Data entry is a key job in all industries in managing and processing information. It has always been essential, regardless of the industry.

With the age of digitalization, companies are transitioning from paper-based to online databases. This shift requires adapting information storage and management.

The introduction of OCR (Optical Character Recognition) technology is leading many companies to transition from manual to automated data processing systems.

Simplify your accounting tasks with AI – learn more in our eBook!

What is OCR Data Entry?

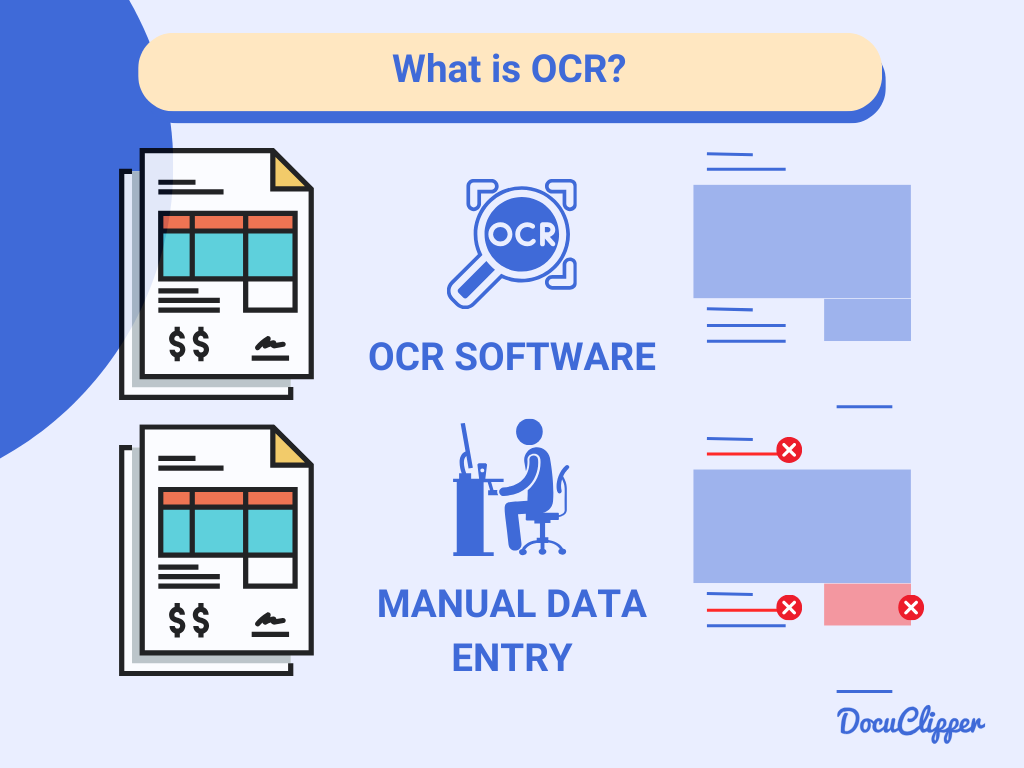

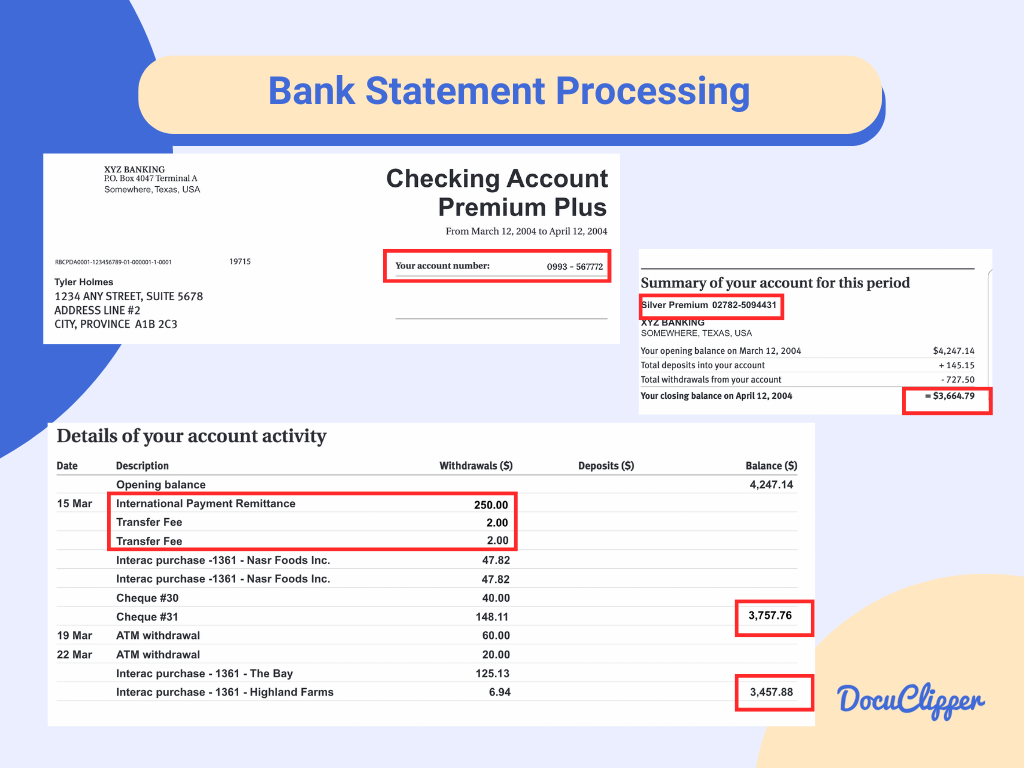

OCR data entry is the process of extracting data from various sources using OCR technology. For example, bank statements are commonly processed with OCR to gather their data.

