Family law and financial matters are closely linked. Handling financial documents like bank statements, credit card records, invoices, and investments can be overwhelming due to the need for detailed data entry.

This is where Optical Character Recognition (OCR) for family law comes into play.

In this blog, we’ll look at how OCR simplifies dealing with financial cases in family law. By converting scanned documents into editable text, OCR reduces time spent on data entry and improves accuracy.

It changes a lot for legal professionals, analyzing financial information much more manageable, accurate, and faster.

Improve your financial and bookkeeping process with AI: Download this eBook today

Benefit 1: Reduce Data Entry Errors

Research shows that people make mistakes in 5% of their data entries even with simple spreadsheets. When spreadsheets get more complicated, mistakes happen almost all the time.

These mistakes can cause big problems, like losing money and trust, especially in legal situations and family law. Fortunately, OCR technology can help avoid these errors. OCR accuracy typically is at 98% to 99%, significantly higher than manual data entry.

OCR extracts data automatically, reducing the chance of mistakes. This means financial documents are handled more accurately, keeping information safe and trustworthy.

Benefit 2: Improve Accuracy of Data

Manual data entry in finance often leads to mistakes, with errors happening 18% to 40% of the time. These mistakes are a big deal, especially for businesses. In court or when giving advice, using wrong data can lead to bad decisions, which is risky in family law matters.

A single error can change the outcome of a case or advice. It shows how important it is to be accurate with financial information.

OCR can improve accuracy and possibly limit risks that can have serious consequences in giving legal advice and counsel

Benefit 3: Faster Data Processing & Decision Making

Manual data entry is notoriously slow, often taking 3 to 20 minutes per document. This slow pace is problematic, especially in legal settings where deadlines and client schedules are tight.

Not only that, it can also get costly when hiring a data entry clerk or letting lawyers do their own data entry.

OCR technology speeds up this process significantly. Unlike manual entry, OCR can process numerous documents, including financial records, in just a few seconds.

This efficiency not only saves time but also reduces the stress of meeting crucial deadlines in legal proceedings.

Benefit 4: Streamline Automate Inefficient Manual Data Entry

Using technology to automate work in family law makes things much faster.

For example, with OCR technology, tasks that used to take a lot of time, like entering data from bank statements into a computer, can now be done quickly and automatically.

Clients can upload financial documents and fill out forms, and OCR data entry systems will put the information right into their case management tools.

This means a lot less manual data entry, making it easier to handle more cases faster. Switching to OCR helps family law offices work more efficiently, allowing them to make faster and more accurate decisions for their clients.

Benefit 5: Standardized Workflows

In family law, making processes automatic helps everything run smoother and more consistently.

Getting rid of the need to enter data by hand means fewer mistakes and more accurate information. This isn’t just good for avoiding errors; it also means a law firm can help more clients effectively.

Standardizing workflows allows businesses to scale faster, manage higher workloads without additional pressure on employees, and generally improve the outcomes of those processes.

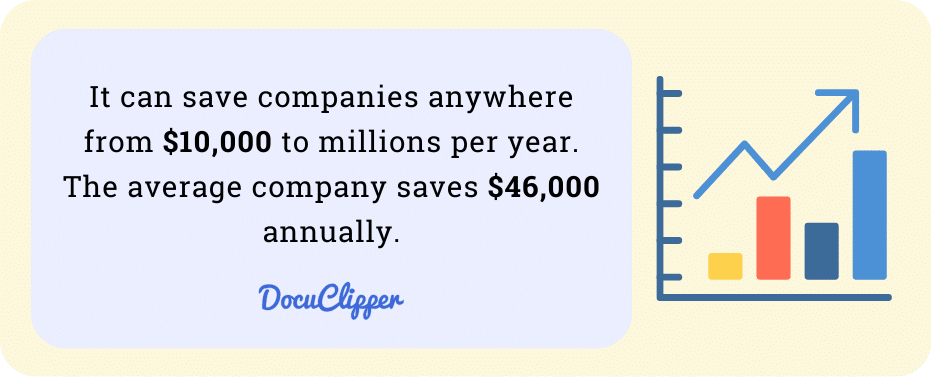

It can save companies anywhere from $10,000 to millions per year. The average company saves $46,000 annually. (Source)

McKinsey estimates that 60% of employees could save 30% of their time with workflow automation.

