Many newcomers in the financial industry often confuse invoices and receipts, leading to the common question: “invoice vs receipt”, are they the same?

This article will explore the differences between an invoice and a receipt.

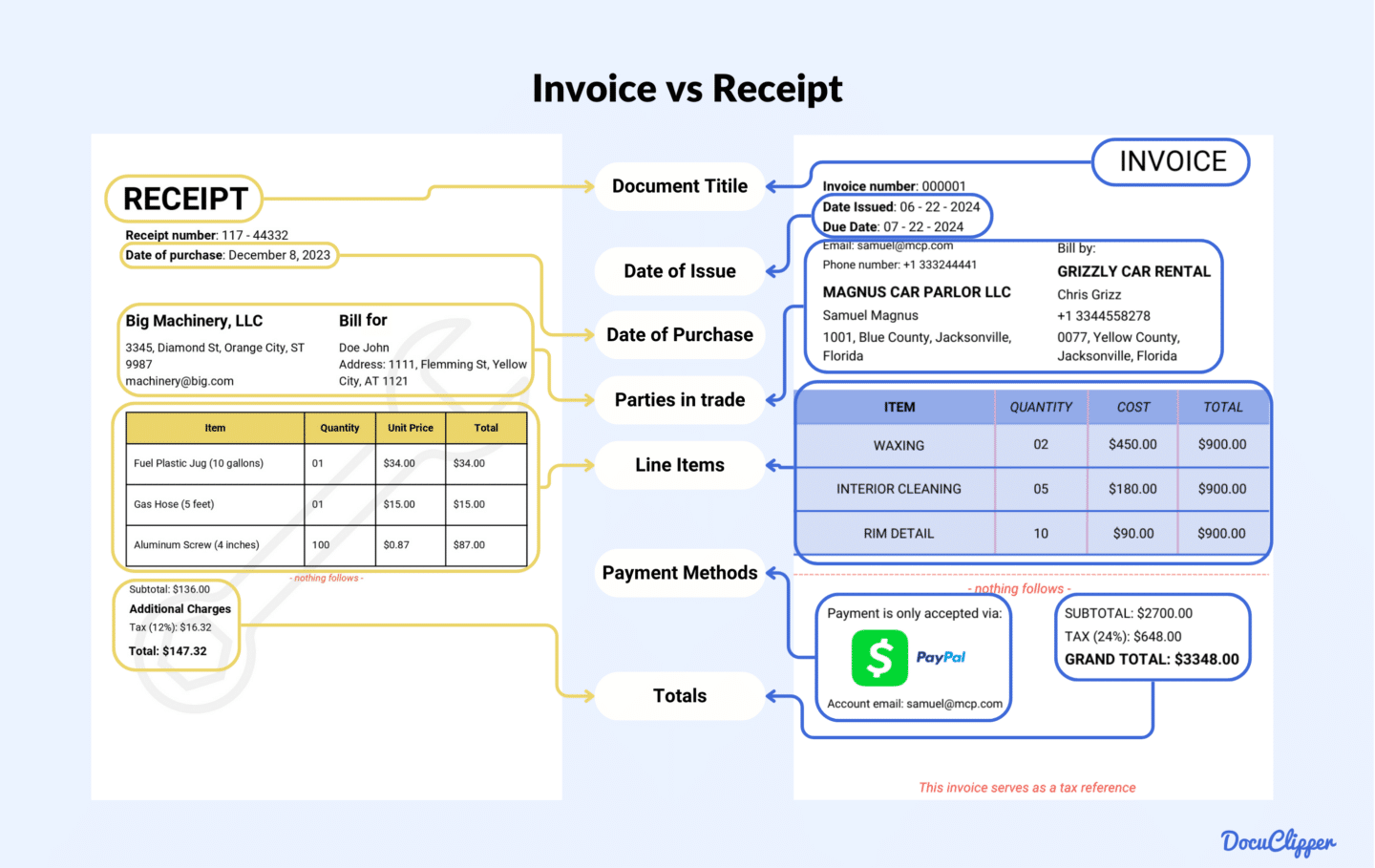

The main difference between an invoice and a receipt is that an invoice is issued before payment, requesting the amount due for goods or services, while a receipt is issued after payment has been made, serving as proof that the transaction is complete.

