A brokerage statement is a monthly update from your bank or financial institution with essential information about your portfolio and lists all your investments and assets.

It shows what you own, how much it’s worth, and any transactions like buying, selling, or receiving dividends.

This statement helps you keep track of how your investments are doing and make smart decisions about your investments. By checking it regularly, you can quickly react to changes in the market or take advantage of new opportunities.

Discover ways to make your accounting process faster: Download this eBook to Learn more!

Why is a Brokerage Statement Important?

A brokerage statement is an essential document for managing your investments and preparing your taxes. It’s a report you get every month from your bank or financial institution that shows everything you need to know about your portfolio such as what investments you have, how much they’re worth, and any recent buying or selling activities.

By understanding this statement, you can make better decisions about your finances. It helps you keep track of your investments, see how they are doing, and adjust your investment strategy if necessary.

It’s also useful during tax time, as it provides the details you need to report your investment income. Checking your brokerage statement regularly helps you stay on top of your financial situation.

What is Typically Included in Brokerage Statements?

A brokerage statement includes a comprehensive set of details to help you understand and manage your investment portfolio. Here’s what you can typically find in one:

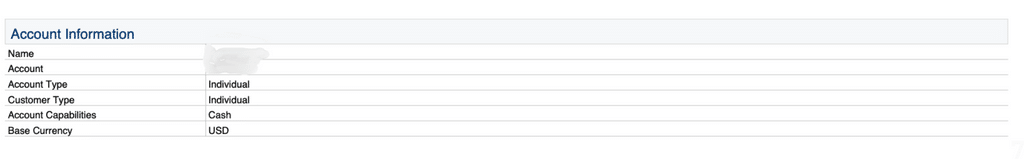

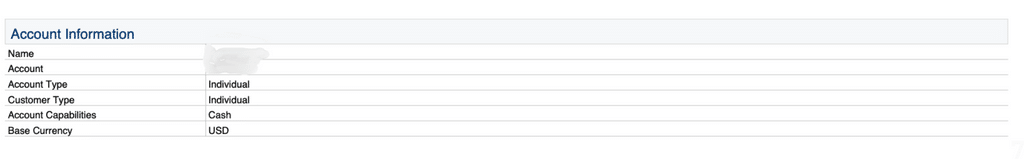

- Account Information: This section contains your personal information, such as your name, account number, and the type of account.

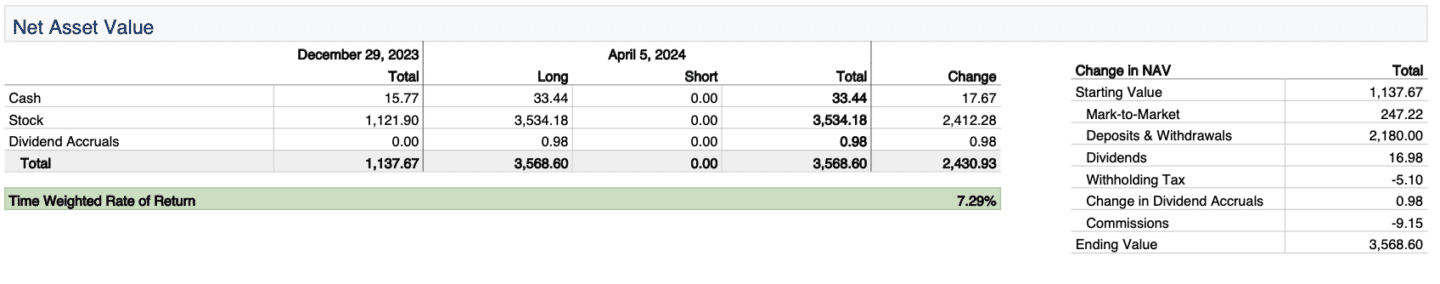

- Account Summary: This provides a snapshot of your account’s overall status, including the total value and any changes from the previous reporting period.

- Income: Details any income generated from your investments during the period, such as dividends or interest payments.

- Fees: Lists all the charges incurred, including management fees or transaction costs.

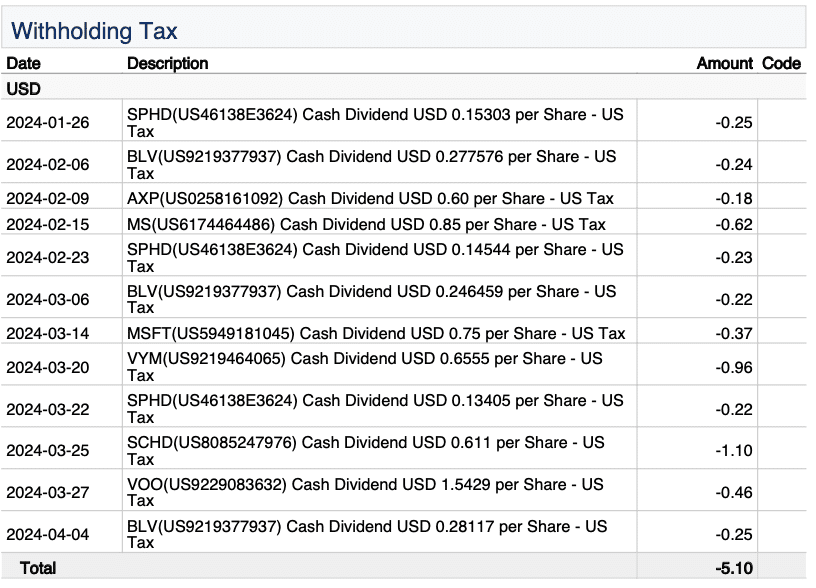

- Taxes: Shows any taxes withheld on investment gains or dividends.

- Account Activity: Records all transactions that occurred during the period, such as purchases, sales, and exchanges of securities.

- Margin: If applicable, this section details any borrowing done against the securities in the account.

- Portfolio Detail: Break down each investment you hold, including quantities, prices, and current values.