Switching to OCR systems is a great improvement for family law practices. It helps them work faster and makes them more attractive to clients. OCR makes the handling of financial documents much simpler and more consistent, which is crucial for growing a law firm.

For example, OCR technology, like the one offered by DocuClipper, can take bank statements in different formats and convert them into a uniform style. This makes it much easier for lawyers to review the same kind of information quickly for each case.

By standardizing how they handle documents, family law practices can work more efficiently and reduce mistakes, helping them serve their clients better.

Benefit 6: Improve Financial Analysis

Financial analysis in family law can be complicated, but OCR software makes it a lot easier by providing very accurate data. This accuracy is crucial for family lawyers to handle their cases effectively.

OCR software like DocuClipper also includes extra features. It can organize transactions, check how money flows in and out, and match financial records automatically. This means less time spent on repetitive tasks like entering data, so lawyers can focus more on making important decisions.

Furthermore, this software allows lawyers to either scan financial documents directly or upload data from spreadsheets. This helps them analyze finances better, understanding things like cash flow and expenses quickly, making their work more efficient and reliable.

Benefit 7: Enhance Customer Satisfaction

Clients value quick and effective service, something that OCR brings to the table in family law. Speeding up tasks that used to take hours to just a few minutes and getting more accurate data helps family law businesses deliver more accurate financial investigations.

OCR technology is a game-changer. This rapid processing not only simplifies your work but also enhances client satisfaction, making them more inclined to return for future legal needs.

Efficiency is key to maintaining a positive client experience. With fast and precise work thanks to OCR, both the legal team and the clients come out ahead.

Benefit 8: Reduce Employee Burden & Improve Satisfaction

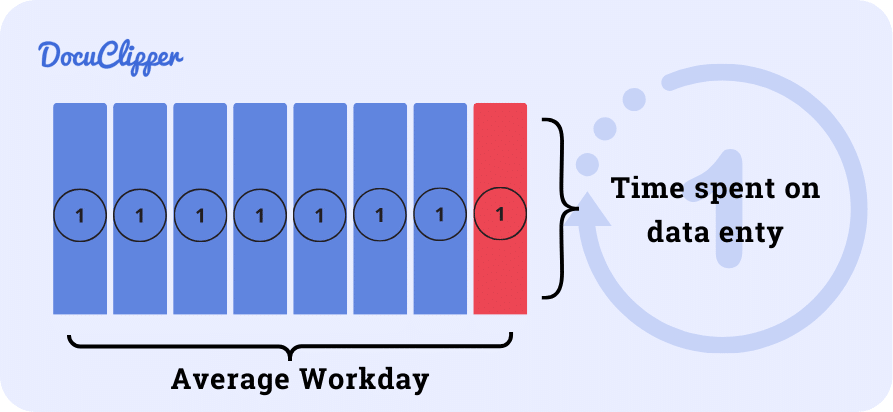

In family law offices, a lot of time, about 10% of the day, is spent on boring tasks like typing data into computers. This isn’t just dull, it can make employees unhappy and lower the quality of their work.

When employees are overwhelmed with too much manual data entry, they can feel stressed, especially as the company grows and their workloads get bigger. This stress can distract them from more important tasks like analyzing data and preparing for cases.

By reducing these repetitive tasks, we can make employees happier and less stressed. Happier employees are more focused and do better work, which means clients are also happier and more satisfied.

