PNC bank only gives CSV formats of bank statements in the past 90 days of bank activity. This can be a problem for you when doing extensive accounting work for a client.

Fortunately, we have a solution for it. PNC bank gives away PDF statements regularly and with a bank statement converter you can easily convert PNC bank statement to Excel, CSV, and even QBO.

To get you started, upload your PNC bank statement in here and follow the steps below:

Step 1: Upload PNC Bank Statement to DocuClipper

To convert bank statements start by getting a PDF version of your PNC bank statement. You can download it directly from your bank or scan a paper copy if a digital one is not available.

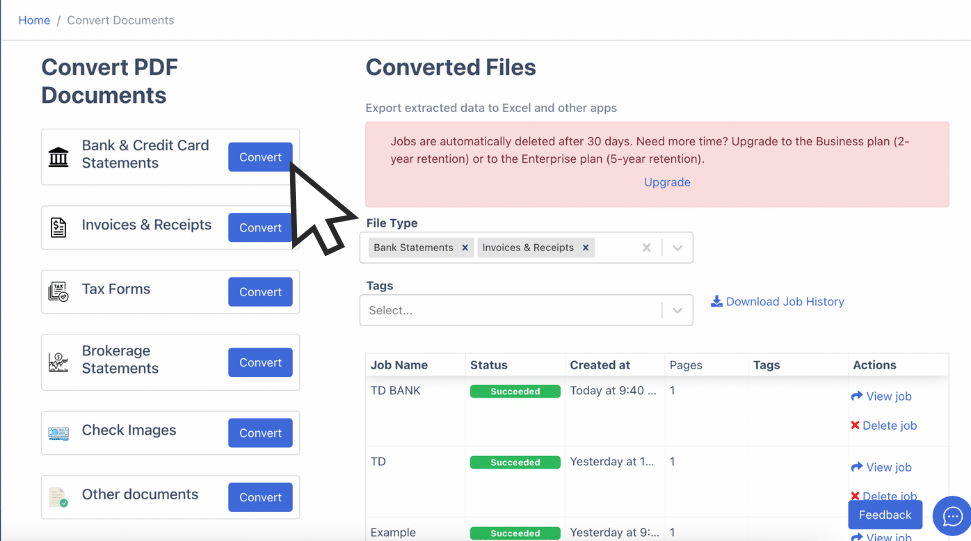

Next, log in to your DocuClipper account and head to the “bank statement” section.

Drag and drop your PDF file(s) from your computer. Add a job name and relevant tags to keep track of your files.

Click “Convert” to begin processing the statement into Excel format.