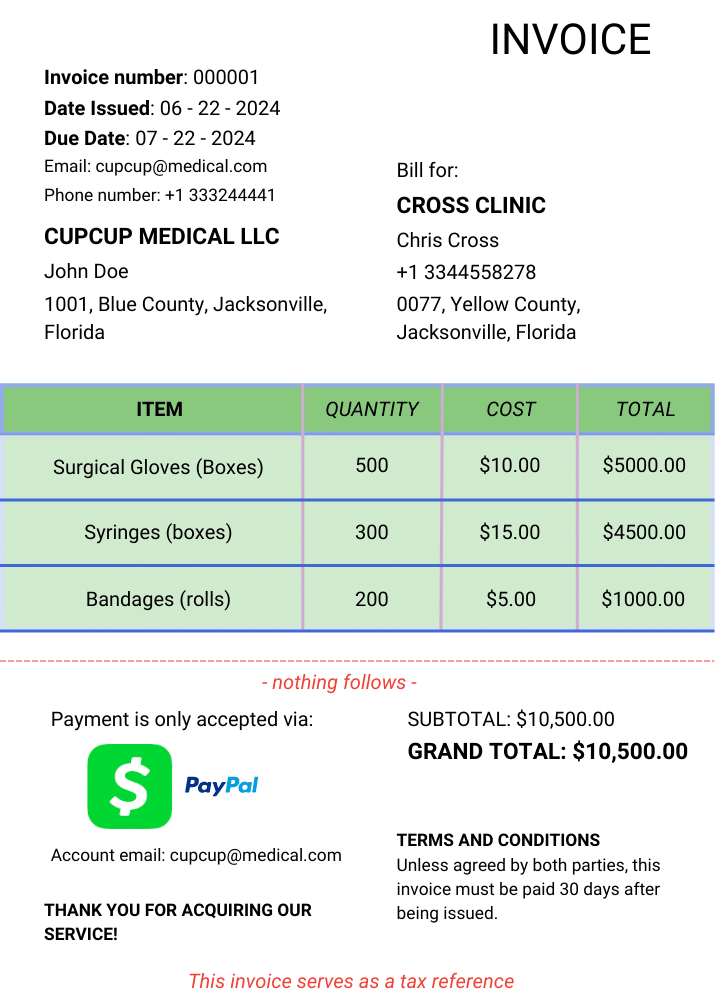

What is an Invoice?

An invoice is a formal document issued by a seller to a buyer that details the transaction of goods or services provided.

It serves as a request for payment, outlining the amount due, payment terms, and methods available for payment, but what it includes depends on the type of invoice.

Invoices typically include itemized lists of products or services, along with dates and prices. For businesses, invoices help track outstanding payments, ensuring timely collections and accurate record-keeping.

For customers, invoices provide a clear record of their purchases and the associated costs.

Often used in business-to-business transactions or when goods are sold on credit, invoices are essential for maintaining financial clarity and ensuring both parties understand the payment expectations.

