Optical character recognition (OCR) software is an invaluable tool for automating document and OCR data capture in today’s digital world.

With countless documents being produced and shared every day, manually extracting information can become extremely tedious. That’s where quality OCR software comes into play.

But with so many OCR tools on the market, how do you determine what solution is right for your needs?

In this post, we’re breaking down the top 6 OCR software tools for accountants and bookkeepers to help you find one that truly optimizes your financial workflows.

1. DocuClipper

DocuClipper is a cloud-based intelligent financial data extraction OCR software that converts bank and credit card statements, invoices, receipts, brokerage statements, and checks into Excel or accounting software formats.

It uses optical character recognition to extract data from financial documents in PDF formats and extract necessary information. It has an OCR accuracy rate of 97% to 99% across all document types.

With DocuClipper advanced OCR, you can quickly and easily import your financial documents into your accounting software, saving you time and reducing errors.

Key Features

- Wide Format Support: Supports all invoices, receipts, and bank statements.

- Automatic Extraction: Automatically extract data from provided financial documents without the need to create parsing templates.

- Batch Processing: Process hundreds of financial documents at once.

- Security Measures: DocuClipper features SOC 2 compliance, Amazon’s robust servers, and AES 256-Bit SSL encryption, ensuring your data remains protected.

- Customizable Output for bank and credit card statements: Download spreadsheets in the format you need. You can select dates, descriptions, credit, debit, balance, account names, and many other fields.

- Transaction Categorization: Automatically categorize transactions using keywords, simplifying data analysis and interpretation.

- Financial Analysis: Analyze your cash flow, spending patterns, P&L statements, and quickly identify any fraudulent transactions.

Pros

- Highest accuracy in bank statement and credit card statement, and brokerage statement conversion.

- Very fast in processing documents regardless of the number of statements.

- Very user-friendly interface with non or minimum training requirements.

- Very affordable comprehensive financial document OCR.

- Great and responsible customer support.

- Can process large number of documents without any issue.

Cons

- There are not many direct integrations.

- No mobile app to scan invoices/receipts into PDF.

Pricing

DocuClipper offers four pricing tiers:

- Starter ($39/mo): For freelancers and small businesses, includes 200 pages/month, bank statement and CSV conversions, unlimited users, accounting integrations, batch processing, customizable output, and 30-day data retention.

- Professional ($74/mo): Suits growing businesses with 500 pages/month, transaction categorization, and 1-year data retention.

- Business ($159/mo): Ideal for larger firms, offering 2,000 pages/month, advanced reporting, premium support with a dedicated account manager, faster processing, API access, and 2-year data retention.

- Enterprise: Customizable for large firms, with a negotiable number of pages, single sign-on, and 5-year data retention.

2. Dext Prepare

Dext is an automated data extraction tool that helps businesses easily capture, extract, and organize their bank statements, invoices, receipts, and other financial documents.

It uses machine learning to extract key information from these documents, such as the vendor, date, amount, and category, and then automatically codes it to your accounting software.

This can save businesses a significant amount of time and money on their bookkeeping and accounting tasks.

Key Features

- Data Capture: can capture documents from a variety of sources, including scanners, mobile devices, and email.

- Integration with Accounting Software: Dext Prepare integrates with various accounting software and supports over 11,500 banks and institutions, demonstrating strong compatibility and integration capabilities.

- Standardized Digital Format: The software converts all paperwork into a standardized digital format, streamlining the data management process.

- Data Extraction and Accuracy: It extracts relevant data with 99% accuracy and automatically processes it to your accountancy software, ensuring high reliability and accuracy in data handling.

- Expense Management: Dext Prepare simplifies expense management by allowing users to snap paper receipts and financial documents in one click, analyze, and extract important information, and then publish it to the accounting software of choice

Pros

- High accuracy in conversion for receipts, invoices, and bank statements.

- Excellent and direct integration with accounting software.

- Great collaboration features.

- Great in matching QuickBooks transactions.

- A lot of advanced features.

Cons

- Relatively expensive.

- Customer service can be slow.

- In most cases only a few features are actually useful.

