Capital One allows you to download bank statements in CSV format through its website, but only for up to 90 days. This poses a challenge when doing bookkeeping or auditing for clients who don’t have online access, as they can’t provide a CSV file.

This situation leaves you with only PDFs or printed statements, forcing you to manually enter each transaction into a spreadsheet. This is tedious and it will pose a roadblock down the line when you accidentally type mistaken entries.

Fortunately, you don’t need technical skills to avoid this manual entry.

In this guide, we’ll show you how to use a bank statement converter to easily convert Capital One bank statement to Excel, saving time and ensuring accuracy.

Step 1: Upload Capital One Bank Statement to DocuClipper

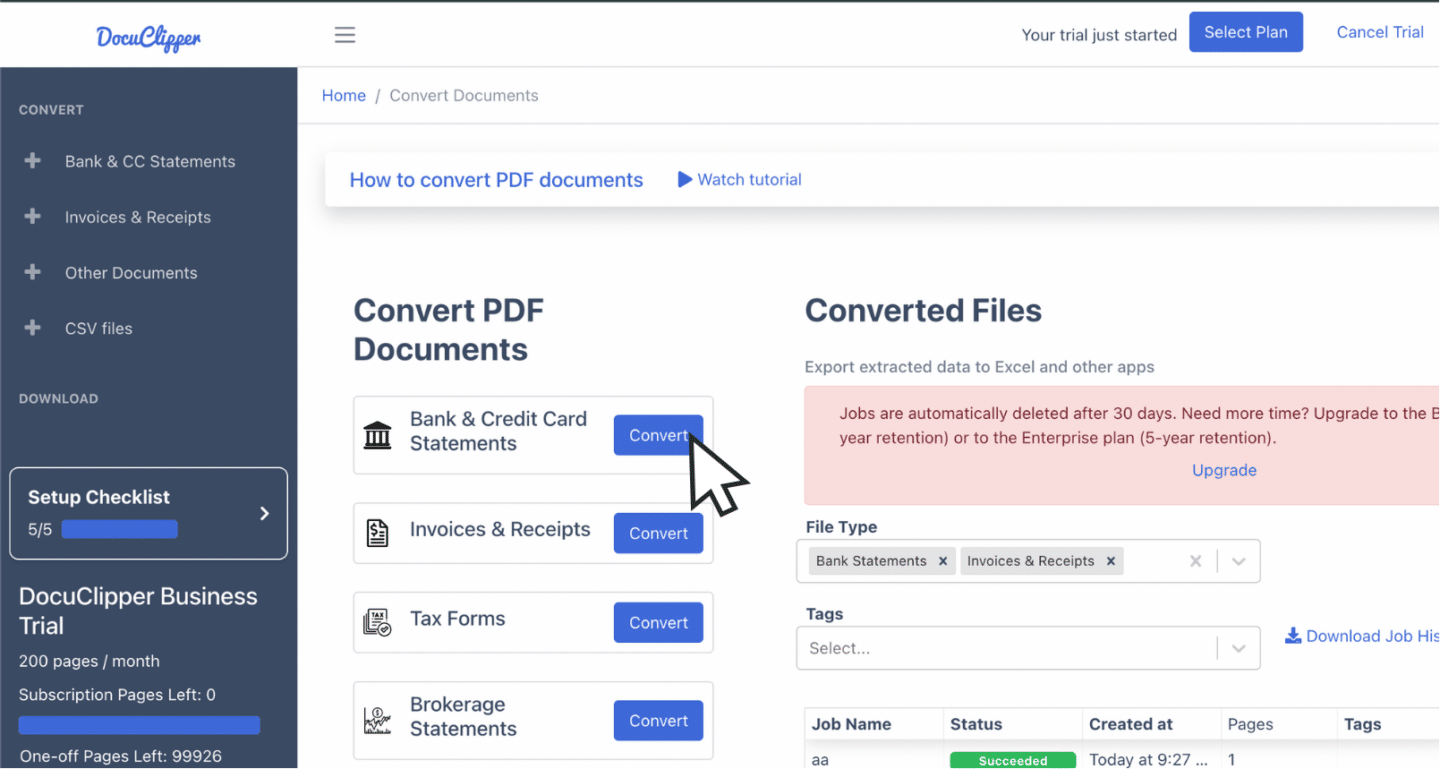

