Currently, almost 70% of businesses still process invoices manually by extracting key data and importing it into ERP or accounting software.

Additionally, the average cost of manually processing an invoice is $15, making this not only a significant time waster but also an expensive process for many businesses worldwide.

Moreover, 39% of manual invoices contain errors, resulting in poor financial data.

Therefore, invoice automation software is becoming increasingly important for businesses to implement.

In this article, we will teach you how to automate invoice data entry to save time, and money, and improve invoice data accuracy.

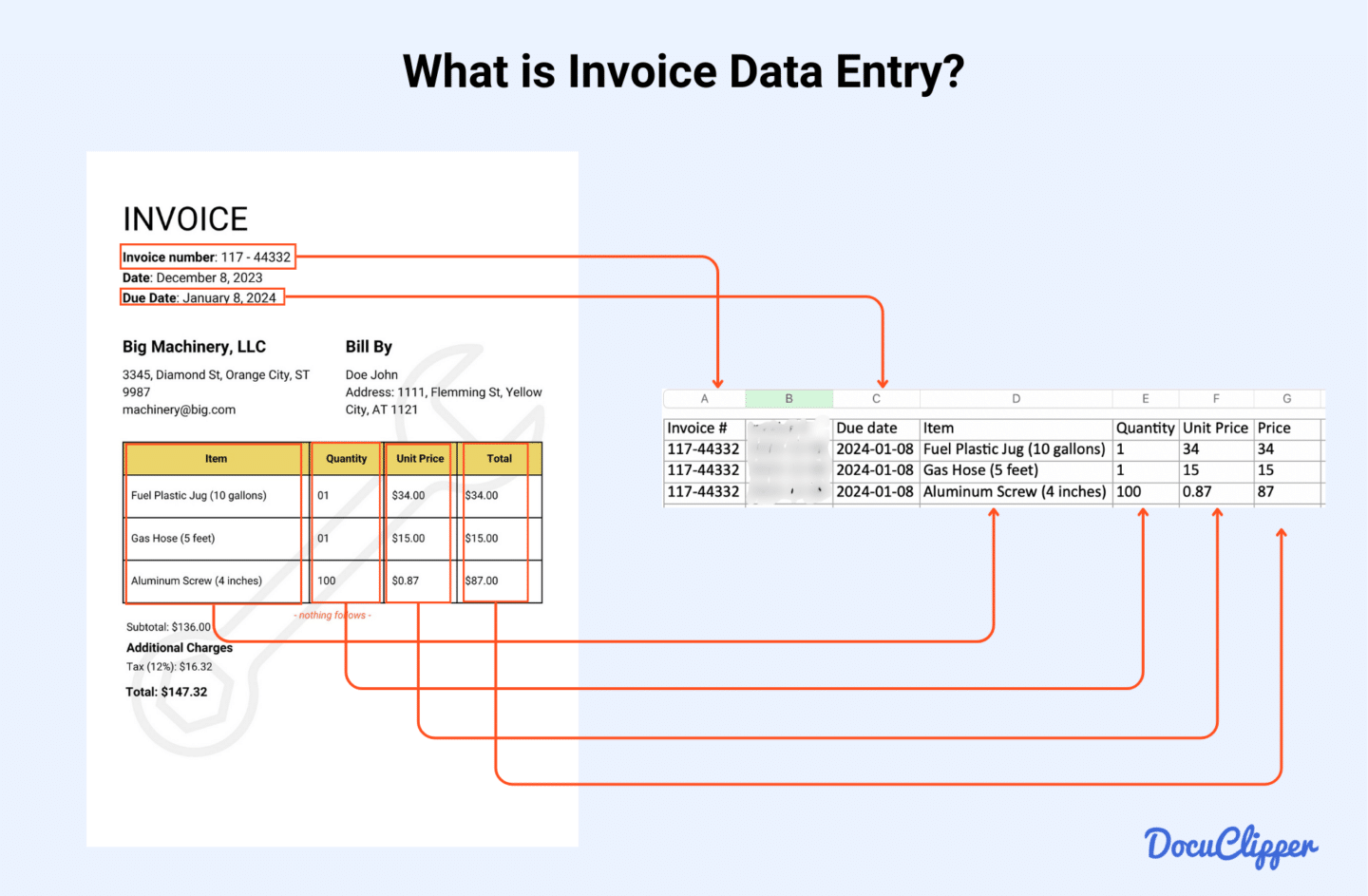

What is Invoice Data Entry?