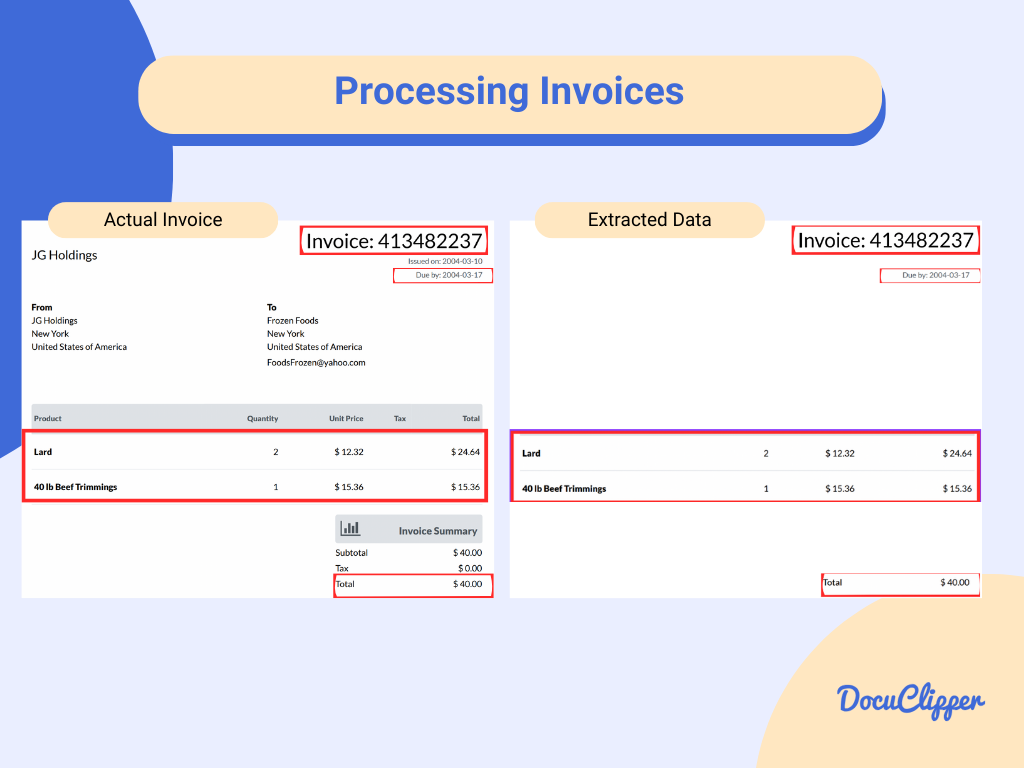

Or OCR is used also for invoice data extraction, and receipt data capture as well.

OCR processes scanned images to identify characters and convert them into digital, editable formats.

Why is OCR Used for Data Entry

Using OCR in data entry has been a game-changer for many companies. It reduces the required personnel involved in data extraction and can save a lot of time and money.

According to the latest data entry statistics, on average data entry personnel are paid $40,504 annually but a year’s worth of OCR data entry software is less than $1,000.

Therefore using OCR software can help you eliminate the need to outsource data entry.

OCR is highly effective in document data extractions such as bank statements into editable formats like Excel and CSV, boasting an accuracy rate of 99.5% for this task. Making significantly fewer errors compared to manual data entry.