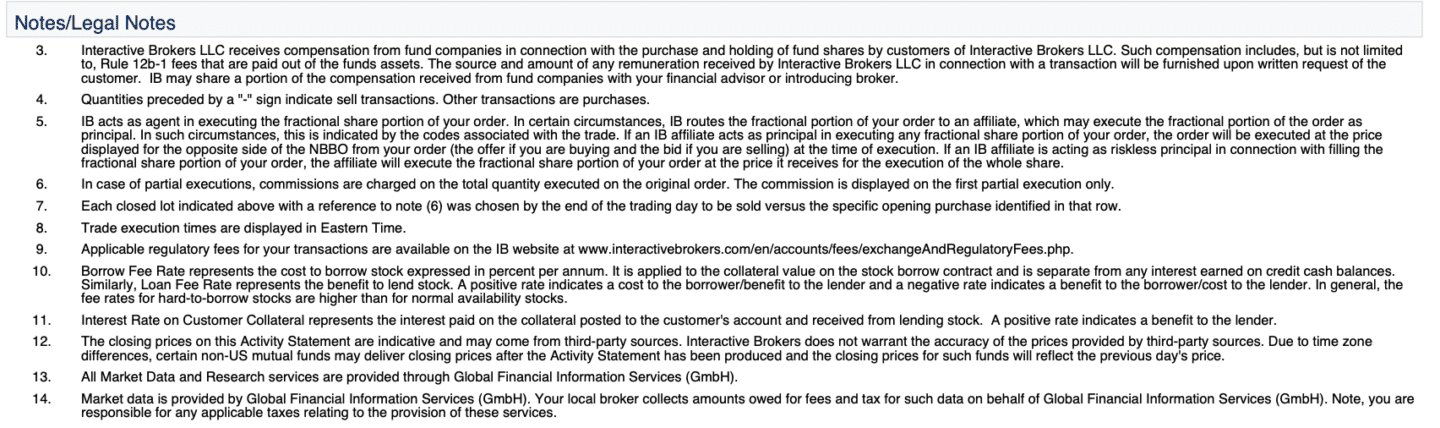

- Disclosures and Definitions: Provides explanations of terms and conditions related to your account and its management.

Typical Abbreviations in Brokerage Statements

Like bank statements, brokerage statements also consist of many abbreviations that are quite difficult to understand and wrap our heads around.

Here are some of the commonly used terms that are being used.

- ADR – American Depositary Receipt Fee: Charges related to holding foreign stocks.

- AFx – Automatic Foreign Exchange: Currency conversion due to international trading.

- B – Automatic Buy-in: Purchases made automatically to cover a short position.

- Bo – Borrow: Indicates a loan is taken, typically for leverage.

- C – Closing Trade: A transaction that closes an open position.

- CD – Cash Delivery: Delivery of cash instead of securities.

- CP – Complex Position: Refers to positions involving multiple types of securities.

- Ex – Exercise: Act of buying or selling the underlying asset in an options contract.

- FP – Fractional Portion: Part of a trade involving less than one full share.

- G – Guaranteed Account Trade: Trading within a guaranteed account.

- HFR – Hedge Fund Redemption: Withdrawing investments from a hedge fund.

- IM – Internal Matching: Part of a trade matched within the broker’s system.

- LI – Last In, First Out: A method to calculate gains and losses, using the most recently bought assets first.

- Po – Posting of Interest or Dividends: Recording earnings from dividends or interest.

- R – Dividend Reinvestment: Automatically using dividends to buy more shares.

- RE – Redemption: The process of selling shares back to a fund.

- RP – Riskless Principal for Fractional Shares: The broker’s affiliate acts as a principal in a risk-free capacity during fractional share transactions.

- SL – Specific Lot: Choosing specific shares to sell for tax purposes.

- ST – Short Term: Gains or losses on assets held for a short duration.

More terms are being used in a brokerage statement. One institution can vary from one another.

Talk with your broker, financial advisor, or banker when you want to clarify and ask for financial advice.

How to Read and Understand Brokerage Statement?

Reading a brokerage statement effectively requires an understanding of its various components. Here’s an expanded explanation of each section to help you interpret your statement with greater clarity:

- Account Information: Your name, account type, and account number are listed here. This section also details whether the account is for cash, margin, etc., and indicates the base currency for account transactions.

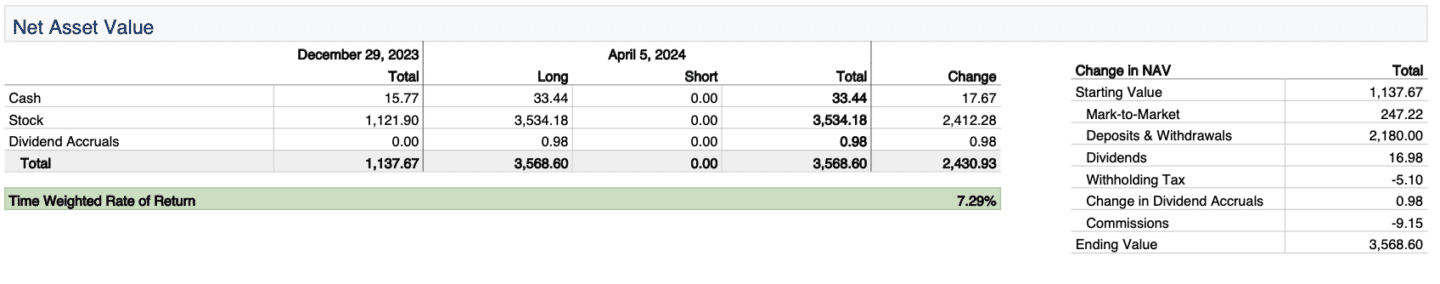

- Net Asset Value: This part shows the total value of your account at the start and end of the statement period, highlighting any value changes.