Invoice data entry is the process of extracting information from invoices into a list, spreadsheet, or database. Typically, this includes details like names, dates, line items, amounts, taxes, and prices.

Traditionally, this process was done manually, with someone reviewing each invoice and compiling the necessary data into a spreadsheet or directly into accounting software.

However, with advancements in automation technology, OCR (Optical Character Recognition) software now makes it easy to automate this task.

These tools can efficiently scan and extract data from various invoice formats, significantly reducing the time and effort required while minimizing the risk of errors.

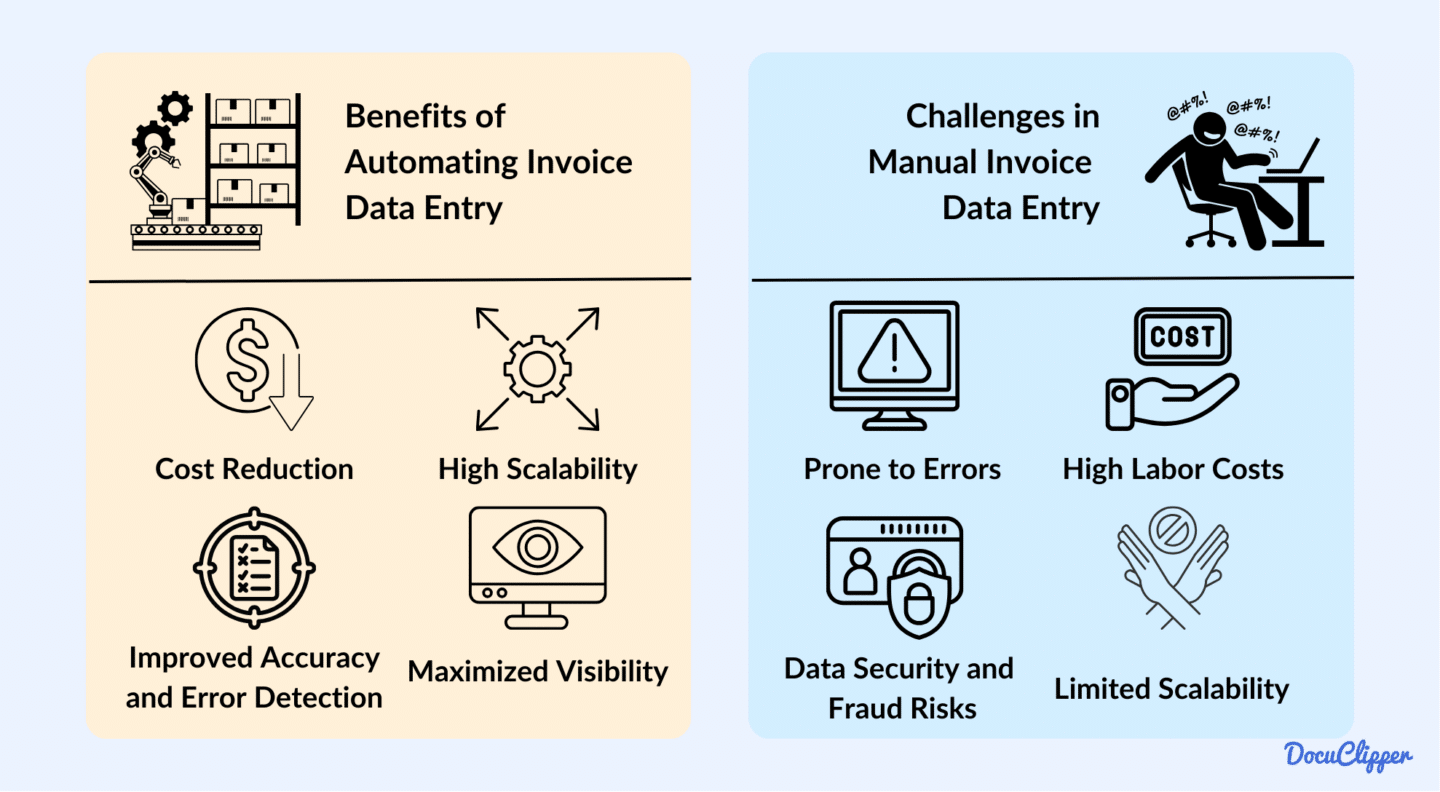

Challenges in Manual Invoice Data Entry

When you stick to manual invoice data entry, you face several challenges that can seriously impact your business’s efficiency.

Here are some key issues:

- High Labor Costs: Hiring personnel for data entry is costly, with hourly rates averaging $15.94. This adds up quickly, especially if you have a high volume of invoices.

- Prone to Errors: Manual data entry is susceptible to human error. A single mistake can lead to significant financial losses and time-consuming corrections.

- Data Security and Fraud Risks: In 2019, businesses lost $132 million to fraudulent invoices and not all employees have the same integrity or capability to detect it. Some might miss fraudulent invoices, while others might exploit the system.

- Limited Scalability: Manual processing is inherently slow and can only handle one invoice at a time and on average, a person can only process 32 to 40 invoices daily. This bottleneck becomes a significant issue as your business grows and the volume of invoices increases.

Manual invoice data entry creates inefficiencies in both pre-accounting workflows, where data is collected and validated, and post-accounting stages, where errors can compromise financial accuracy.

Benefits of Automating Invoice Data Entry

Automating invoice data entry offers numerous benefits, making it a smart choice for your accounting department.

Here are some key advantages:

- Cost Reduction: Automation significantly cuts down the need for manual data entry, reducing processing costs. Basic software features are available for under $100, making it a cost-effective solution.

- Improved Accuracy and Error Detection: Automated systems boast an accuracy rate of up to 97%, especially when processing e-invoices and standardized digital formats, minimizing errors common in manual data entry.

- Maximized Visibility: Automation ensures you have a clear view of all your invoices, even as volume increases, preventing any from being overlooked.

- High Scalability: While manual processing is limited by employee capacity, automated software can handle hundreds of invoices simultaneously, efficiently scaling with your business growth.

