Forensic accounting is like detective work for money matters. It’s used when businesses suspect something’s wrong with their finances.

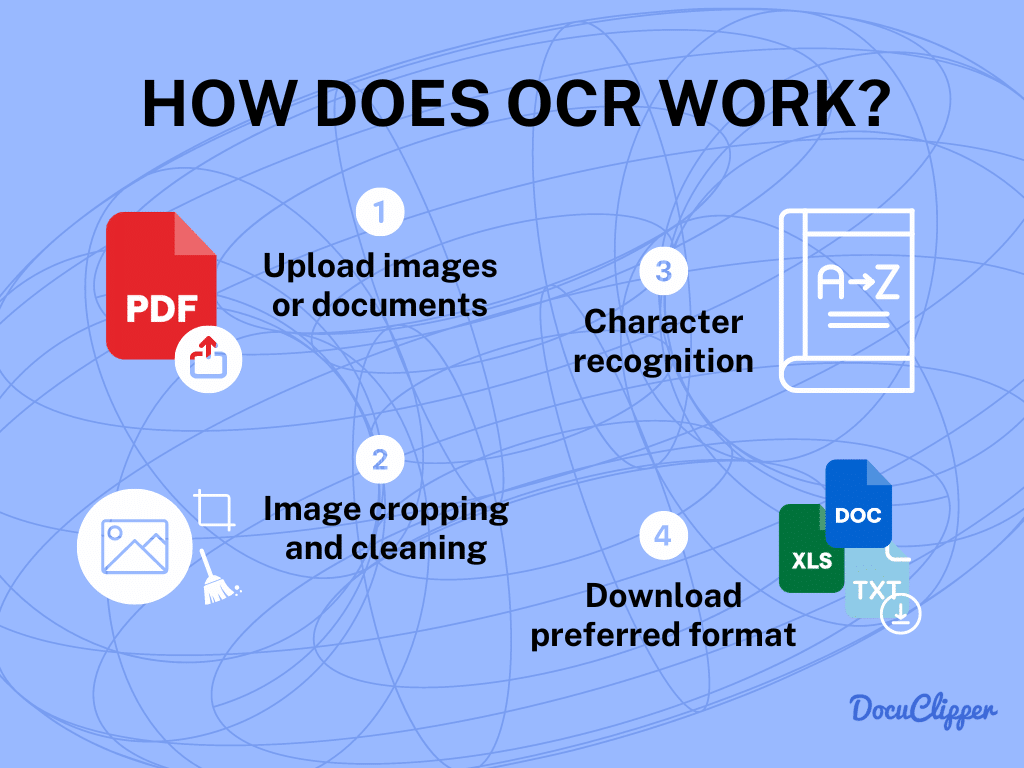

These accountants look closely at all sorts of money records, such as bank statements and sales reports, thus involving a lot of manual data entry. Optical Character Recognition, or OCR, is a tool that helps in this process.

In this blog, we’ll discuss how to use OCR for forensic accounting. OCR technology scans paper documents and turns them into digital files that a computer can read.

This means accountants can find and analyze important information much faster. It’s a big help in sorting through lots of data quickly and accurately, making the task of uncovering financial issues less of a headache.

Make accounting much faster and more accurate with AI: Download this eBook today to learn more

Benefit 1: Reduce Data Entry Errors

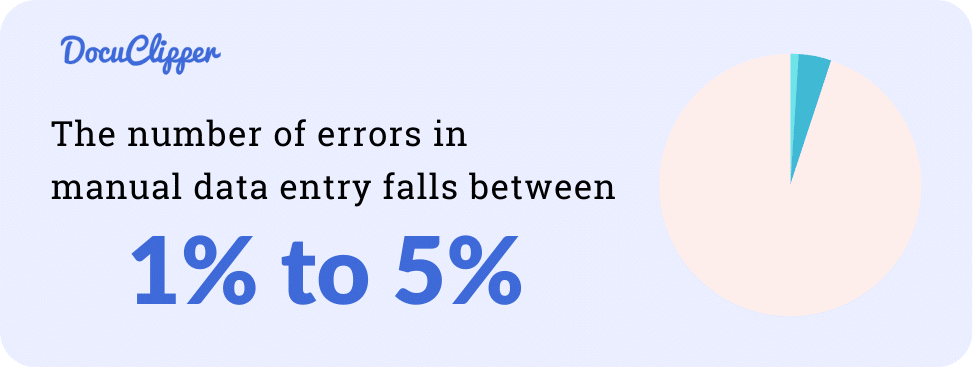

Manual typing of data is prone to human error. Research indicates that error rates in manual data entry range from 1% to 5%, influenced by the data’s complexity and the operator’s experience.

