Underwriting is an important part of financial processes, especially when risks are involved.

According to famous businessperson Millard Drexler, “You can’t run a business without taking risks.” As a business owner who covers insurance or lends money, a decent quality underwriting process is a must.

Access to fintech and data extraction has become easier and many tools are readily available, and Optical Character Recognition (OCR) is one of them. OCR bypasses the typical manual data entry process that can often disrupt underwriting.

In this blog, we’ll talk about how to use OCR for underwriting and how to set it up for your lending or insurance business.

Explore using AI in accounting: Download our eBook to bring your practice to the next level.

Benefit 1: Reduce Data Entry Errors

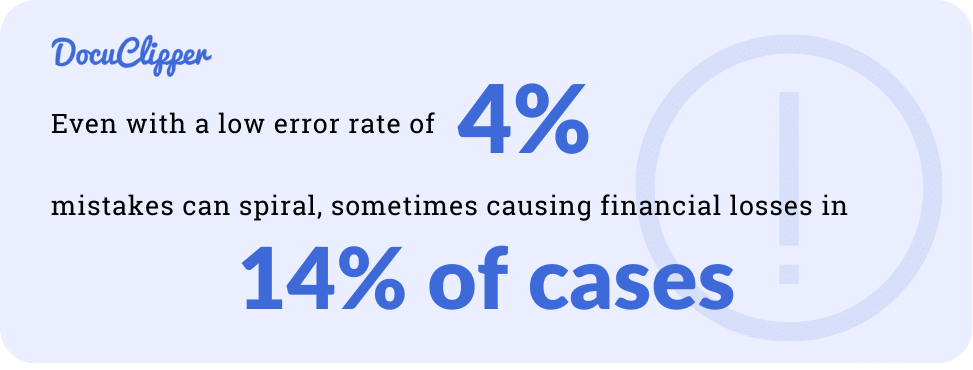

Manual data entry is a weak spot in finance, often error-prone, and takes a very long time! Even with a low error rate of 4%, mistakes can spiral, sometimes causing financial losses in 14% of cases. These aren’t just numbers; they’re real risks that could damage your business.

OCR technology promises near-flawless accuracy, with some tools boasting a 95-99% success rate in converting non-editable text into customizable and digital ones.