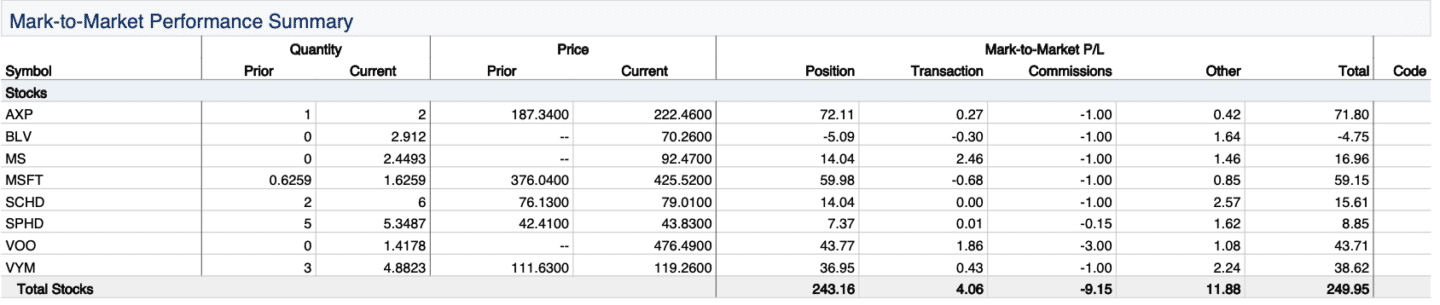

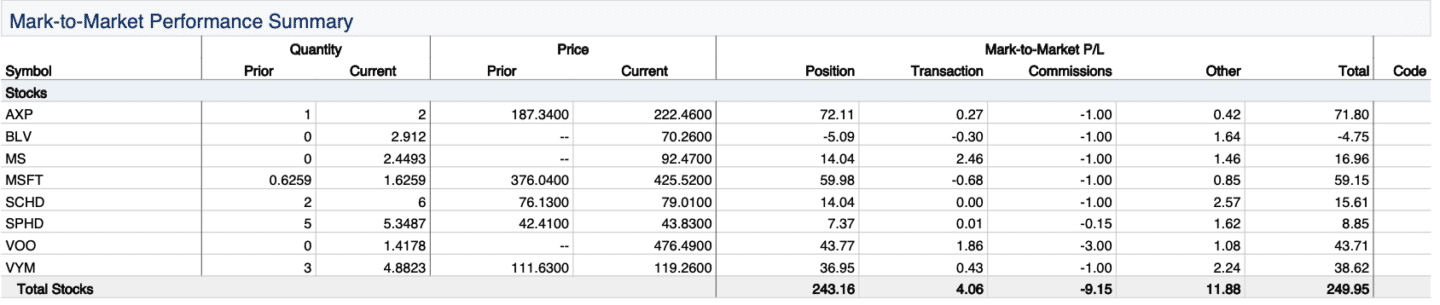

- Mark-to-Market Performance Summary: It details changes in the market value of securities from the beginning to the end of the period, reflecting any gains or losses.

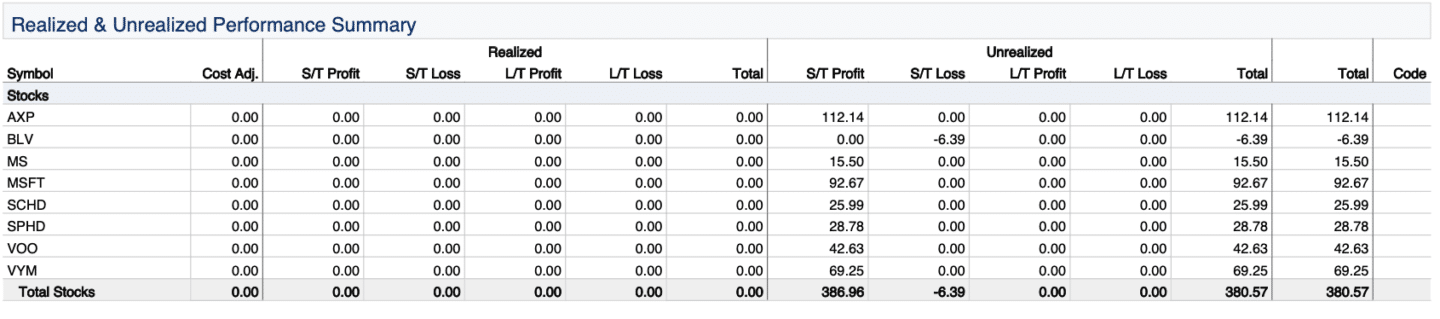

- Realized & Unrealized Performance Summary: Profits or losses from securities sold during the period are detailed under-realized performance. The unrealized performance shows current gains or losses on securities held but not yet sold.

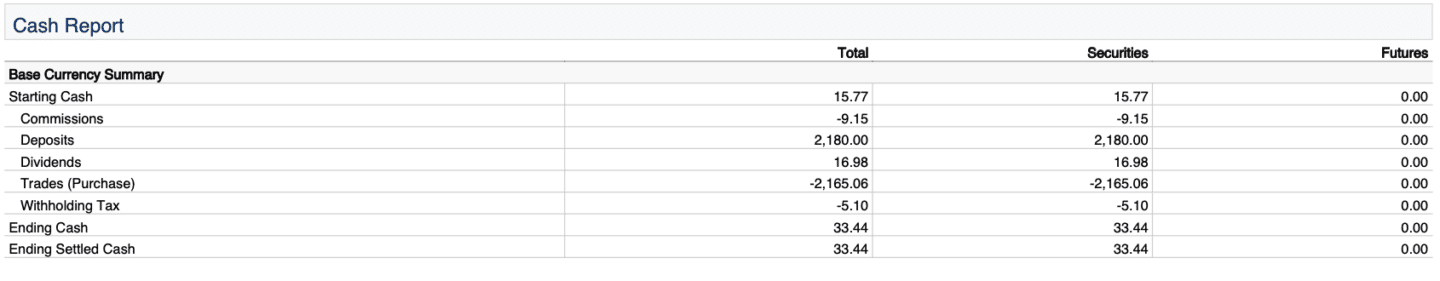

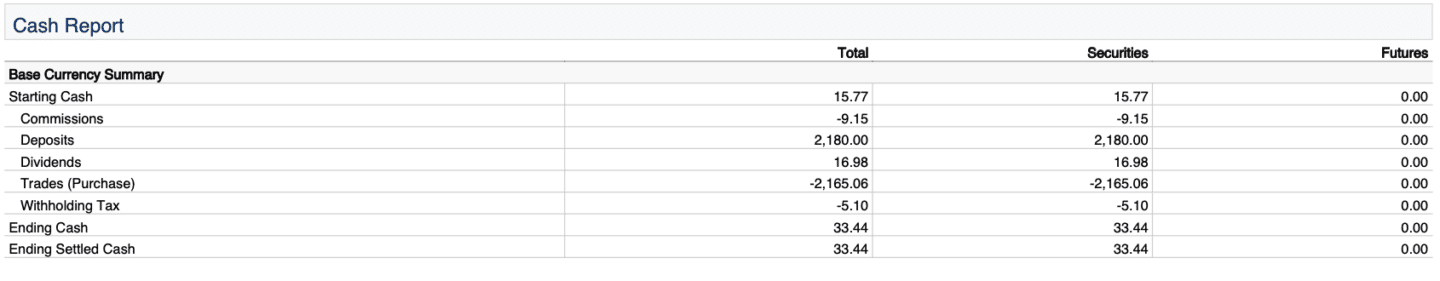

- Cash Report: Displays the opening and closing cash balances and includes detailed entries for dividends, trades, deposits, and withdrawals.

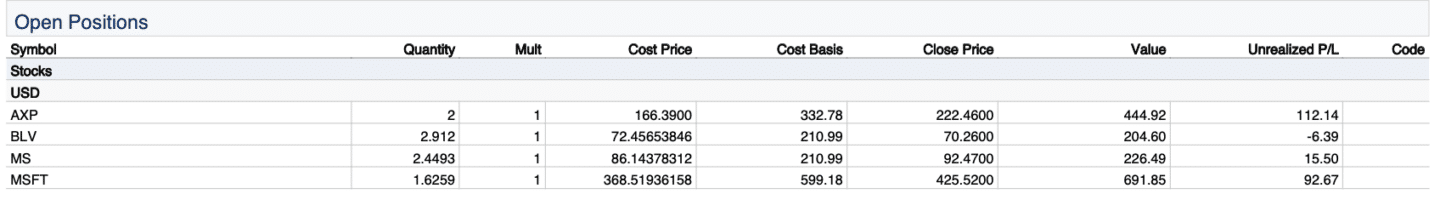

- Open Positions: Lists all active positions in securities, including quantities, cost, and current market price.