Pricing

Dext Prepare offers monthly subscription plans, with prices starting at $229.99/month for 10 clients and unlimited users.

The plans focus on simplifying document collection, optimizing document processing, and providing pre-accounting automation tools.

They also offer a comprehensive solution for client management and automate expense processes.

All plans include integration with over 30 accounting software providers, access to a self-guided training academy, 10-year secure client data storage, and round-the-clock human support.

A Dext price calculator is available to help customize the perfect plan.

To learn more about Dext, visit:

3. AutoEntry

AutoEntry is a cloud-based OCR data entry automation solution that helps businesses eliminate manual data entry of invoices, receipts, and bank statements.

It uses machine learning to extract key information from these documents, such as vendor name, date, amount, and tax codes, and then automatically enters this data into your accounting software.

This can save businesses a significant amount of time and money, as well as improve accuracy and reduce errors.

Key Features

- Upload: Simply upload documents to AutoEntry by selecting a document from your File Manager, or drag and drop files from your computer.

- Email: Are documents sent to your email address? Easily forward these files to the unique email addresses assigned to your account, and AutoEntry will do the rest!

- Mobile app: The mobile app is the simplest way of getting documents into AutoEntry! Have an invoice, receipt ,or an expense in paper format in front of you? Simply take a picture and it will be sent directly to your AutoEntry account for extraction

- Auto-suggested suppliers: If you have yet to teach AutoEntry ‘rules’, AutoEntry will make a smart suggestion for a supplier account, based on the accounts pulled in from your accounting software, or manually uploaded by you.

- Rules: Once you have categorised a document once, you can teach this as a ‘rule’ to AutoEntry, meaning the same categorisation can be applied to the document by AutoEntry each subsequent time, without any human intervention.

Pros

- Great in receipt and invoice accuracy.

- Native integration with Sage.

- Great overall AP automation.

- Very intuitive and user friendly.

- Good integration options with other accounting apps.

Cons

- Average conversion for bank statements.

- Very expensive to competitors.

- Sometimes buggy.

Pricing

AutoEntry offers a pay-as-you-go pricing structure with no contracts or hidden fees, charging based on credits used. Plans include:

- Bronze: $12/month for 50 credits.

- Silver: $23/month for 100 credits.

- Gold: $44/month for 200 credits.

- Platinum: $98/month for 500 credits.

- Diamond: $285/month for 1500 credits.

- Sapphire: $450/month for 2500 credits.

All plans come with unlimited users and a free trial option. Credits are used per document, with different types like invoices, expense receipts, and bank statements costing between 1 to 3 credits each.

To learn more about AutoEntry visit:

4. Docsumo

Docsumo is a document automation platform that uses AI to extract data from documents. It can analyze data and detect fraud. Docsumo can also convert unstructured data into actionable information.

Key Features

- Auto-classify documents: Distinguish between different documents before processing them to push data into correct database

- Categorize data automatically: Proprietary NLP-based classification framework that categorizes key value pairs and line items

- Data Capture: Bring data from email inboxes, scanners or other document management systems into Docsumo.

- Document Processing: Be it PDF, images, excel, emails – use Docsumo to parse them all.

- Custom ML Models: Didn’t find your API? Create your own by training on your data with as little as 50 documents.

- Analytics: Docsumo analytics screen enables you to view number of corrections per document.

- Validation checks:

Pros

- Process and convert many different documents.

- Advanced ML and AI models.

- High accuracy for different documents.

- Great customer support.

- Great automation and collaboration features.

Cons

- In general, does not excel in any of the documents and can make mistakes.

- Relatively expensive.

- Struggle with bulk processing.

Pricing

Docsumo offers usage-based pricing with three tiers:

- Growth ($500+/mo): Ideal for startups needing to automate one or two document types. Includes pre-trained APIs, data accuracy scores, machine learning capability, and supports 3 users. Lacks features like email parsing and custom ML model training.

- Business (Custom Pricing): Suitable for businesses requiring specific data point capture and custom data training. Offers enhancements over Growth, including email parsing and validation rules.

- Enterprise (Custom Pricing): Designed for enterprises needing to process multiple document types and implement custom workflows. Includes all features of Business tier plus advanced validation, unlimited users, and more.