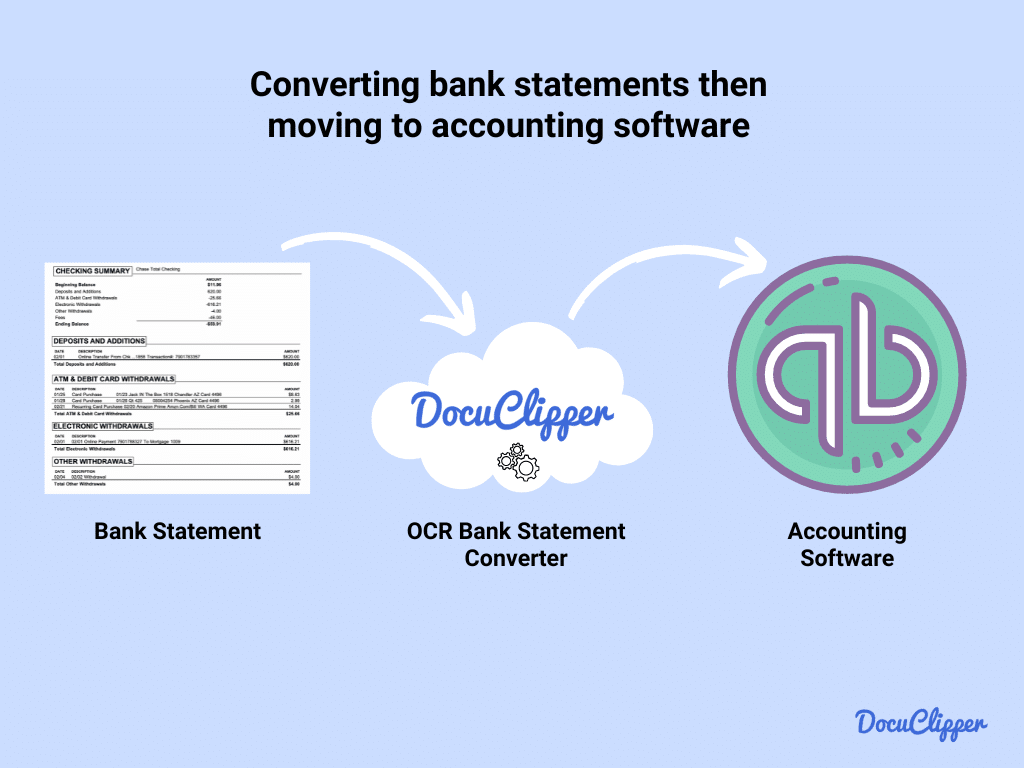

For example, DocuClipper’s OCR bank statement converter allows underwriters to convert as many bank statements as needed in a few seconds with an OCR accuracy rate of 99.6%.

By drastically cutting down errors, OCR not only speeds up processing times but also slashes the hours spent correcting mistakes. It’s a game-changer for anyone that is planning to process large amounts of financial data and slight mistakes can have detrimental consequences.

Benefit 2: Improve Accuracy of Data

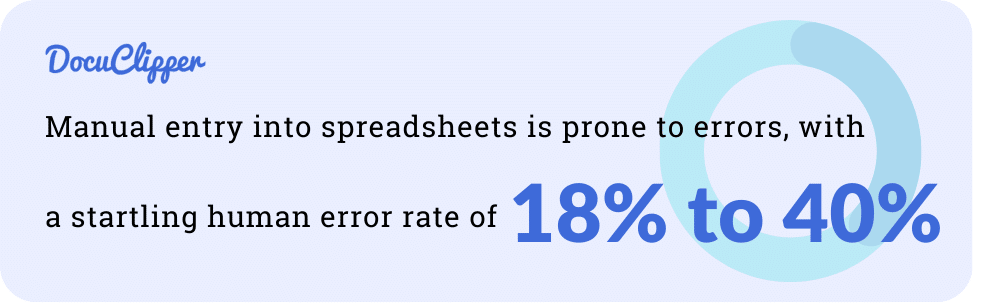

Accuracy in handling financial data is crucial, yet manual entry into spreadsheets is prone to errors, with a startling human error rate of 18% to 40%. This level of inaccuracy can have serious implications for any business.

OCR accuracy can have a rate of 99%. The difference is stark, significantly reducing the risk of costly mistakes, it takes only a few seconds of an employee’s time to extract data from PDF documents.

With OCR, the process of digitizing financial information becomes both more reliable and efficient, ensuring that your data is precise and dependable. Adopting OCR can be a strategic move for enhancing the quality of your financial operations.

For underwriting processes, it just means that using OCR means you’ll be dealing with more accurate data, ensuring a secure standpoint.

Benefit 3: Faster Data Processing & Decision Making

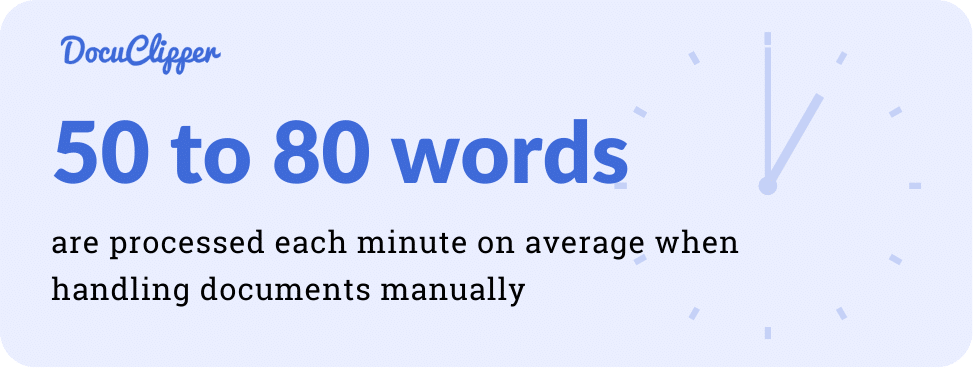

Processing documents manually is slow, averaging about 50 to 80 words for each minute. In underwriting, where evaluating credit scores, collateral, and capital is essential, this can take even longer.

