Businesses handle invoices whenever they procure products and services from other companies. Your business has to make sure each one is valid to pay suppliers.

To check and verify each invoice that comes through, you must establish an invoice approval workflow.

In this article, we’ll talk about what is an invoice approval workflow, why it is important, and how you can make one that fits your accounting practice or business enterprise.

What is an Invoice Approval Workflow?

An invoice approval workflow is a standardized procedure that businesses use to review, verify, and approve invoices before paying vendors.

It’s a part of accounts payable (AP) operations that ensure that invoices are accurate, legitimate, and comply with company policies.

Your workflow will involve the employee responsible for procuring a specific product or service, who will check the corresponding invoice as well as your AP department to ensure the payments are processed accurately and quickly.

Why is Invoice Approval Workflow Important?

You need an effective invoice approval workflow for these reasons:

- Improve Data Accuracy & Error Reduction: An invoice approval workflow is maintained as a filter that checks every invoice. This sorts out any inaccuracy from invoices that pass through.

- Increase Fraud Prevention: In 2021, UK businesses lost €81 million and Irish businesses lost €6 million due to fake invoice payments. Putting a structured workflow can avoid serious losses like these.

- Enhances financial control: A 2012 KPMG poll revealed that 64% of organizations still depend mainly on manual control testing to detect issues like duplicate invoice payments. This is already known to be outdated and a proper workflow keeps more control compared to other business organizations.

- Enhanced Supplier Relationships: Suppliers may think you’re untrustworthy if there are delays with your payments because of your slow approval process. Having an established workflow makes it faster.

- Avoid fees and get discounts: Suppliers often place penalties on late payments to compel buyers to pay on time. 12% of SMEs hire someone to chase late payments which adds extra cost. It is necessary to the invoice process faster including invoice approval to avoid such costs.

- Streamlined Operations: Once there is an appropriate invoice workflow at hand, the invoice processing will be much faster since discrepancies will be significantly reduced and avoid frequent damage control.

- Reducing Cost of Invoice Processing: Invoice approval workflows reduce invoice processing costs by streamlining approvals, reducing delays, minimizing errors, and cutting down on manual processing efforts.

