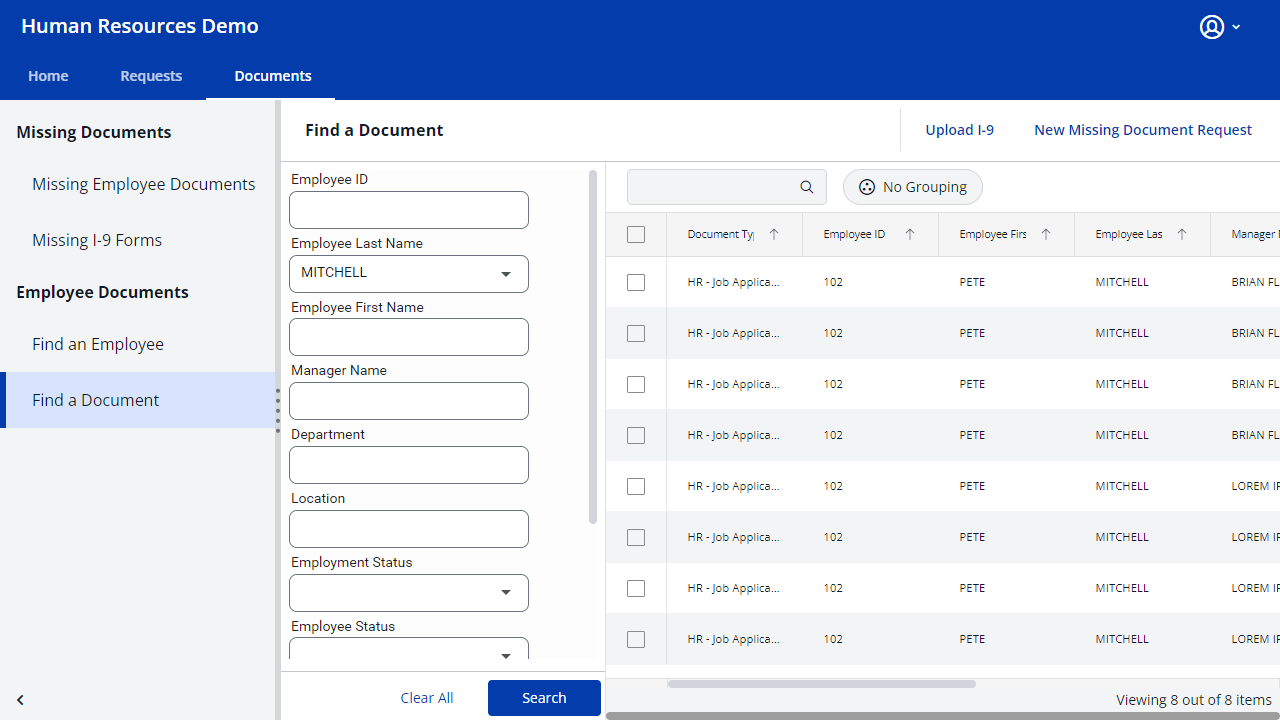

10. Hyland (OnBase)

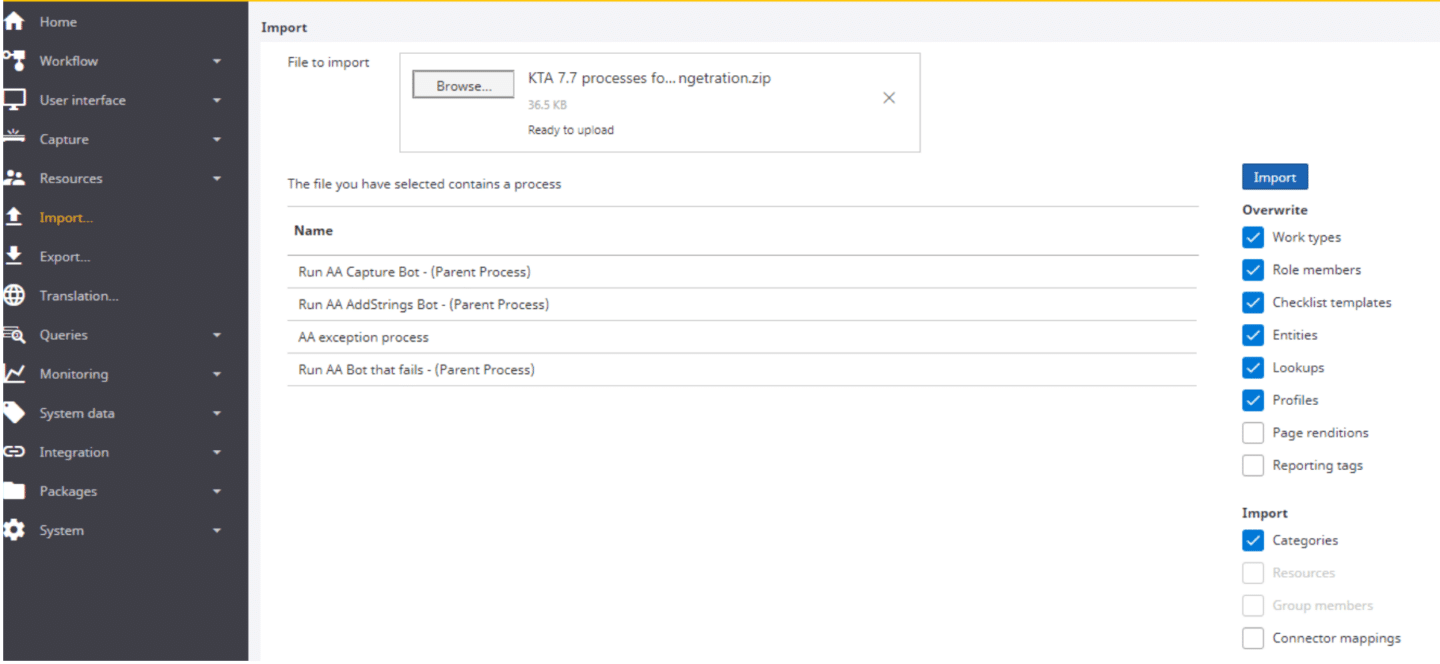

Hyland, commonly recognized under its OnBase brand, provides a comprehensive enterprise platform offering turn-key industry and departmental solutions tailored to meet specific business challenges.

Hyland’s Accounts Payable (AP) automation solution is particularly adept at efficiently capturing invoices at their point of origin, whether they are scanned documents or received electronically.

Pros

- User-Friendly Administration: Hyland OnBase is known for its “clicks not code” approach, making it easy for accountants to use when scanning invoices, reducing the need for coding expertise.

- Adaptability and Automation: The platform is highly configurable and has successfully automated numerous manual invoice processes, improving efficiency and accuracy across various business functions.

Cons

- Outdated Configuration Interface: Hyland OnBase’s configuration interface utilizes a thick client that is in need of modernization. Some features within this interface are limited, which can lead to an increase in manual tasks, diminishing the efficiency of operations.

- Complex Maintenance: Upgrading OnBase can be a challenging process that often necessitates extensive planning and troubleshooting. This complexity can lead to longer downtimes and potential disruptions in workflow, requiring a considerable amount of IT resources.

- Reliability Issues: Users may encounter disruptions, particularly with unstable internet connectivity. Such conditions can cause the application to unexpectedly close during critical tasks like uploads or imports, affecting productivity and data integrity.