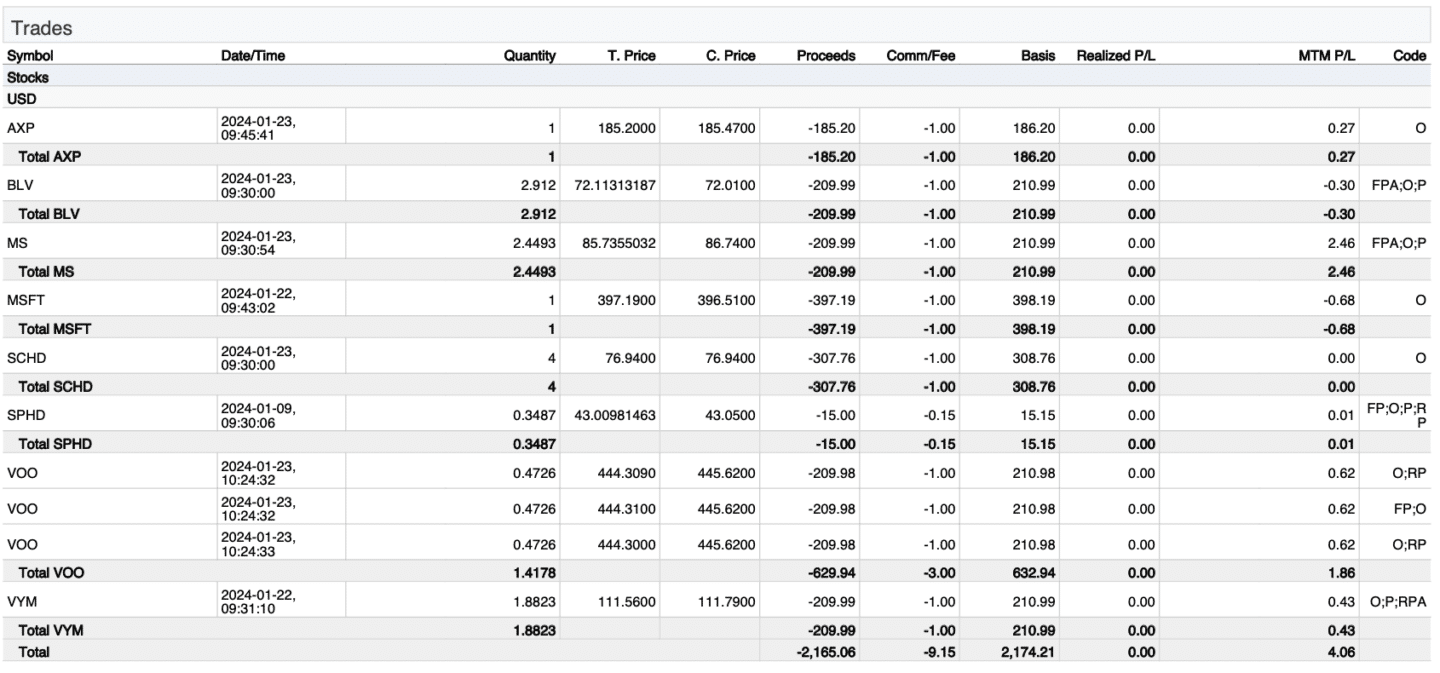

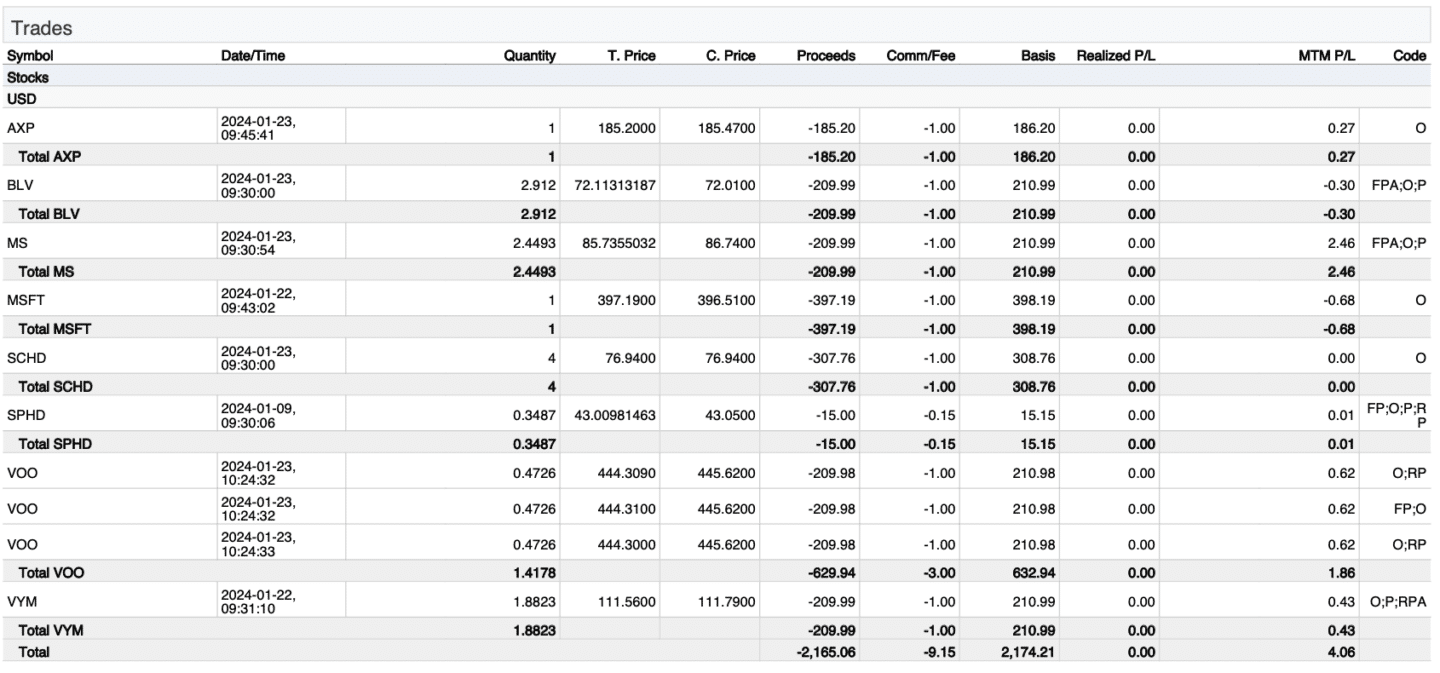

- Trades: A record of all buy and sell transactions within the statement period, including the date, price, and quantity of each trade.