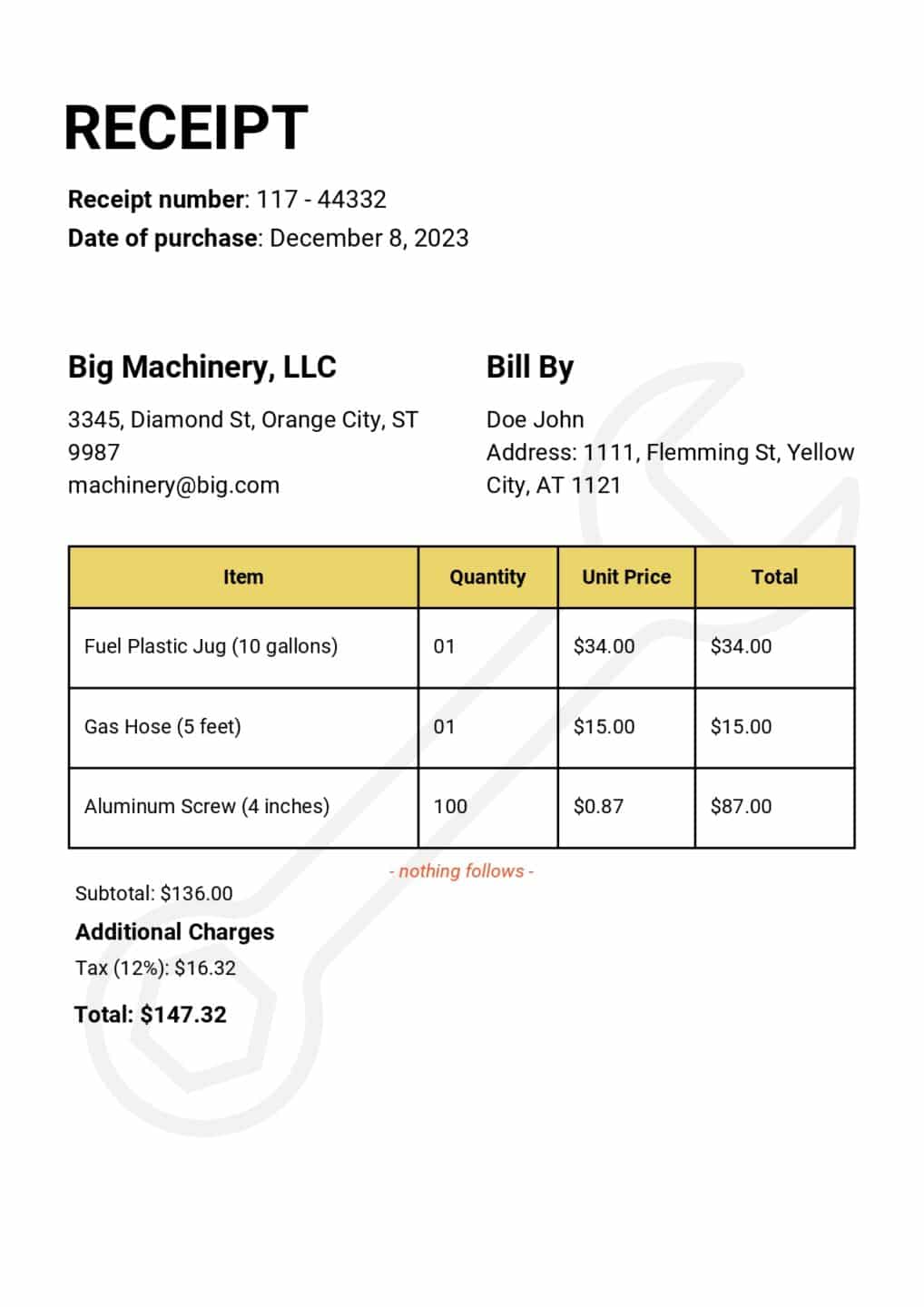

What is a Receipt?

A receipt is a document that serves as proof of a completed transaction between a buyer and a seller, confirming that payment has been received for goods or services.

It can be issued in paper or electronic form and typically includes key details such as the date of purchase, items or services acquired, the price paid, and the payment method used.

Receipts are essential for both personal and business financial tracking, helping to document expenses and support returns, exchanges, or warranty claims.

For businesses, receipts provide a record for tax reporting and compliance, while for customers, they confirm payment and ownership of the purchased items.