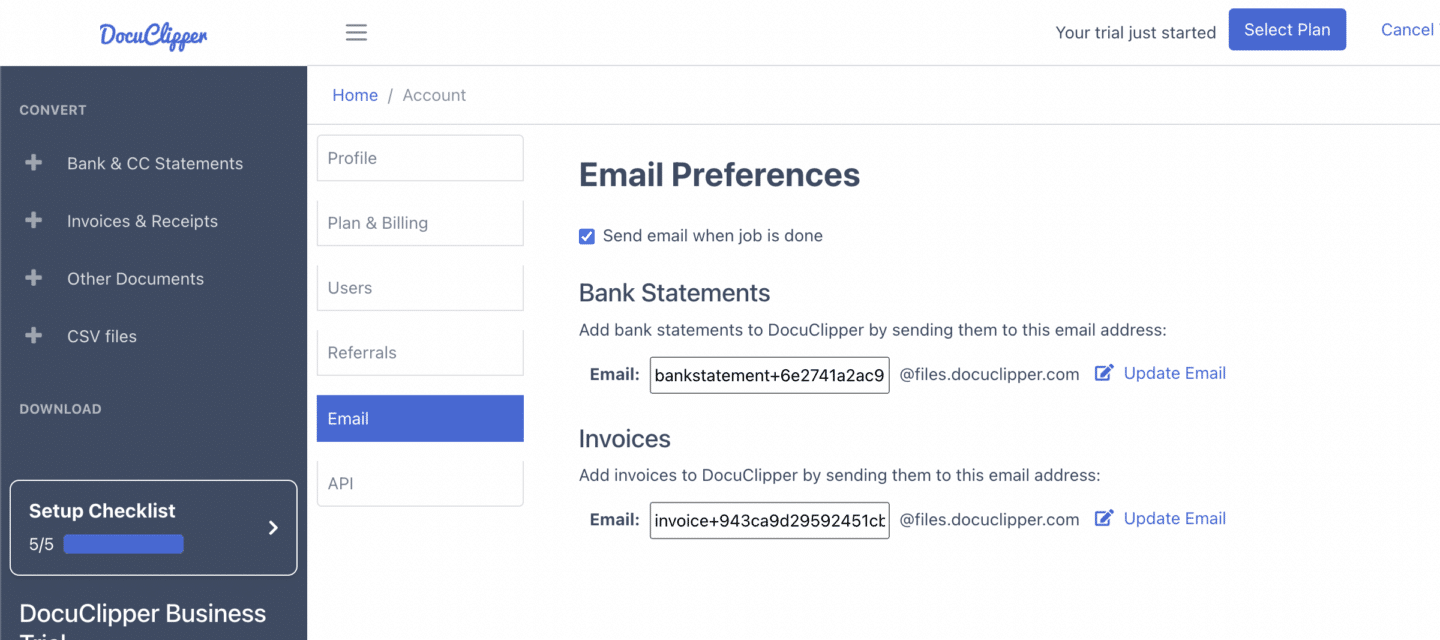

Alternatively, you can upload files via email. Go to your account settings, find the custom email address, and send the PDF files as attachments. Make sure they’re not encrypted.

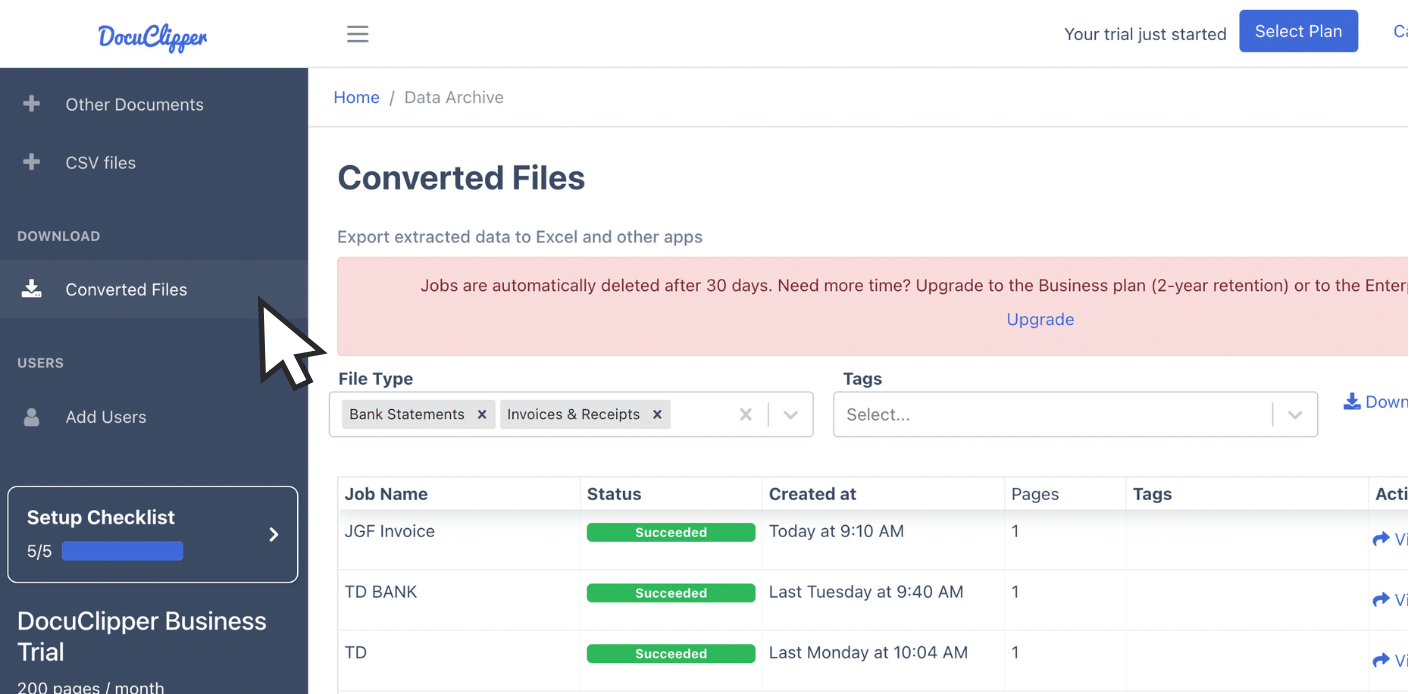

Your converted files will appear in the “Converted Files” section on the left.