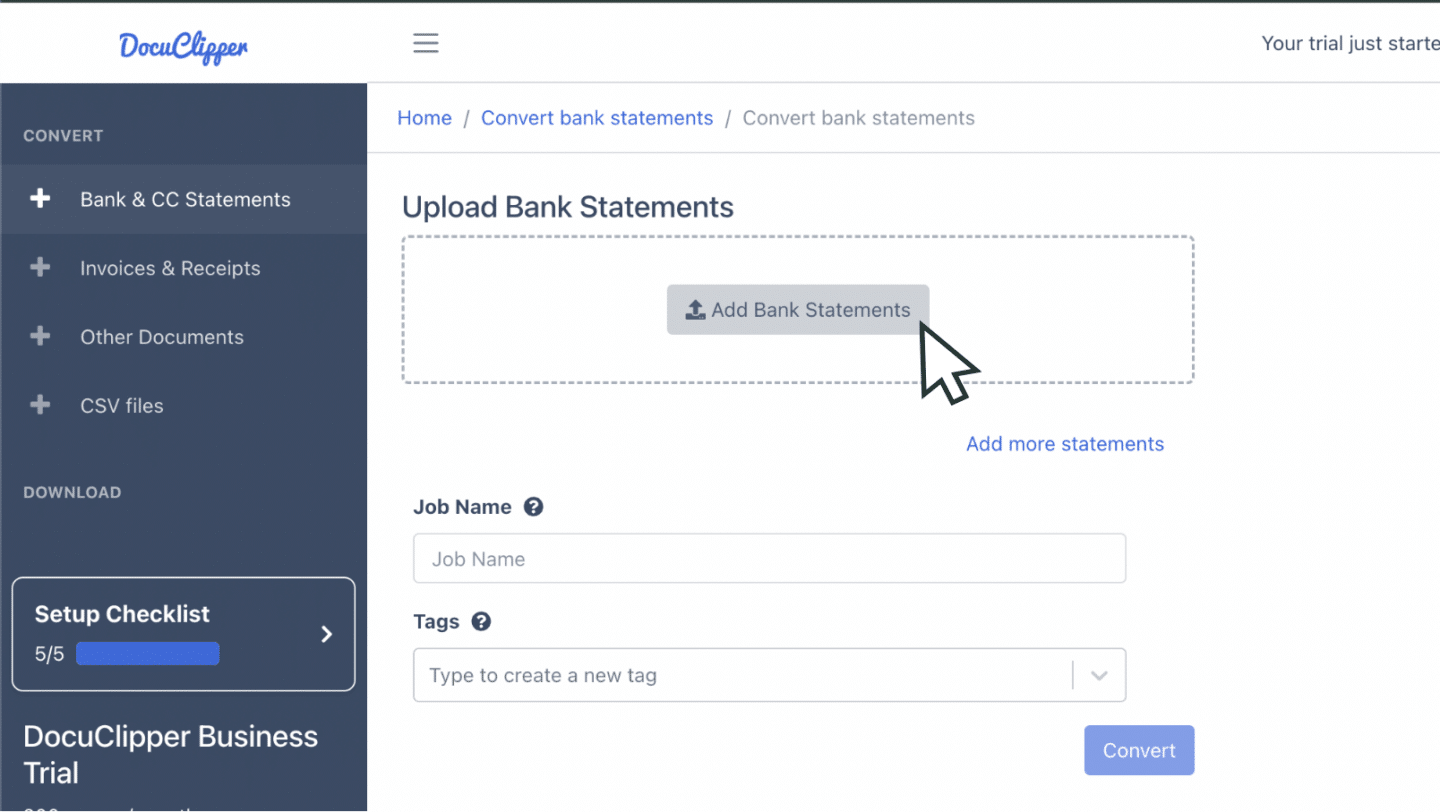

Start by logging into your DocuClipper account. If you’re new to DocuClipper, you can sign up for a free trial. Once logged in, go to the “Convert” section designed specifically for bank and credit card statements.

Here, you can upload your Capital One PDF statements by simply dragging and dropping the files. DocuClipper also allows you to upload multiple files at once, saving time if you have multiple statements.

For better organization, you can label files with tags or custom names.

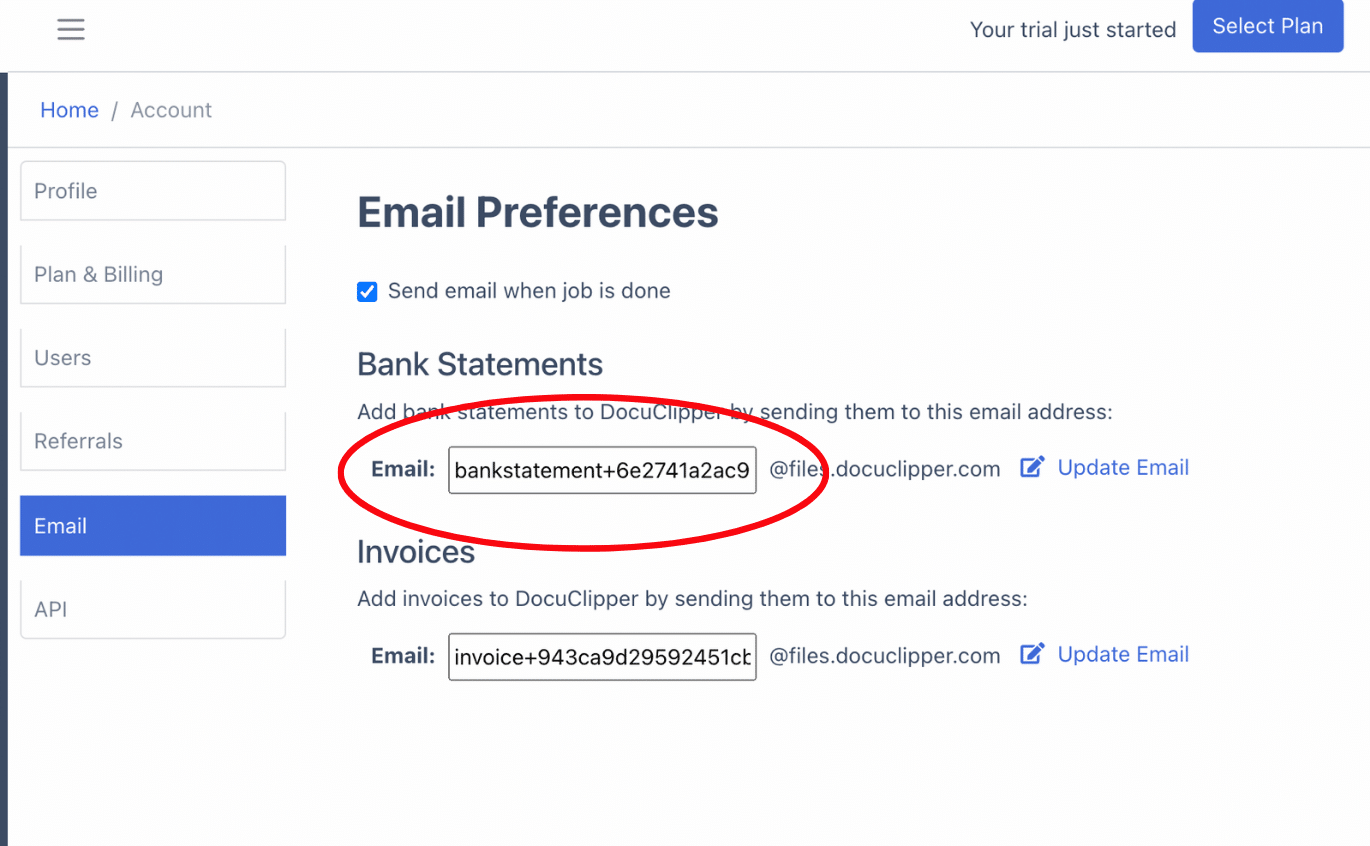

Alternatively, email your statements directly to a unique email address found in your account settings. Once uploaded, your files will appear under “Converted Files” in the left menu and will be ready to convert bank statements to Excel.

