Investments can in many forms and sizes, coming with different interest rates that come in different sets of intervals.

Brokerage accounts come with statements typically every month, this depends on the bank providing.

But there are times when it is needed to show and there is only a limited time in how long you can keep it and it is useable.

In this blog, we’ll talk about how long to keep brokerage statements and why is it important.

Smoothen your accounting practice with AI: Download this eBook to start

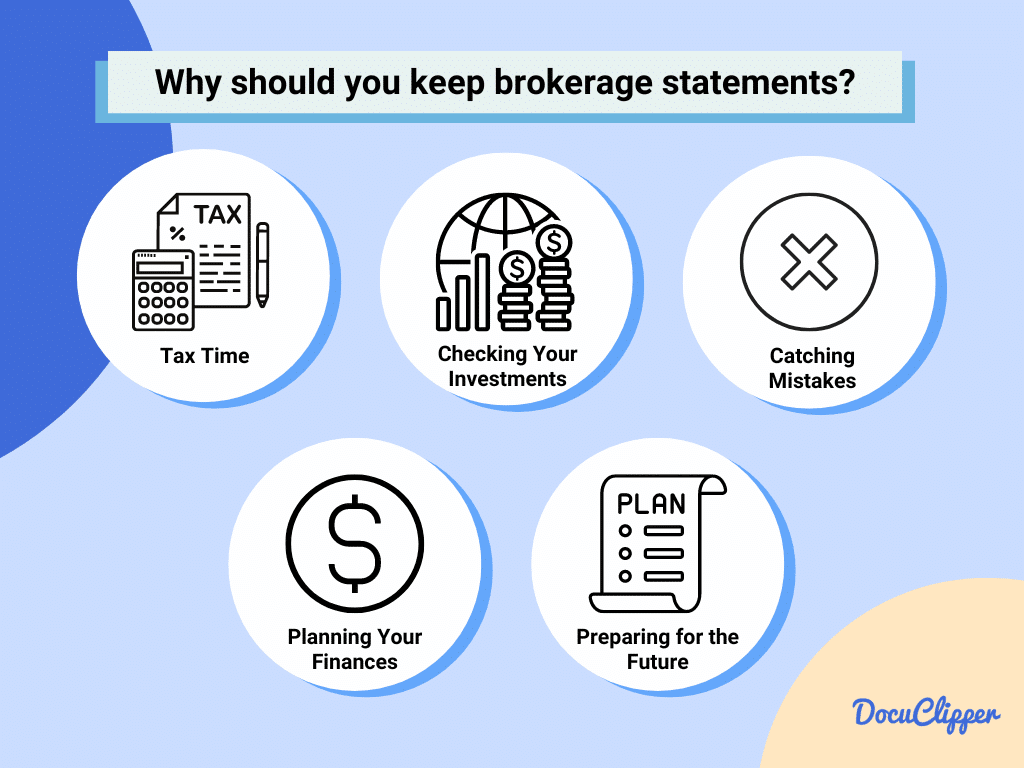

Why Keeping Brokerage Statements is Important?

There are a few reasons why you should not discard your brokerage statements right away.

They can still be useful in some situations involving taxes and finances.

Here are the common reasons why people keep their brokerage statements:

- Tax Time: Brokerage statements are essential when you’re doing your taxes. They show what you earn from your investments and what you might owe the government. This makes sure you pay the right amount in taxes and don’t run into issues with the IRS.

- Checking Your Investments: These statements let you see how your investments are doing over time. Are they growing? Are you losing money? Regularly checking these can help you make informed decisions about buying or selling.

- Catching Mistakes: Sometimes, errors happen. If you regularly look over your brokerage statements, you can catch mistakes early, like unauthorized transactions, which could save you a lot of trouble and money.

- Planning Your Finances: If you’re working with a financial planner or advisor, your brokerage statements give them a clear picture of your financial health. This helps them give you better advice tailored to your needs as well as provide any alternative investments.

- Preparing for the Future: If you’re planning your estate, your brokerage statements will show the current value of your investments. This is crucial for smoothly passing on your assets to your family or heirs.

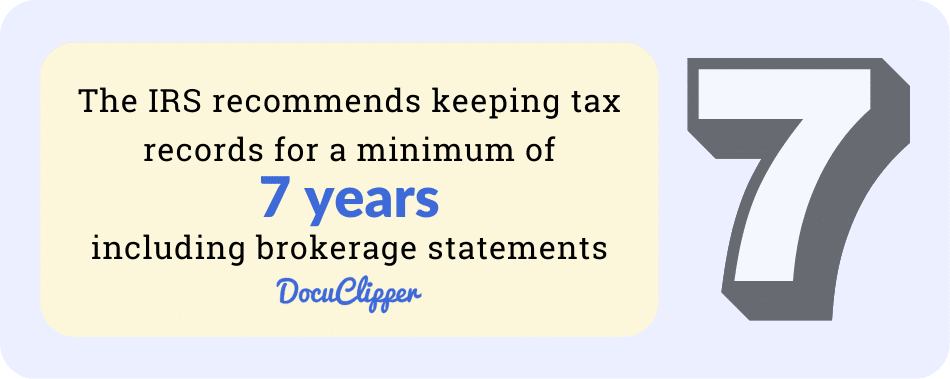

How Long to Keep Brokerage Statements?