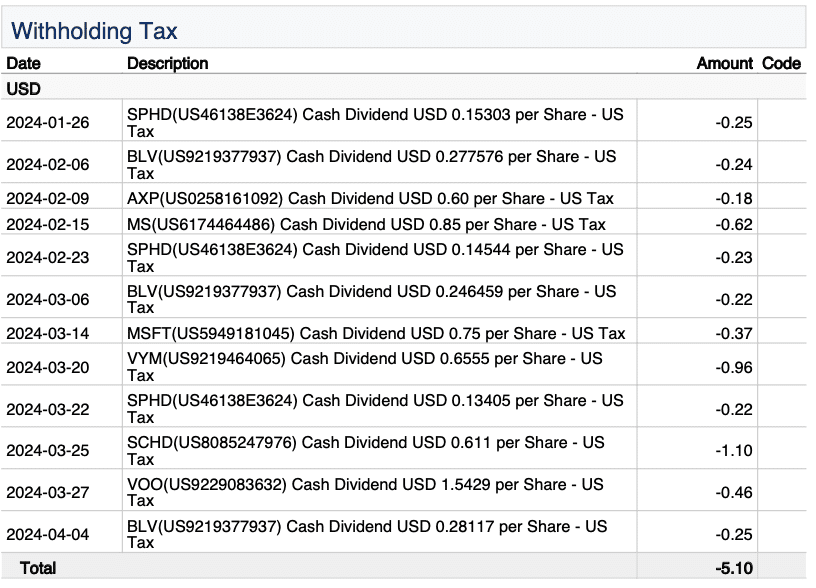

- Withholding Tax: Shows taxes withheld on dividends and interest, which is crucial for tax reporting.

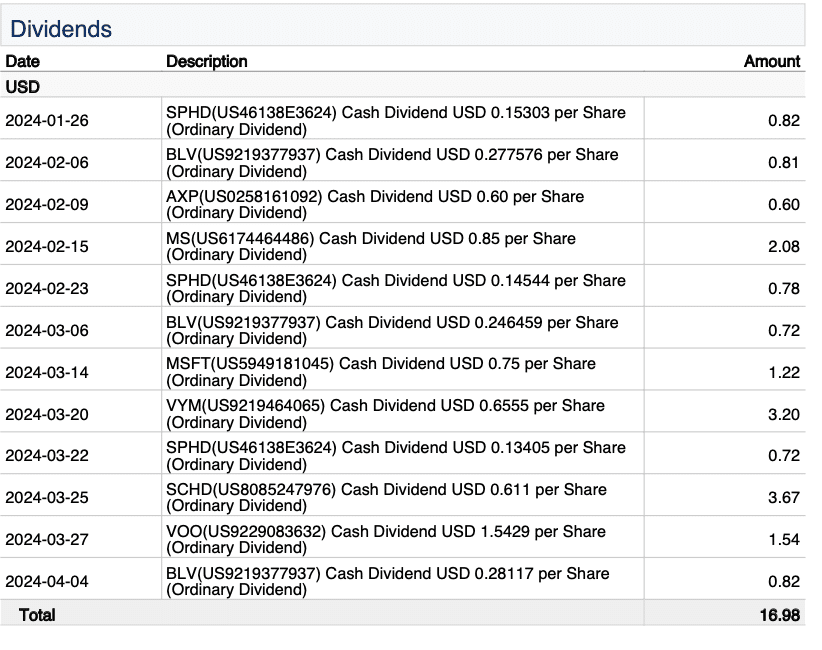

- Dividends: Details dividends received from investments over the period.

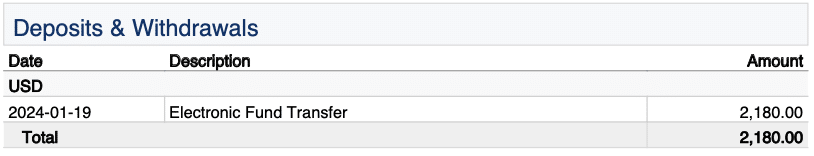

- Deposits and Withdrawals: Summarizes all cash inflows and outflows from the account, such as transfers and dividend deposits.

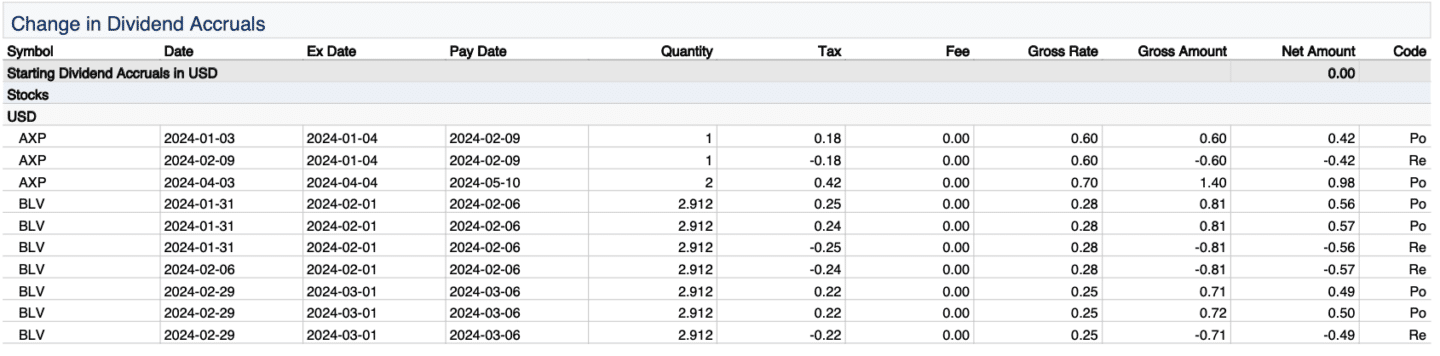

- Change in Dividend Accruals: Reports adjustments in accrued dividends, providing a before and after snapshot.

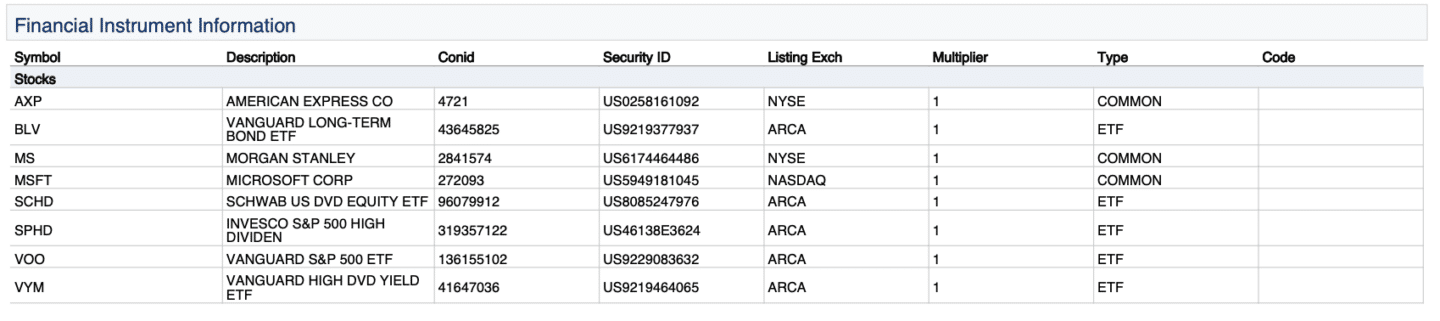

- Financial Instrument Information: Provides details on each security held, including stock name, exchange, and identification code.