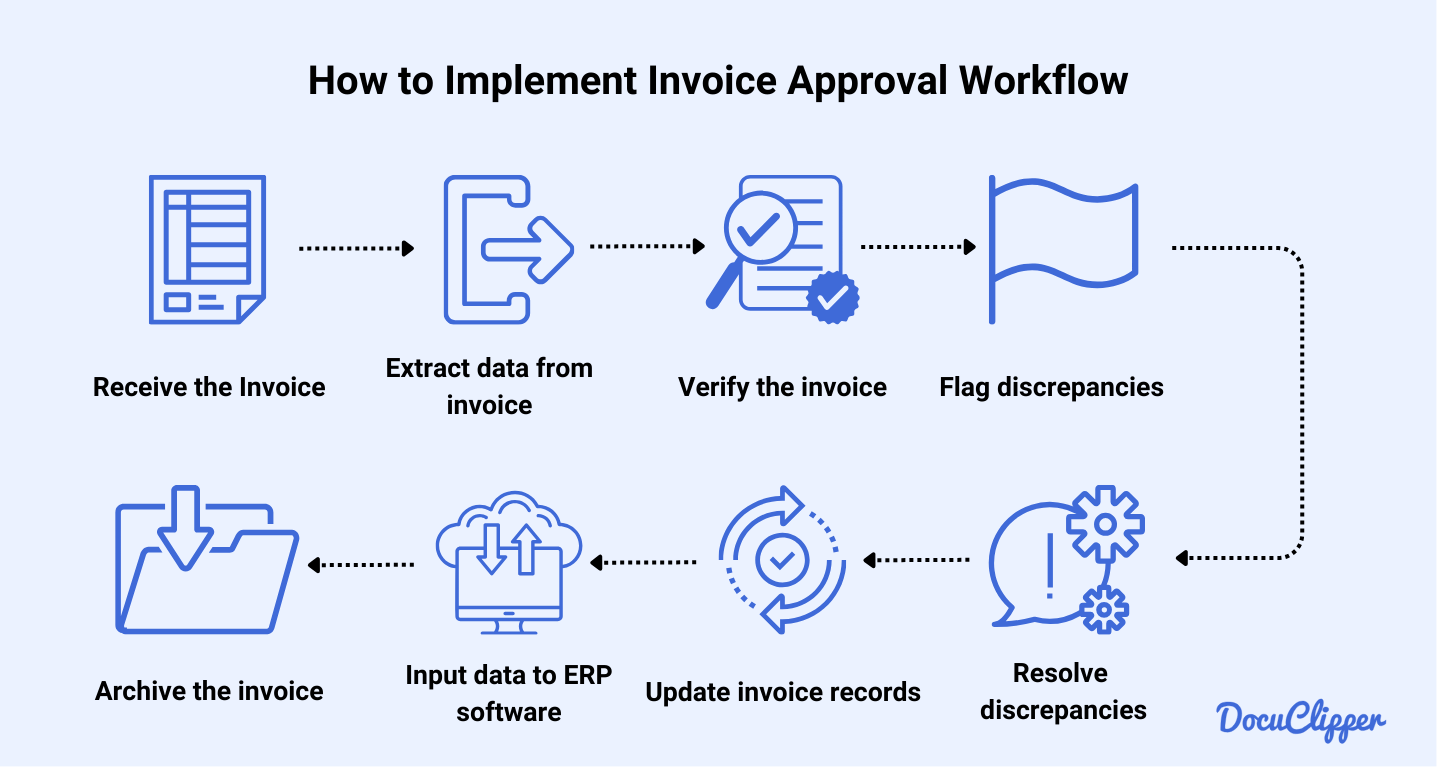

How to Implement Invoice Approval Workflow

Your company probably already has a form invoice approval system. If it isn’t performing as smoothly as intended, you may need to improve your current methods.

Check the basic steps of an invoice approval workflow to see whether yours needs additional processes:

Step 1: Receive the Invoice

Receive the invoice from your seller, either in PDF or paper form. Choose the format that suits your needs, but remember, PDFs are easier for automated processing. Ask your supplier or vendor for the preferred format.

It’s recommended to have a centralized place only for invoices in order for your AP team not to miss any of them.

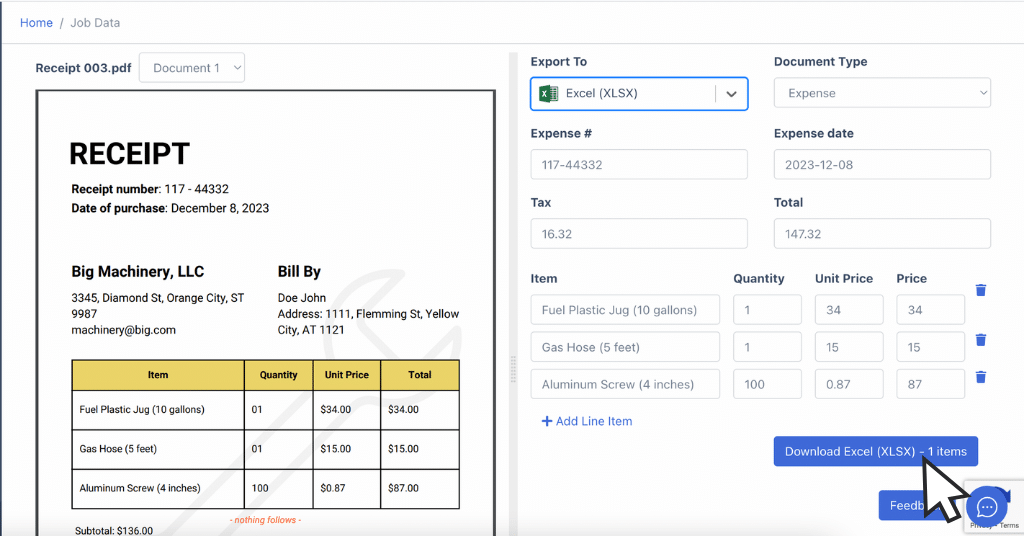

Step 2: Extract Data from the invoice

Extract the necessary information from the invoices like dates, names, amounts, quantities, and many more. When done manually, AP teams will put it in a spreadsheet.

Using one of the best OCR software, DocuClipper for example, makes it easier to process hundreds of invoices in a few seconds. It converts PDF invoices and receipts into a preferred format such as XLS, QBO, and CSV.

Step 3: Start Invoice Reconciliation

Start cross-checking the captured invoice data against purchase orders and delivery receipts for your invoice reconciliation process.

Your accountant or AP team should look for things such as incorrect amounts or missing items.

Your accounting team should also check documents attached to the invoices, such as purchase orders and goods receipts.

Using a three-way verification to check your invoices is more common nowadays when businesses started automating. Invoices should contain information that is exactly the same as your invoice, purchase order, and goods receipt provided by the supplier or seller.

Step 4: Flag Discrepancies

The accounting department must flag and correct any discrepancies. This step may involve contacting suppliers or obtaining approvals for revisions.