How OCR Data Entry Works

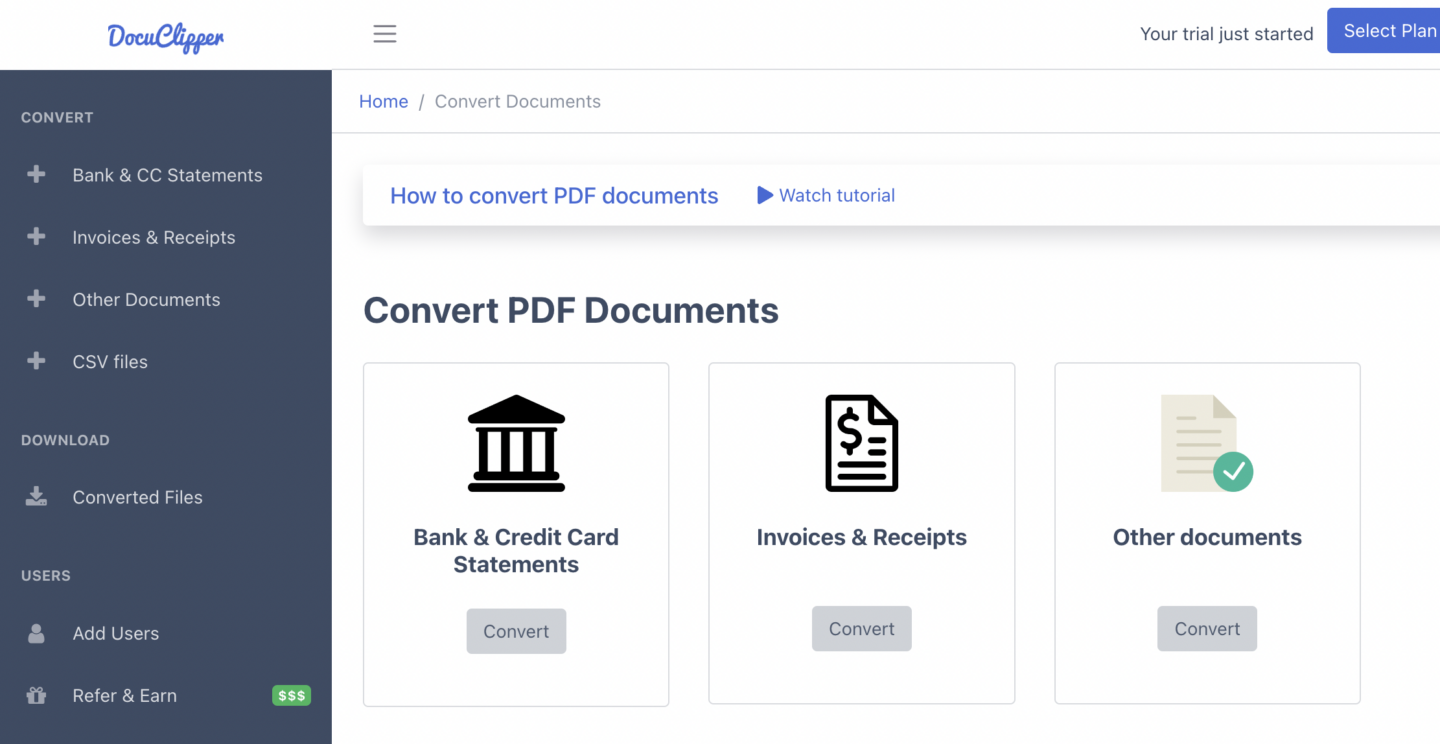

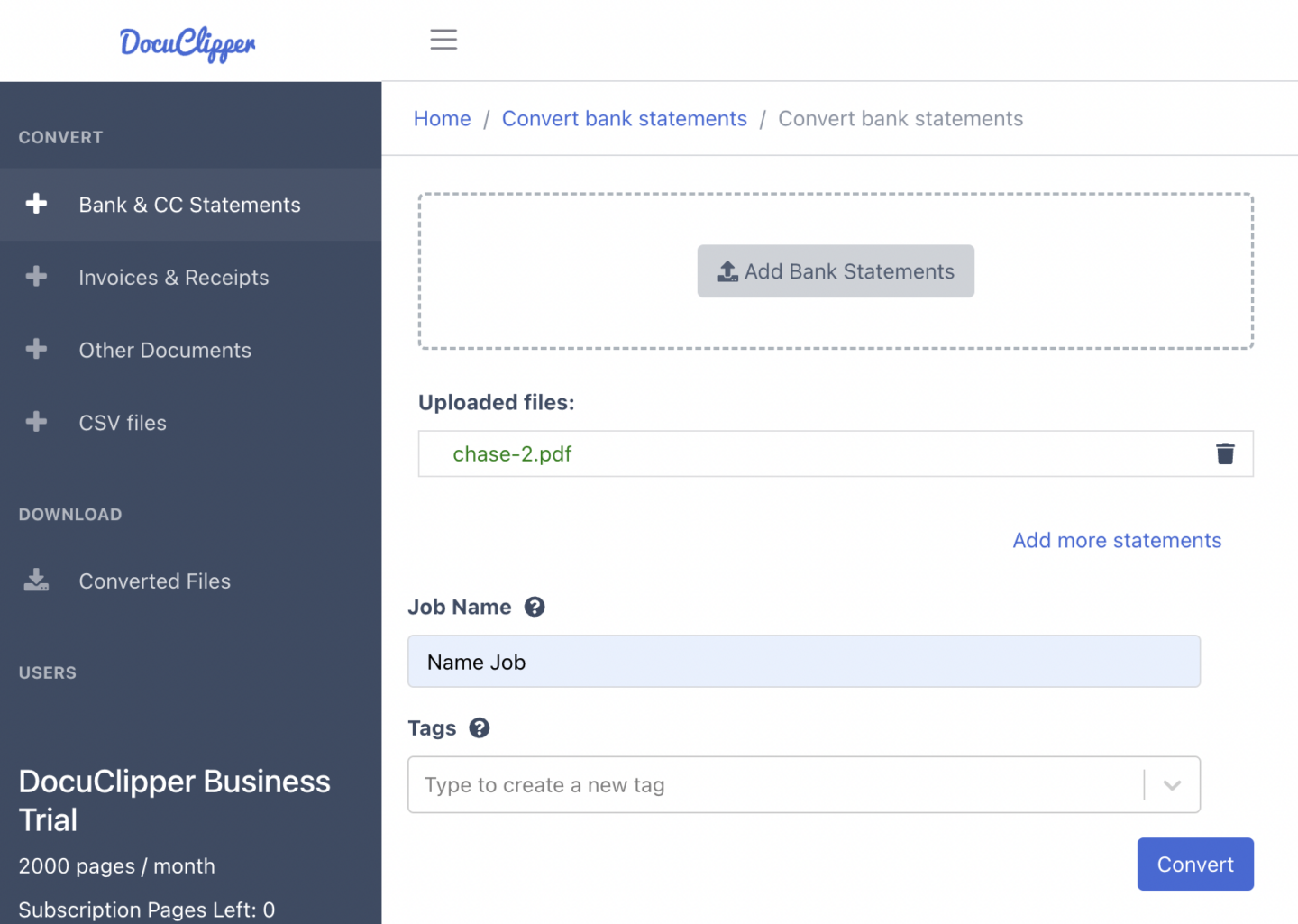

OCR data entry operates using specialized OCR software tailored for specific niches. For instance, DocuClipper is an OCR software designed specifically for converting bank statements. Here are some fundamental steps in how OCR works.

Step 1: Upload Image/Document

The OCR process starts when a user uploads an image or document with text, like scanned documents or photographs. The input’s quality and clarity significantly affect OCR accuracy.

Clear images, such as PDFs and bank statements, typically yield more accurate results, whereas handwritten or typewritten documents may be less precise.

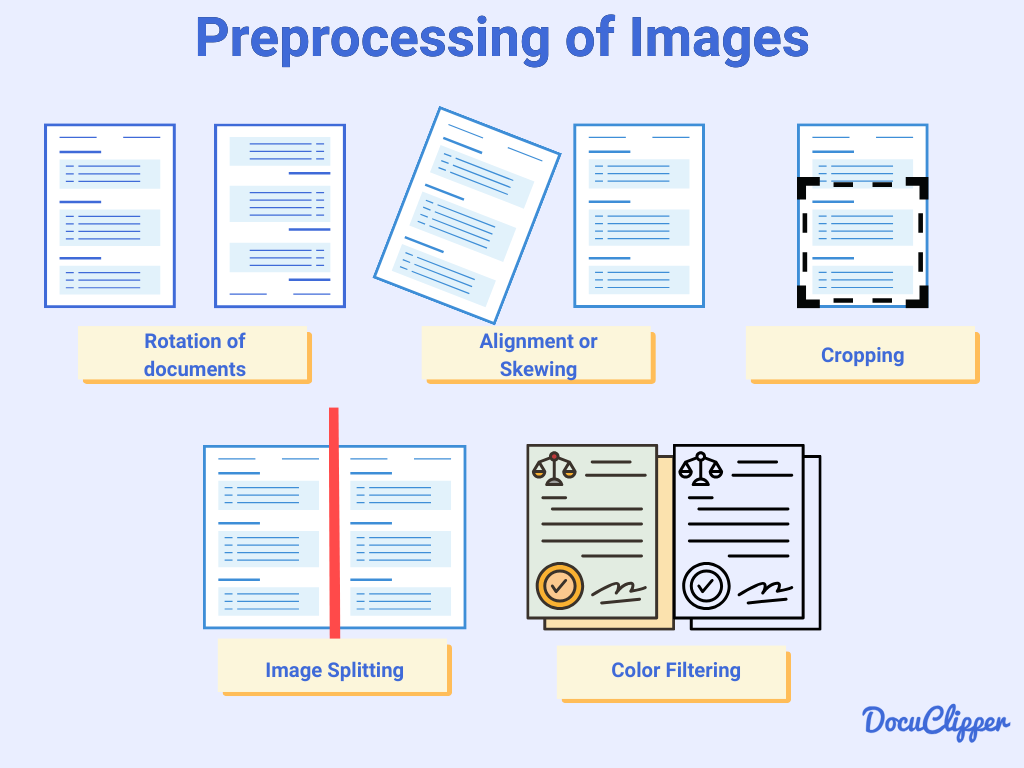

Step 2: OCR Preprocessing

When an image is uploaded, the OCR system preprocesses it to enhance quality and remove noise. This includes adjusting uneven lighting for uniformity and standardizing different font sizes, ensuring accurate text recognition.

