Bank statements, like any other documents, can easily get tampered with if there is intent to steal or mask any activities. These can create serious problems for banks and other financial institutions. That’s why they made a way to make certified bank statements.

In this blog, we’ll talk about how to certify bank statements and the reasons why to certify your bank statements.

Make your accounting process more efficient with AI – Download this eBook today

Key Takeaways:

- A certified bank statement is an official document verified by the bank to be accurate and untampered, providing an extra security layer for financial transactions.

- It’s essential for proving financial stability, qualifying for benefits, rental agreements, visa applications, legal matters, and investigations, and showcasing verified financial activities and status.

- To obtain one, email your bank detailing your request without sensitive information, prepare necessary identification and account details, and specify the needed statement period.

- Certified bank statements must be recent, officially signed or stamped by the bank, and include key identification details; specific regulations apply in locations like the U.K.

What is a Certified Bank Statement?

A certified bank statement is a version of your bank statement that has been officially verified by the bank. It confirms that the information on the statement is accurate and matches the bank’s records.

This certification process adds an extra layer of security, ensuring that the statement hasn’t been altered or tampered with. Certified bank statements are often required for legal, financial, or property transactions to prove your financial status and activity.

Certified bank statements are also used in bank statement analysis for bookkeeping purposes when they assess business records and see if there are acts of theft and laundering.

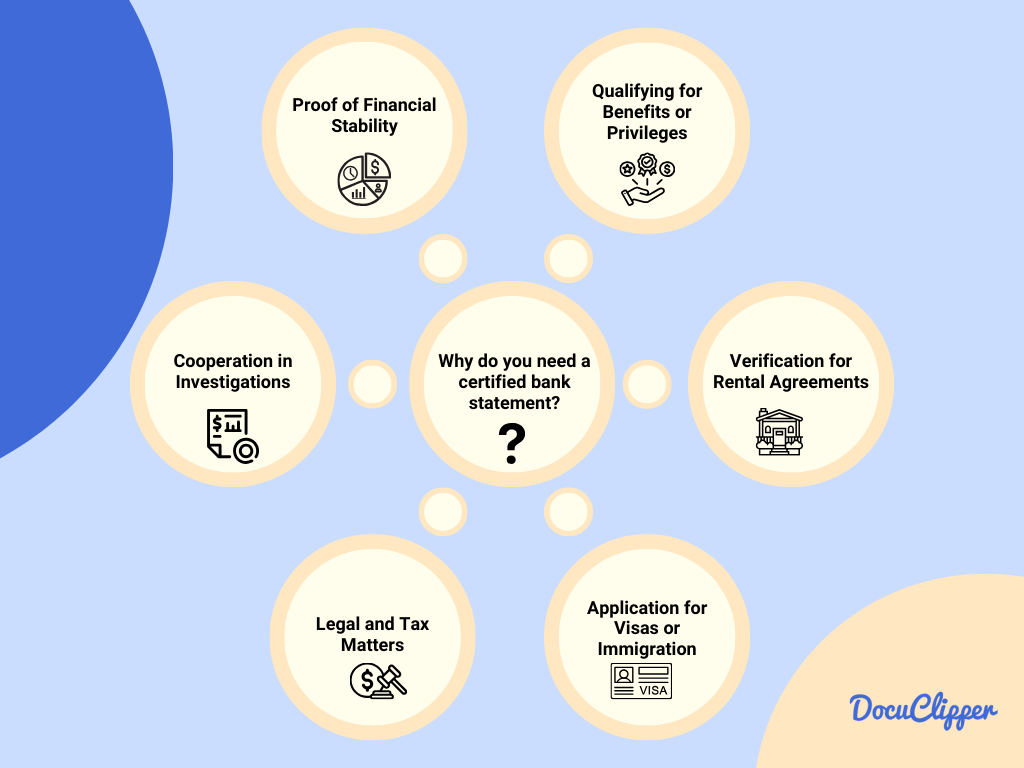

Why Would You Need a Certified Bank Statement?

A certified bank statement has many purposes. In a way, it is to show or prove that this is your financial status that allows you to acquire benefits, and privileges, and cooperate in investigations. Here are some notable reasons:

- Proof of Financial Stability: It demonstrates your financial health and stability, which is often required when applying for loans, mortgages, or other credit facilities.

- Qualifying for Benefits or Privileges: Financial institutions or other entities may require a certified statement to grant certain benefits or privileges based on your financial status.

- Verification for Rental Agreements: Landlords may require a certified bank statement for income verification to see whether you have the ability to rent the property.

- Application for Visas or Immigration: Some countries require proof of financial stability as part of the visa or immigration process to ensure visitors or immigrants can support themselves.