When it comes to managing your tax documents, it’s wise to swing on the side of caution and retain your records for a substantial period. The IRS recommends keeping tax records for a minimum of seven years.

This is because the IRS audit window extends three years but can expand to six or seven if significant errors, like underreporting income by 25% or more, are detected.

Additionally, state tax audit rules can differ, so it’s important to understand the specific requirements in your area by consulting with a tax professional.

It’s advisable to retain your tax returns indefinitely. In the event of an audit, having complete records readily available can be incredibly beneficial.

Similarly, keep all supporting documents, such as W-2s, 1099s, receipts, and payment records, for at least seven years.

For assets that could increase in value, like your home, hold onto relevant receipts, such as those from major renovations, for as long as you own the property. This precaution ensures you’re well-prepared to handle any future tax inquiries or requirements efficiently.

How to File Brokerage Statements

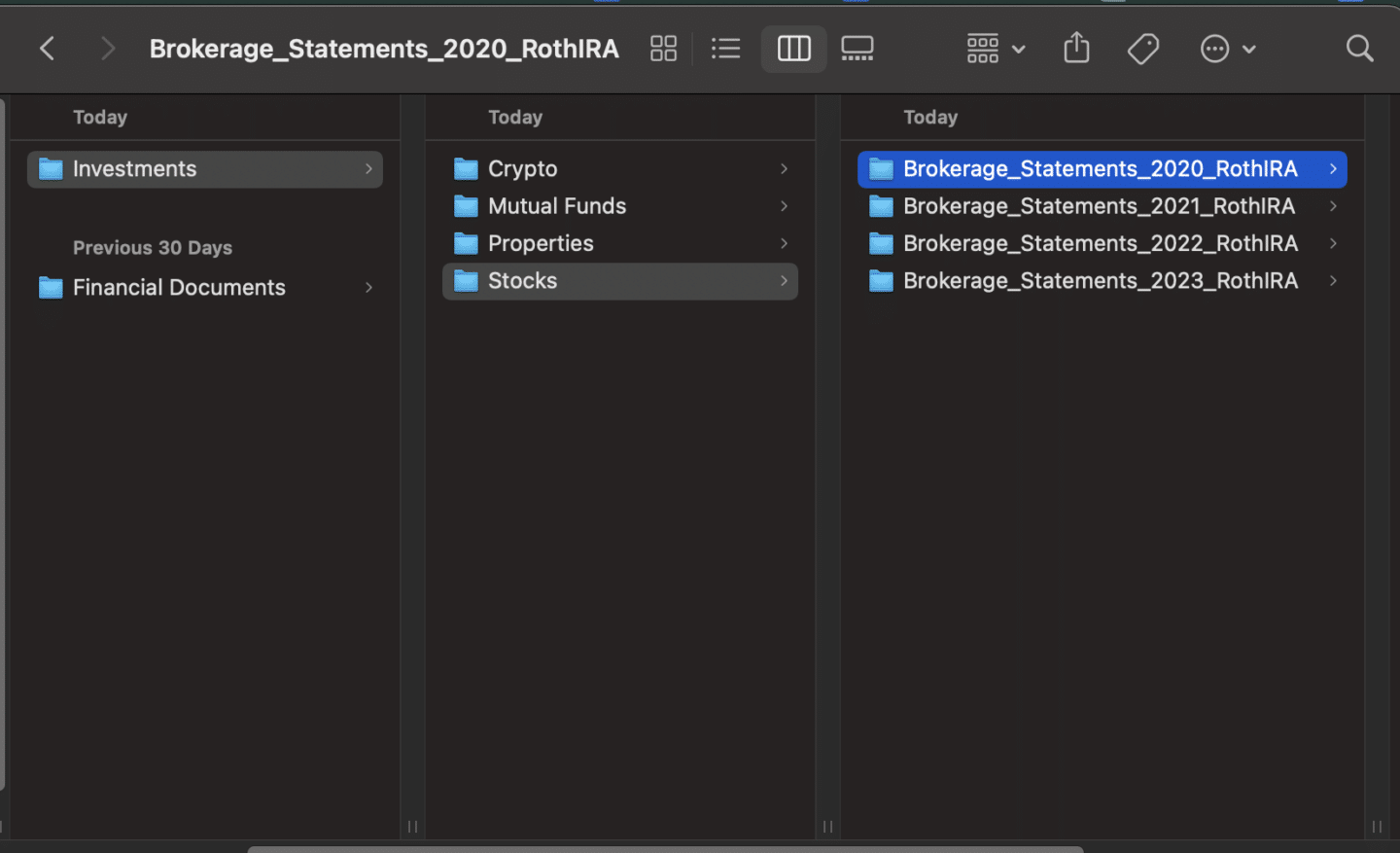

Filing your brokerage statements efficiently can save you time and headaches, especially when you need to access them for taxes or account reviews. Here’s a simple guide on how to organize and file your brokerage statements:

1. Go Digital: Most brokers offer electronic statements. Opt for digital copies to reduce paper clutter and increase accessibility. Ensure you download and save these documents in a secure, backed-up location on your computer and cloud storage.

2. Create a Filing System: Organize your statements by year and type of account. Use clear, consistent naming conventions for your files, such as “Brokerage_Statements_2023_RothIRA”. This makes it easier to locate specific documents when you need them.

3. Regular Updates: Update your digital folders whenever you receive a new statement. Staying on top of this monthly task prevents pile-ups and keeps your records up-to-date.

4. Security Measures: Protect your financial information by using strong passwords for any accounts and encrypted folders on your devices. Consider two-factor authentication for added security.

5. Retain Physical Copies When Necessary: While digital is convenient, some prefer or need to keep physical copies. If you do, maintain a dedicated file cabinet or safe where these documents can be securely stored, organized by year and account type.

6. Know Retention Times: Keep your brokerage statements for at least seven years, as you might need them for tax purposes or to dispute account errors.

Also, learn more about how to read a brokerage statement.

How to Discard Brokerage Statements

Discarding brokerage statements requires care to ensure that your sensitive financial information remains secure. Here’s how you can safely dispose of your brokerage statements:

1. Review Before Discarding: Double-check that you no longer need the documents for tax purposes or financial record-keeping. The general rule is to keep brokerage statements for at least seven years in case of audits or tax amendments.

2. Go Paperless: If you haven’t already, switch to electronic statements to reduce the amount of physical paperwork you need to manage and eventually discard.

3. Shred the Documents: To protect against identity theft, shred your brokerage statements before discarding them. Use a cross-cut shredder that cuts paper into confetti-sized pieces, making the information virtually impossible to reconstruct.

4. Consider a Shred Event: Many communities offer free shredding events where you can bring your documents to be securely destroyed. This is particularly useful if you have a large volume of papers to dispose of.

5. Recycle the Shredded Paper: After shredding, make sure to recycle the remains if possible. This helps reduce waste and is environmentally friendly.

6. Secure Digital Data: If you have digital copies of statements that you need to discard, ensure you permanently delete the files from your computer or storage device. Using software designed to securely erase data is recommended, as it ensures that the files cannot be recovered.

Conclusion

It’s important to keep your brokerage statements for at least seven years to meet IRS guidelines and be prepared if audited.

Setting up a simple digital system can help you keep track of these documents easily, reducing clutter. When it’s time to get rid of old statements, make sure to shred them to protect your personal information from identity theft.

By managing your statements properly, you can keep your finances in order and avoid future problems

How DocuClipper Can Help?

DocuClipper simplifies handling financial documents. This tool employs OCR technology to convert PDF brokerage statements into editable formats like CSV, XLS, and QBO. Its capabilities extend across numerous banks, making it versatile for personal and professional use.

Additionally, DocuClipper aids in reconciliation, categorization, and financial analysis. These features streamline the process of tracking and managing your brokerage statements, saving you time and enhancing your financial oversight.

Whether you’re reconciling accounts or analyzing expenses, DocuClipper provides the tools you need to stay organized.

FAQs about How Long to Keep Brokerage Statements

Here are some frequently asked questions about how long can you keep brokerage statements:

How long do brokerage firms need to keep statements?

Brokerage firms are required to keep statements for six years. This regulatory requirement ensures they can address any compliance issues or customer inquiries effectively.

Do I need to keep all my investment statements?

Yes, you should keep all your investment statements for at least seven years to aid in tax preparation and resolve any disputes about your account.

What financial records should be kept for 7 years?

Financial records that should be kept for seven years include tax returns, W-2 and 1099 forms, receipts for deductions, and any records of losses.

How long do you have to keep money market statements?

Money market statements should be kept for seven years. This period aligns with the IRS’s ability to audit tax returns where related transactions might appear.

How long should I keep bank and investment statements?

Bank and investment statements should be retained for at least seven years. This timeframe helps in managing taxes, tracking the progress of investments, and resolving disputes.

How long must a member firm maintain client account statements?

Member firms must maintain client account statements for six years. This requirement is set by financial regulatory authorities to ensure transparency and accountability in client transactions.