Step 2: Analyze Capital One Bank Statement

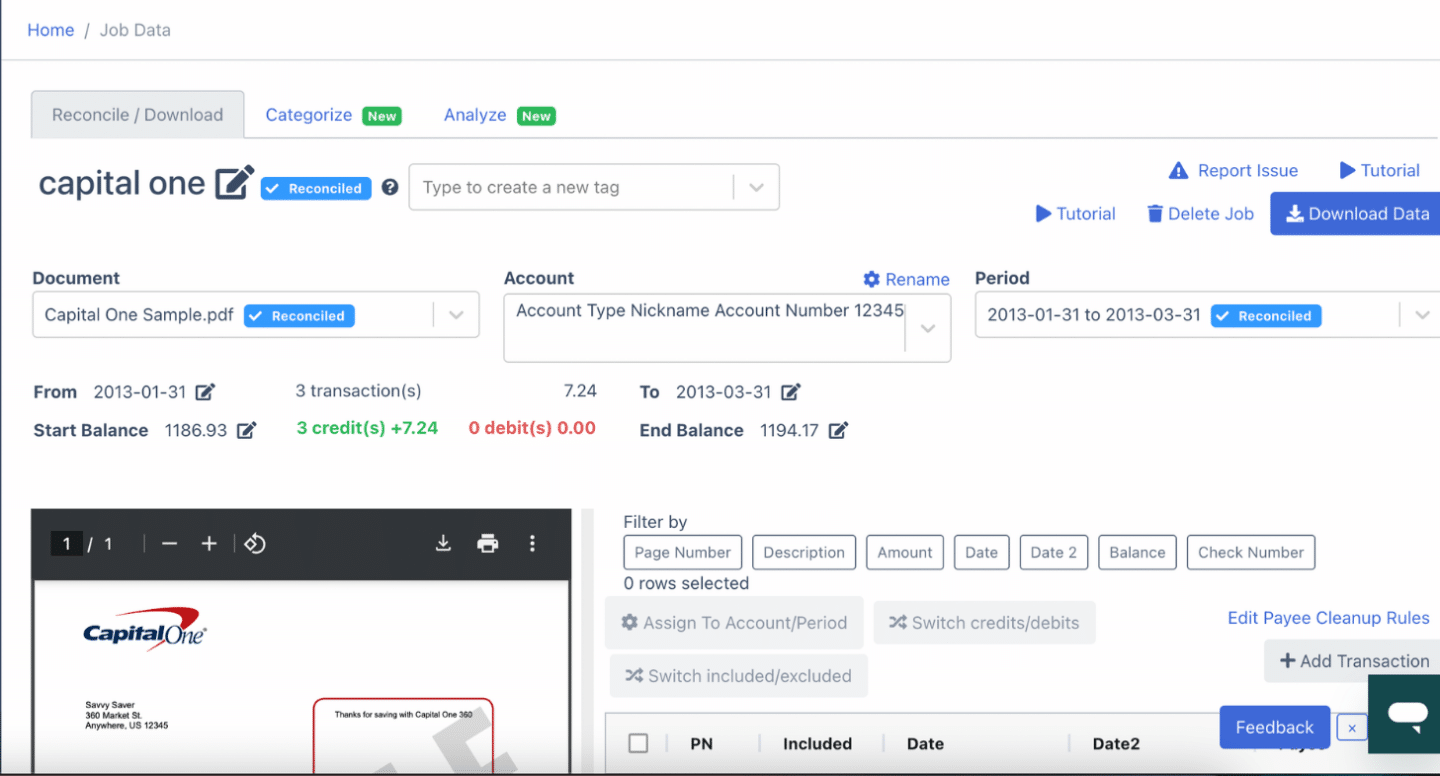

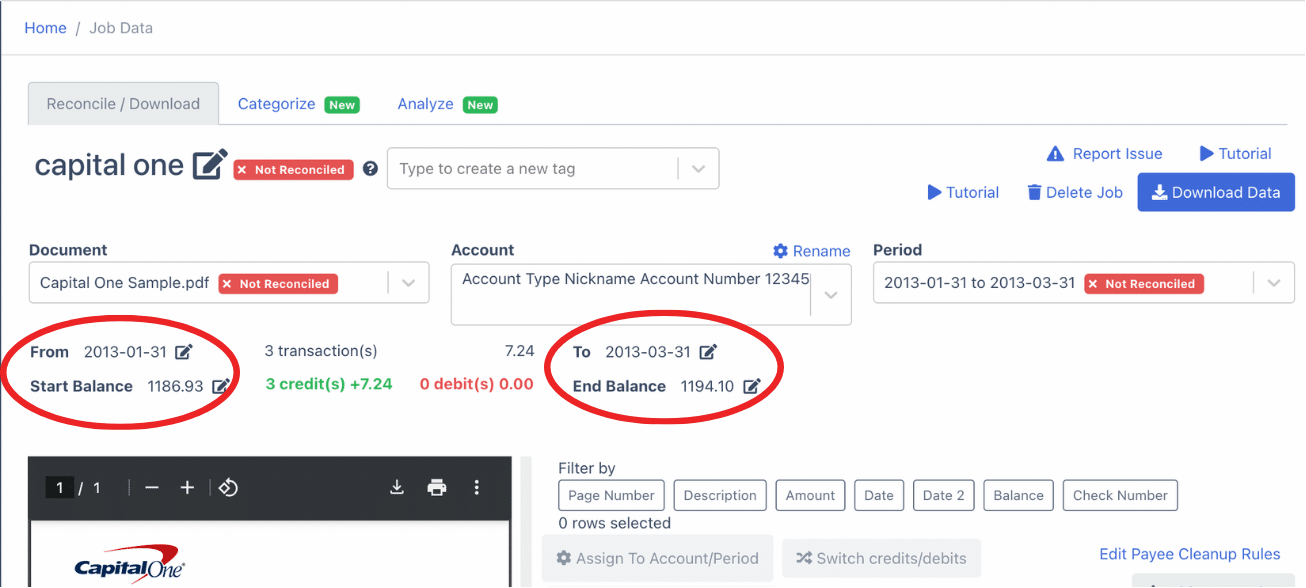

After uploading, DocuClipper presents a side-by-side view of your original statement and the extracted data in spreadsheet format, along with a user-friendly dashboard for easy navigation.

This layout allows you to see each bank transaction, helping you spot any discrepancies in amounts, dates, or totals that could be due to bank errors.

If you’re working with scanned paper statements, take extra care to review for potential scanning errors, as these can impact data accuracy. This step ensures that all transaction data is correct before moving on to further processing.