OCR technology dramatically improves this situation with an accuracy rate of around 96%. This high level of precision is invaluable for forensic accountants, who need to piece together financial information accurately.

Reliable data speeds up their investigations, helping them solve financial puzzles more effectively. Essentially, OCR reduces mistakes and ensures the information used in financial investigations is dependable, making the accountants’ work more straightforward and accurate.

Benefit 2: Improve the Accuracy of Data

When data is entered manually, errors are common due to human factors and the process used.

However, OCR technology is a game-changer, achieving 99% accuracy in tasks such as converting and analyzing bank statements, invoices, receipts, and other documents.

For example, DocuClipper bank statement OCR averaging 99.6% OCR accuracy across different bank statements, helping forensic accountants to get accurate data from bank statements fast and effortlessly.

This high OCR accuracy is crucial for tasks like forensic accounting, where every piece of data is important. It significantly reduces the likelihood of errors, ensuring that the financial information used for investigations is dependable.

This makes the investigative process faster and more efficient, enabling forensic accountants to reach accurate conclusions more quickly.

Benefit 3: Faster Data Processing & Decision Making

Hand-entering data or shifting files between programs can be slow, especially in forensic accounting where delays frustrate clients or even can negatively impact the case.

OCR technology is vital here. It allows for rapid processing, with the ability to handle 100 documents in mere seconds.

This swift processing aids forensic accountants in completing their analyses quicker, leading to faster decision-making in investigations.

By incorporating OCR, the workflow becomes more efficient, ensuring clients receive timely and precise outcomes, streamlining the investigation process significantly.

Benefit 4: Streamline Automate Inefficient Manual Data Entry

Doing things by hand often means you have to double-check your work a lot, which can make things slow, especially if you need to fix something based on feedback. But with OCR, forensic accountants can start looking into the details as soon as the data is turned into a digital format.

When you are running the operation with data entry clerks, hiring and training processes can take longer when getting new people on the job. It takes months for them to be adequate enough to have minimal mistakes in the data entry process.

OCR cuts down on the need to keep checking everything over and over. This way, as soon as the data is ready, investigators can get straight to their main job without being slowed down by lots of checks when dealing with massive and complex cases.

Benefit 5: Standardized Workflows

Forensic accountants work with lots of financial documents like bank and credit statements, and each client’s documents are a bit different. This can make things confusing in terms of the workflow. But with OCR that helps make everything more consistent.

For example, DocuClipper bank statement converter can read and process thousands of different kinds of bank statements. This makes the job of entering data much simpler and less error-prone since the workflow is standardized.

With OCR, forensic accountants can easily handle different documents in the same way, making their work faster and more accurate. This technology helps them avoid mistakes and confusion, no matter the variety of documents they’re dealing with.

Benefit 6: Improve Financial Analysis

Analyzing financial documents is a big part of what forensic accountants do, but it can take a lot of time and effort.

OCR tools can automatically match transactions, sort them into categories, analyze the flow of funds, highlight potential fraudulent transactions, and analyze cash flow. This is a big help for forensic accountants because it takes care of the basic steps for them.

With these tools, they can spend less time on simple tasks and more time on the more detailed parts of their work. This makes their job quicker and more accurate, helping them get to the bottom of financial puzzles faster.

Benefit 7: Enhance Customer Satisfaction

Customers like their services quickly and of good quality. OCR helps make things faster and gives better information.

This technology takes away a lot of the boring typing work, making employees happier. It’s because they can provide better spend more time with customers, deliver better quality services, and spend time on more important value-adding tasks in general than spending time on manual data entry.

Using OCR technology helps forensic accountants do their work faster and more accurately, which makes their clients happy.

It also makes the office a better place to work because there’s less stress from having to type in lots of data by hand.