Such delays increase operational costs and can lead to unsatisfactory client experiences. Plus as said, it can lead to errors within the financial data significantly increasing the risk of providing credit to the wrong people or mistakenly rejecting eligible applicants.

However, OCR technology can process these documents in a mere 20 seconds, drastically cutting down wait times and expenses.

This improvement is not just about speed; it’s about enhancing overall efficiency and client satisfaction.

By integrating OCR, underwriting becomes smoother and faster, ensuring clients receive timely and accurate services. This technological shift is a game-changer, streamlining operations and setting a new standard for efficiency in financial services.

Benefit 4: Streamline Automate Inefficient Manual Data Entry

Automating business processes undeniably speeds things up.

OCR data entry technology exemplifies this by streamlining tasks, significantly reducing the need for manual rechecks and feedback on data entry.

For example, our clients when processing bank statements, can quickly convert uploaded bank statements into their system using our API and automatically import the data into their own credit assessment application to review the underwriting for clients significantly reducing the manual processing while greatly increasing the scalability of their operations.

These functionalities can eliminate major manual tasks, allowing for a more efficient underwriting process that is completed in one step.

Shifting to OCR is a smart move for underwriting businesses looking to improve their processing speed to provide more accurate and faster services that determine the likelihood of financial risks for a client.

Benefit 5: Standardized Workflows

Automating the underwriting process leads to standardized workflows. By cutting out manual data entry, we see fewer process loops and errors, thanks to more accurate outputs.

This standardization doesn’t just mean fewer mistakes; it allows for handling more clients efficiently.

A streamlined workflow ensures that every client receives consistent, reliable service, improving the overall efficiency and capacity of the underwriting process.

With automation, underwriting becomes not only faster but also more reliable, opening up opportunities to serve a larger client base without compromising on quality.

This shift towards automated processes marks a significant improvement in how financial services manage their underwriting, making them more competitive and client-friendly.

Having standardized processes is a key to scaling a business and OCR can help you with standardizing the output data from financial documents.

For example, DocuClipper bank statement converter allows you to receive converted bank statements in the same format every single time which makes it easier to upload them into your own underwriting tool for further financial analysis.

Benefit 6: Improve Financial Analysis

Financial analysis is inherently complex and OCR software simplifies this task significantly.

Certain OCR solutions come equipped with built-in financial analysis capabilities, including transaction categorization, cash flow analysis, and automatic reconciliation. These advanced features enhance the quality of underwriting processes by ensuring data accuracy and streamlining tedious tasks.

Or as I already said, they give you standardized output that’s easy to upload into your credit analysis software.

As a result, financial teams can focus on more strategic analysis and decision-making, rather than getting bogged down in data entry.

The adoption of OCR technology in financial analysis not only boosts efficiency but also improves the reliability of the underwriting process, making it a valuable tool for businesses looking to optimize their financial operations.

Benefit 7: Enhance Customer Satisfaction

Customers appreciate fast and good service. Using OCR in underwriting makes things quicker, which customers love.

It could even make them come back for more. Instead of spending hours on manual data entry, OCR zips through the same work in minutes. This speed boost doesn’t just make our lives easier; it keeps customers happy and more likely to stick around.

It’s all about getting things done efficiently and keeping those smiles on customers’ faces. Fast, accurate processing with OCR? It’s a win-win for everyone.

Benefit 8: Reduce Employee Burden & Improve Satisfaction

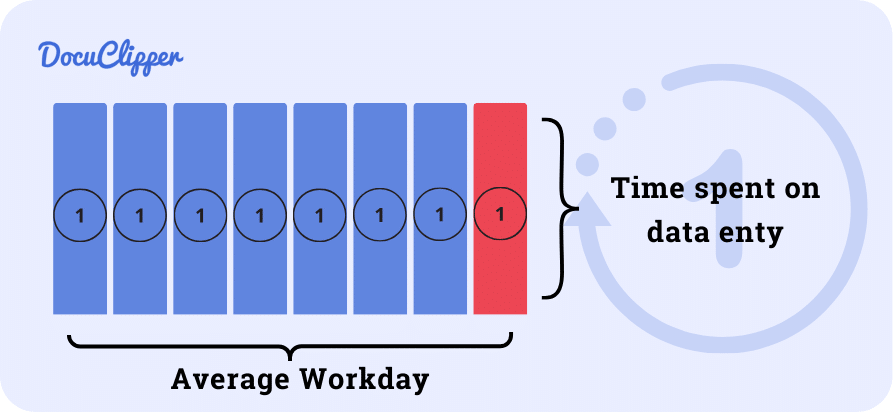

Employees often get bogged down with repetitive tasks. A typical office worker spends 10% of their day on manual data entry, whether it’s into ERP systems, CRMs, or spreadsheets.