Smaller companies usually rely on manual invoice approval. Their finance staff handle this process and have the authority to pay the invoice itself.

On the other hand, larger corporations have accounts payable (AP) teams with specialist personnel who typically follow specific policies.

For example, a company may require invoices over $5,000 to have approval from the head of procurement and AP.

Step 5: Resolve Any Delays and Discrepancies in Approval

After checking the flagged discrepancies from the invoice, the AP team or accounting staff can double-check with the supplier and the company that received the order.

Your assigned personnel should contact the supplier frequently things like these arise as fraudulent invoices are more common especially when processing multiple invoices in a single day.

Step 6: Complete Approval and Update Records

When there are no flagged invoices and the flagged ones are already resolved, this can be given a thumbs up by the department head. This means that these invoices are ready to be inputted into accounting software and paid.

Step 7: Input to an ERP system or Accounting software.

Once all the invoices are already approved, verified, and genuine, your accounting team then enter the invoice details into your Enterprise Resource Planning (ERP) or accounting software.

This step updates your financial records to reflect the payment in the correct accounting period. Also, invoice data extraction tools can integrate with ERP systems to automate invoice processes.

Through this window, your company can also make payments to the appropriate suppliers.

Step 8: Archive Invoices

You should archive your invoice for future reference. This means storing digital and physical backups in a secure, organized manner. Your archives should be easily accessible for audits and financial reviews.

Best Practices for Streamlining the Invoice Approval Process

You’ve seen how important the invoice approval process is for your business. Enhance your invoice processing with these methods:

- Set clear policies and approval hierarchies: Assign people who will approve specific invoice types and set clear, different approval levels.

- Standardize invoice formats and submission methods: Encourage your suppliers to use standard invoice formats and submission methods for better processing.

- Centralize invoice receiving: Have a central hub for all invoices to ensure a consistent approval process.

- Regular training and updates for staff: Update your employees regularly regarding any changes to the invoice approval workflow. Moreover, provide regular training on technological updates.

- Establish clear lines of communication: Ensure departments have clearly defined ways to contact each other to resolve issues quickly.

- Create multi-level approvals for large invoices: Some invoices demand more attention, especially those that involve huge sums. Consequently, you should have a special approval system for these high-value transactions for increased oversight.

- Implement AP automation solutions: Use quality tools like DocuClipper to facilitate data capture, verification, and approval.

Conclusion

An efficient invoice approval workflow facilitates supplier payment processing in your company. It ensures your financial records are up-to-date, maintaining a positive relationship with suppliers.

Automated tools are the best way to streamline this process and significantly minimize human error. This can help you avoid the negative impact on efficiency like penalties from sellers, making mistakes, and ruining vendor relationships.

How DocuClipper Can Automate Your Invoice Approval Workflow

DocuClipper is an OCR software that can quickly convert PDF invoices into XLS, CSV, and QBO. It has an accuracy of 97%, which is greater than most invoice processing software available in the market.

DocuClipper is also capable of processing hundreds of invoices in a few seconds, which is way faster done manually.

By automating invoice processing, DocuClipper helps businesses make their invoice approval workflow efficient.

FAQs about Invoice Approval Workflow

Do you need quick info regarding invoice approval workflows? Learn more about improving your invoice processing with the frequently asked questions below:

What is the workflow of invoicing?

The workflow of invoicing or the invoice approval workflow facilitates your company’s invoice management. It involves receiving an invoice, capturing its data, verifying it, requesting approval, processing payment, and archiving a record.

If your invoice processing is prone to errors or has poor performance, you may need to add some of these steps. Read the guide above for more details.

What are the steps of invoice processing?

The typical invoice workflow starts with receiving an invoice. Then, your accounting or AP department performs invoice data capture manually or with digital tools.

Your staff will send the invoice to other departments for approval and corrections. Afterwards, your staff will process the approved invoice and enter the information into an ERP or accounting software for archiving.

What are the stages of an invoice?

An invoice starts with the vendor who fills in details regarding the goods or services provided. Then, they submit the invoice to the customer.

The customer records it into their AP system and verifies it against other documents. Then, other departments check the invoice for discrepancies.

Afterwards, the AP department processes the payment and logs it into their accounting system.

What are the stages of a workflow process?

The vendor fills in information into an invoice and submits it to their customer. Then, the customer records it into their accounts payable (AP) system.

Next, other departments will check the invoice for discrepancies and provide corrections.

Once approval is complete, the accounting department will log the payment into their system. Later, it will archive invoice data for future reference.