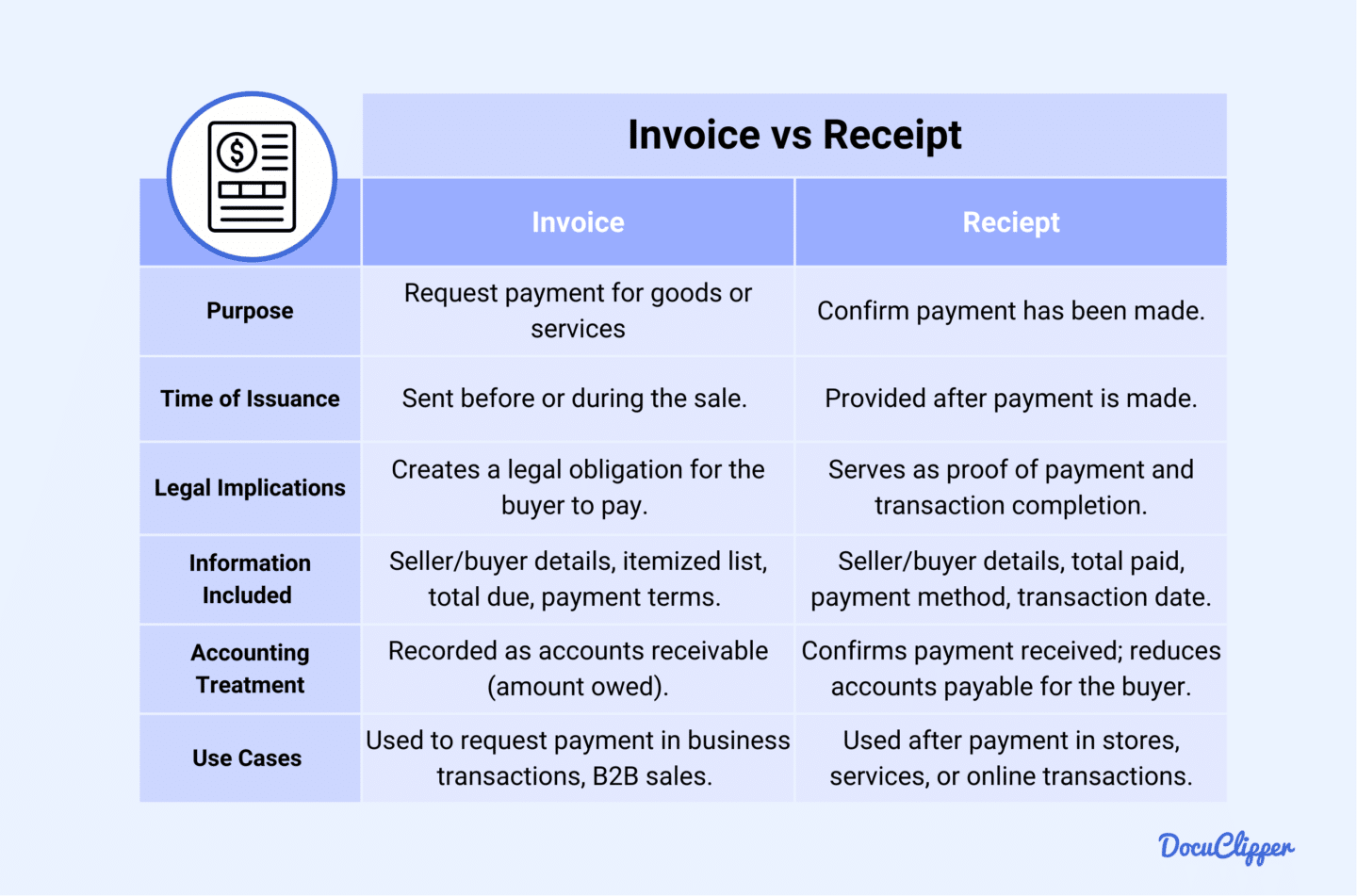

Invoice vs Receipt: The Main Differences

Invoices and receipts may seem similar, but they serve different purposes in business transactions.