- Legal and Tax Matters: Certified bank statements can be used in court proceedings or for tax purposes to provide a verified record of your financial transactions.

- Cooperation in Investigations: In cases of financial investigations, certified statements can be used to verify transactions and account activities against allegations of fake bank statements.

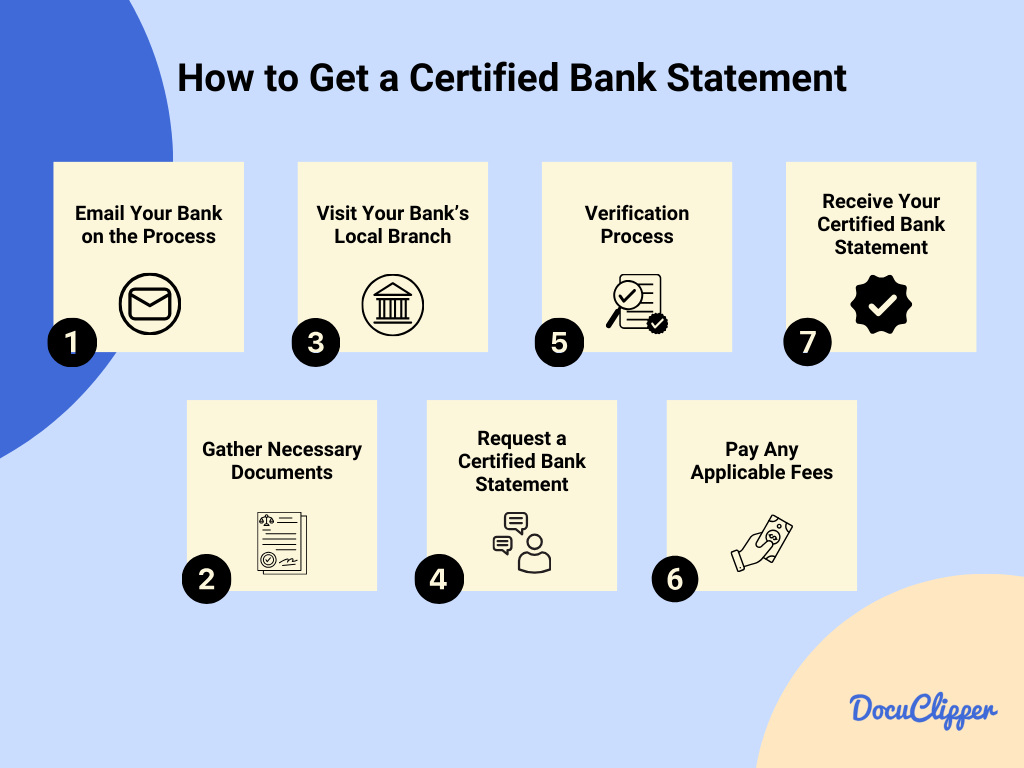

How to Get a Certified Bank Statement

Getting a certified bank statement does not require an accountant. It is as easy as going to your local bank or contacting them beforehand to prepare the necessary documents. Here are the steps:

Step 1: Email Your Bank on the Process

When you want to get a certified bank statement, the first step is to email your bank. Here’s how to do it effectively:

Drafting Your Email:

- Your Name: Start by introducing yourself.

- Account Type: Mention whether it’s a checking, savings, or any other type of account you’re inquiring about.

- Your Request: Clearly state that you’re requesting a certified bank statement.

- Safety Tip: Remember, don’t include sensitive information like your full account number or social security number in the email.

Bank’s Response:

After your email, the bank will guide you on what to do next. They might ask you to come to a branch, or they might handle everything online. They’ll tell you exactly how to get your certified bank statement.

Benefits of Emailing First:

Here are some reasons why you should email your bank first and not rush through the bank:

- It clarifies the process: You’ll know exactly what steps you need to follow.

- It informs about any fees: Banks might charge for certified statements, and emailing first will let you know how much.

- It saves time: You’ll find out if you can do everything online or if you need to visit a branch, helping you plan accordingly.

Here is an email template for example:

Subject: Request for Certified Bank Statement

Dear [Bank Name] Customer Service,

I hope this message finds you well. My name is [Your Name], and I am writing to inquire about obtaining a certified bank statement for my [Type of Account, e.g., checking, savings] account.

For my records and upcoming transactions, I require a certified statement that accurately reflects my account activity and current balance. I believe this document will be instrumental for [Purpose, e.g., loan application, visa process, rental agreement].

Please inform me of the necessary steps to obtain this document. Specifically, I am interested in knowing:

1. The process for requesting a certified bank statement.

2. Any fees associated with this request.

3. Whether this request can be processed online or if a visit to my local branch is required.

For security reasons, I have not included my full account number or personal identification number in this email. However, I am ready to provide any necessary verification details upon your request.