Benefit 9: Cost Savings

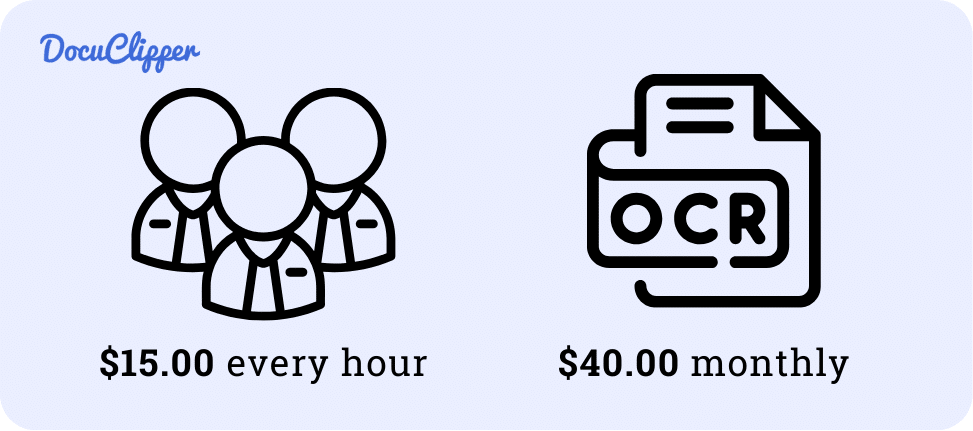

Hiring someone to enter data costs $15 an hour, but using an OCR only costs about $40 a month. This program can quickly change financial papers into a format that’s easy to use in other legal software.

It’s not just about saving money on wages; it’s also about the program working all the time without breaks, anytime you need it, making things run faster and as already mentioned, more accurate.

By choosing OCR, family law practices save money and time, making their work more efficient and less expensive. Switching to this program helps manage finances better and makes everything more straightforward.

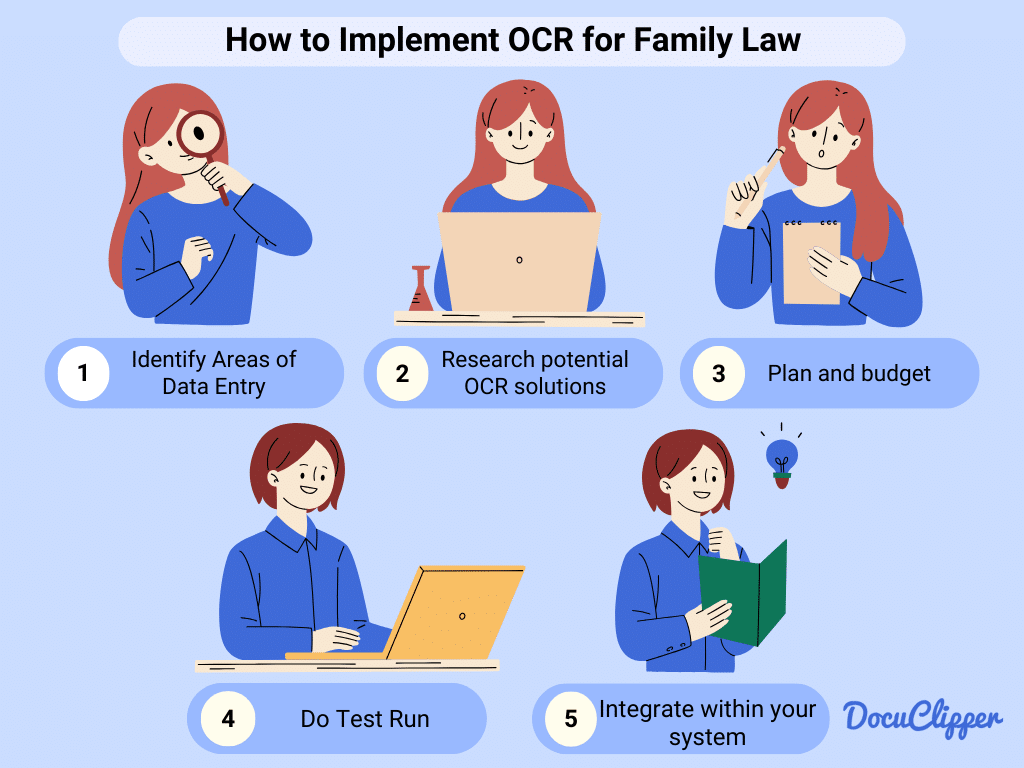

How to Implement OCR for Family Law

If you have decided to use OCR for your family law practice, here are some steps that you can take:

Step 1: Identify Key Areas of Manual Data Entry from Documents

Consider where you’re currently doing a lot of manual data entry in your practice. OCR technology can assist in various tasks, such as converting financial documents into editable formats, organizing information, and verifying details.

Integrating OCR makes these processes faster and more accurate, reducing manual labor, saving time, and minimizing errors.