Understanding their differences is essential for effective receipt and invoice management, legal compliance, and maintaining professional customer relationships.

Here are the main differences between both documents:

Purpose

Invoice: You send an invoice to formally request payment for goods or services provided. It outlines the amount owed and includes payment terms.

Receipt: You provide a receipt to confirm that payment has been made and the transaction is complete. It serves as proof of payment.

Timing of Issuance

Invoice: An invoice is sent before or during a sale to request payment for goods or services. It specifies the amount due and provides payment terms, ensuring clarity on financial obligations.

Receipt: After payment is made, a receipt is provided to confirm the transaction. It serves as proof of payment, including details like the purchase date and payment method, offering a clear record that the sale has been completed.

Legal Implications and Requirements

Invoice: An invoice is a non-binding document requesting payment for goods or services, serving as an itemized bill and evidence in legal proceedings but not enforceable like a contract. It can only be legally binding when both parties accept the terms.

Receipt: A receipt serves as your confirmation of payment, providing legal proof that the transaction is complete. This document is crucial for addressing disputes, facilitating returns, and maintaining a clear, verifiable record of the completed exchange for both you and the customer.

Information Included in Each Document

Invoice: In an invoice, you typically include details like the names and contact information of both the seller and buyer, a breakdown of the goods or services provided, the total amount due, payment terms, an invoice number, and the due date.

Receipt: A receipt contains information confirming that payment has been made. It includes the seller’s and buyer’s details, the total amount paid, the payment method, the date of the transaction, and a description of the goods or services, providing proof that the transaction is complete.

Accounting Treatment

Invoice: In accounting, when you issue an invoice, it’s recorded as accounts receivable on your end, while the buyer records it as accounts payable. The invoice reflects the amount owed and is recognized as revenue once payment is expected, tracking the financial obligation between both parties.

Receipt: On the other hand, a receipt is recorded to confirm the transaction’s completion. For you, it indicates that payment has been received, closing your accounts receivable. For the buyer, it reduces accounts payable, marking the transaction as fully settled.

Use Cases and Scenarios

Invoice: Invoices are typically issued when you need to request payment for goods or services. This might happen after completing a project, delivering products, or in any situation where payment is expected at a future date. You’ll often use invoices in business-to-business transactions, subscription billing, or freelance work where delayed payment terms are agreed upon.

Receipt: Receipts come into play once payment has been made. Whether it’s after purchasing items in a store, paying for a service, or completing an online transaction, a receipt acts as proof of that payment. Receipts are particularly useful for returns, exchanges, or maintaining accurate records for accounting purposes.