Step 2: Analyze the PNC Bank Statement

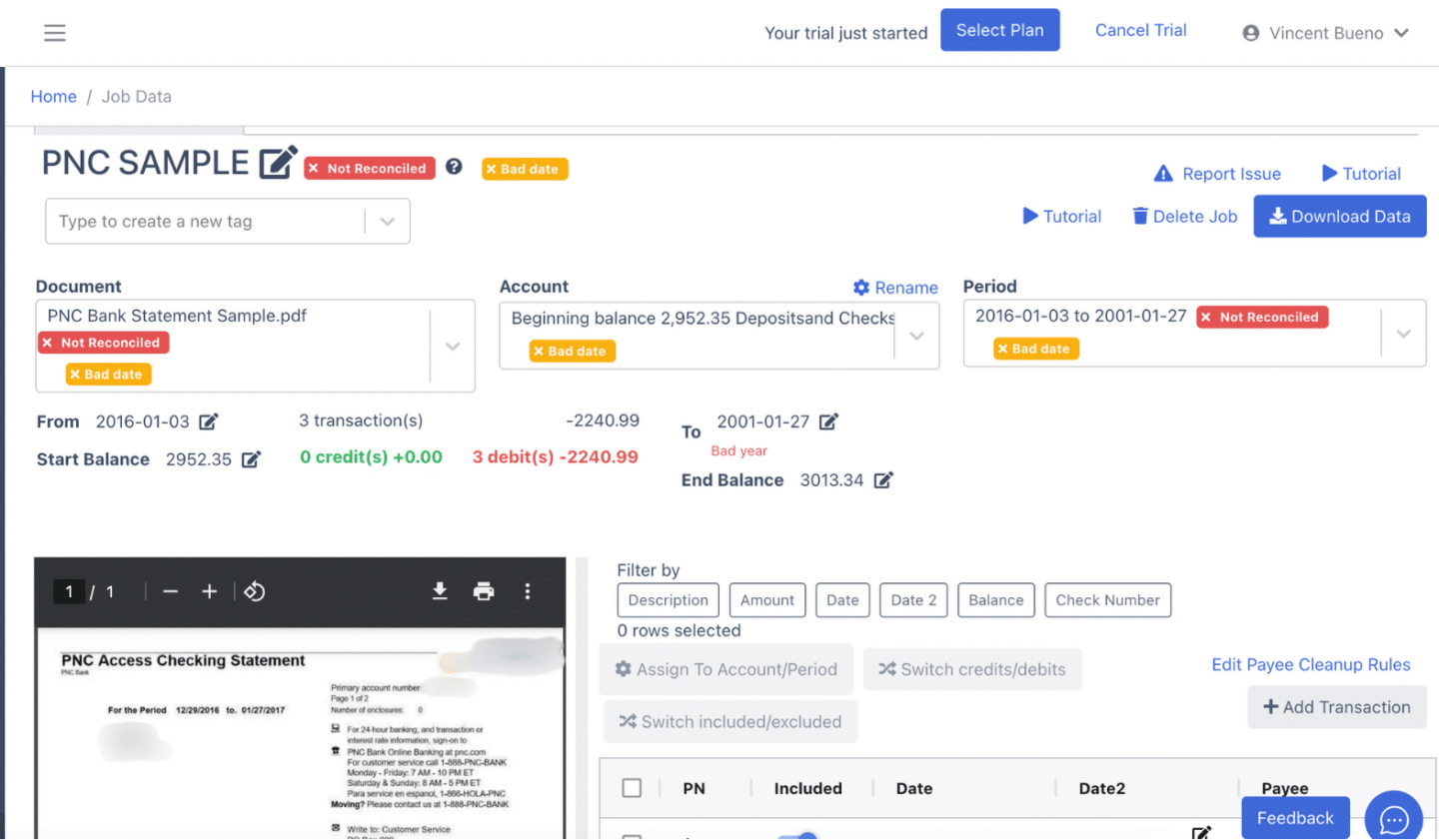

Once you click “Convert,” the process will take a few seconds. You’ll then see a side-by-side view of your PDF bank statement and the spreadsheet and totals of the contents.