Pricing

Hyland OnBase does not publicly disclose its pricing information. Interested parties are encouraged to contact Hyland directly to obtain detailed pricing information tailored to their specific business needs and configurations

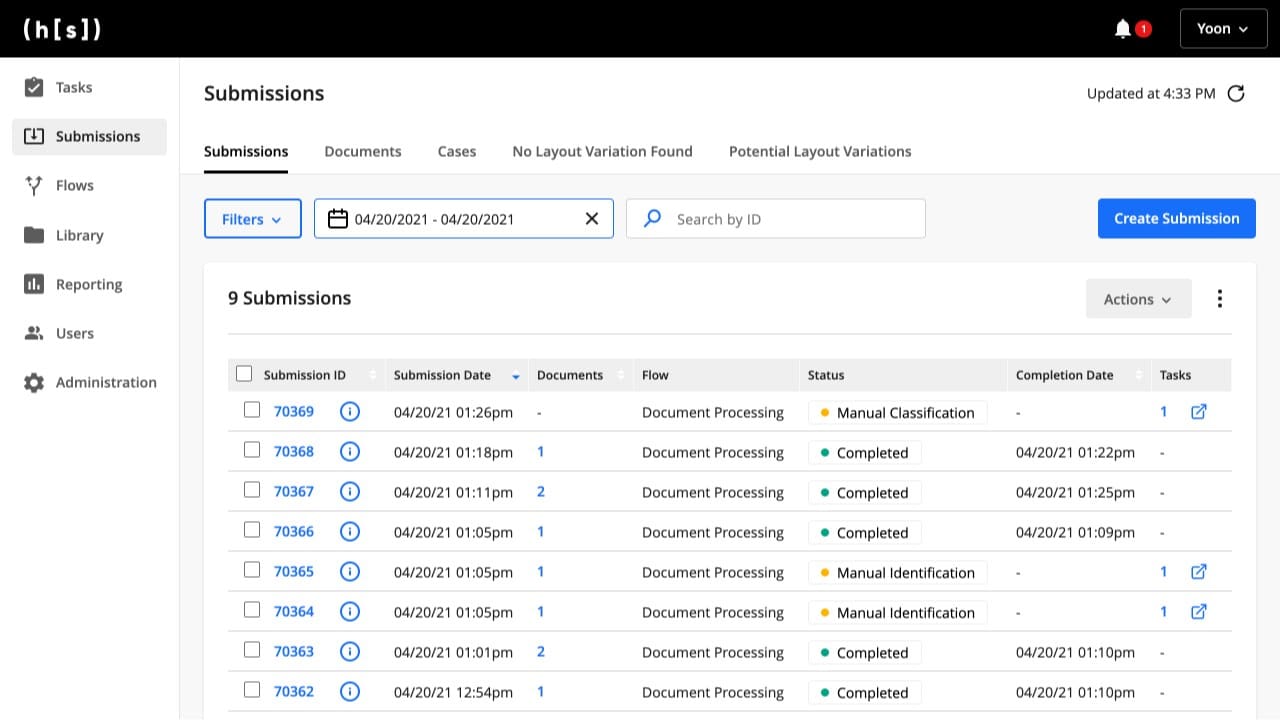

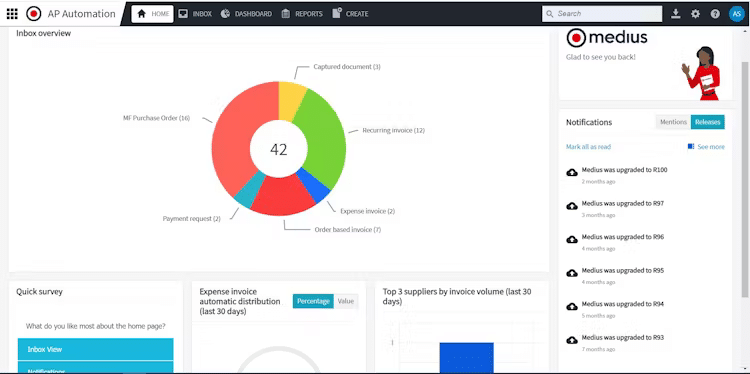

11. Medius

Medius automates all aspects of spend management, from sourcing to payment, reducing manual tasks and speeding up invoice processing. It supports various receipt formats and offers rapid implementation, user-friendly interfaces, and analytics for continuous improvement, ensuring quick returns on investment.

Pros

- Cost Control: Medius enhances visibility into spending by category, cost center, and project, enabling better financial record-keeping, re-forecasting, and budgeting. It also reduces common errors such as duplicate POs, incorrect pricing, and budget overruns.