How to Get a Brokerage Statement?

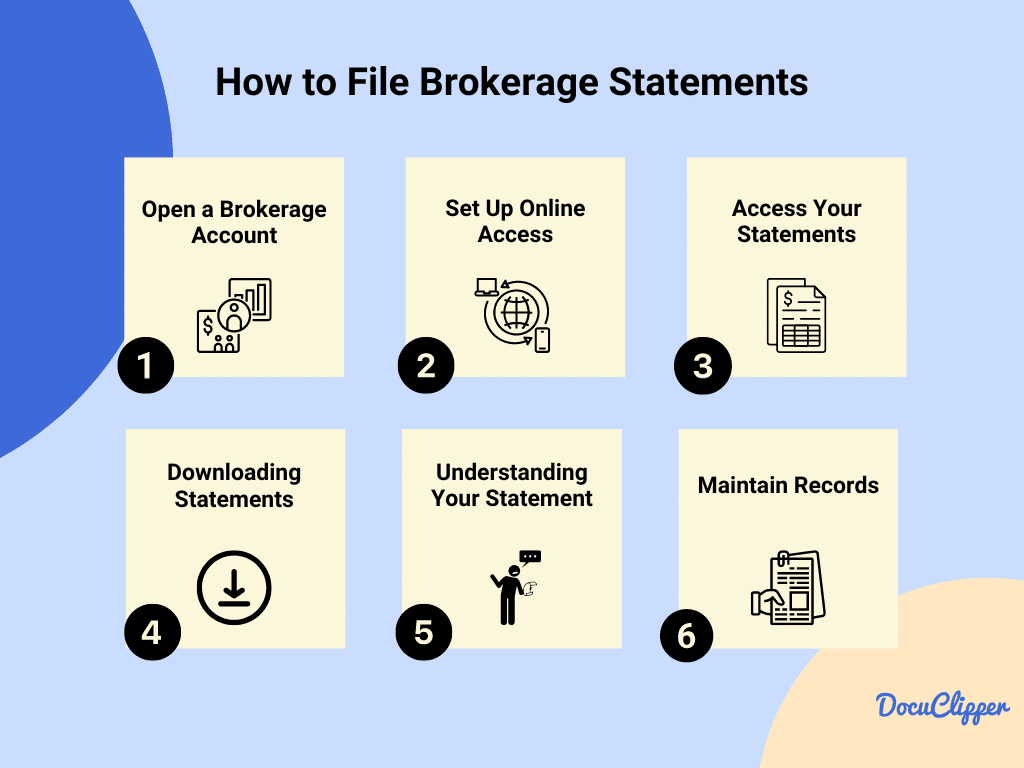

Getting a brokerage statement starts with opening a brokerage account, followed by regular monitoring and accessing your account statements. Here’s a step-by-step guide to obtaining your brokerage statement:

Open a Brokerage Account

Start by selecting a brokerage firm that aligns with your investment goals and preferences. Consider factors like trading fees, account types, available investments, tools and resources, and customer service.

Here are some recommendations of the best brokerage accounts by Investopedia.

Once you’ve chosen a broker, complete the application process, which typically involves providing personal information, and financial details, and setting up funding options. This process may vary slightly depending on whether you’re opening an individual, joint, or retirement account.

Set Up Online Access

After your account is opened, register for online access via your brokerage’s website or mobile app. This will require creating a username and password.

Enable Paperless Statements: Opt for paperless statements if available. Most brokerages encourage this option for environmental reasons and for ease of access.

Access Your Statements

Brokerage firms generally issue statements monthly or quarterly. These statements are available through your online account dashboard under a section typically labeled “Documents,” “Statements,” or “Account History.”

Besides periodic statements, most brokerages offer real-time monitoring tools on their platforms where you can view current balances, portfolio performance, transactions, and more without waiting for the formal statement.

Downloading Statements

For official record-keeping or financial planning purposes, you can download your statements in PDF format from your brokerage account. This is useful for archiving or providing documents to financial advisors or tax professionals.

If you prefer or need paper statements, you can typically choose this option in your account settings. Some brokerages charge a fee for mailed statements due to the extra processing and shipping costs.

Understanding Your Statement

Familiarize yourself with key sections of your statement such as account summary, transaction history, net asset value, dividends, and taxes. Understanding these sections will help you manage your investments more effectively.

Maintain Records

Maintain records of your statements for at least seven years, as advised for tax purposes. Store them securely, whether digitally or in paper form, to ensure you have access to your financial history when needed.

How to Convert Brokerage Statement to Excel, CSV?

Analyzing your brokerage statements can provide valuable insights into your investment activities and overall financial health.

However, reviewing pages of transactions and investment activities can be a time-consuming task.

Converting your brokerage statements into Excel or CSV can simplify this process significantly by getting important transaction information about your portfolio into spreadsheets or your portfolio analysis tool to conduct deep analysis.