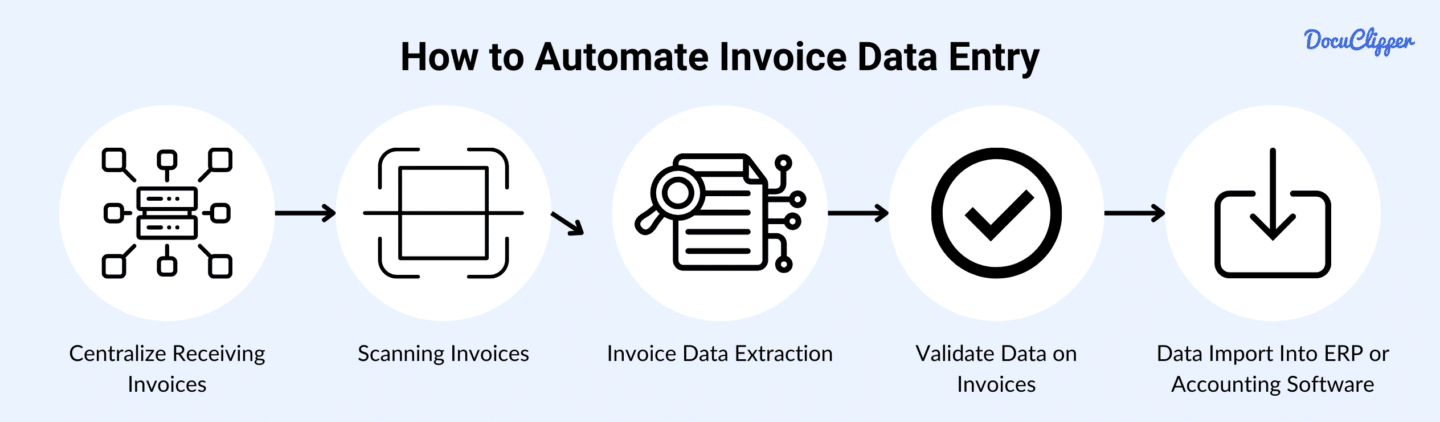

How to Automate Invoice Data Entry

Since you already know the good and the bad of invoice data entry, here are the steps when you start getting into it:

Step 1: Centralize Receiving Invoices

Begin by centralizing all your invoices and receipts in a single system or location, such as dedicated accounts payable software or a centralized digital repository.

This ensures that every invoice and receipt is accounted for and your team does not miss incoming invoices.

- For PDF invoices: Set up a periodic schedule for receiving and processing invoices. Direct all PDF invoices to a specific email address or utilize an active CRM system with your vendors to compile invoices in one place. This invoice organized approach simplifies tracking and management.

- For paper invoices: Manage paper invoices similarly by receiving them at regular intervals. Ensure all invoices are sent by mail in sealed envelopes, and have them opened exclusively by the accounting team to prevent tampering. This method maintains the integrity and security of your invoicing process.

Step 2: Scanning Invoices (only for paper invoices)

After collecting your invoices, focus on the paper ones since PDF invoices can be directly processed by data capture tools.

For paper invoices, ensure they are scanned and can be exported as PDF files.

Clean scans are crucial—remove any dirt or specks from the paper to prevent errors during OCR processing.

High-quality scanners help the OCR software accurately extract the necessary data, reducing the need for manual corrections later.

Step 3: Invoice Data Extraction

After centralizing and scanning all your invoices and receipts into PDF format, the next step is invoice data extraction.

Using tools like DocuClipper invoice scanning software you can easily and accurately extract invoice data from PDF in seconds.

DocuClipper Invoice OCR technology excels at handling hundreds of invoices in various formats, efficiently extracting critical details such as invoice numbers, dates, amounts, and line items.

While invoice parser significantly reduces manual labor, it’s still wise to periodically review the extracted data to ensure accuracy.

Regular checks help catch any errors early, ensuring your records remain precise. This step simplifies invoice management, minimizes mistakes, and streamlines your invoicing process.

Step 4: Validate Data on Invoices

Although OCR technology is highly accurate, validating the extracted data to ensure it matches the original invoices is essential. Learn more about invoice validation.

OCR can have limitations, especially with scanned PDFs, so improving accuracy through preprocessing steps is beneficial.

Review the data against predefined rules and cross-check it with purchase orders, contracts, and receipts to confirm accuracy and compliance.

If your process includes three-way matching, ensure the data also aligns with corresponding receipts and purchase orders.

Regular invoice reconciliation helps maintain data integrity and prevents errors from slipping through, making your financial records accurate and reliable.

Learn more about invoice matching:

Step 5: Data Import Into ERP or Accounting Software

Now, import the extracted data into your accounting or ERP software. Tools like DocuClipper integrate seamlessly with QuickBooks Online, allowing you to import invoices into QuickBooks with one click.

With DocuClipper, you can link the extracted data directly to your QuickBooks accounts without needing to re-upload files.

If you use a different ERP or accounting software, you can still import the data by uploading a CSV file of your spreadsheet.

Choosing the Right Tools for Invoice Data Entry

Before you can start the data entry process yourself, you still have to pick the best invoice scanning software that works best for you the best.