- Ease of Use: The platform is noted for its simplicity, especially in processing and managing invoices, which is straightforward for both processing staff and managers.

Cons

- Limited Support for Prepayment Invoices: Currently, Medius does not support prepayment invoices. However, improvements in this area are expected as the platform continues to evolve and enhance its capabilities to meet broader business needs.

- Complexity in Customization: Users report that Medius’ administration interface can be overwhelming due to its multitude of categories, making the customization of business rules a challenging task.

- Technical Issues: Occasional technical glitches, such as goods receipts not automatically updating, are noted. These issues often require manual refreshes or the submission of support tickets to resolve.

- Usability Issues: Some setups within the system are not intuitive, necessitating support for navigation. The platform may also experience slowdowns when handling larger document sizes and currently lacks a mobile solution for invoice approval workflows, limiting its accessibility.

- System Organization: The Medius dashboard and system can appear cluttered due to the presence of multiple versions of invalidated documents. Additionally, the audit trail for deleted invoices is difficult to trace.

Pricing

Pricing details are not publicly available; interested parties need to contact Medius directly for a quote.

What is Invoice Data Extraction Software?

Invoice data extraction software is designed to extract and organize information from a variety of invoice formats, aiding in the simplification of accounts payable processes. The key advantage of this technology lies in its ability to automatically extract data accurately and swiftly, which helps minimize errors and save valuable time.

The software is versatile, capable of processing numerous types of invoices, and integrates seamlessly with existing accounting systems, thereby enhancing financial record-keeping and boosting overall operational efficiency.

Why is Invoice Data Extraction Software Important?

Invoice data extraction is vital, here are some reasons why you should get a software set up:

- Time Efficiency: It automates the data entry tasks, freeing up staff to concentrate on more strategic activities rather than manual data input.

- Cost Reduction: Automation reduces the need for manual processing, cutting labor costs and decreasing the chances of costly mistakes.

- Accuracy Enhancement: The software ensures high precision in data extraction, drastically lowering the risk of discrepancies in financial records.

- Simplified Processes: It eliminates the laborious and error-prone manual data entry, simplifying the accounts payable workflow.

- Improved Integration: Featuring API capabilities, the software effortlessly connects with existing accounting platforms, facilitating efficient data management and real-time financial oversight across systems.

How to Choose the Right Invoice Data Extraction Software

Selecting the appropriate invoice data extraction software involves a few key steps:

- Assess the Need: First, evaluate whether your operation truly benefits from this software. Discuss how it might enhance efficiency and accuracy in your financial processes.

- Cost Evaluation: Consider the potential losses from lack of automation and weigh them against the costs of various software options to ensure a good return on investment.

- Feature Analysis: Examine the features provided by each software. Make sure they meet your needs without offering unnecessary extras that inflate costs.

- Trial Implementation: Test the software to gauge its performance. Interact with the customer support team during this phase to assess their efficiency and support quality.

- Integration and Implementation: If the trial phase is successful, move forward with integrating the software into your current systems. Check that it syncs well and improves your existing processes.

Why Choose DocuClipper for Your Invoice Data Extraction Needs?

DocuClipper is a standout choice for invoice data extraction due to its exceptional accuracy and processing speed. It offers cost-effective pricing, starting at just $0.08 per invoice, and facilitates the conversion of PDF invoices into Excel, CSV, and QBO formats, which are simpler to manage.

With API capabilities that connect easily with accounting software like Xero, Sage, and QuickBooks, DocuClipper can process hundreds of invoices in seconds, drastically enhancing the efficiency of financial operations.

Conclusion

In conclusion, selecting the right invoice data extraction software is crucial for enhancing your business finances. This blog has explored the top 11 software options, each made to meet various business needs.

Choosing the appropriate software will enable you to manage invoices more efficiently—saving time and minimizing errors. Ultimately, this investment not only streamlines your operations but also provides your business with a significant competitive edge.