To learn more about Docsumo visit:

5. Dokka

Dokka is a cloud-based accounting automation application that helps finance teams eliminate a significant part of their accounts payable (AP) workload. It uses machine learning to automate tasks such as manual invoice processing, smart document management, and automated invoice approval flows. This can free up finance professionals’ time so they can focus on more strategic work.

Key Features

- Invoice Processing: Using the power of proprietary AI technology, DOKKA extracts data from invoices of all formats and languages.

- Integrations: Whether you’re using a well-known ERP or a lesser known accounting system, DOKKA integrates into any tech stack.

- Accounts Payable Management: DOKKA consolidates all messaging, records, and processes in a single hub.

- 2-Way and 3-Way Matching: Easily reconcile between invoices, purchase orders and goods receipts.

- Line Item Extraction: Extract line items from a document into a journal entry, in one click of a button.

- Automated Invoice Collection: DOKKA automatically imports documents from email, office scanner, proprietary mobile app, csv and even WhatsApp and organizes them for you.

- Automated Approval Workflows: Set custom invoice approval workflows and the system will automatically send approval requests to relevant people based on the data in the invoices.

Pros

- Excellent seamless integration.

- High accuracy in invoice conversion.

- Easily reconcile your bank account.

- Centralized AP management platform.

Cons

- Struggle to process more complex documents like bank statements.

- Longer learning curve.

- Longer setup phase.

- Expensive.

Pricing

Dokka’s AP Automation starts at $400.00/month, with a starter package including 500 documents. It offers flexible month-to-month pricing suitable for all business sizes, from SMEs to enterprises, and features automated invoice collection and processing, AI recognition, smart document management tools, and more.

What is OCR Software?

OCR (optical character recognition) software provides the capability to convert different types of documents and images into machine-readable and editable text.