At this time you can review important details such as dates, balances, credits, debits, and bank transactions.

If you notice any discrepancies between the extracted data and the statement, this is your chance to highlight them.

Some errors may be due to poor preprocessing techniques during scanning, the bank statement PDF is not complete, or some unusual bank format is used within the bank statement.

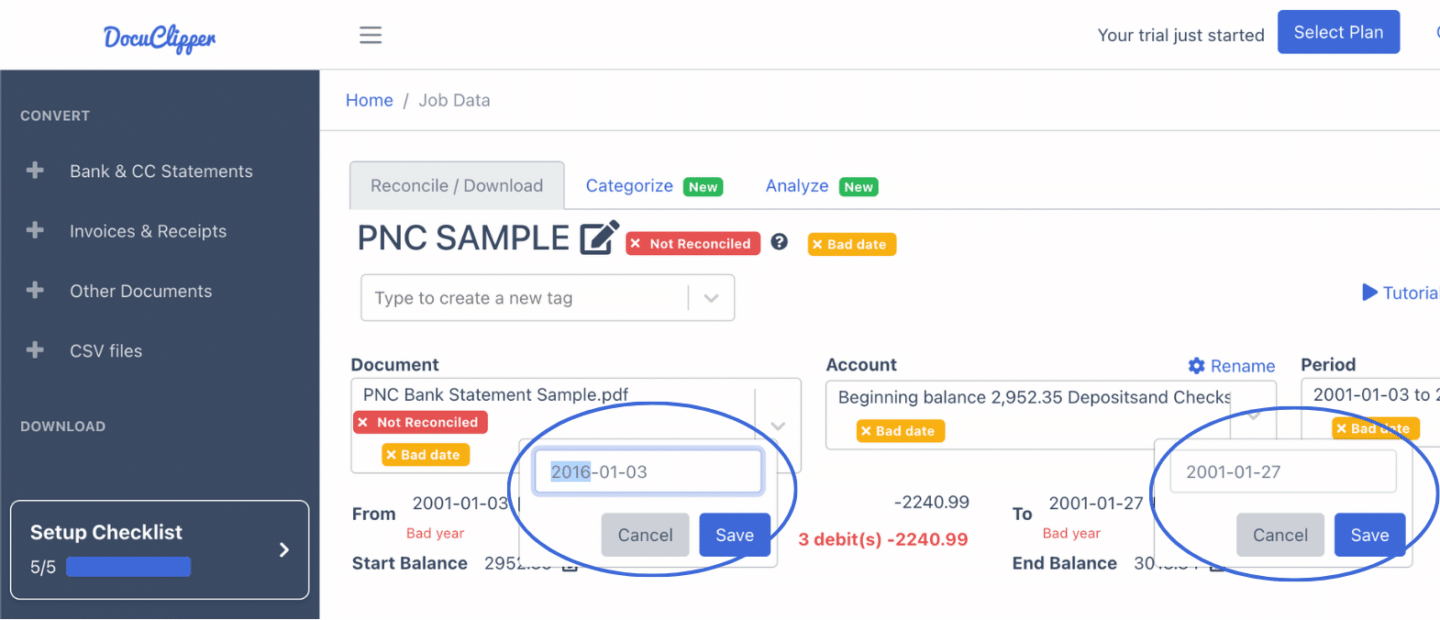

Step 3: Reconcile PNC Bank Statements

After clicking “Convert,” DocuClipper will automatically reconcile your PNC bank statement.

Any discrepancies from the extracted data and bank statement will be flagged for your attention.

For example in fixing this, if there’s a mismatch in the date, simply click the side icon next to the data and input the correct date.