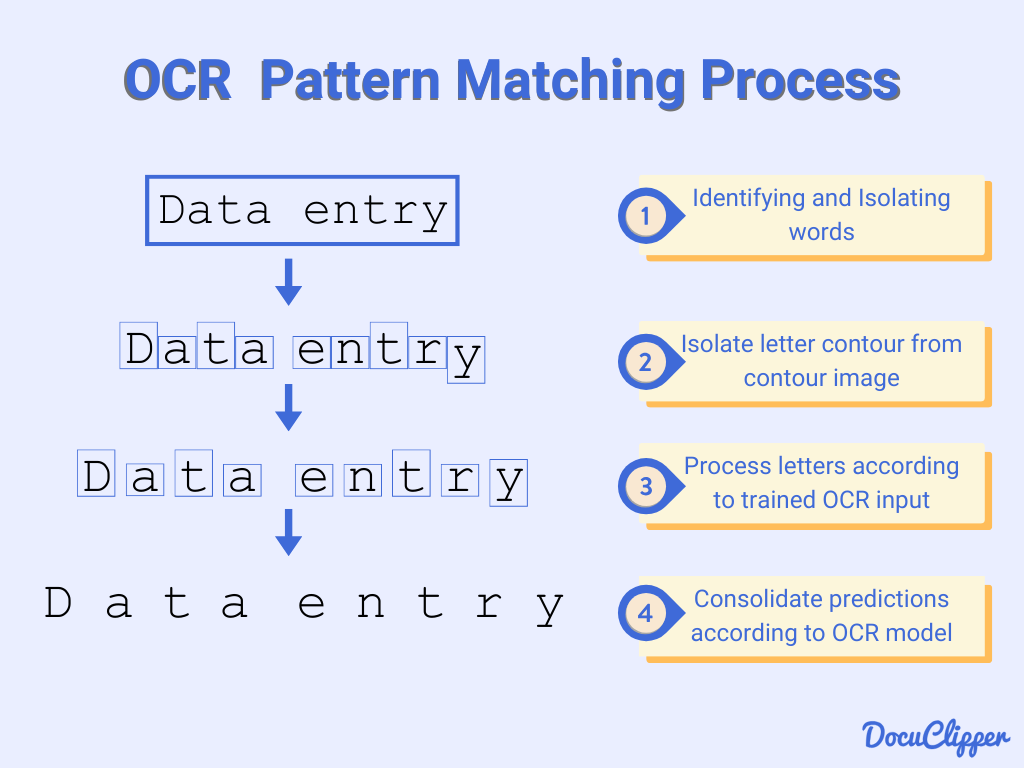

Step 3: Text Recognition

In this stage, OCR software matches the visual patterns of text against a character database to identify and differentiate characters. It’s particularly effective in handling invoices with varying styles and fonts, and identifying key elements like numbers, dates, and amounts.

The software’s access to known patterns ensures accurate information extraction from different layouts.

Additionally, OCR systems use advanced algorithms to extract unique character features, including line thickness, curvature, and spatial relationships, enhancing character recognition and reducing errors.

Step 4: Postprocessing

Postprocessing in OCR includes error correction, contextual analysis, and assembling recognized characters into words and sentences. This stage corrects inaccuracies from earlier steps.

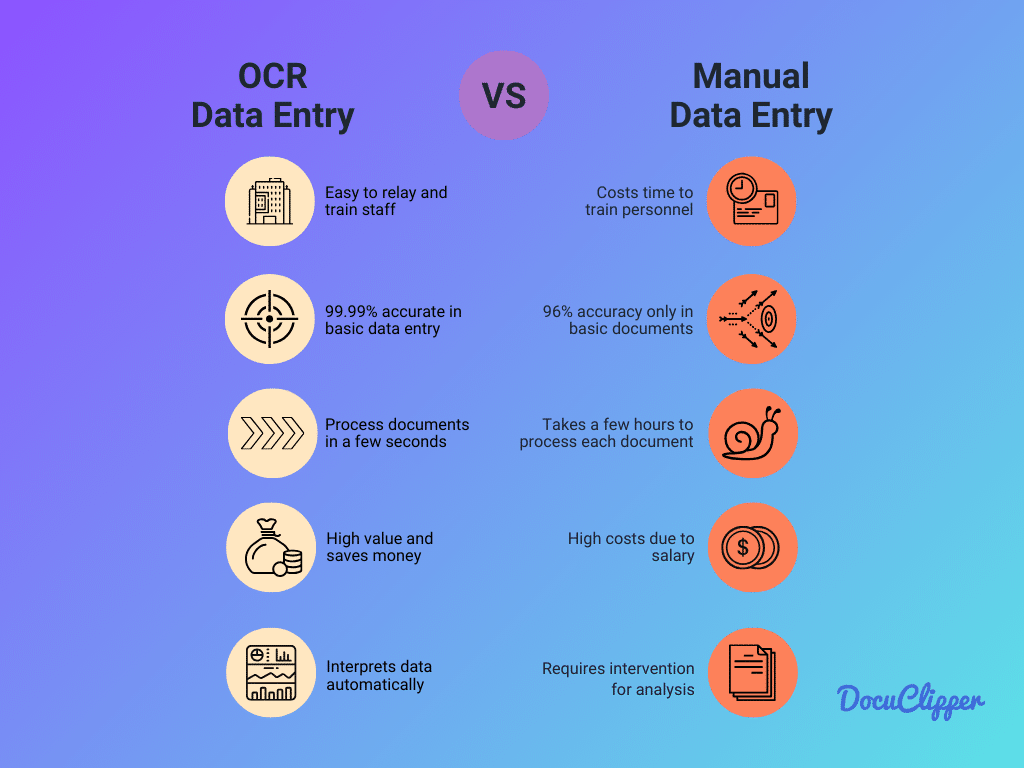

OCR Data Entry vs Manual Data Entry

Data entry is a demanding task for companies in every industry, involving employees from various levels. OCR data entry, however, offers more advantages than manual methods.