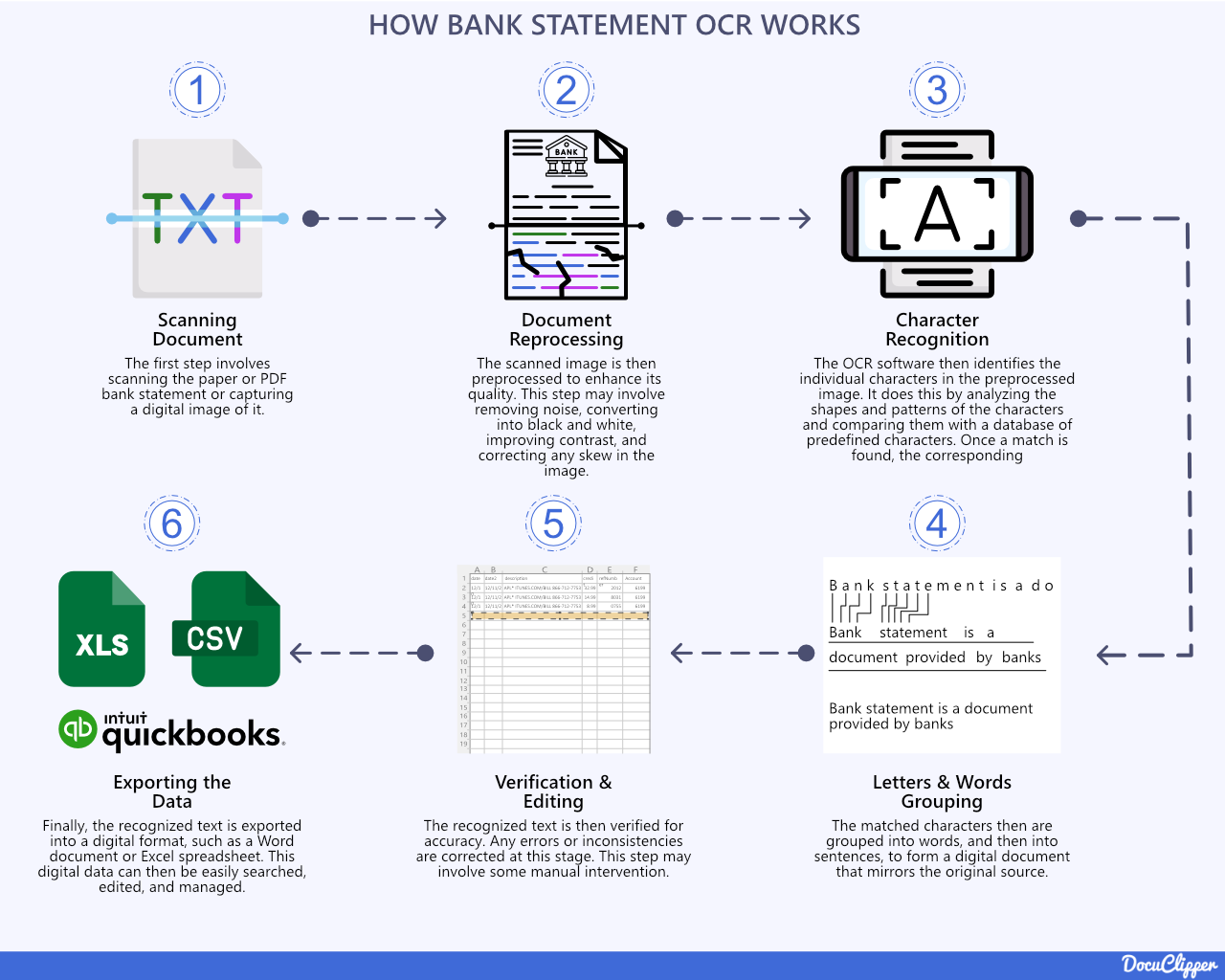

The OCR process includes the following steps:

- Scanning a physical document or taking a photo of a document with a camera.

- Document reprocessing to enhance the quality of the document and quality of the conversion.

- Detecting text in the image and recognizing characters using OCR algorithms.

- Converting the characters into a digital text document.

- Verification and editing process is often manual done by humans to ensure that everything is captured correctly.

- Exporting and saving the output text into various file formats like PDF, Word, Excel, HTML and more.

Key capabilities of OCR software include:

- Automating data capture from scanned or photographed documents without needing to type information manually.

- Reducing time spent on administrative tasks like data entry and document transcription.

- Extracting text data from image files or PDF documents not previously machine readable.

- Quick and accurate conversion of documents into searchable and editable formats.

- Preserving original document formatting and layouts through OCR conversion.

- Supporting document digitization across a range of languages and specialty fonts.

For financial professionals, OCR technology enhances productivity by eliminating slow and inaccurate manual data entry.

Information stored on paper documents can be quickly captured, searched and analyzed digitally using OCR software.

This allows for efficient yet precise extraction of key data like amounts, dates and other critical details needed for financial reconciliation and reporting.

Key Features of Top OCR Software

When evaluating OCR solutions, there are several integral features to consider that set market-leading options apart:

- Conversion Accuracy: The most advanced OCR software options leverage machine learning and AI to deliver maximum accuracy in recognizing text elements and retaining original formatting. Accuracy rates reaching as high as 99%+ ensure precise data extraction.

- Conversion Speed: Rapid processing speeds allow large volumes of documents to be converted quickly and efficiently. Batch processing capabilities are important for digitizing high quantities of scans or images simultaneously.

- Export Formats: The ability to export OCR output into editable and universally usable file types is critical. Top solutions support exports into Word, Excel, PowerPoint, PDF and more as well as structured data formats like JSON and CSV.

- Cloud Storage Integrations: Direct integration with popular cloud storage platforms like Google Drive, OneDrive and Dropbox streamline OCR conversion workflows to and from the cloud.

- Accounting System Integrations: Integrations with accounting platforms and SMB tools like QuickBooks Online and Xero save time by eliminating manual data entry into financial systems.

- Document Uploading: Easy uploading of image files, PDFs, and scanned documents directly into the OCR platform for conversion.

- Customization: From custom dictionaries and glossaries to personalized automated tasks, the top solutions provide customization to increase accuracy and precision.

- Parsing: Automatically splitting documents into relevant data fields is key for downstream reporting and analytics. Multi-format parsing like forms recognition and invoice parsing extract granular data from any document type.