Step 3: Reconcile Capital One Bank Statements

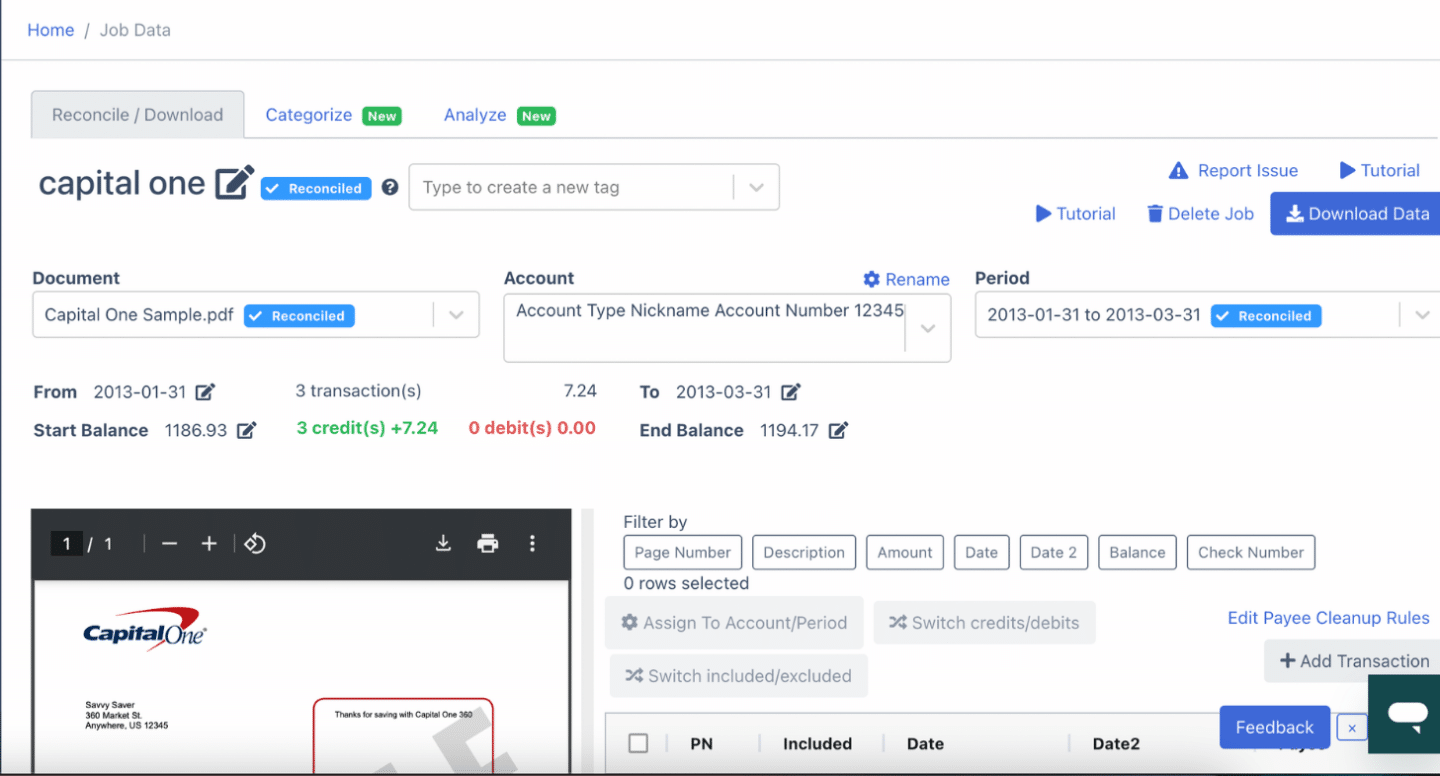

After reviewing the data, DocuClipper will automatically reconcile your Capital One bank statement. If there are any discrepancies, the reconciliation status will mark bank the statement as incomplete.

To address these issues, you can modify transaction details—such as amounts, dates, or descriptions—by clicking the arrow next to each entry.

If additional transactions are needed, simply click “Add Transaction,” enter the details, and ensure all credits and debits are correctly categorized. Once all adjustments are complete, your Capital One statement will be fully reconciled and ready for export.