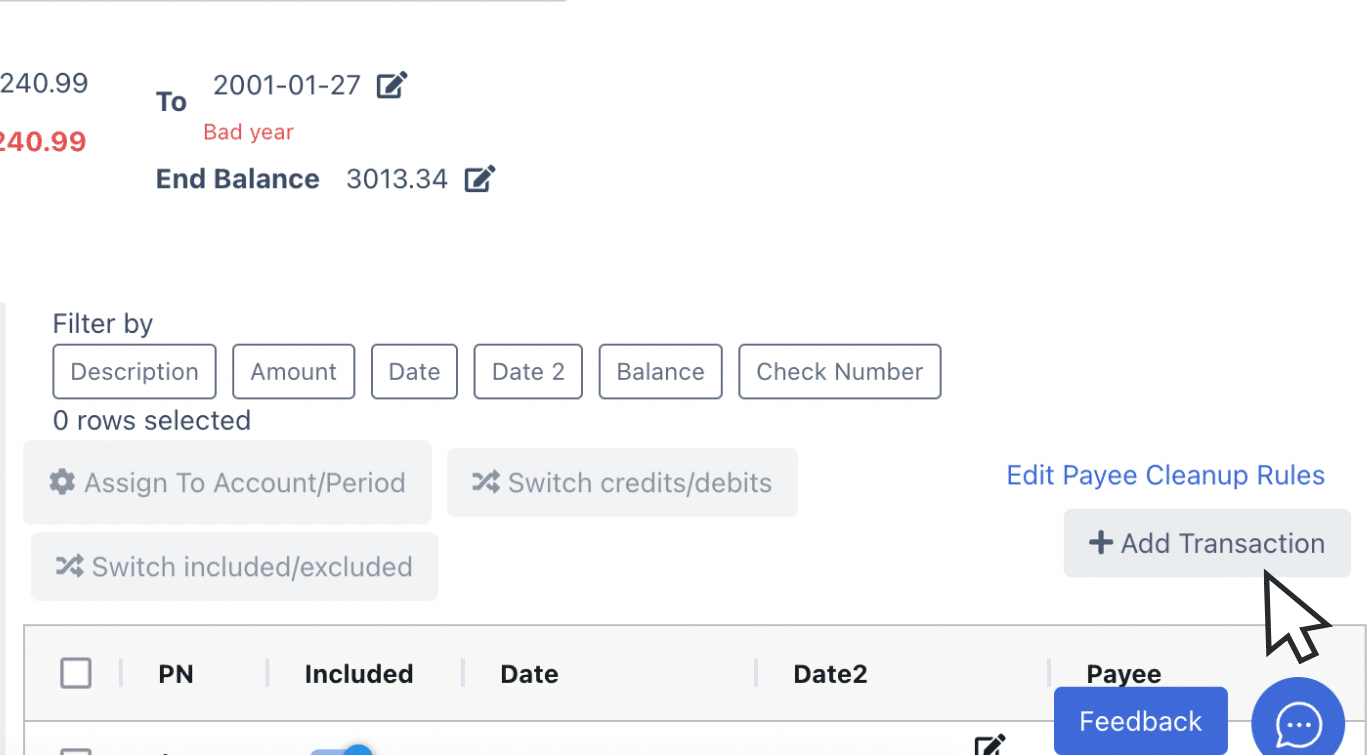

If a transaction is missing, click “Add Transaction” to manually enter it. Be sure to specify whether it’s a debit or credit, as this affects the bank statement reconciliation process.

Once you’ve made all necessary adjustments to the transactions, totals, and dates, your bank statement will be fully reconciled and you’ll be ready to export.