- API: Having an API enables connecting the OCR tool with other applications and building custom integrations tailored to specific use cases.

Prioritizing these pivotal features allows financial professionals to maximize OCR technology for enhanced document processing workflows in accounting and bookkeeping.

The right solution accurately and rapidly unlocks data stored on paper while integrating with existing bookkeeping systems.

How to Choose the Right OCR Software

With the wide variety of OCR software options available, it can be challenging to determine which solution best fits your needs.

Here are some tips on finding the ideal OCR tool for your accounting and bookkeeping workflows:

- Consider your volume. If you need to convert high quantities of documents frequently, make sure to choose a solution with fast batch processing and automation features. For lower volumes, ease of use may be more important than speed.

- Evaluate accuracy rates. conversions for spreadsheet data and financial files. Look for accuracy rates of at least 99% to minimize errors.

- Assess supported file formats/types. Certain software specializes in invoices or receipts while others handle a wider range of documents equally well. Pick one tailored to your common document types.

- Require a workflow-friendly solution with capabilities like cloud storage integrations, seamless data export, automation and API/customization options to streamline OCR processes.

- Ensure compatibility with your existing accounting platforms and business tools through native integrations or Zapier partnerships.

- Compare plans and pricing models, looking for value, scalability and room for growth aligned with your goals.

By carefully weighing these factors against top-rated solutions, it becomes easier matching specific accounting documentation needs to the perfect OCR software for efficiency gains.

Automating time-consuming scans and extractions accelerates business productivity.

Conclusion

With countless documents produced daily, manually extracting information is extremely tedious, and when compared to manual vs automated data entry it doesn’t really make sense.

OCR software automates data capture to enhance productivity. T

his article reviewed top accounting-focused OCR options based on accuracy, speed, integrations, and more to match financial teams with the ideal solution.

Carefully weigh your volume, file types, workflows, accounting platforms, and budget to select the perfect software for maximizing efficiency gains through automating extractions. Accelerating scans and data entry drives business productivity.

Overall when you’re deciding about OCR software you want to compare the manual data entry that you want you automate and search for relatable solution.

Frequently Asked Questions about Best OCR Software

Here are some frequently asked questions about the best OCR software available in the market:

Is OCR outdated?

OCR is not outdated; it’s evolving with advancements in AI and machine learning, enhancing its accuracy and applications in various industries, including finance, healthcare, and legal sectors.

How to choose OCR software?

Choose OCR software based on accuracy, conversion speed, compatibility with existing systems, ease of use, cost, and specific features like batch processing and cloud integration.

What is the future of OCR?

The future of OCR includes deeper integration with AI and machine learning, improved accuracy, broader language support, and enhanced capabilities for processing complex document formats and unstructured data.

Is OCR considered AI?

Modern OCR is considered a subset of AI, especially as it increasingly incorporates machine learning and deep learning techniques to improve accuracy and adapt to various text formats and languages.

How reliable is OCR technology?

OCR technology is very reliable, with top-tier software achieving accuracy rates above 99%. Its reliability continues to improve with advancements in AI and machine learning algorithms.

How OCR can be used by accountants and bookkeepers?

OCR software can be used to convert documents such as bank statements, receipts, and invoices, and perform numerous tasks from bank reconciliation, cash flow analysis, bank statement analysis, or even bank statement audits.

What is the success rate of OCR?

The success rate of OCR varies but can reach over 99% accuracy for high-quality, machine-printed documents. It’s lower for handwritten texts and poor-quality scans.

How is OCR used in real life?

OCR is used in real life for automating data entry, digitizing historical documents, processing business documents like invoices and receipts, and improving accessibility for visually impaired individuals through text-to-speech conversion.

Related Articles:

- 8 Best Data Entry Accounting Software

- How to Manually Import Bank Transactions Into QuickBooks Online

- Bank Transactions: Everything You Need to Know

- OCR vs AI: 7 Differences, Pros, Cons, & Which to Choose

- What is OCR Preprocessing and How It Works

- Best receipt app scanner software

- Best Accounting Affiliate Programs