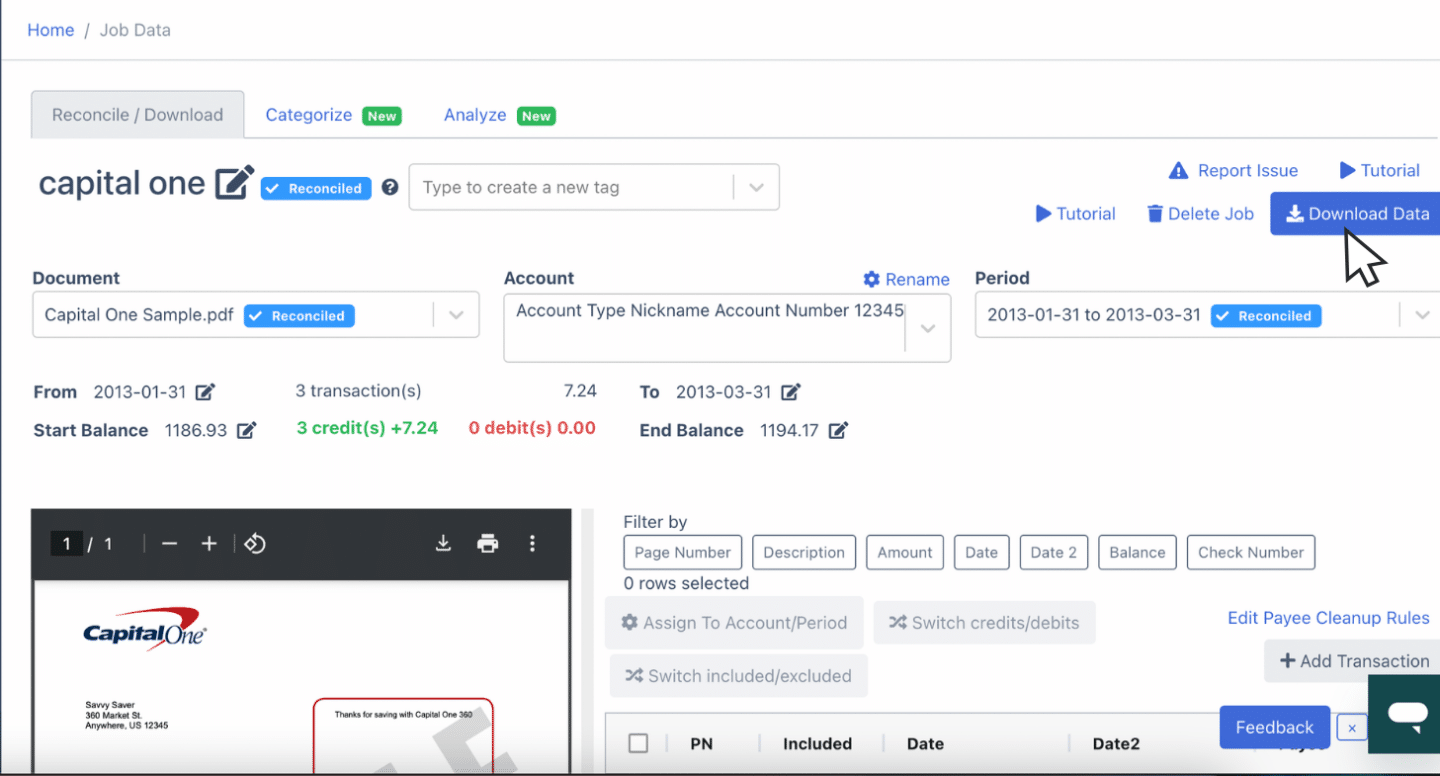

Step 4 Export Capital One Bank Statement to Excel, CSV, QBO

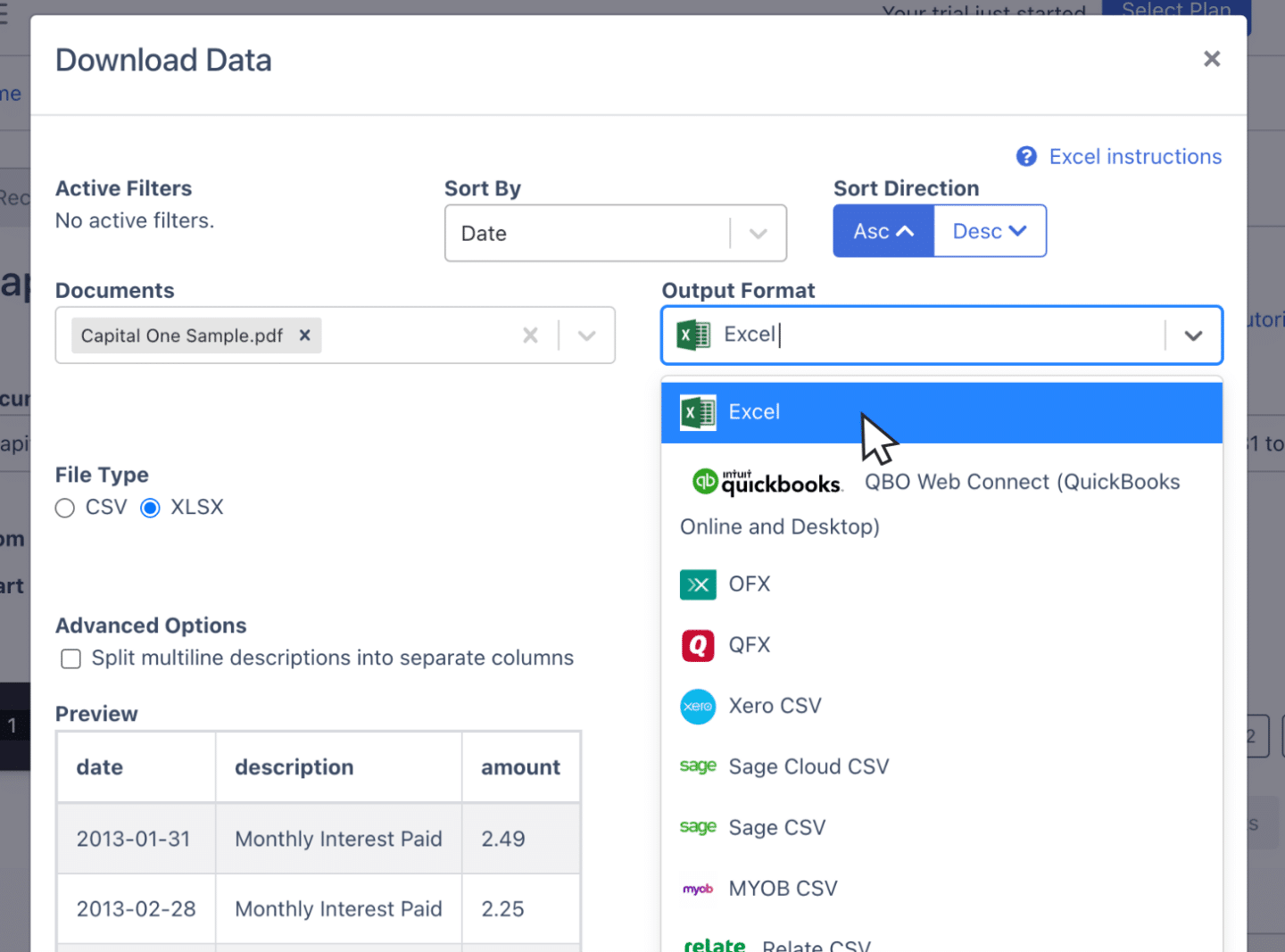

With your Capital One bank statement fully reconciled, you’re ready to export it to Excel, CSV, or QBO formats. Click “Download” to initiate the export and select the format you want.