This monotony isn’t just tedious; it dampens their mood and can negatively impact their work quality.

When quality dips, customer and client satisfaction follows suit. It’s a domino effect: unhappy employees lead to lower-quality work, which in turn can make customers and clients unhappy.

Finding ways to minimize these repetitive tasks could boost employee morale and, by extension, improve the quality of service customers receive and also their productivity.

Benefit 9: Cost Savings

The average data entry worker costs $18 per hour, yet OCR software can start as low as $40 per month for basic plans.

These starter plans, often enough for underwriting tasks, convert bank statements to CSV files for easy accounting software uploads.

This isn’t just about saving on hourly wages; it’s also about cutting down the total time you pay for. OCR doesn’t get tired or need breaks, translating to continuous, efficient work whenever you need it.

By choosing OCR over manual entry, you save money and time, making your operation leaner and more efficient. This switch not only optimizes costs but also streamlines your processes, making financial management smoother and more cost-effective.

Benefit 10: Make Data Verification Easier

Ensuring data accuracy is crucial. Manually checking everything is time-consuming and tedious.

OCR simplifies this by easily flagging discrepancies, making the underwriting process more efficient.

OCR aids in swiftly identifying mismatches or errors in data, which is vital for thorough underwriting.

This technology not only speeds up verification but also enhances reliability, allowing for faster decision-making and processing. By incorporating OCR, underwriting becomes less about sifting through data manually and more about focusing on analysis and outcomes.

It’s a game-changer in making sure the information used is correct, reducing the risk of errors, and improving overall efficiency in financial assessments.