Thank you for your attention to this matter. I look forward to your prompt response and guidance on how to proceed.

Best regards,[Your Name]

[Optional: Your Contact Information]

Step 2: Gather Necessary Documents

When requesting a certified bank statement, it’s important to gather the right documents beforehand. Here’s what you’ll need:

Identification

Make sure to have valid identification to prove your identity. This could be any of the following:

- Driver’s License

- Passport

- Other State ID

Account Information

You’ll need to provide details about your bank account so the bank can narrow down:

- Account Number(s): Know your account number. While you shouldn’t email this information, be ready to provide it during the bank statement verification processes or in secure forms.

- Type of Account(s): Specify whether it’s a checking, savings, or another type of account for which you’re requesting the statement.

Specific Time Frame

If you need statements for a particular period, mention the exact date. Be clear about the start and end dates of the statements you’re requesting. You can only ask for a specific year period or months.

Step 3: Visit Your Bank’s Local Branch

To get your certified bank statement, you’ll have to go to your bank. First, find out where the closest bank branch is and when it’s open by checking the bank’s website or app.

To avoid waiting too long, try going early in the morning or during the middle of the week. These times are usually not as busy, so you can get help faster.

Going when in the less busy hours means you won’t have to wait as much, and you can get more help from the bank staff if you need it. This makes getting your bank statement easier and quicker.

Step 4: Request a Certified Bank Statement

When you get to the bank, find someone who works there and tell them you need a certified bank statement. Have your ID and account details ready, but remember, only share sensitive information like your account number if they ask for it safely.

If you need your statement to show certain dates or specific transactions, tell the bank teller exactly what you’re looking for. This helps make sure the statement they give you has all the information you need.

Step 5: Verification Process

When you ask for a certified bank statement, the bank needs to make sure it’s you asking for it. They’ll do this by checking your ID against the details they have on file for you. They might also ask you some security questions that only you would know the answers to, or check your account details to confirm everything matches up.