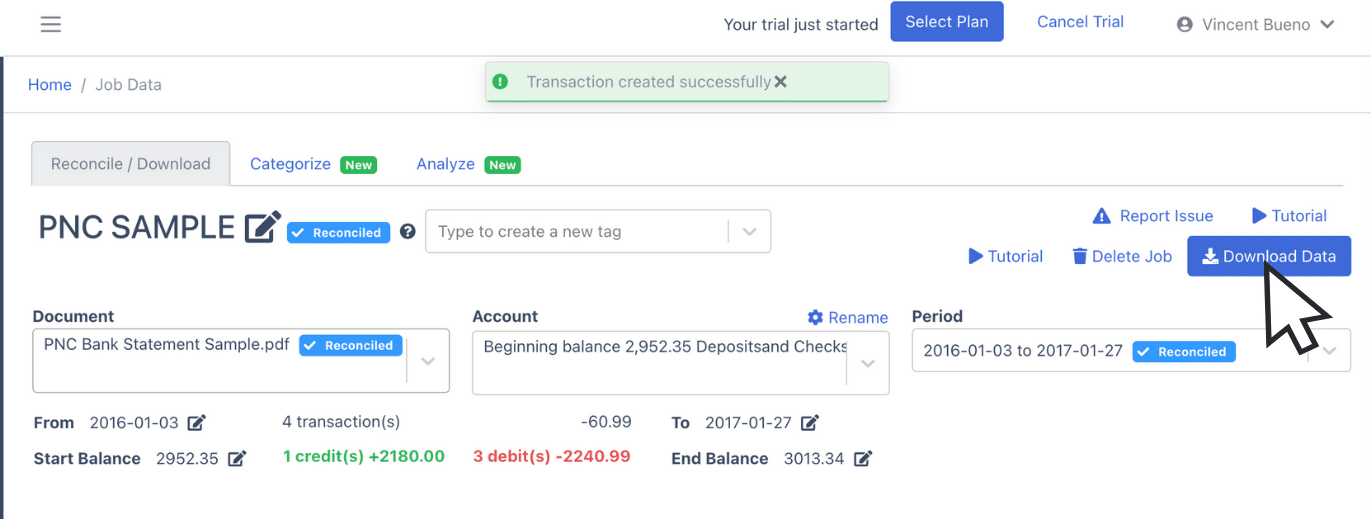

Step 4 Export PNC Bank Statement to Excel, CSV, QBO

After reconciling and you are fine with the data in the spreadsheet that’s being shown, you are ready to export your bank statement. Click “Download Data” to see the export menu.

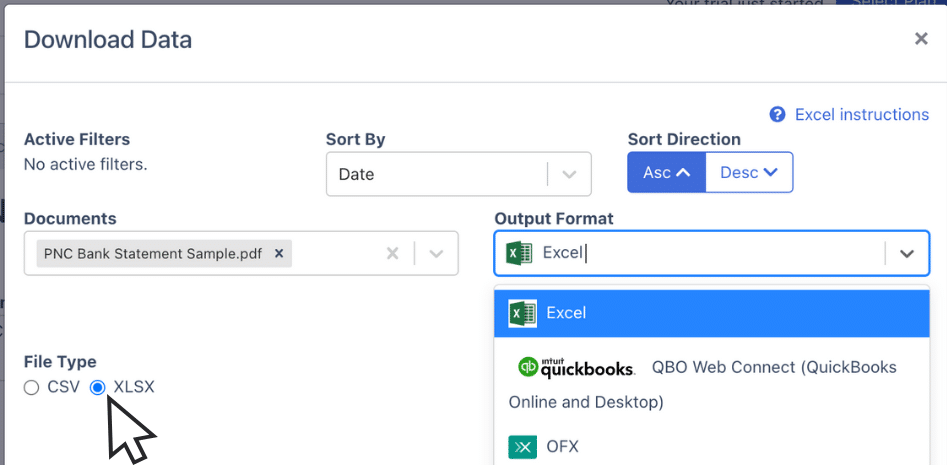

Export PNC Bank Statement to Excel

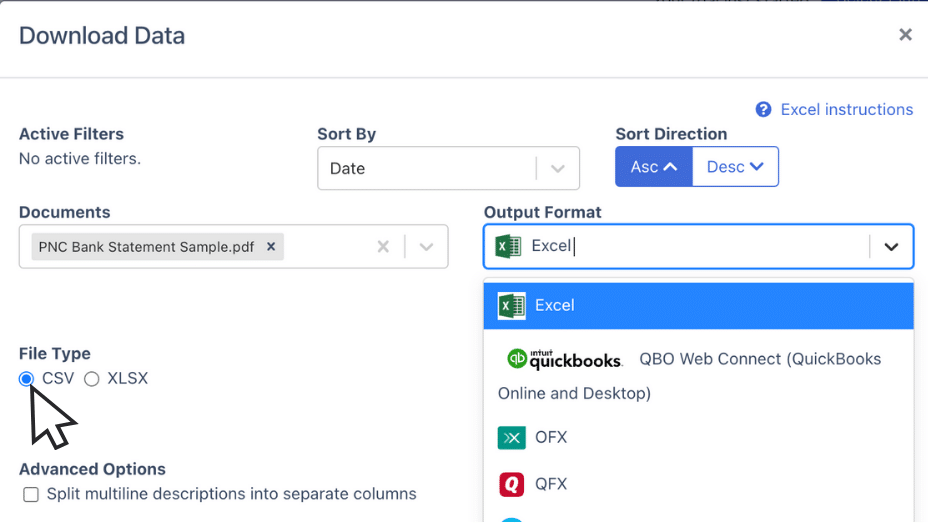

If you need your PNC bank statement in Excel, toggle down the export bar and choose “Excel.”