Here are some of the best tools available:

- DocuClipper: This OCR software excels at converting invoices into structured data formats like Excel, CSV, and QBO with an impressive 97% accuracy rate. It supports batch processing, which enhances file conversion efficiency. Additionally, DocuClipper offers API functionality, allowing seamless integration with leading accounting platforms such as QuickBooks, Xero, Sage, and other ERP software.

- QuickBooks: QuickBooks Online (QBO) features a Receipt Capture tool that lets you scan or upload receipts. It then automatically extracts the data to create transactions for review, editing, and matching. The QBO mobile app allows you to capture receipts on the go.

- Sage OCR: The Purchase Invoice Automation solution uses intelligent OCR technology to capture data from paper invoices and credit notes. It then automates the filing process in the Electronic Document Management system for Sage Business Cloud X3.

- AutoEntry: AutoEntry is a specialized data automation tool designed to streamline accounting processes. It automates the extraction and publication of data directly into major accounting software platforms and can scan invoices for accounting purposes.

- Dext Prepare: Dext Prepare boosts the productivity and profitability of accountants and businesses through enhanced data management and insightful analytics. It offers robust tools that efficiently prepare, sort, and automatically publish invoices and receipts, minimizing manual data entry.

- Nanonets: This AI-driven automation platform provides a no-code solution that transforms invoices and receipts from various sources (documents, emails, tickets, databases) into actionable insights, enhancing decision-making and operational efficiency.

- Docsumo: Docsumo is a leading Intelligent Document Processing (IDP) solution specializing in financial documents. Initially launched to automate invoice processing, it efficiently handles large volumes of financial documents, improving processing speed and accuracy.

Criteria for Selecting the Best Invoice Data Entry Tool

Choosing the right invoice data extraction software is essential for streamlining your accounting processes and ensuring efficiency. Here are key criteria to consider:

- Integration Capabilities: Your chosen tool must seamlessly integrate with your existing accounting software. This ensures smooth file transfers and easy processing, allowing you to maintain consistency and accuracy across platforms.

- Ease of Use: The tool should be user-friendly, particularly for new users and during employee training. An intuitive interface reduces the learning curve and boosts productivity.

- Scalability: As your business grows, the tool should handle increasing volumes of invoices without significant costs or performance issues. Scalability ensures long-term usability and cost-effectiveness.

- Customer Support: Reliable and knowledgeable customer support is crucial. Responsive support services can assist you in navigating the software, resolving issues promptly, and ensuring smooth operation.

- Pricing: Invoice data entry tools may charge per line item or per page. Opt for a pricing model that offers better value; typically, per-page pricing is more cost-effective as a single page can contain multiple line items. Ensure the cost is a fraction of what you would spend on manual data entry labor.

Conclusion

Automation is essential for your business growth, and implementing it is simpler than you think. Automating invoice data entry evolves how you handle invoices, making the process faster and more efficient.

With OCR technology, you can quickly process invoices with high accuracy, eliminating the tedious task of manual data entry. This frees up valuable time and resources, allowing your team to focus on strategic tasks that drive your business forward.

Get into automation to streamline your invoicing, reduce errors, save costs, and enhance overall efficiency. Let technology handle the mundane so you can concentrate on what truly matters.