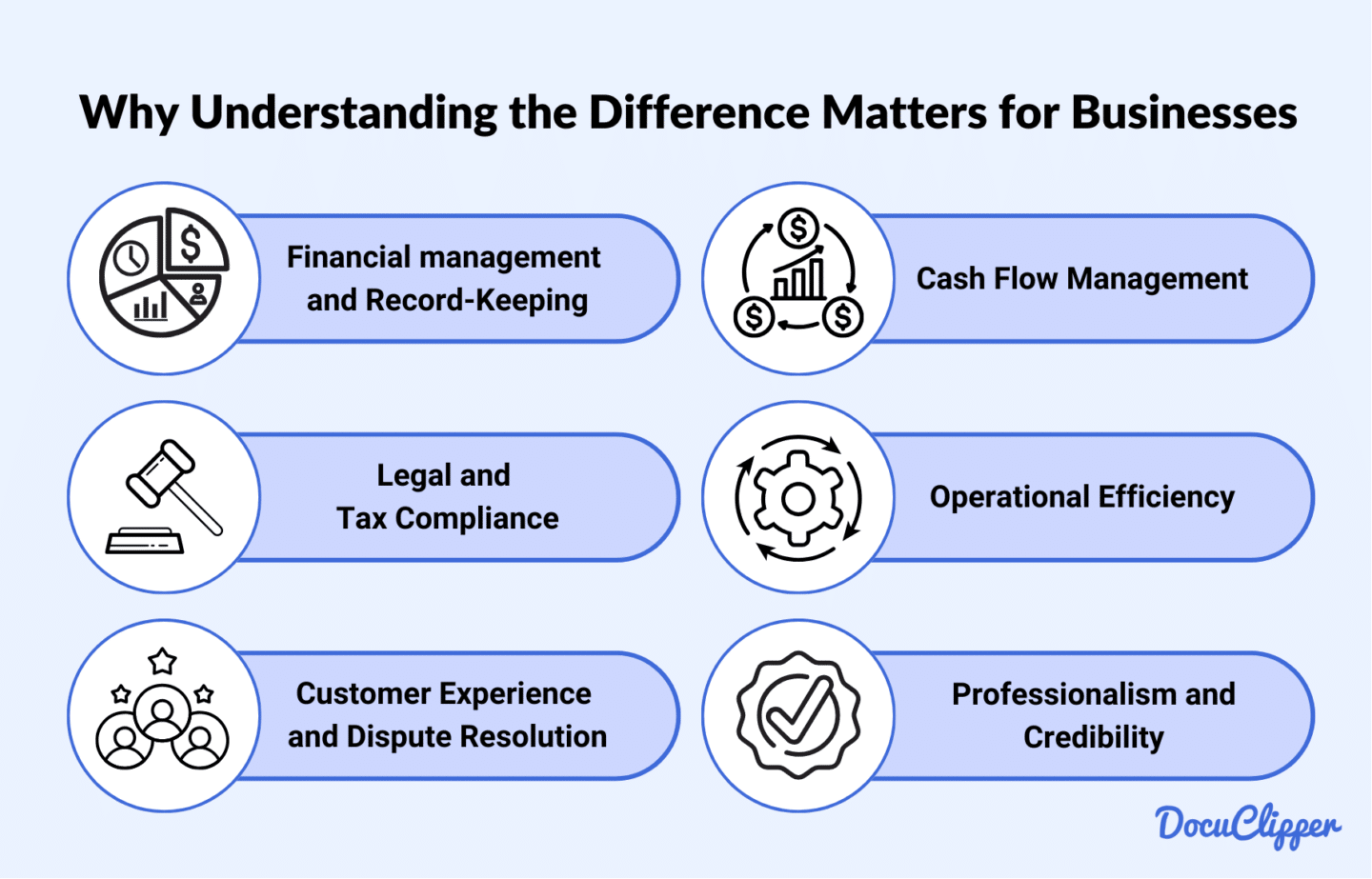

Why Understanding the Difference Matters for Businesses

Understanding the differences between invoices and receipts is crucial for businesses.

It ensures accurate financial tracking, compliance, and smooth operations, ultimately contributing to better cash flow, customer satisfaction, and overall efficiency.

Financial management and Record-Keeping

Understanding the difference between invoices and receipts is important to accurate financial management.

Invoices indicate money owed to vendors, while receipts confirm payments made.

Confusing the two can lead to errors, such as issuing a receipt instead of an invoice for unpaid goods, potentially causing disputes. Keeping them straight ensures clear tracking of business transactions and prevents costly mistakes.

Legal and Tax Compliance

It’s necessary to differentiate between invoices and receipts for legal and tax compliance. While the IRS may accept summaries, they could request individual invoices during audits.

Confusing a receipt with an invoice may lead to incorrect expense reporting. Invoices show what you still owe, while receipts confirm payment, so tracking them correctly is key to accurate tax filing and expense management.

Enhancing Customer Experience and Dispute Resolution

Clarifying whether you provided an invoice or a receipt is crucial for resolving customer disputes. Many customers mistakenly present invoices as proof of payment, leading to confusion.