Step 2: Research Potential OCR Solutions

There’s a wide array of OCR tools available, each with its strengths. While some are versatile, others are specialized for tasks like analyzing financial documents.

A tool that can accurately read and process bank statements, for example, would be important in family law for assessing financial stability quickly and efficiently.

Step 3: Plan & Budget

Determine your budget for an OCR tool, considering the different features and prices on the market.

While some OCR solutions are affordable, others with advanced functionalities may cost more.

Decide what features are essential for your practice and which ones you can do without if the cost exceeds your budget. Aim for a solution that meets your needs at a reasonable price.

Step 4: Do a Test Run

Test the OCR software within your practice to see how it performs with your specific needs. Monitor how well it integrates with your existing processes and note any OCR limitations.

If issues arise, consider tweaking the software’s settings, switching to a different plan, or exploring other solutions. This testing phase is crucial for understanding how OCR can best support your work.

Step 5: Integrate Within Your System/Workflow

Once you find the OCR solution that suits your practice and budget, fully integrate it into your workflow.

Train your team on how to use the software effectively and encourage them to provide feedback. Their insights can help refine the integration process and ensure the technology is adding value to your work.

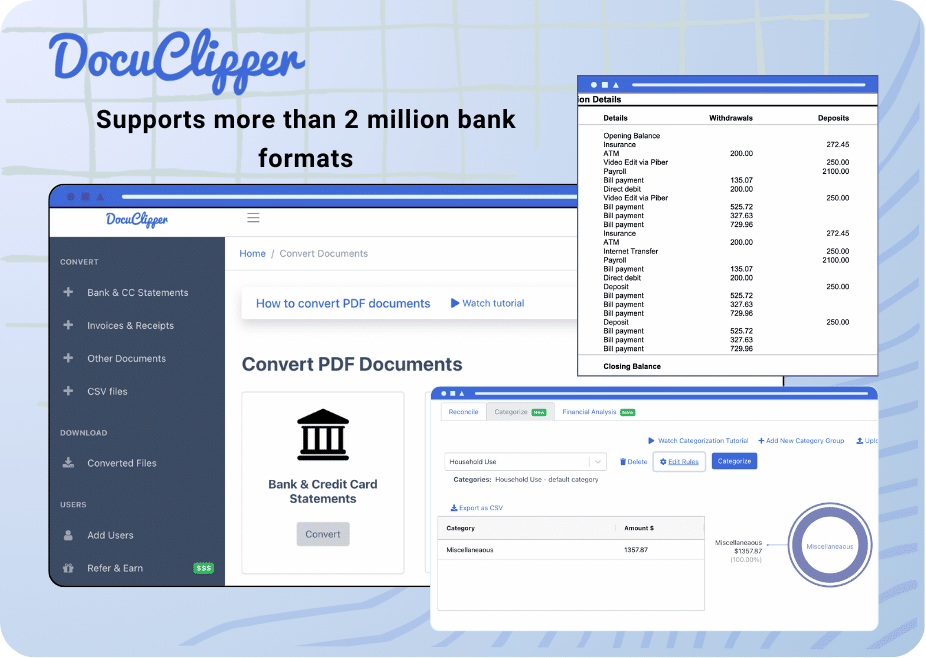

How DocuClipper Can Help Your Underwriting Business

DocuClipper can make work a lot easier for family law practices by quickly and accurately handling financial documents. It uses special technology designed just for financial information, with a very high accuracy rate of 99.5%. This means it can correctly read and understand over 2 million different types of bank statements.

It’s fast, taking about 20 seconds to process each document. This helps lawyers get to important case information quickly. DocuClipper not only turns PDFs into easier formats like Excel but also helps sort out and make sense of money flows and transactions.

The cost of using DocuClipper is reasonable, making it a good choice for any size of law practice. It helps save time and money by making financial document handling more straightforward, which in turn, allows lawyers to serve their clients better and faster.

Conclusion

In conclusion, OCR technology is transforming the way family law practices handle financial documents, from bank statements to investment records.

By automating data entry, OCR allows legal professionals to focus more on analysis, strategy, and client service, enhancing both efficiency and client satisfaction.

Implementing OCR is straightforward and can significantly benefit practices of any size, making it a smart investment for those looking to improve their handling of financial matters in family law.