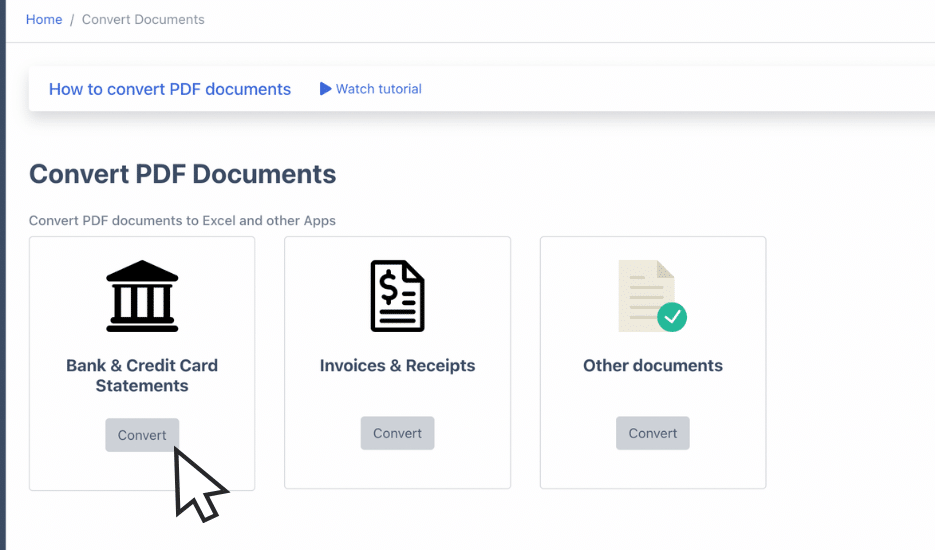

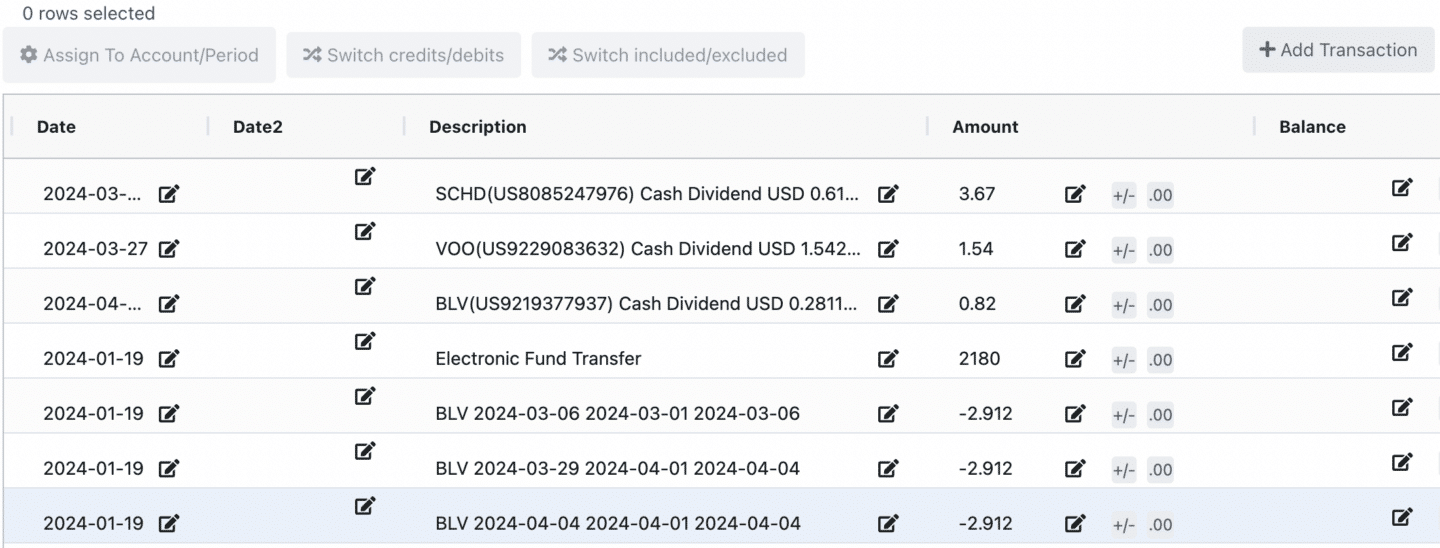

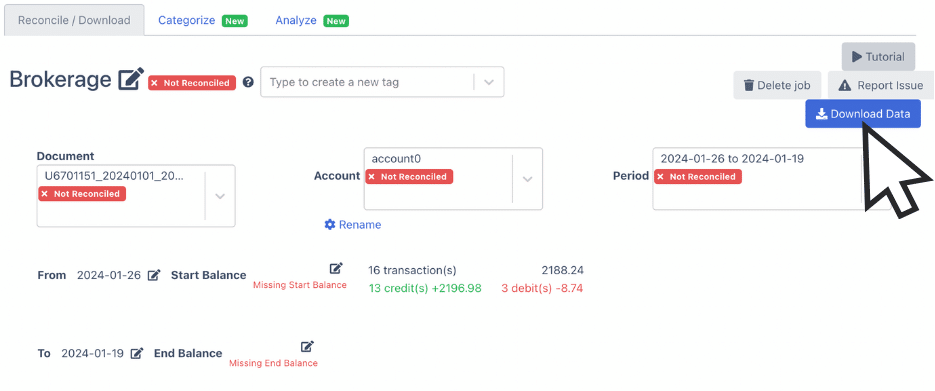

With DocuClipper, you can easily convert your brokerage statements to Excel or CSV formats. Here’s how you can do it:

- Select the Brokerage Statement Converter: Log into DocuClipper and select “Brokerage & Investment Statements”.

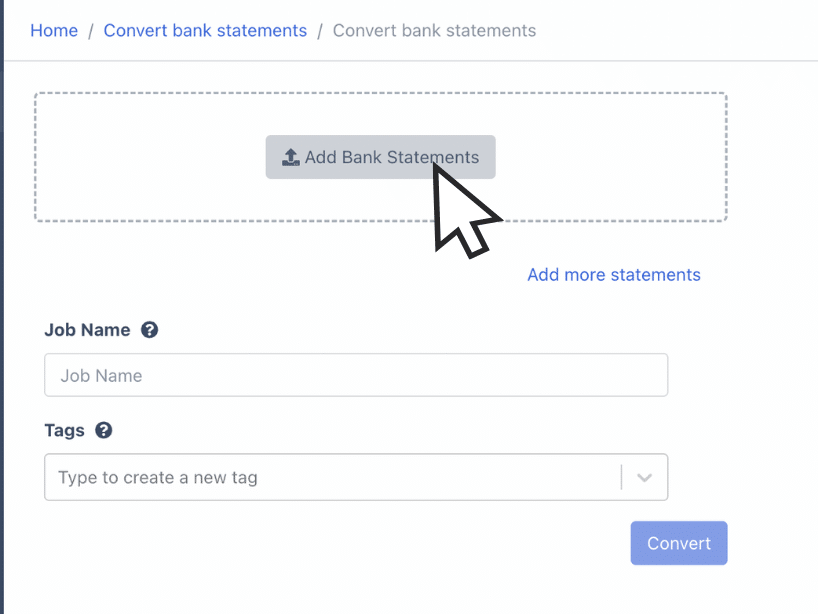

- Upload Your Brokerage Statements: Drag and drop one or more statements into the platform. DocuClipper works with any text or scanned brokerage statement and can process multiple statements simultaneously. Click on convert.

- Transactions are Extracted Automatically: DocuClipper’s OCR technology extracts all the transactions from your brokerage statements, creating a detailed extract that includes additional data like balances, dates, transaction types, etc.