In comparing OCR bank statement conversion with manual data entry, here are the key differences:

Efficiency & Speed

- OCR Data Entry: Automates the process, drastically reducing the time needed for data input. With advanced software like DocuClipper, data from bank statements can be converted quickly and efficiently.

- Manual Data Entry: Slower due to the need for human input, with speeds averaging around 10,000 to 15,000 keystrokes per hour.

Accuracy

- OCR Data Entry: Highly accurate, with rates typically between 99.959% to 99.99%. This precision is especially critical in handling financial documents like bank statements.

- Manual Data Entry: Less accurate, with human data entry accuracy ranging from 96% to 99%. The error rate without verification can be as high as 4%.

Cost

- OCR Data Entry: This can be more cost-effective in the long run due to reduced labor costs and time savings.

- Manual Data Entry: Often incurs higher costs due to the need for extensive manpower and the potential for errors which may require correction.

Security and Compliance

- OCR Data Entry: Offers enhanced security features and compliance with data protection regulations, crucial for sensitive financial data.

- Manual Data Entry: Potentially more vulnerable to security risks and compliance issues, especially in handling confidential information.

Scalability

- OCR Data Entry: Easily scalable to handle large volumes of data without significant increases in time or cost.

- Manual Data Entry: Scaling up often means hiring more staff, which can be costly and time-consuming.

User Training & Skill Requirements

- OCR Data Entry: Requires initial training in using specific OCR software but significantly reduces the need for advanced data entry skills.

- Manual Data Entry: Demands a high level of accuracy and speed from data entry clerks, typically requiring more intensive training and skill.

Overall many professionals are using OCR data entry capabilities to automate processes. For example, accounting companies are using it for automated bookkeeping processes.

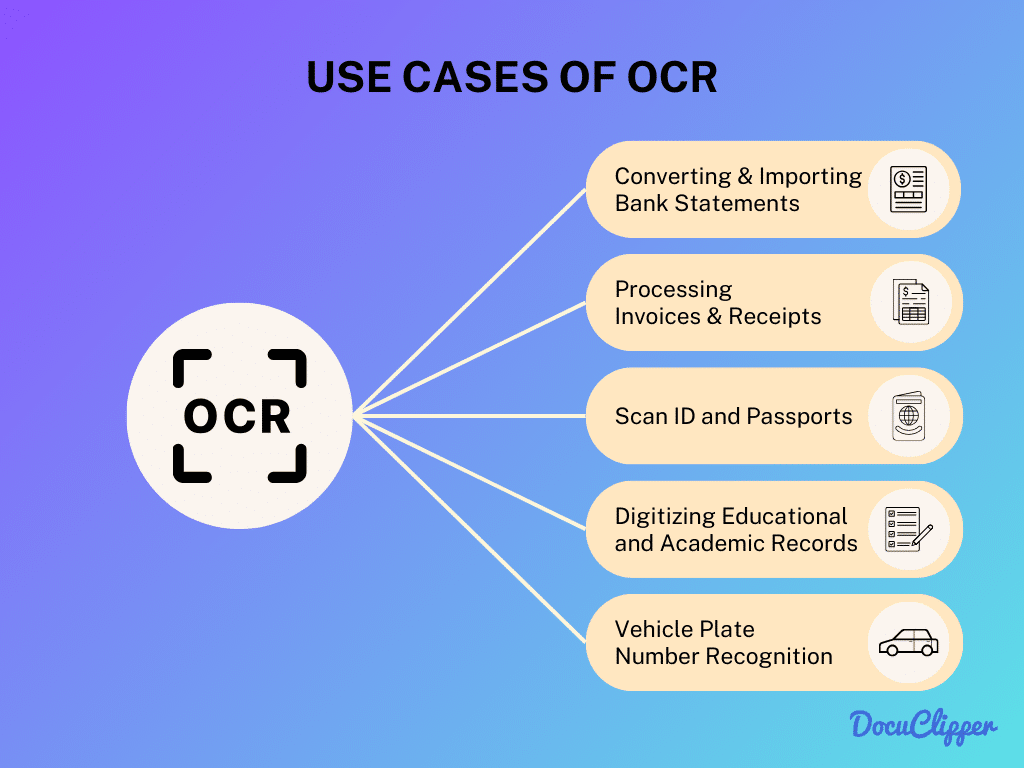

5 Examples of Using OCR Data Entry

OCR data entry has various applications across various industries, demonstrating its versatility and efficiency. Here are some examples of how OCR data capture and entry is being utilized in different fields:

Converting & Importing Bank Statements

OCR bank statement converters, such as DocuClipper, simplify the process of transferring financial information from bank statements to spreadsheets or bank feeds.

They minimize the risk of errors and misplaced data, offering flexibility in generating various formats. This opens room for automating and making faster and more accurate processing of financial data with fewer resources spent.

Processing Invoices & Receipts

Just as it processes bank statements, OCR can also automate invoice data entry. It accurately identifies detailed information, such as complex and unique bank transactions and invoice numbers. The information can be exported in organized formats, either by default or customized.

Vehicle Plate Number Recognition

State enforcement, trucking companies, overland logistic operations, and car rental and dealerships use OCR to easily identify one of their very many cars’ plate numbers.