By issuing the correct documents, you streamline transaction records and prevent misunderstandings. Proper management of invoices and receipts helps build trust and improves overall customer satisfaction by making dispute resolution more straightforward.

Cash Flow Management

Accurate invoicing enables you to monitor outstanding balances, forecast revenue, and maintain control over your cash flow. Invoices help predict future payments, while receipts confirm completed transactions.

You’ll gain a clear understanding of your current financial position when you distinguish between the two well, allowing you to allocate resources effectively and ensure financial stability for your business.

Operational Efficiency

Issuing invoices and receipts at the right time helps streamline your financial processes. Proper management reduces the chances of delayed payments and ensures transactions are recorded promptly.

This organization improves your billing cycle’s transparency, keeps your records accurate, and enhances overall operational efficiency, allowing your business to run more smoothly and with fewer payment-related issues.

Professionalism and Credibility

Issuing invoices and receipts correctly boosts your business’s professionalism and credibility. Mixing them up can confuse customers and harm your reputation.

For smaller purchases like in retail stores or the supermarket, only receipts are often given, but for larger transactions, invoices add another layer of assurance.

Providing the appropriate document on time ensures customers understand their payment obligations, preventing misunderstandings and solidifying trust in your business practices.

How to Create an Invoice

Creating a professional invoice is essential for maintaining clear communication, ensuring timely payments, and establishing credibility with your clients.

Follow these steps to craft an effective invoice that reflects your brand and conveys the necessary payment details.

- Brand Your Invoice: Ensure your invoice reflects your company’s branding. Include your logo, company name, and contact information to create a professional and recognizable document. This not only adds credibility but also strengthens your business identity.

- Add a Professional Header: Create a clear and professional header at the top of your invoice. This should include the word “Invoice” along with a unique invoice number for easy reference. A well-structured header helps with the organization and identification of the document.

- Identify the Parties: Clearly state the names and contact information of both parties involved in the transaction. Include your business details and the customer’s information to ensure clarity in communication. This helps ensure the invoice reaches the correct recipient.

- Include Invoice Information: Provide essential invoice details, such as the invoice number and issue date. This information helps both you and the customer track and reference the invoice accurately. It’s also critical for proper bookkeeping.

- Describe What’s Being Exchanged: Provide a clear description of the goods or services delivered. Be detailed in listing quantities, descriptions, and rates, as this ensures transparency and avoids misunderstandings. Your customers should easily understand what they are being billed for.

- Include Tax Details and Highlight the Total Amount Owed: List any applicable taxes and highlight the total amount due at the bottom of the invoice. Ensure that the tax rate is specified and correctly calculated. This ensures transparency and helps avoid payment discrepancies.

- Include Payment Terms: Clearly state your payment terms, including the due date and acceptable payment methods. This informs the customer of when and how to pay, reducing the chance of late payments. Providing clear terms also sets expectations upfront.

- Add Explanatory Notes with Terms and Conditions: Include any additional notes, such as terms and conditions or payment instructions. This can be used to outline refund policies, penalties for late payments, or other relevant conditions. Clear communication of these terms helps protect your business and ensures smooth transactions.

How to Create a Receipt

Making a professional receipt is a good look for many clients. When you are planning to use one for your business and sales, here are some steps to get started:

- Choose or Create a Reusable Receipt Template: Select a standard template or create your own using word processing software. Include placeholders for essential details like your company name, customer information, date, item descriptions, and total amounts. Save the template as a fillable PDF for easy reuse.

- Brand the Receipt: Add your business branding to the receipt, such as your logo, company name, and contact information. This not only makes your receipts look professional but also reinforces your business identity. Branding helps your customers easily recognize who issued the receipt.

- Input Sales Information: Fill in the transaction details, including the date of purchase, items sold, quantities, and their respective prices. Don’t forget to include taxes and any additional fees. Accurate information ensures transparency and prevents disputes later on.