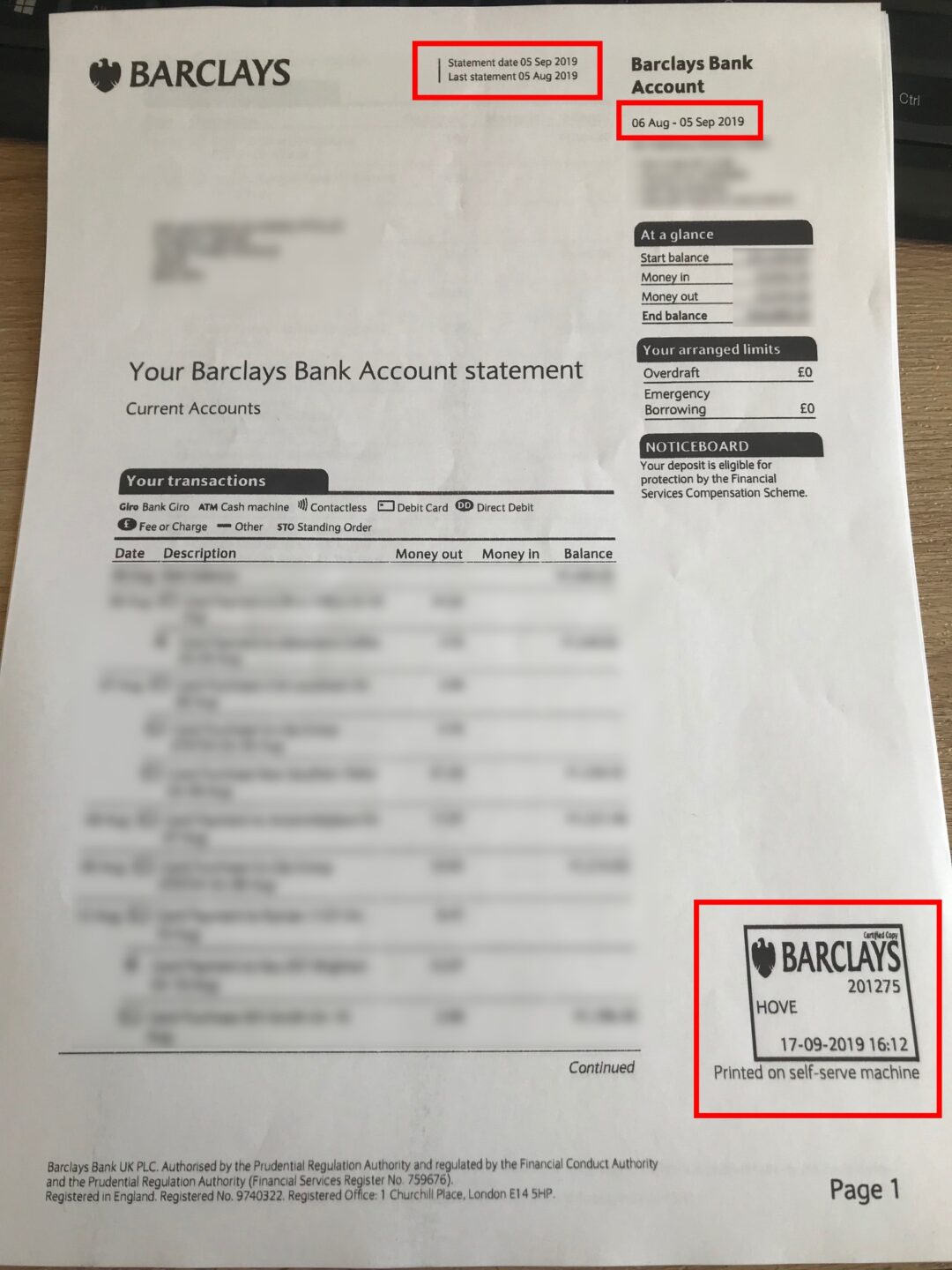

To make a bank statement “certified,” the bank adds a stamp or a signature from someone important at the bank, or a letter saying it’s real. This shows anyone who sees the statement that it’s definitely from the bank and hasn’t been changed by anyone else.

Step 6: Pay Any Applicable Fees

It’s important to know that some banks might charge a fee for providing a certified bank statement. Before you request one, make sure to ask the bank about any fees so you’re not surprised later.

When it comes to paying any fees for the certified statement, banks usually accept various payment methods. You can often pay with cash, use your debit card, or sometimes even write a check.

It’s a good idea to ask the bank which payment methods they prefer by call or email so that you can come prepared.

Step 7: Receive Your Certified Bank Statement

When you request a certified bank statement, some banks might be able to give it to you right away, during the same visit. This is convenient because it means you can get what you need quickly without having to come back later.

However, if the bank can’t provide the statement immediately, they will let you know how long you’ll have to wait. The waiting time can vary, but they’ll tell you whether the statement will be sent to you by mail or if you need to come back to the bank to pick it up.

What are the Requirements for a Certified Bank Statement?

The document must meet the following requirements:

- Recent Date: It should be dated within the last 90 days to ensure the information is up-to-date.

- Bank Verification: The statement needs to be officially signed or stamped by the bank as a mark of authenticity.

- Identification Details: It must display the bank’s name or logo, as well as include the address, bank account number, and the name of the account holder (or primary contact person) to correctly identify the ownership of the account.

In the U.K., certified bank statements have specific rules. They must be printed on official bank stationery. Electronic statements need a certified letter from the bank or a stamp on every page to prove they’re real.

The letter should include your name, account number when you opened the account and your last balance. If needed, you can ask for the statement to be printed on the front or back of bank letterhead paper for authenticity.

Conclusion

Getting a certified bank statement is easy and important for financial, legal, or personal uses. It adds a layer of security, making sure your financial info is correct and secure. Just email your bank, collect the needed documents, visit your bank, and follow their steps.

Don’t forget to ask about fees and how to pay. With some planning, you can quickly get your certified statement without any trouble.

FAQs about Certified Bank Statement

Here are some frequently asked questions about getting your bank statement certified:

What makes a bank statement certified?

A bank statement becomes certified when it’s officially verified by the bank with a stamp, signature, or a letter of authenticity, confirming the accuracy of the information.

What is a bank certificate?

A bank certificate is a document from a bank stating your account balance and other financial details at a specific moment in time. It’s often used to prove your financial standing.

Does a bank statement need to be certified?

Not always, but for certain transactions or verifications (like loan applications or visa processes), a certified bank statement may be required for added authenticity.

What’s the difference between a bank statement and a bank certificate?

A bank statement provides a detailed record of transactions over a period, while a bank certificate shows the account balance at a particular date.

How do I get proof of my bank account?

Proof of your bank account can typically be obtained through a bank statement or bank certificate, which you can request from your bank.

Are online bank statements certified?

Online bank statements themselves are not automatically certified, but they can be certified by the bank upon request, following their verification process.

How do I verify bank documents?

Bank documents can be verified by requesting a certified copy from the bank, which will bear official stamps or signatures.

How do I get a stamped bank statement?

You can get a stamped bank statement by requesting certification from your bank, which may involve a verification process and potentially a fee.