Benefit 8: Reduce Employee Burden & Improve Satisfaction

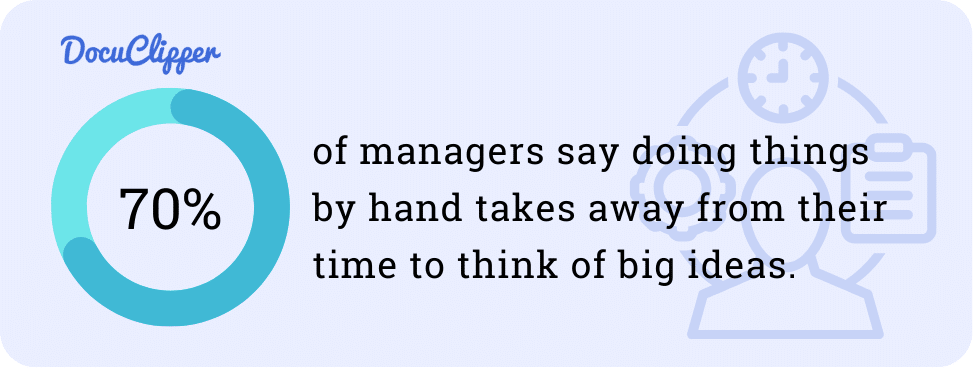

Manual data entry means doing the same thing over and over, which can be very tiring. A study from 2016 by ServiceNow found that 70% of managers say doing things by hand takes away from their time to think of big ideas.

Simply said, humans are not meant for repetitive and boring tasks, but computers do! They excel at it and their productivity does not drop nor the quality of the data.

While data entry clerks are only at peak performance for the first hour or two and each passing hour they get slower, and more tired, increasing the risk of errors.

OCR helps by doing the repetitive work automatically, making things much easier. It’s perfect for a document data extraction, so people have more time for important tasks.

This means less boring work and more time to plan and be creative. With OCR, work gets done faster, and everyone has a chance to focus on more interesting and important jobs.

Benefit 9: Cost Savings

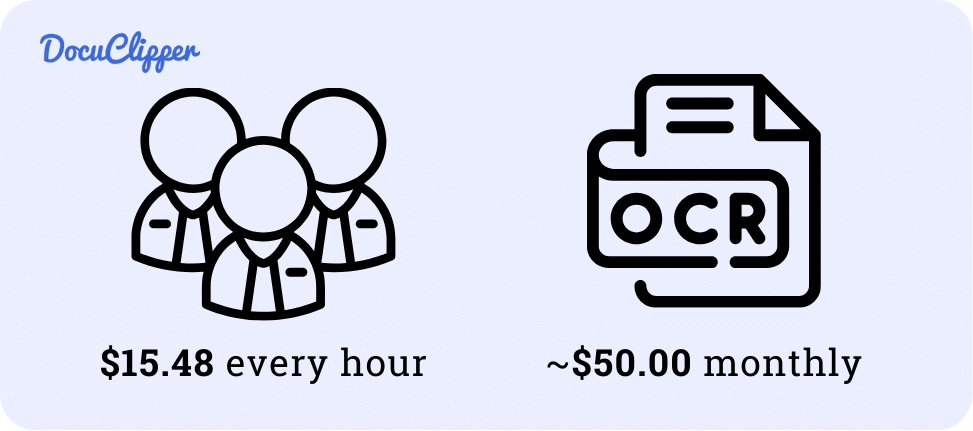

OCR helps save money in forensic accounting by cutting down on the need for many people to type data into computers.

Normally, paying someone to enter data costs about $15.48 every hour. However, using OCR software costs only below $50 of monthly use.

Plus, this software can do more than just read text from documents; it also has tools to help with basic financial checks.

This means forensic accountants can work faster and more efficiently without spending a lot on hiring extra help.

By using OCR, forensic accounting firms can lower their costs and put their money into other important areas of their work, making it a smart choice for managing their operations and investigations.

Benefit 10: Make Data Verification Easier

In forensic investigations, it’s really important to make sure all the information is correct. Checking everything by hand takes a lot of time and that’s where OCR comes in handy.