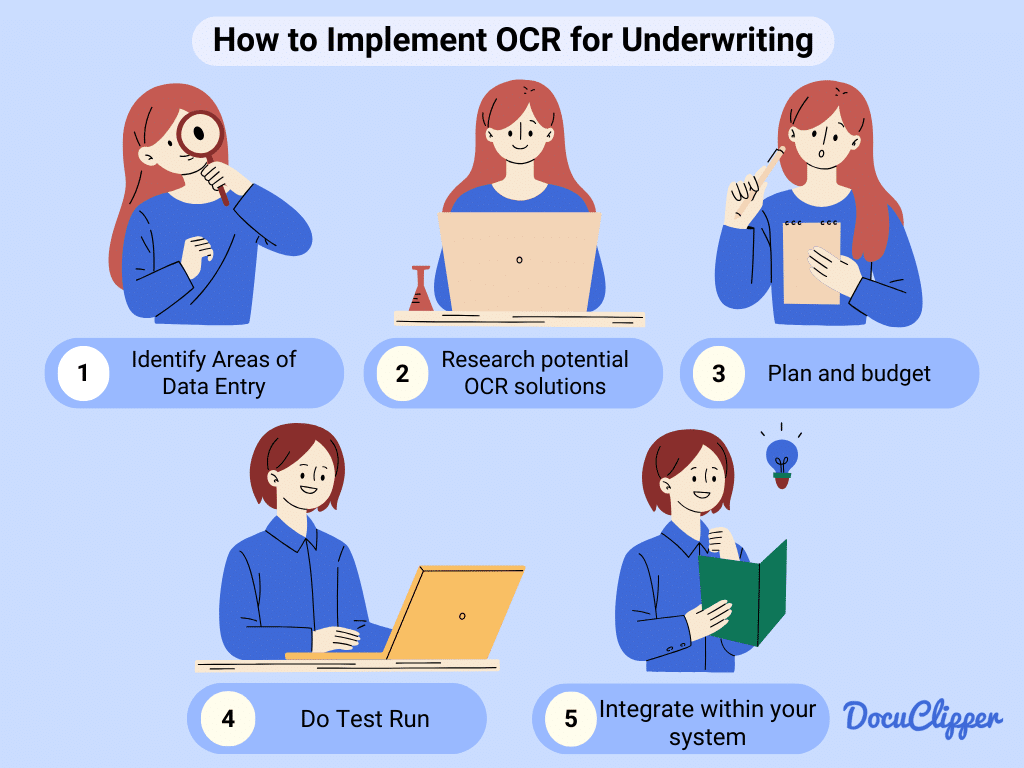

How to Implement OCR for Underwriting

Once you think the benefits are great for your lending business or insurance firm, you can start implementing OCR in your underwriting process.

Step 1: Identify Key Areas of Manual Data Entry from Documents

Think about where you can use automation in your underwriting process. OCR technology can help with many tasks like turning bank statements into editable formats, sorting information, and checking facts.

By using OCR, you make these steps quicker and more accurate. This means you do less manual work, save time, and make fewer mistakes.

Adding OCR to your process is a smart way to speed things up and make sure everything is correct, helping your business keep up with fast-paced demands.

Step 2: Research Potential OCR Solutions

There are lots of different OCR tools out there. Some are for all kinds of jobs, and some are made for specific tasks.

If you’re working with underwriting and need to check people’s assets, using an OCR tool that can read bank statements is helpful.

It quickly turns bank statements into data you can use, so you can easily see if a client is financially stable. This makes deciding who qualifies for a loan or insurance much faster and easier.

Step 3: Plan & Budget

When picking an OCR tool, it’s important to set your budget. Look at different options to see what features they offer for the price.

Sometimes, paying a bit more gets you extra tools for financial tasks, which can be useful.

Now, the price for OCR tools can differ, some tools cost just a couple of tens of dollars, while some can reach thousands of dollars per month.

It really comes down to what you need the OCR tool do as well as what are the nice things to have that you could probably cut down if the price goes over your budget.

The main thing is to get a good deal: a tool that does what you need without costing too much. This smart choice helps you work better and saves you money at the same time.

Step 4: Do Test Run

Give the OCR software a try in your work and see how it goes. Pay attention to what works well and what doesn’t in your underwriting process since OCR has limitations.

If you run into problems, think about ways to fix them, like changing how the OCR works, adjusting its settings, or maybe choosing a different subscription level.

This will help you figure out how OCR can best help you and make your job easier. Keep track of the good and the bad to make sure you’re getting the most out of it.

Step 5: Integrate Within Your System/Workflow

If the OCR tool works well for your tasks and isn’t too expensive, begin using it regularly in your work.

Teach your team how to use it and ask them to share what they like and what problems they encounter. This way, you can keep making things better.

Using OCR can make your work faster and easier, but it’s important to listen to your team’s experiences and suggestions for improvement.

How DocuClipper Can Help Your Underwriting Business

DocuClipper can transform your underwriting business by making bank statement processing faster and more accurate. With its specialized OCR algorithm, it boasts a 99.5% accuracy rate, ensuring reliable data extraction.

Unlike general OCR tools, DocuClipper is designed specifically for financial documents, supporting over 2 million bank formats. It speeds up conversion to about 20 seconds per document, enabling quick decision-making.

This tool not only converts PDFs to user-friendly formats like Excel and CSV but also offers deep insights with its analysis features, covering cash flow and transaction categorization.

Affordable plans make DocuClipper accessible for all business sizes, optimizing your operations without stretching your budget.

By streamlining data handling, DocuClipper enhances your team’s efficiency, ultimately benefiting your clients with faster, more accurate underwriting services.

Conclusion

OCR technology is a game-changer for businesses that deal with a lot of financial paperwork, like those in lending and insurance. It helps reduce mistakes, makes processing data faster, and can save money by cutting down on manual work.

Using a specialized tool like DocuClipper for bank statements can make things even better, thanks to its quick and highly accurate service.

Adding OCR to your business tools means doing things more quickly and accurately, making both employees and customers happier.

In short, if you’re looking to make your underwriting process smoother and more efficient, OCR is a smart choice that can help your business grow and improve.