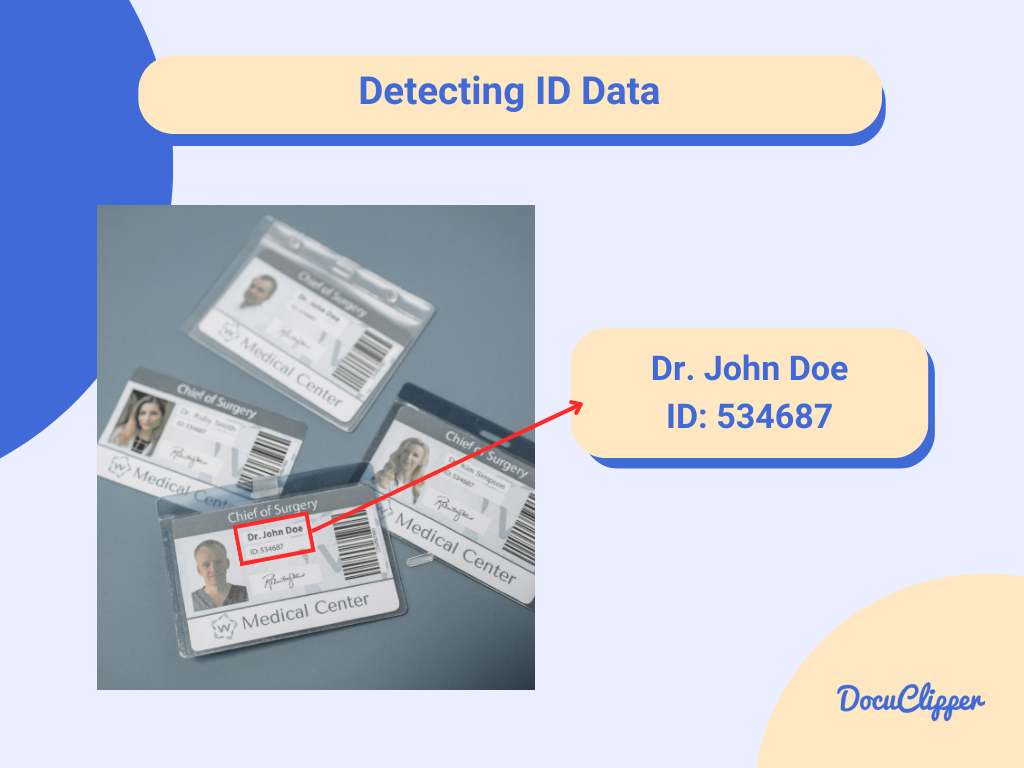

Scan ID and Passports

Government offices and border security use OCR for ID scans and passports, efficiently managing the high volume of people passing through daily.

This technology automatically records data into their database without manual typing and also helps in detecting potential fraud.

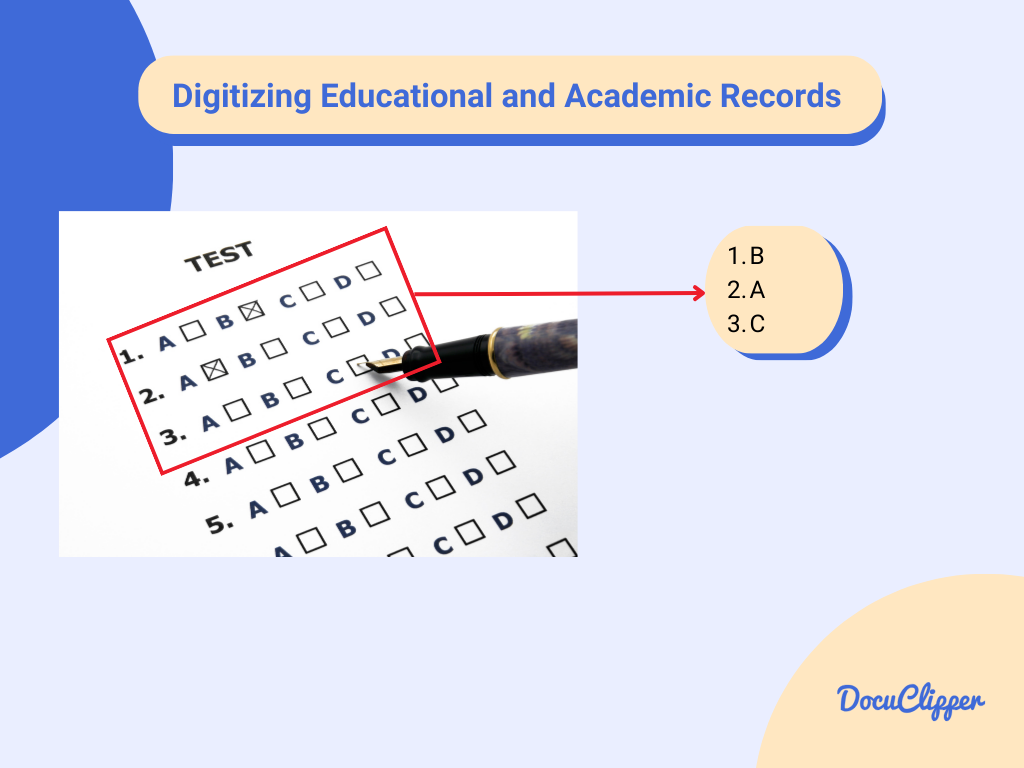

Digitizing Educational and Academic Records

Universities and educational institutions use OCR to grade and evaluate assessments, as well as to process forms and polls in large volumes. This enables schools to process grades and remarks quickly and accurately.