It helps by quickly pointing out any mistakes or things that don’t match up, which makes the whole investigation process faster and smoother.

This means investigators can find errors quickly, making their work more reliable and helping them make decisions faster.

By using OCR, the focus shifts from the slow task of typing in data to more important things like figuring out what the data means and solving cases.

Essentially, OCR helps make sure the information used in investigations is right, cutting down on mistakes and making the investigation process more efficient.

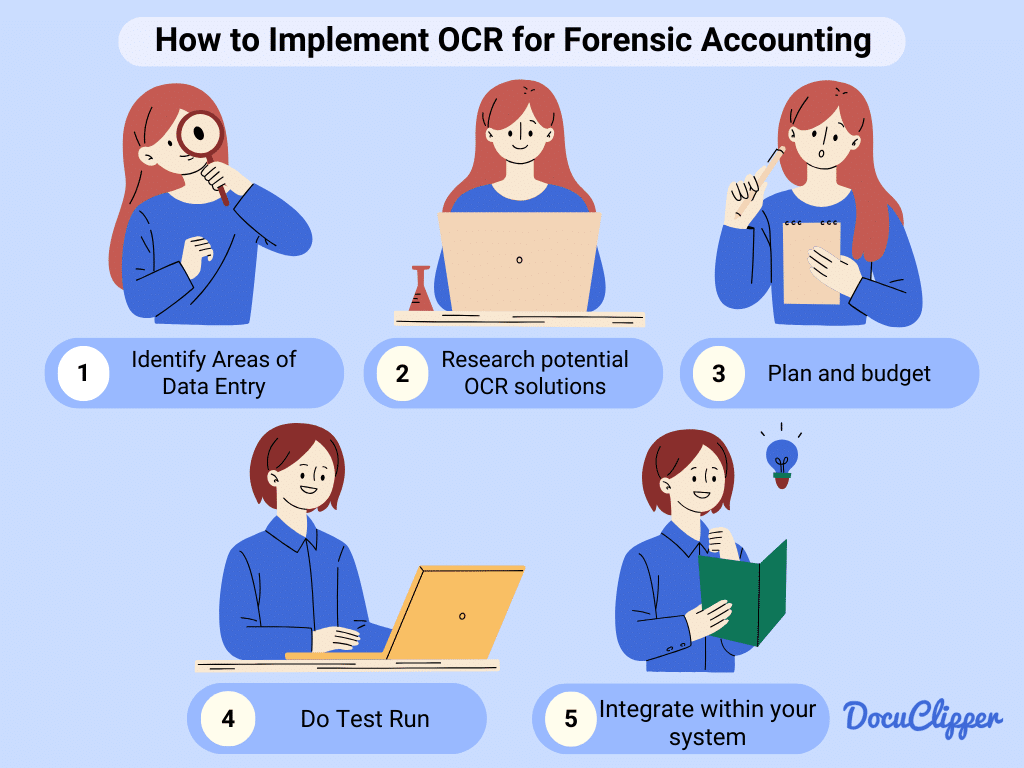

How to Implement OCR for Forensic Accounting

Once you recognize the advantages OCR data entry technology offers for your forensic accounting or investigation firm, you can begin incorporating it into your investigative processes.

Step 1: Identify Key Areas of Manual Data Entry from Documents

Consider which parts of your investigation process could benefit from automation. OCR can assist with tasks such as converting financial documents into editable formats, organizing information, and verifying details.

Implementing OCR streamlines these tasks, reducing manual effort, saving time, and decreasing errors. Integrating OCR into your processes enhances accuracy and efficiency, helping you meet the demands of fast-paced investigations.

Step 2: Research Potential OCR Solutions

Various OCR tools are available, each with its own set of capabilities. Some are designed for general use, while others cater to specific needs, such as analyzing financial statements.

For forensic investigations, an OCR tool that can accurately process financial documents is invaluable. It quickly transforms these documents into analyzable data, enabling you to assess financial transactions and patterns effectively.

This facilitates a faster and more accurate analysis, crucial for making informed decisions during investigations.

Step 3: Plan & Budget

Selecting the right OCR tool involves balancing cost and functionality. Compare different OCR solutions to understand what each offers for its price.

Sometimes, investing a little more can provide additional features that are beneficial for forensic analysis.