Next at the bottom left part, choose the “XLSX” file format by clicking the appropriate bullet point.

Once selected, click “Download” to save the Excel file to your computer. You’ll find the file in your Downloads folder, ready for use in your accounting tasks.

Export PNC Bank Statement to CSV

When you are using accounting software, a CSV format is usually required to import bank statements.

To export your PNC statement as a CSV, follow the same process as converting bank statements to Excel.

Toggle down the selection bar, click “Excel,” and then change the file type to CSV by clicking the button.

Then click “Download” to save the CSV file to your computer. You’ll see the file in your downloads folder

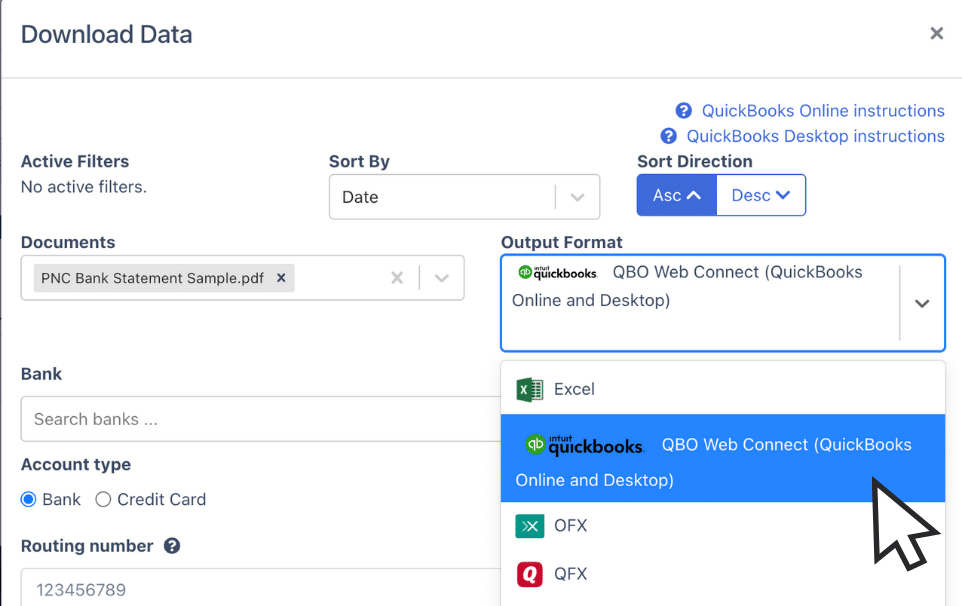

Export PNC Bank Statement to QBO

You can export QBO file formats that are more compatible with QuickBooks using DocuClipper.

To export your PNC bank statement in QBO format, toggle down the bar and select “QBO”.

Fill in the appropriate bank details for your file to be oriented with the software.

Also, we have more guides on how to import bank statements into different software:

- Import bank statements into QuickBooks

- Import bank statements into Sage

- Import bank statements into Xero

- Import bank statements into NetSuite

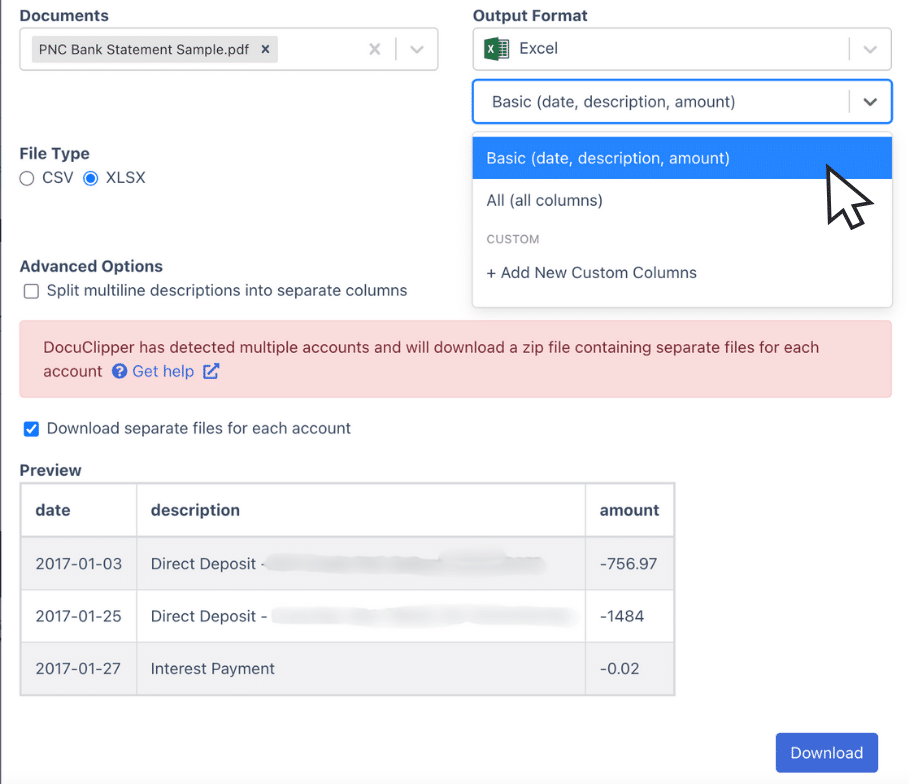

Step 5: Configure the Output Format

Before downloading, you will see a preview of your spreadsheet. You can edit the columns depending on your preference.

You can customize your own but DocuClipper has a provided template.

Final Advice

One of the obstacles in processing bank statements is dealing with PDF or paper formats, which make it difficult to analyze or import data into accounting software.

DocuClipper can solve this obstacle by converting these files into Excel, CSV, or QBO. This saves you time, reduces manual errors, and improves your productivity in the accounting process.

Automating these tasks allows you to focus on more in-depth accounting problems and it can save you overall cost.

Why Use DocuClipper to Convert PNC Bank Statements

DocuClipper is a web-based tool that specializes in converting PDF bank statements into formats like XLS, CSV, and QBO with ease. It uses advanced OCR technology to detect data fields accurately.

DocuClipper also integrates with widely used accounting software like QuickBooks, Sage, and Xero, making data transfer and management easier. It has a transaction categorization feature that keeps all transactions well-categorized according to the assigned group.

In addition to bank statements, DocuClipper processes credit card statements, brokerage statements, receipts, and invoices.

FAQs about PNC Bank Statement to Excel

Here are some frequently asked questions about converting PNC Bank Statements to Excel:

How to export PNC bank statements to Excel?

To export your PNC bank statement to Excel, first log in to your DocuClipper account and upload your statement in PDF format. After the statement is processed, click “Download Data” and select “Excel” from the export options. Choose the XLSX format and click “Download” to save the file to your computer. You’ll find it in your Downloads folder, ready for use.

Can PNC bank statements be imported into accounting software?

Yes, PNC bank statements can be imported into accounting software. First, convert your PNC statement to a compatible format like CSV or QBO using a tool like DocuClipper. Once converted, you can easily import the file into popular accounting software such as QuickBooks, Xero, or Sage for seamless integration with your financial records.

Best software to convert PNC bank statements to CSV

One of the best tools for converting PNC bank statements to CSV is DocuClipper. It offers a user-friendly platform that accurately extracts data from PDF statements and converts it into CSV format. With features like Optical Character Recognition (OCR) and easy integration with accounting software, DocuClipper ensures quick, precise conversions.

Learn more

Looking for more types of bank statements to convert? Check out our library about bank statement conversion:

- How to Convert M&T Bank Statement to Excel, CSV, and QBO

- Convert TD Bank Statements to Excel, CSV, and QBO

- How to Convert Halifax Bank Statement to CSV, Excel, and QBO in a Minute or Less

- How to Convert Chase Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

Or use these resources to learn more about accounting:

- How Long to Keep Bank Statements?

- How to Read a Bank Statement and Actually Understanding It

- OCR vs AI: 7 Differences, Pros, Cons, & Which to Choose