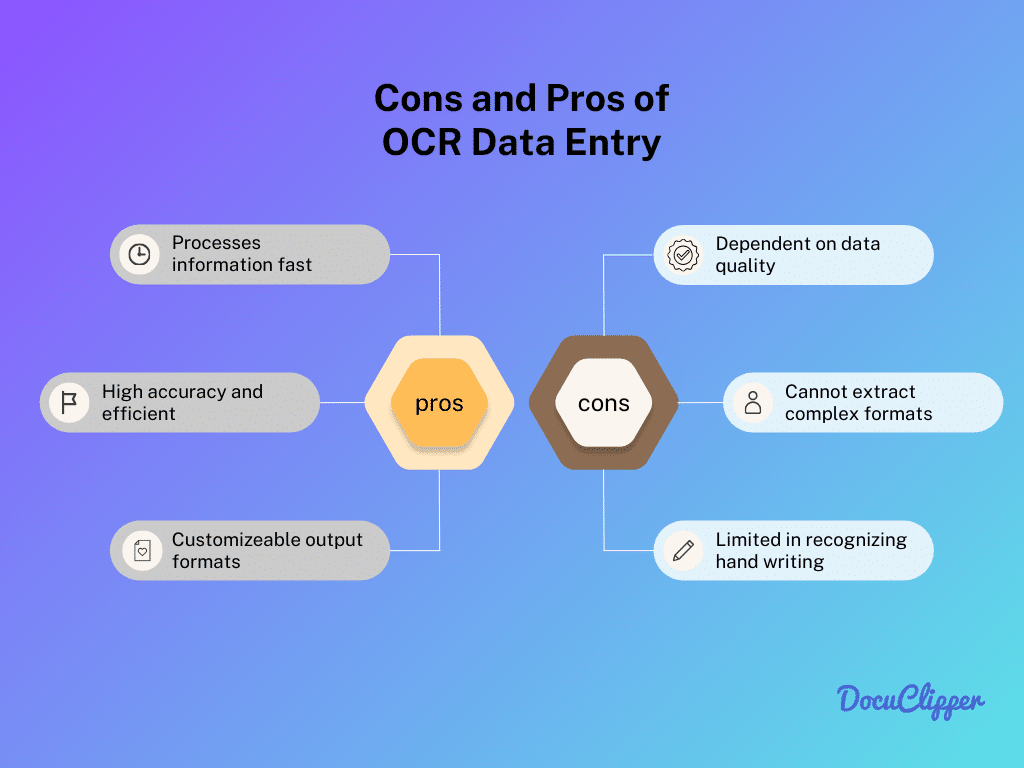

Advantages & Disadvantages of OCR Data Entry

OCR data entry has its pros and cons, and while it’s not perfect, there are solutions to its challenges.

Here are some key advantages and disadvantages of using OCR for data entry:

Advantages of OCR Data Entry

- Increased Efficiency: OCR significantly speeds up the data entry process, processing large volumes of documents quickly.

- High Accuracy: Offers high accuracy rates, especially in printed text, reducing the likelihood of errors.

- Cost-Effective: Reduces labor costs associated with manual data entry, making it a cost-effective solution in the long run.

- Enhanced Security: Provides better security for sensitive data, as it minimizes human handling.

- Easy Storage and Retrieval: Digitized data is easier to store, organize, and retrieve, improving data management. (Read more: How to organize bank statements)

- Scalability: Easily handles increased data volumes without a proportional increase in resources or expenses.

- Accessibility: Digitized data can be easily accessed from different locations, enhancing remote work capabilities.

Disadvantages of OCR Data Entry

- Initial Setup Cost: While setting up OCR systems can be costly, this is a one-time investment that pays off through increased efficiency and reduced labor costs over time.

- Quality Dependence: OCR accuracy depends on document quality. However, this can be managed by ensuring good-quality scans and using preprocessing techniques to enhance image clarity.

- Limited Text Recognition: OCR may struggle with handwriting and stylized fonts. To mitigate this, it’s used primarily for printed text, and continuous improvements in technology are expanding its capabilities.

- Setup Complexity for Specific Needs: Customizing OCR for particular document types requires effort, but once configured, it streamlines the data entry process significantly for those document types.

- Technical Maintenance: While technical issues and updates are a concern, regular maintenance and choosing reliable OCR software can minimize these challenges, ensuring smooth operation.

Best OCR Data Entry Software

There are various OCR technologies available, each excelling in its own specialization for data entry. Here are some notable ones, along with their specific niches:

DocuClipper

Primarily focused on financial documentation, DocuClipper excels in converting PDF bank statements to user-friendly formats like Excel, CSV, and QBO. This cloud-based OCR software is a game-changer for automating data extraction, especially from bank, credit card, and brokerage statements.

Here are the key features:

- Automates and simplifies the conversion of financial statements.

- Detects and manages data from multiple accounts in a single statement.

- Streamlines transaction data for easy analysis and reporting.

- Provides versatile output options, catering to various user needs.

- Easily linked with its data entry capabilities to accounting software.

- OCR data visualization enables users to perform financial analysis from the extracted or imported data.

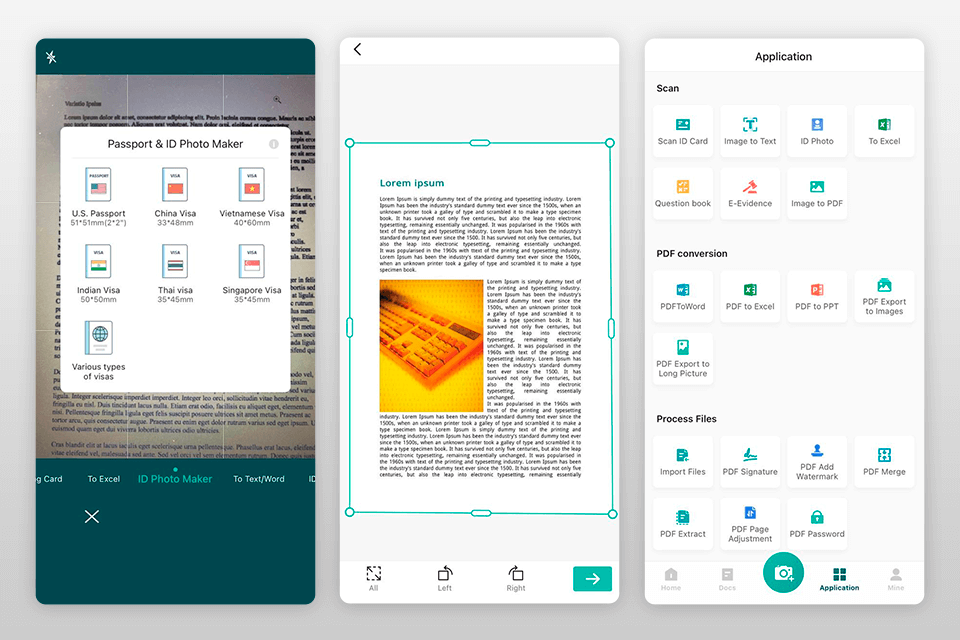

CamScanner

CamScanner turns any smartphone into a versatile document scanner, ideal for quick digitization of physical documents.

Here are the key features:

- Scans documents to create JPEG or PDF files.

- Features automatic cropping and straightening of images.

- Removes background noise for clearer scans.

- Enables document editing, watermarking, and signature additions.