The goal is to find a cost-effective solution that meets your investigative needs without breaking the bank. Making a thoughtful choice here can enhance your operational efficiency while also being cost-effective.

Step 4: Do Test Run

Test the OCR software with your actual investigative tasks to see its impact. Observe how well it integrates with your forensic processes and note any OCR limitations.

Address any issues by tweaking the OCR settings, customizing its application, or possibly changing your plan.

This trial period is crucial for understanding how OCR can best serve your investigations, making your work more manageable. Keep an eye on both successes and challenges to ensure you’re maximizing the technology’s benefits.

Step 5: Integrate Within Your System/Workflow

Once you’re satisfied with the OCR tool’s performance and cost-effectiveness, fully integrate it into your daily operations.

Train your team on how to use the software and encourage them to provide feedback on its functionality and any difficulties they face. Continuous improvement is key to using OCR technology effectively.

By listening to your team’s feedback and making necessary adjustments, you can ensure that OCR technology not only speeds up your investigations but also supports your team’s needs.

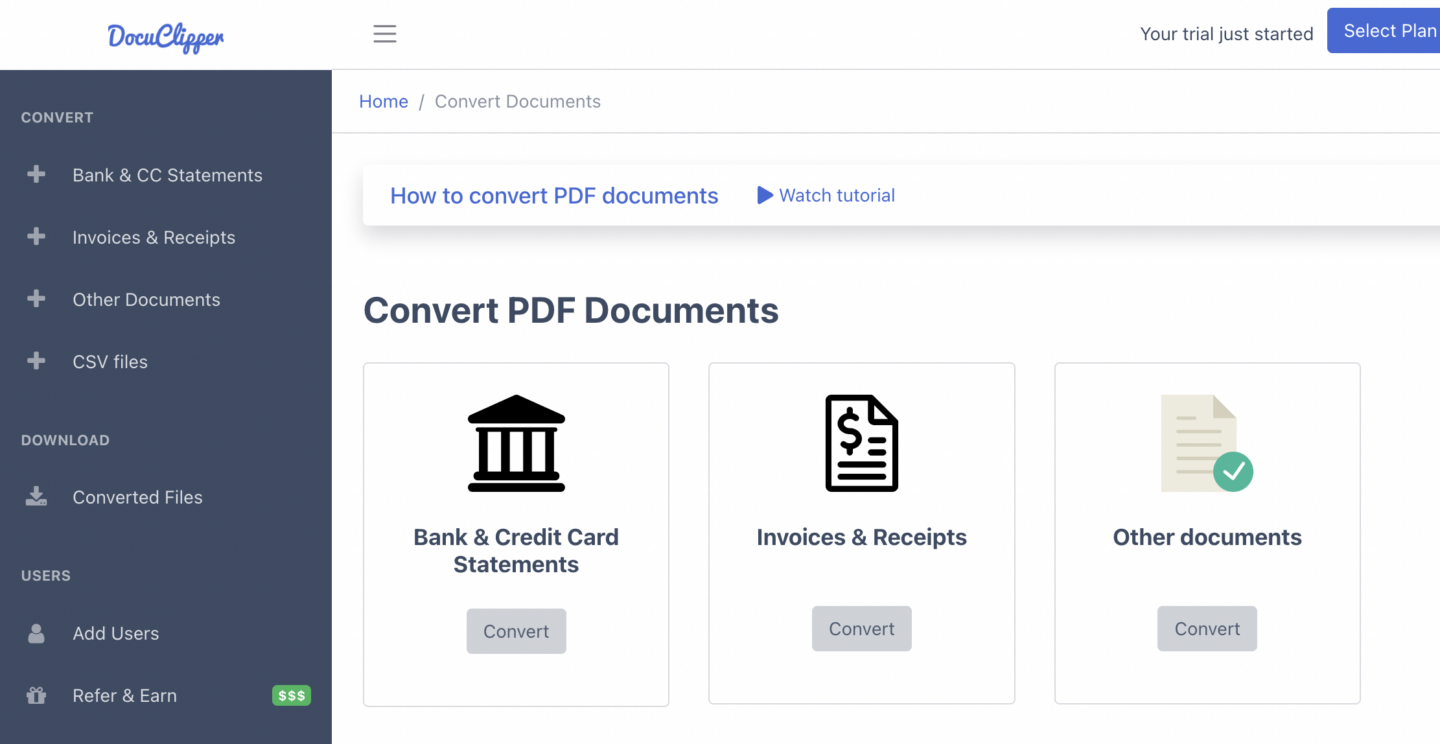

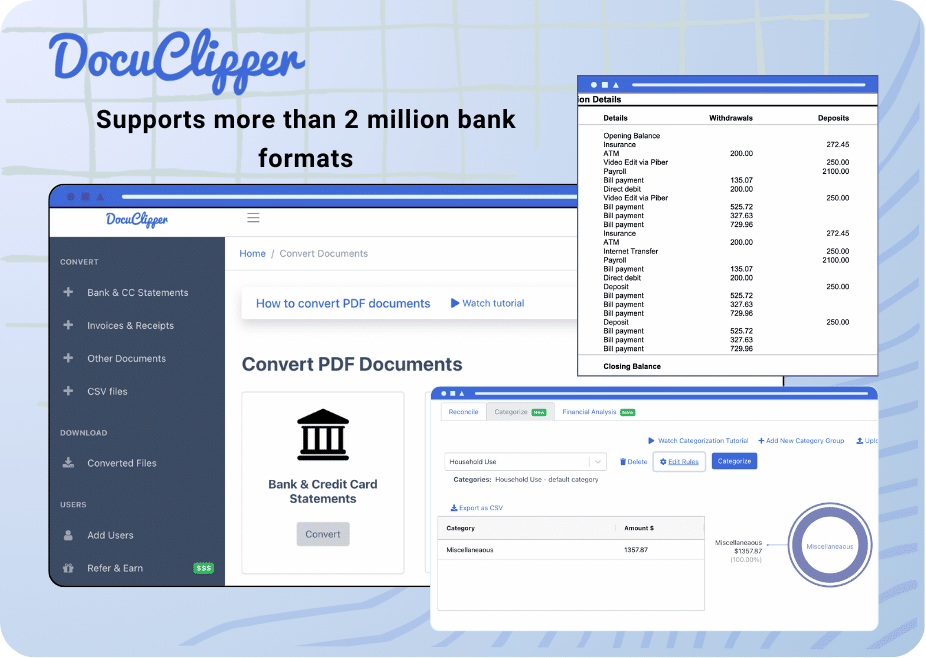

How DocuClipper Can Help Your Forensic Accounting Business

DocuClipper can revolutionize forensic investigations by making the processing of financial documents quicker and more precise.

With its advanced OCR algorithm, it achieves a 99.6% accuracy rate, ensuring dependable OCR data extraction.