- Specify Payment Method: Indicate the payment method used (cash, credit card, or other) and, if applicable, have the customer sign for credit card transactions. This step provides clarity on how the payment was made and is vital for both your records and the customer’s reference.

- Deliver the Receipt to the Customer: Provide the completed receipt to the customer, either by printing it or sending it via email. Always retain a copy for your records, whether in digital format or in a physical receipt book. This keeps your business receipts and invoices organized and helps with future referencing.

Conclusion

Understanding the differences between invoices and receipts is vital for maintaining accurate financial records, ensuring tax compliance, and enhancing customer relationships. Invoices request payment for services or goods, while receipts confirm that payment has been made.

Using these documents properly helps businesses improve cash flow, professionalism, and operational efficiency.

How DocuClipper Can Help Businesses with Processing Invoices and Receipts

DocuClipper is an OCR software that efficiently converts PDF invoices and receipts into XLS, CSV, and QBO formats. It enables businesses to process large volumes of documents quickly, with high security and accuracy.

With the ability to handle hundreds of receipts and invoices in seconds, it streamlines data extraction at scale. Additionally, DocuClipper functions as a bank statement converter, integrating seamlessly with accounting platforms like Xero, Sage, and QuickBooks.

FAQs About Invoice vs Receipt

Here are some frequently asked questions about invoices and receipts:

Is an invoice the same as a receipt?

No, an invoice and a receipt serve different purposes. An invoice is a request for payment from a seller to a buyer, detailing the goods or services provided and the amount owed. A receipt, on the other hand, is issued after the payment has been made, serving as proof of the completed transaction and confirming the details of the purchase.

Is invoice equal to receipt?

No, an invoice is not equal to a receipt. An invoice is issued to request payment for goods or services provided and includes details like the amount owed and payment terms. A receipt, on the other hand, is issued after the payment is made to confirm that the transaction has been completed. Both serve different purposes in the payment process, with an invoice representing a request and a receipt serving as proof of payment.

Is the receipt valid as an invoice?

No, a receipt is not valid as an invoice. While both documents are used in financial transactions, they have distinct purposes. An invoice requests payment for goods or services provided, whereas a receipt is issued after payment has been made to confirm the transaction. Therefore, a receipt cannot replace an invoice, as it does not outline payment terms or request payment.

Can I send a receipt instead of an invoice?

No, a receipt cannot be sent in place of an invoice. An invoice is issued to request payment for goods or services rendered and includes payment terms. A receipt, however, is issued only after payment has been received to confirm the transaction. Invoices help track accounts receivable, while receipts serve as proof of payment, so they fulfill different roles in the payment process.

Can the invoice work as a receipt?

While an invoice and a receipt are related, they cannot be used interchangeably. An invoice requests payment for services or goods rendered, while a receipt confirms that payment has been made. Some businesses may include receipt information on an invoice after the payment is completed, but an invoice alone does not serve as a receipt until the payment is fully processed.

Does invoice mean paid?

No, an invoice does not mean the payment has been made. An invoice is a document sent by a seller to a buyer, requesting payment for goods or services provided. It outlines the amount due, payment terms, and a breakdown of what was sold. Payment is made after receiving the invoice, and only then can a receipt be issued to confirm that the invoice has been paid.

Is an official receipt an invoice?

No, an official receipt is not an invoice. An official receipt is issued after payment has been made, serving as proof of the completed transaction. In contrast, an invoice is issued to request payment from a customer for goods or services. Both documents are important for business transactions, but they fulfill different roles in the billing and payment process.

Is an invoice just a bill?

Yes, an invoice can be considered a type of bill, but it is more detailed. While a bill requests payment, an invoice includes specifics like the goods or services provided, the amount due, payment terms, and the seller’s details. Invoices are often used in business-to-business transactions and are key for tracking payments, whereas a bill may refer to simpler transactions, such as in retail.