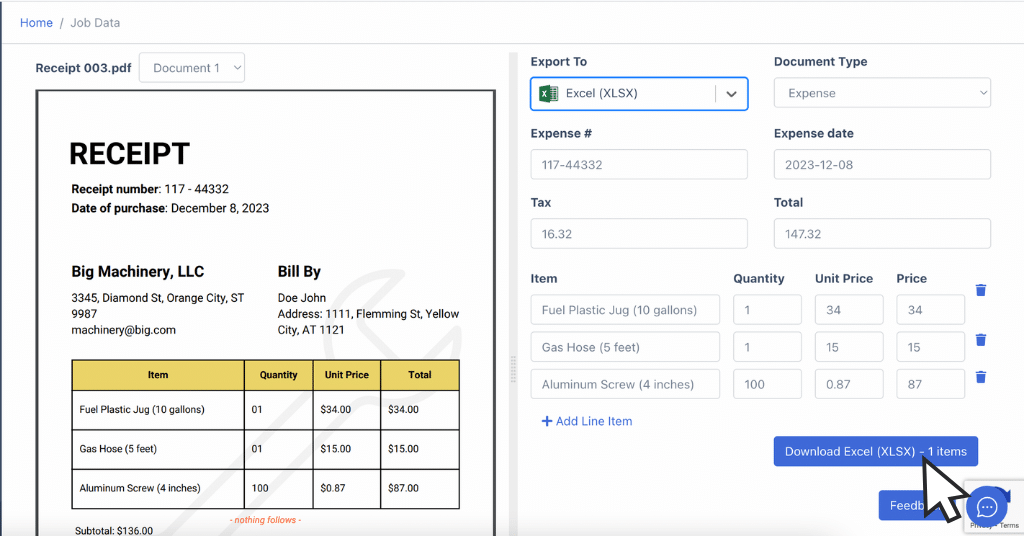

How DocuClipper Helps to Automate Invoice Data Entry

DocuClipper can help automate invoice data entry because it is capable of extracting vital information such as invoice numbers, dates, prices, amounts, line items, and taxes.

This OCR software has an accuracy of up to 97%, the highest in invoice standards. It can easily extract across different formats and it is highly scalable, processing hundreds of invoices in a few seconds only. It offers API functionality for seamless integration with leading accounting platforms such as QuickBooks, Xero, Sage, and other accounting and ERP software.

FAQs about Invoice Data Entry

Here are some frequently asked questions about invoice data entry:

What is an invoice in data entry?

An invoice in data entry is a document that lists the goods or services provided, along with their prices, quantities, and total amount due. It’s used to record and track sales transactions, ensuring accurate financial records for both the seller and buyer.

What is the invoice entry?

Invoice entry is the process of inputting invoice details into your accounting or ERP system. This includes information such as invoice number, date, vendor details, line items, amounts, and taxes, ensuring accurate and organized financial records.

What type of data is an invoice?

An invoice contains data such as invoice number, date, vendor details, line items, quantities, prices, total amount due, taxes, and payment terms. This information is essential for tracking sales transactions and maintaining accurate financial records.

What is invoice data capture?

Invoice data capture is the process of extracting key information from invoices using tools like OCR software. This data includes invoice number, date, vendor details, line items, amounts, and taxes, which are then entered into accounting or ERP systems for accurate record-keeping.

What data is needed for an invoice?

An invoice requires data such as the invoice number, date, vendor and buyer details, item descriptions, quantities, prices, total amount due, applicable taxes, and payment terms. This information ensures clear and accurate financial transactions between parties.

What is the difference between data entry and data capture?

Data entry involves manually inputting information into a system, while data capture uses automated tools, like OCR, to extract information from documents. Data capture is typically faster and more accurate, reducing the need for extensive manual input and minimizing errors.

What does an invoice record?

An invoice records crucial details about a transaction, including the invoice number, date, and both the seller’s and buyer’s information. It itemizes the goods or services provided, along with quantities, unit prices, total amounts, applicable taxes, and payment terms.

What is billing data?

Billing data includes all the necessary information to generate and process an invoice for goods or services rendered. This typically comprises customer details (name, address, contact information), transaction details (invoice number, date, items or services provided, quantities, prices, and total amount due), payment terms, and any applicable taxes or discounts.

What is the invoice dataset?

An invoice dataset is a collection of invoice records stored in a structured format, such as a spreadsheet or database. Each entry in the dataset includes detailed information from individual invoices, such as invoice numbers, dates, vendor and customer details, item descriptions, quantities, unit prices, total amounts, taxes, and payment terms.