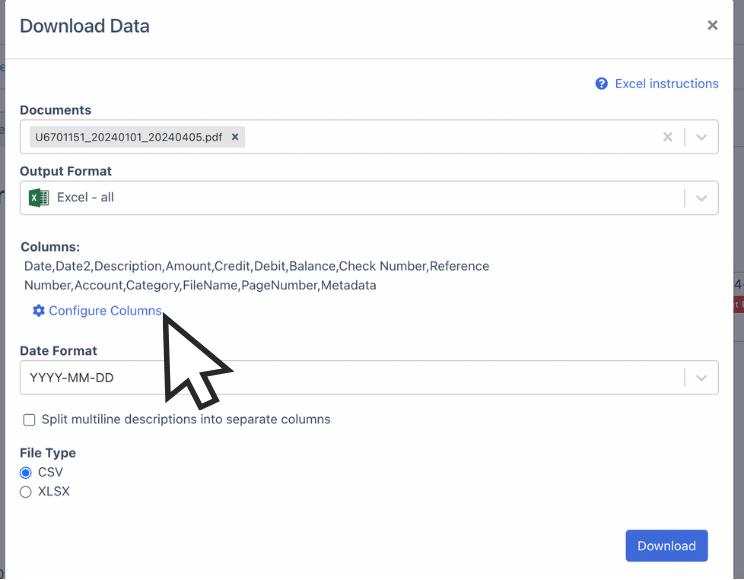

- Convert Brokerage Statement to Excel or CSV: Click on “Download data”. Choose “Excel” as the output format if you prefer an Excel file, or select CSV for a CSV file. Click on “Download Data”, and the spreadsheet will be downloaded to your computer.

- Configure the Output Format: With DocuClipper, you can choose which columns to include in the output. Supported fields include “date”, “transaction type”, “amount”, “buy/sell”, “security name”, “account number”, and more.

By converting your brokerage statements into Excel or CSV, managing and analyzing your investment transactions becomes much easier, providing you with better tools for financial analysis and decision-making.

How Long to Keep Brokerage Statement?

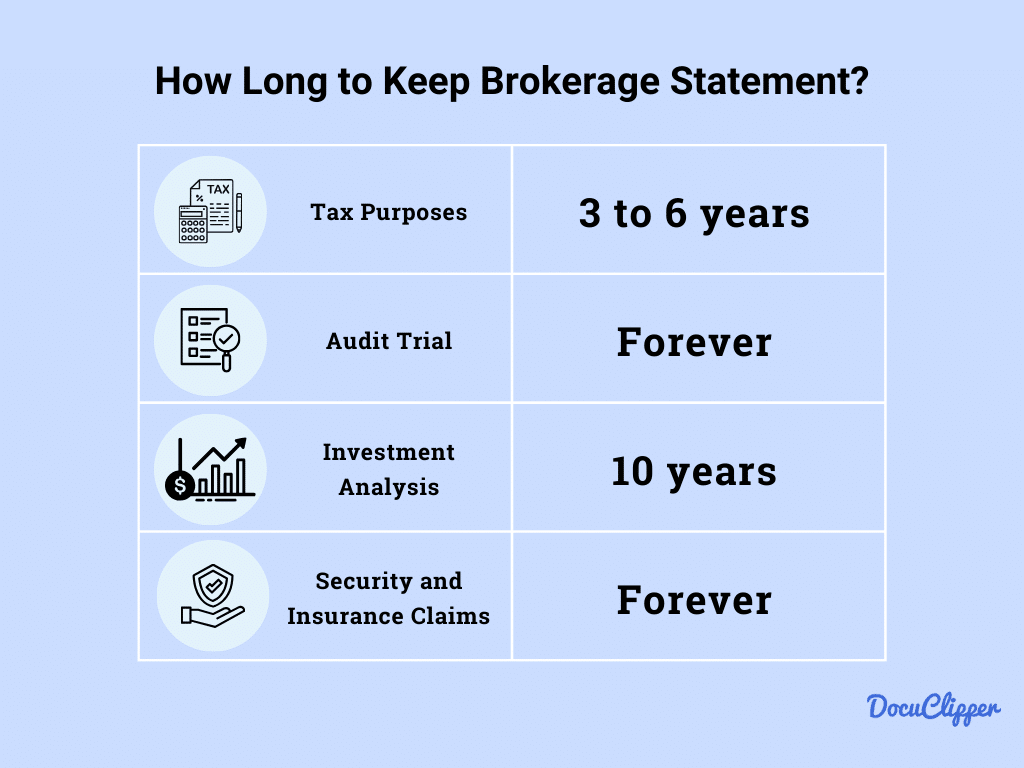

Deciding how long to keep brokerage statements is important for effective financial management and compliance with tax regulations. Generally, the recommended duration to keep such records is at least seven years. Here’s why and how to manage these documents:

- Tax Purposes: The IRS recommends keeping records of purchases, sales, distributions, and dividends of securities to substantiate your gains and losses. These records are vital for calculating capital gains or losses on your investments and should be kept until the period of limitations for the tax year in question expires. The IRS can audit your returns typically within three years of filing, but they can go back up to six years if they find a substantial error.

- Audit Trail: Brokerage statements provide a detailed history of your investment activities. Keeping these statements helps create a reliable audit trail, which can be crucial for resolving disputes or queries about account activities, both for personal reference and legal purposes. For legal purposes, it’s better to keep them forever as cases can arise unexpectedly in different contexts.

- Investment Analysis: Past brokerage statements can be valuable for assessing the performance of your investments over time. They offer insights into how decisions made in different market conditions turned out, aiding in future investment strategies. Some experts say to keep up to 10 years to help with projection

- Security and Insurance Claims: In cases of fraud, identity theft, or insurance claims, brokerage statements serve as proof of your asset ownership and value. Its important to keep it always in a secure place as insurance claims can be complicated and each document counts.

Conclusion

A brokerage statement is a monthly report from your bank or financial institution that shows all your investments and their values. It lists what you own, how much it’s worth, and any buying or selling you’ve done.

This report helps you keep an eye on your investments so you can make smart money decisions. It’s also useful for doing your taxes.

By checking this statement regularly, you can quickly react to changes in the market or take advantage of new opportunities to grow your money.

FAQs about Brokerage Statement

Here are some FAQs about brokerage statements and its importance:

What happens if you don’t have a brokerage statement?

If you don’t have a brokerage statement, you might miss crucial information about your investments, such as performance, dividends, and fees. This can make it difficult to manage your portfolio effectively, file taxes accurately, or even notice unauthorized transactions.

Can a broker refuse to give you a statement?

No, a broker cannot refuse to give you a statement. Regulations require brokerage firms to provide regular account statements to their clients. If you’re not receiving them, you should contact your broker immediately. It’s your right as an investor to have access to your financial records.

Do you have to pay to get a brokerage statement?

Generally, you do not have to pay to receive brokerage statements. They are a standard part of the services provided when you open an investment account. However, if you request paper copies or specific historical statements, some firms might charge a fee, especially if you want them mailed.