Tailored for financial documents, DocuClipper supports more than 2 million bank formats, reducing document conversion time to about 20 seconds each, which facilitates swift analysis.

This tool doesn’t just change PDFs into easy-to-use formats like Excel and CSV; it also provides in-depth insights through features that analyze cash flow, flow of funds, allowing customers to tag transactions based on a set of rules, and even categorize transactions.

With affordable pricing, DocuClipper is suitable for forensic teams of any size, enhancing your operations without overextending your budget.

By improving how data is managed, DocuClipper boosts your team’s productivity, delivering faster and more accurate results in forensic investigations, ultimately serving your clients better.

Conclusion

OCR technology is a big help in the field of forensic accounting, making the job of looking into financial records much quicker and more accurate.

It takes over the boring task of typing in data, which not only speeds things up but also reduces mistakes. This means forensic accountants can spend more time-solving financial mysteries and less time on paperwork.

Plus, OCR is affordable and easy to add to the tools they already use, helping them do their work better without spending a lot of money. In short, OCR helps accountants find and analyze important information faster, leading to happier clients and more effective investigations.

Related Articles:

- OCR vs AI: 7 Differences, Pros, Cons, & Which to Choose

- What is OCR Data Capture and Why Is It Important

- How to Convert PDF to QBO Format Easily & Automatically

- Guide to OCR for Underwriting

- What is OCR Data Visualization? Why Is It Important & Examples

- How to Read a Brokerage Statement

- How Long to Keep a Brokerage Statement