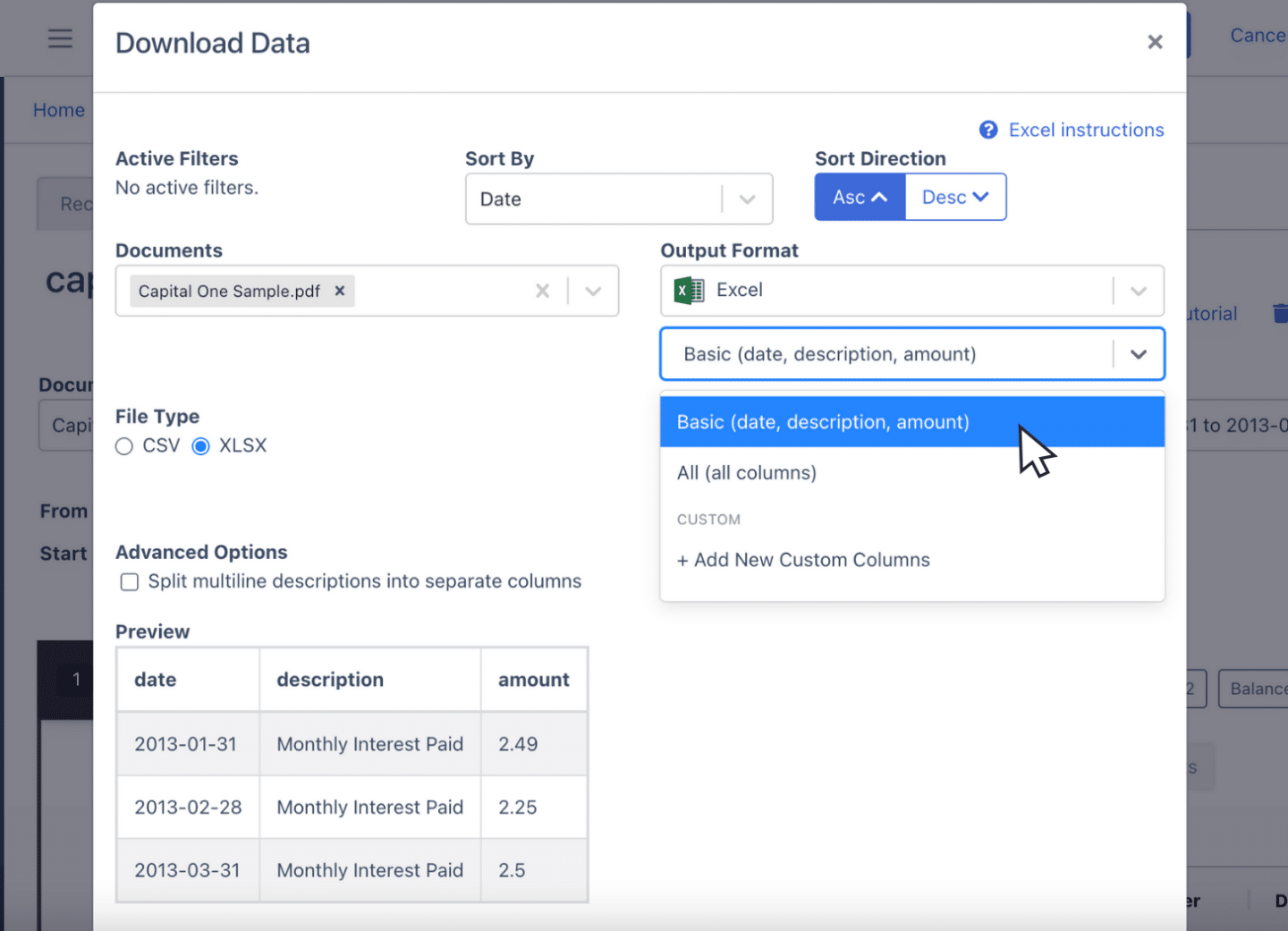

Export Capital One Bank Statement to Excel

To export your Capital One statement as an Excel file, go to the export menu and select “Excel.” Choose the “XLSX” format to ensure compatibility with most spreadsheet software.