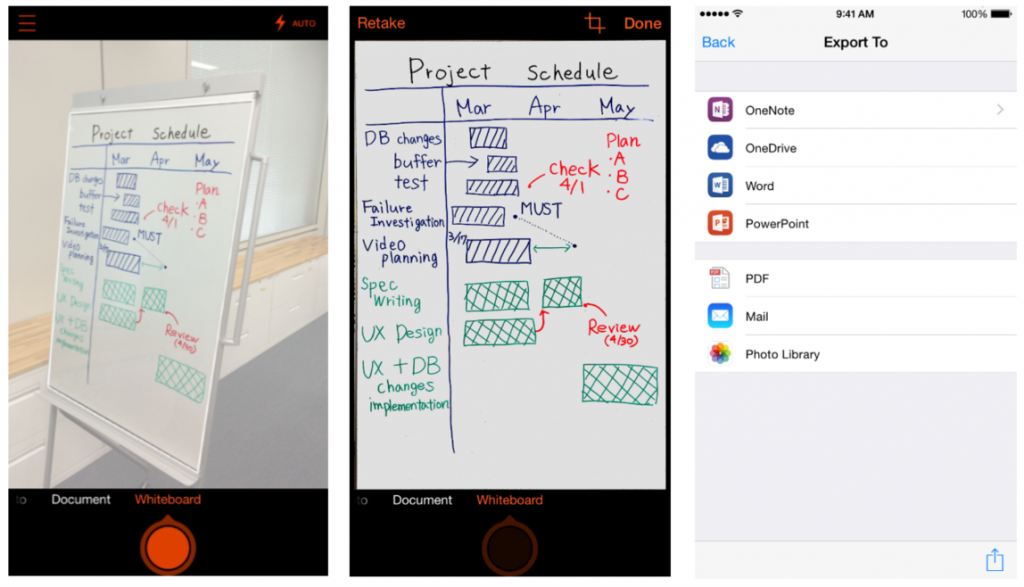

Microsoft Lens

Microsoft Lens serves as a multifunctional tool for capturing information from documents and images, integrated seamlessly with Microsoft’s ecosystem.

Here are the key features:

- Captures text from a variety of sources, including documents and whiteboards.

- Removes shadows and corrects angles for clear image capture.

- Allows uploading to Microsoft applications like OneNote, Word, PowerPoint, and OneDrive.

- Saves captures in PDF format and supports email sharing.

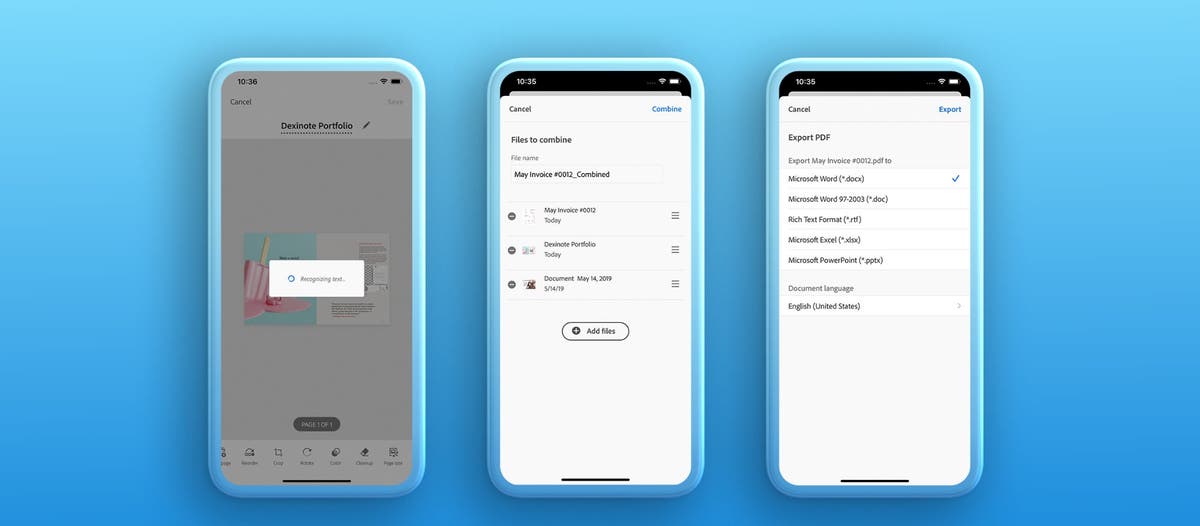

Adobe Scan

Adobe Scan offers a comprehensive scanning solution with OCR capabilities, suitable for a wide array of document types.

Here are the key features:

- Automatically recognizes text in scans for conversion to PDF and JPEG.

- Scans a variety of materials, including receipts, notes, and whiteboards.

- Provides tools for file editing, protection, and format conversion.

Nanonets

Nanonets, a cutting-edge machine learning platform, enables the creation of custom deep learning models without the need for coding, suitable for diverse OCR tasks.

Here are the key features:

- Specializes in OCR extracting data from various document types, including IDs and invoices.

- Transforms complex data like electrical meter readings and food menus into structured formats.

- Supports a wide range of document types, enhancing versatility in data extraction.

Conclusion

OCR data entry represents a significant advancement in digital data management, offering businesses a fast, accurate, and efficient way to process information. This technology streamlines workflows and reduces manual labor, making it a vital tool for modern businesses aiming to optimize their operations.

As OCR continues to evolve, its impact on the future of data handling and management is immense, marking a new era in efficient and effective information processing.

Try DocuClipper for OCR Data Entry

Looking to transform your manual data entry process? Give DocuClipper a go. Its advanced OCR capabilities make it a breeze to convert bank statements and financial documents into manageable formats like Excel, CSV, and QBO.

With DocuClipper, you’ll experience a significant reduction in manual labor, increased accuracy, and a more efficient workflow.

Ideal for accountants, financial analysts, and businesses of all sizes, DocuClipper is your go-to solution for seamless financial data management. Start your journey towards streamlined data entry today

FAQs about OCR Data Entry

In this section we’re going to answer commonly asked questions regarding to OCR data entry:

What is OCR Data Entry?

OCR data entry is the process of using Optical Character Recognition technology to convert different types of documents, such as bank statements and invoices, into digital, editable formats.

How Accurate is OCR Data Entry?

OCR data entry is highly accurate, with top OCR software like DocuClipper offering an accuracy rate of up to 99.5%, significantly reducing errors compared to manual data entry.

What Are the Advantages of Using OCR for Data Entry?

Advantages include increased efficiency, high accuracy, cost-effectiveness, enhanced security, and easy scalability, especially when using advanced OCR