Once selected, click “Download,” and the file will be saved to your Downloads folder, ready for immediate use in your accounting tasks.

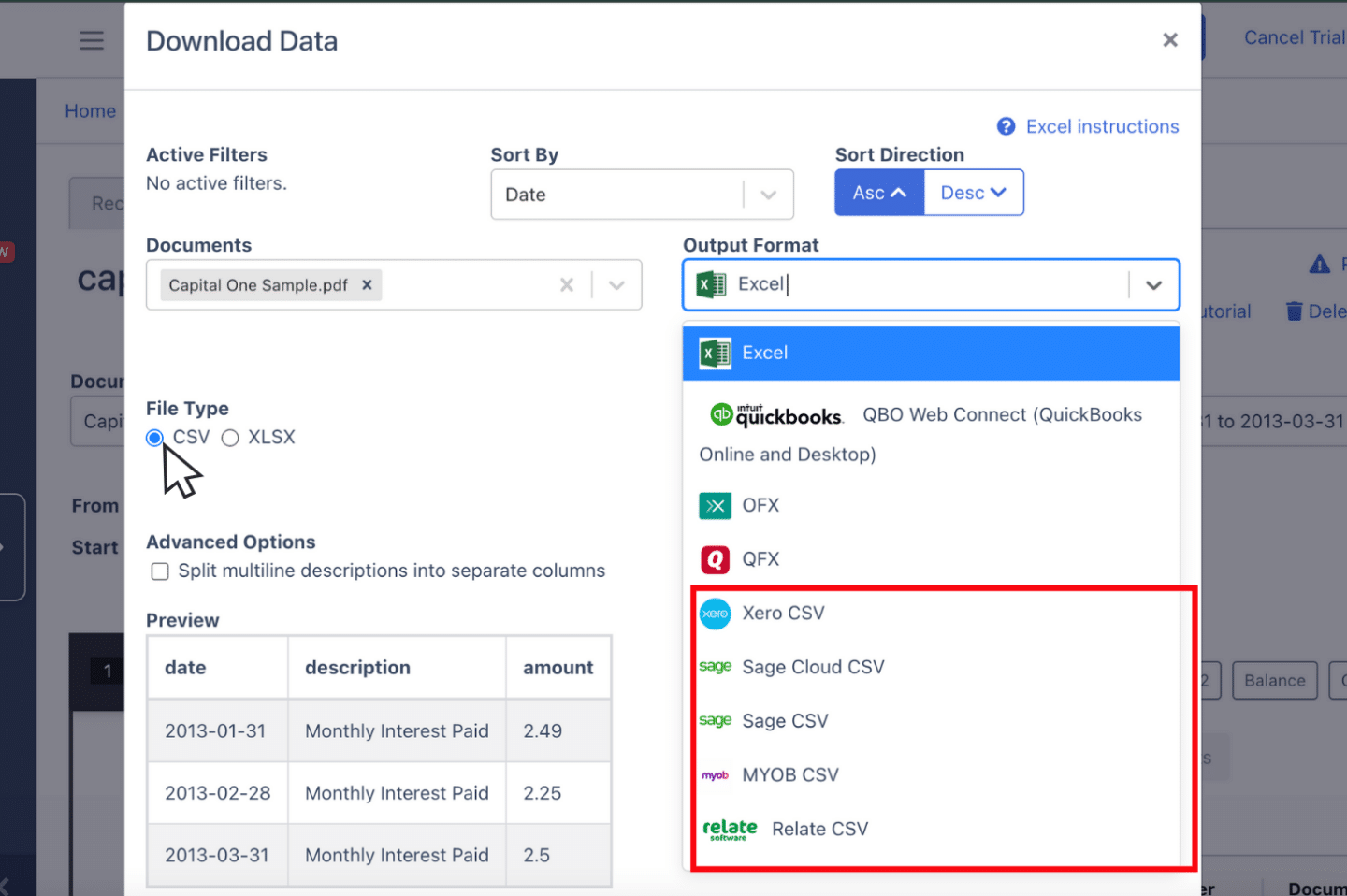

Export Capital One Bank Statement to CSV

If you need your Capital One statement in CSV format for compatibility with popular accounting platforms, start by opening the export menu. Select “Excel,” then choose “CSV” from the dropdown options.

DocuClipper offers ready-made formats optimized for software like Quicken, Xero, Sage, MYOB, Relate, and NetSuite, ensuring a seamless fit with your preferred platform.

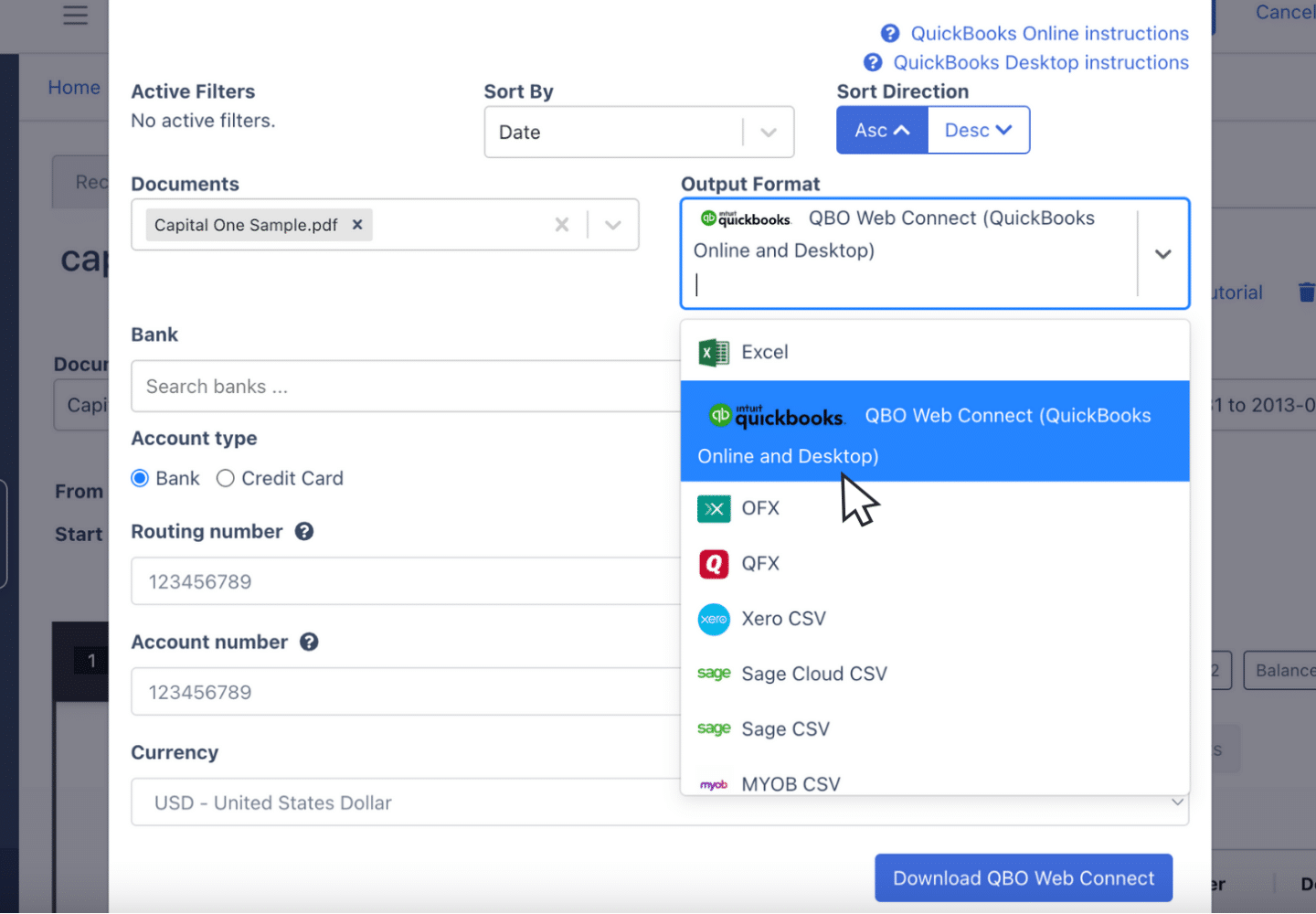

Export Capital One Bank Statement to QBO

For QuickBooks users, exporting your Capital One statement in QBO format enables easy import into the software.

To do this, open the export menu, select “QBO,” and fill in any required fields, such as bank account numbers, names, and classifications.

Once configured, click “Download” to save the file, making it ready for seamless import into QuickBooks for efficient accounting management.

Step 5: Configure the Output Format

Before downloading your data, review the spreadsheet’s output format to ensure it aligns with your specific needs. Adjust settings such as date formats or column order to fit your preferences.

DocuClipper’s default layout can be easily modified by selecting “Customization,” allowing you to create a personalized setup that matches your accounting requirements.

How to Download Capital One Bank Statements

You can easily view your Capital One bank statements through either the website or mobile app.

On the Website:

- Log In: Go to capitalone.com and sign in to your account.

- Select Account: Choose the account for which you need statements.

- Access Statements: Click “View Statements” to see your statement history.

On the Mobile App:

- Log In: Open the Capital One Mobile app. If you haven’t installed it, text “MOBILE” to 80101 for a download link.

- Choose Account: Tap the account you want to review.

- View Statements: Scroll to the bottom and select “Statements” to access your records.

Final Advice

Many banks limit statement formats to options like bank feeds or CSV, often leaving accountants to work with PDFs. As these PDFs pile up, processing bank statements manually can quickly become overwhelming.

DocuClipper simplify this task by converting PDFs into practical formats like Excel, CSV, or QBO—saving time, minimizing errors, and increasing productivity. Automating these conversions allows you to focus on higher-priority accounting tasks, boosting overall efficiency and reducing operational costs.

Why Use DocuClipper to Convert Capital One Bank Statements

DocuClipper is a web-based tool that efficiently converts PDF bank statements into formats like XLS, CSV, and QBO. Utilizing advanced OCR technology, it accurately extracts data fields from bank statements, minimizing manual entry errors.

Seamless integration with popular accounting software such as QuickBooks, Sage, and Xero ensures smooth data transfer and management.

Additionally, DocuClipper’s transaction categorization feature organizes transactions into groups, streamlining financial analysis.

Beyond bank statements, DocuClipper also processes credit card statements, brokerage statements, receipts, and invoices, making it a versatile solution for comprehensive financial document management.

FAQs about Capital One Bank Statement to Excel

Here are some frequently asked questions about converting Capital One Bank Statement to Excel:

Can I export my Capital One bank statement to Excel?

Yes, you can export your Capital One bank statement to Excel by using DocuClipper. Simply upload your PDF statement, select the “Excel” (XLSX) format in the export options, and download it. This process makes it easy to organize transactions efficiently in Excel.

How do I download a Capital One bank statement to a CSV file?

To download your Capital One bank statement as a CSV file, log in to your account on the Capital One website. Navigate to the desired account and select the option to download transactions. Choose the CSV format and specify the date range for the transactions you need. After confirming your selections, the CSV file will download to your computer.

How do I export a Capital One bank statement to Excel?

To export your Capital One bank statement to Excel, log in to your account on the Capital One website. Navigate to the desired account and select the option to download transactions. Choose the CSV format and specify the date range for the transactions you need. After confirming your selections, the CSV file will download to your computer. You can then open this CSV file in Excel for further analysis.

Learn More

Looking for more types of bank statements to convert? Check out our library about bank statement conversion:

- How to Convert BoA Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

- How to Convert Wells Fargo Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

- How to Convert Citibank Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

Or use these resources to learn more about accounting: