Accounts payable represent the funds that a business needs to pay out. This includes payments to suppliers, creditors, and other financial obligations the company has incurred.

The best OCR software for accounts payable is transforming the accounting and business sector. It provides financial professionals with advanced tools for data entry and organization.

Handling accounts payable can be time-consuming per industry standards. OCR technology aligns and makes this process stress-free.

In this article, we explore top OCR software for accounts payable. These tools are fit to be game-changers in 2024.

Get ahead in accounting with AI – our eBook explains all

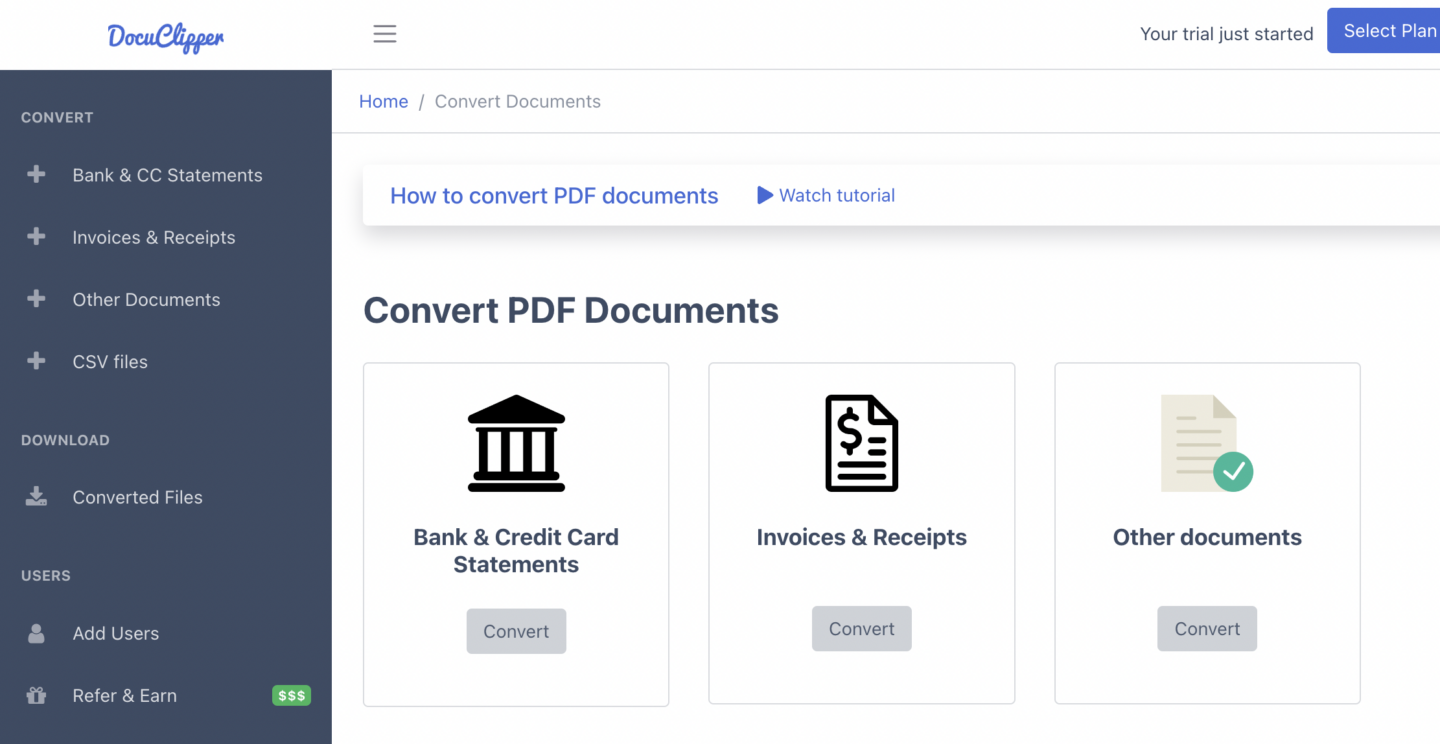

1. DocuClipper

DocuClipper is a cloud-based software designed for OCR financial document data extraction for bank and credit card statements, receipts, invoices, checks, and brokerage statements. It excels in processing documents in large batches and integration with accounting software.

Utilizing DocuClipper’s advanced OCR software and conversion capabilities, businesses can use it to analyze invoices and receipts and determine APs. It facilitates the OCR data capture into spreadsheets or enables direct conversion to various accounting software formats.

Key Features

- Accurate OCR Data Extraction: Utilizes OCR for precise conversion with 97% accuracy when converting invoices and receipts.

- Batch Processing Capability: Converting hundreds of invoices at once, enhancing efficiency in managing accounts payable.

- Importable to QuickBooks: Data extracted from DocuClipper can easily be imported into QuickBooks for easier management.

- Highly Secure: DocuClipper features SOC 2 compliance, Amazon’s robust servers, and AES 256-Bit SSL encryption, ensuring your data remains protected.

Pros

- High accuracy in converting invoices, receipts, checks, bank, credit card, and brokerage statements, crucial for accounts payable.

- Fast processing, efficient, and suitable for handling large volumes of financial documents.

- Easy-to-use interface requiring minimal training.

- Cost-effective for financial document conversion tasks.

- Reliable customer support, beneficial for accounts payable queries.

Cons

- There are not many direct integrations.

- No mobile app to scan invoices/receipts into PDF.

Pricing

- Starter ($39/mo): Ideal for freelancers and small businesses, offering 200 pages/month, bank statement and CSV conversions, unlimited users, accounting integrations, and more, with 30-day data retention.

- Professional ($74/mo): Geared towards growing businesses, including 500 pages/month, transaction categorization, and 1-year data retention.

- Business ($159/mo): Perfect for larger companies, providing 2,000 pages/month, advanced reporting, dedicated support, and 2-year data retention.

- Enterprise: Made for large enterprises, offering customizable page volume, single sign-on, and extended 5-year data retention.”

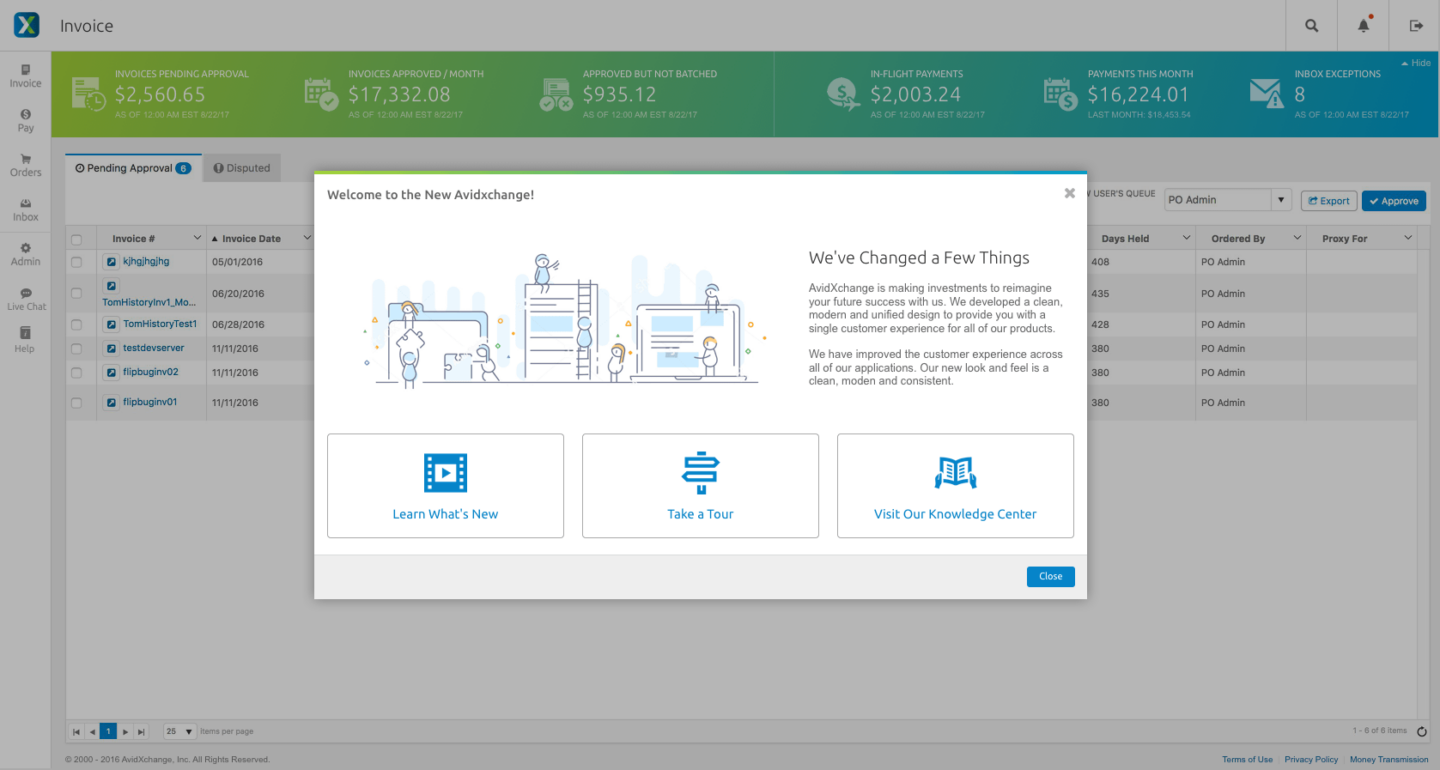

2. Avidxchange

Avidxchange is a comprehensive, cloud-based software designed to efficiently manage accounts payables, invoice processing, purchase orders, and utility bill management in one integrated platform. This allows businesses to streamline their accounts payable operations effectively.

At the core of Avidxchange is AvidInvoice, an invoice scanning software that employs OCR technology to organize and extract data from invoices and import it into accounts payables with ease.

Key Features

- Industry Customization: The user interface is adaptable across various sectors including hospitality, construction, services, and manufacturing.

- Automated Invoice Processing: Utilizes OCR to accurately identify invoices from uploaded documents or payment requests.

- Fraud Detection: Features advanced detection capabilities to identify unauthorized transactions and potential fraudulent activities.

- Efficient Purchase Order Management: Offers seamless access to payment and order management across its platforms, enabling quick and easy operation

Pros

- Provides a centralized system for easy navigation and management of payments.

- Extensive integration with over 180 third-party applications.

- Thorough validation process with 30 distinct steps for enhanced accuracy and security.

Cons

- Lacks a mobile application.

- Pricing can be relatively high depending on the chosen features.

- It needs to be implemented for every business.

Pricing

Specific pricing details are not publicly disclosed on their website. Reports from third-party sources indicate that some subscription packages may cost up to $5,000 for a 45-day implementation period.

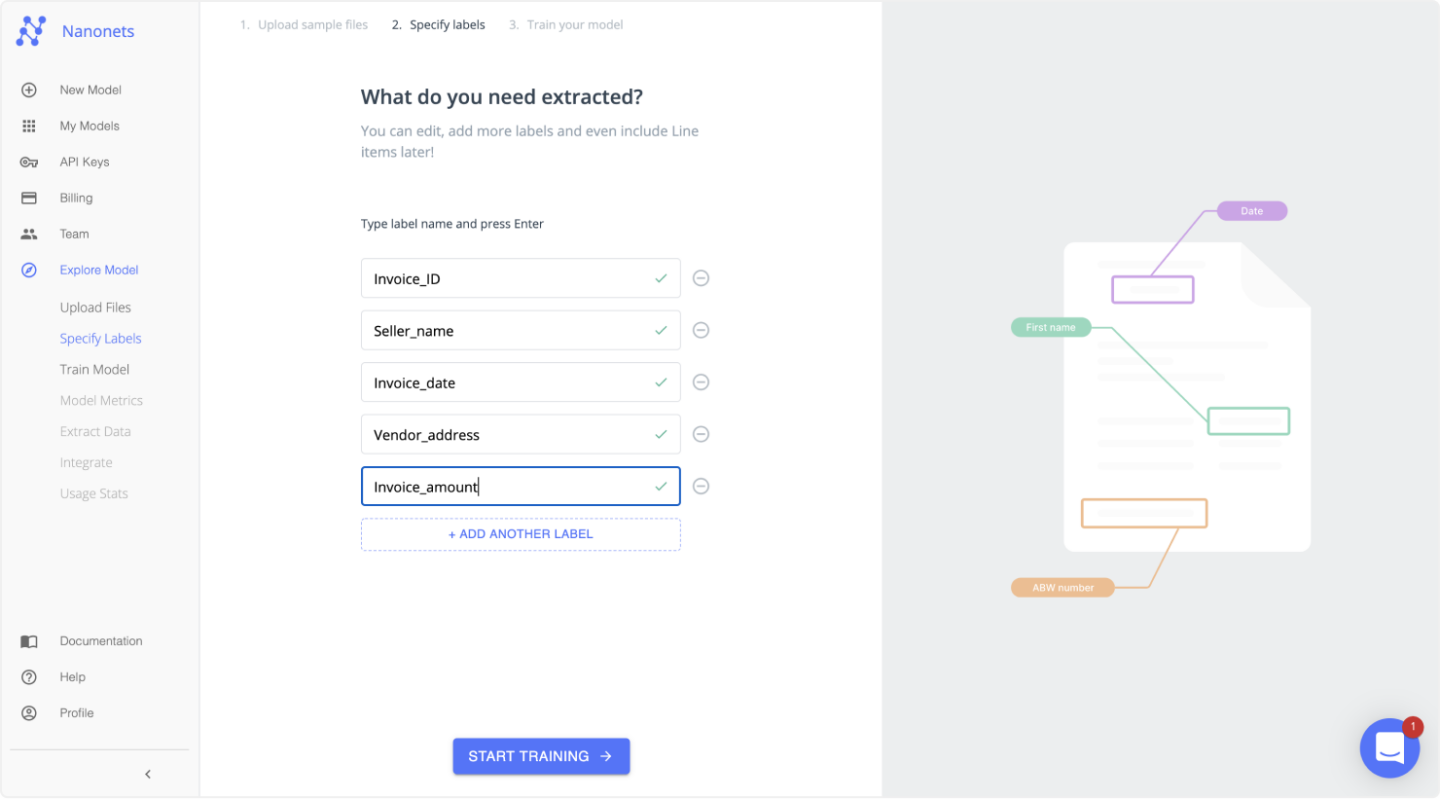

3. Nanonets

Nanonets is one of the leading OCR software out there that caters to over 10,000 users across different practitioners and companies. It goes beyond the typical OCR scan and convert scheme and uses AI and Deep Learning.

It uses AI to arrange and classify unstructured data into an optimized format the user gives. You can place a receipt, OCR detects it, and it automatically tallies out the information including the amount that needs to be settled. (Learn more about OCR vs AI)

Key Features

- Versatile Syncing: Easily integrates with various platforms, including email, websites, and chat channels.

- Payment Channel: Offers international payment options through e-wallets and banks without conversion fees within the software.

- Record Checking: Automatically recognizes paid invoices with scanned receipts, even for external payments.

- Expenses Dashboard: Provides real-time tracking of accounts payable, including amounts, deadlines, and other details.

Pros

- A range of templates for multiple purposes.

- Free trial offer

- Customer service is available 24/7.

Cons

- Limited features in the starter package.

- The Pro package is significantly more expensive compared to similar OCR software

Pricing

- Starter Plan: Free sign-up, pay $0.3 per page after the first 500 free pages. Ideal for individuals or small teams, offering basic features like limited field access and auto-capture for tables.

- Pro Plan: Costs $499 per month for each model. Includes 5,000 pages per month with additional pages at $0.1 each. Suitable for teams automating complex tasks, with benefits like up to 20 fields, team member addition, and integrations with major software.

- Enterprise Plan: Custom pricing, contact sales. Offers all Pro features plus extras like single sign-on, custom integrations, and personalized team training. Ideal for businesses needing tailored automation solutions.

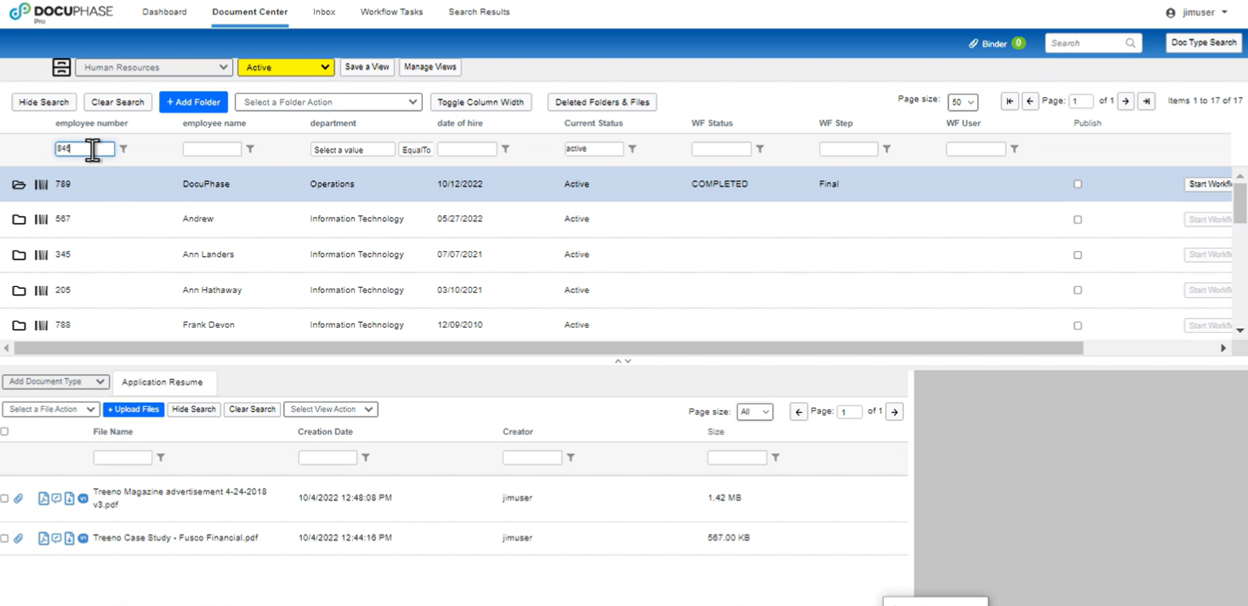

4. DocuPhase

DocuPhase provides automated solutions for accounts payable, including invoice capture and financial document management. These tools streamline back-office operations, enhancing efficiency and visibility in financial transactions.

It uses OCR data capture to extract accounts payable information and automatically detects settlements to be settled. Paying is made easier as it is accessible across many platforms.

Key Features

- Inbox Invoice Approval: Approve invoices efficiently through custom email alerts.

- Efficient Invoice Routing: Direct new invoices quickly to the appropriate approvers.

- Streamlined 3-Way Invoice Matching: Leverage automated technology for efficient order, receipt, and invoice matching.

- Seamless ERP Compatibility: Work effortlessly with a range of ERPs, including NetSuite and Dynamics.

Pros

- Collaborative and customizable solutions.

- High user satisfaction with knowledgeable staff.

- Versatile for automating and storing documents across various departments.

Cons

- Challenging for users new to this type of software.

- Inconsistencies in workflow due to version assignment changes.

- Concerns about pricing structure and licensing fees.

Pricing

- Basic Plan: Priced at $250 per month. Suitable for essential document management, offering features such as Collaboration Tools, Electronic Signature, File Recovery, Offline Access, OCR, and Version Control.

- Most pricing schemes are undisclosed publicly.

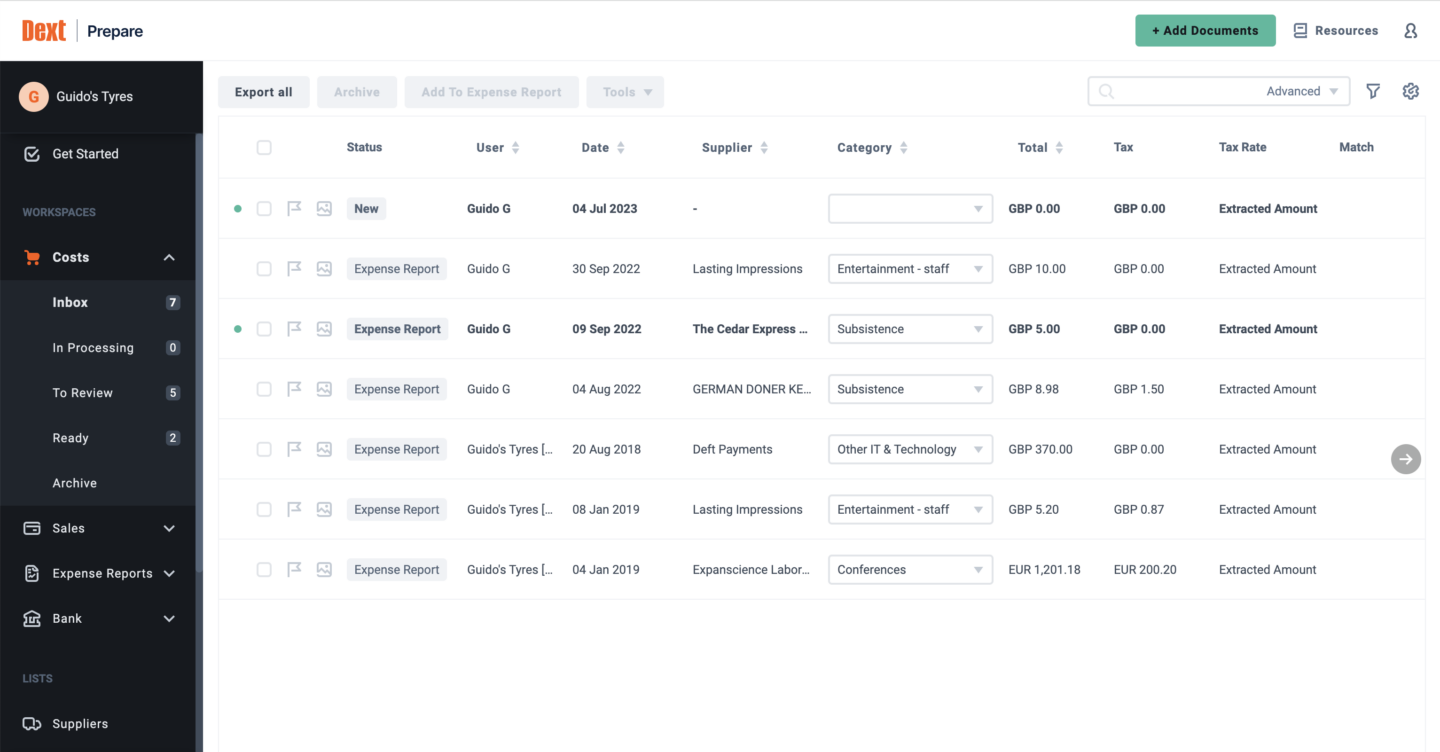

5. Dext Prepare

Dext Prepare is a streamlined platform designed to manage critical financial documents like receipts, invoices, and bank statements. It simplifies the process of consolidating all your paperwork into a digital format.

Dext Prepare will extract the necessary data and seamlessly integrate it with your accounting software using OCR technology. This ensures accurate financial records without the need for manual data entry.

Key Features

- Exceptional Accuracy: Boasts a market-leading 99% accuracy rate in capturing and processing paperwork, ensuring high-quality data for your financial records.

- Extensive Integrations: Compatible with a wide range of accounting software and supports over 11,500 banks and institutions, making it a versatile tool for various financial systems.

- Line Item Extraction: Extracts each purchase from receipts, bills, and invoices with remarkable precision. Ideal for transactions with a single supplier involving items that require categorization under different tax codes or categories.

Pros

- Noted for its ease of use and mobile compatibility, allowing for efficient processing using just pictures.

- Effective in syncing with existing software and offers features that help in organizing receipts and maximizing deductions.

- Valued by business owners and accountants for its cloud archiving capabilities.

Cons

- There have been security concerns with instances of fraudulent invoices being sent to users.

- Customer support issues were reported, including non-responsive or ineffective assistance.

- Occasional inaccuracies in AI supplier identification, necessitate user vigilance.

Pricing

- Essentials Bundle (up to 10 clients): $250/month for a 12-month subscription. Ideal for sole practitioners or small firms to automate document collection.

- Essentials Bundle (up to 20 clients): $450/month for a 12-month subscription. Suitable for mid-size practices focusing on automating data collection and client expenses.

- Advanced Bundle (up to 20 clients): $540/month for a 12-month subscription. Offers additional features for larger practices.

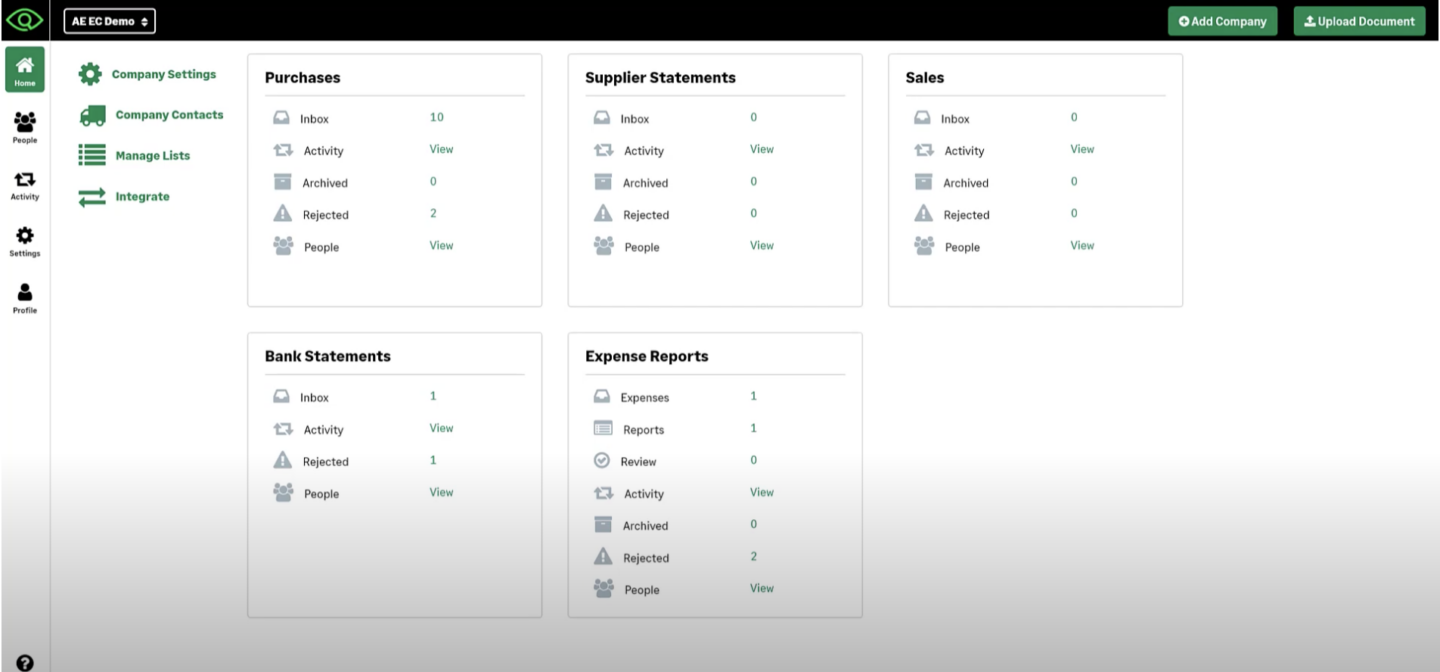

6. AutoEntry

AutoEntry is a user-friendly, cloud-based software that uses OCR technology. This feature automates the data entry process for financial documents like invoices and receipts, by converting text from uploaded images or PDF files.

Operated by Sage, AutoEntry maintains compatibility with a range of other accounting software. Its OCR technology efficiently extracts data from invoices, effectively simplifying the management of accounts payable and maintaining comprehensive financial records.

Key Features

- Streamlined Categorization: Easily categorize documents in AutoEntry for direct publishing to accounting software or export.

- Seamless Software Integration: Syncs with accounting software, importing necessary account and VAT information.

- Customizable Rules: Set up rules in AutoEntry for automatic future categorization of similar documents.

- Intelligent Suggestions: AutoEntry provides suggestions for suppliers and VAT codes, which can be saved as rules for future automation.

Pros

- User-friendly, allowing delegation of scanning tasks to junior staff.

- Simple to teach to clients and integrates well with other software.

- Excellent support team, resolving issues quickly.

- Mobile application is available for use in both Android and Apple

Cons

- Sometimes fails to correctly identify names on invoices.

- Occasional system interruptions requiring refresh or chat support.

- Minor issues and inconsistencies were noted with bank statement imports.

Pricing

- Bronze: 50 credits at $12/month ($0.24/credit).

- Silver: 100 credits at $23/month ($0.23/credit).

- Gold: 200 credits at $44/month ($0.22/credit).

- Platinum: 500 credits at $98/month ($0.20/credit).

- Diamond: 1500 credits at $285/month ($0.19/credit).

- Sapphire: 2500 credits at $450/month ($0.18/credit).

All plans include standard features. No contract is required for subscription.

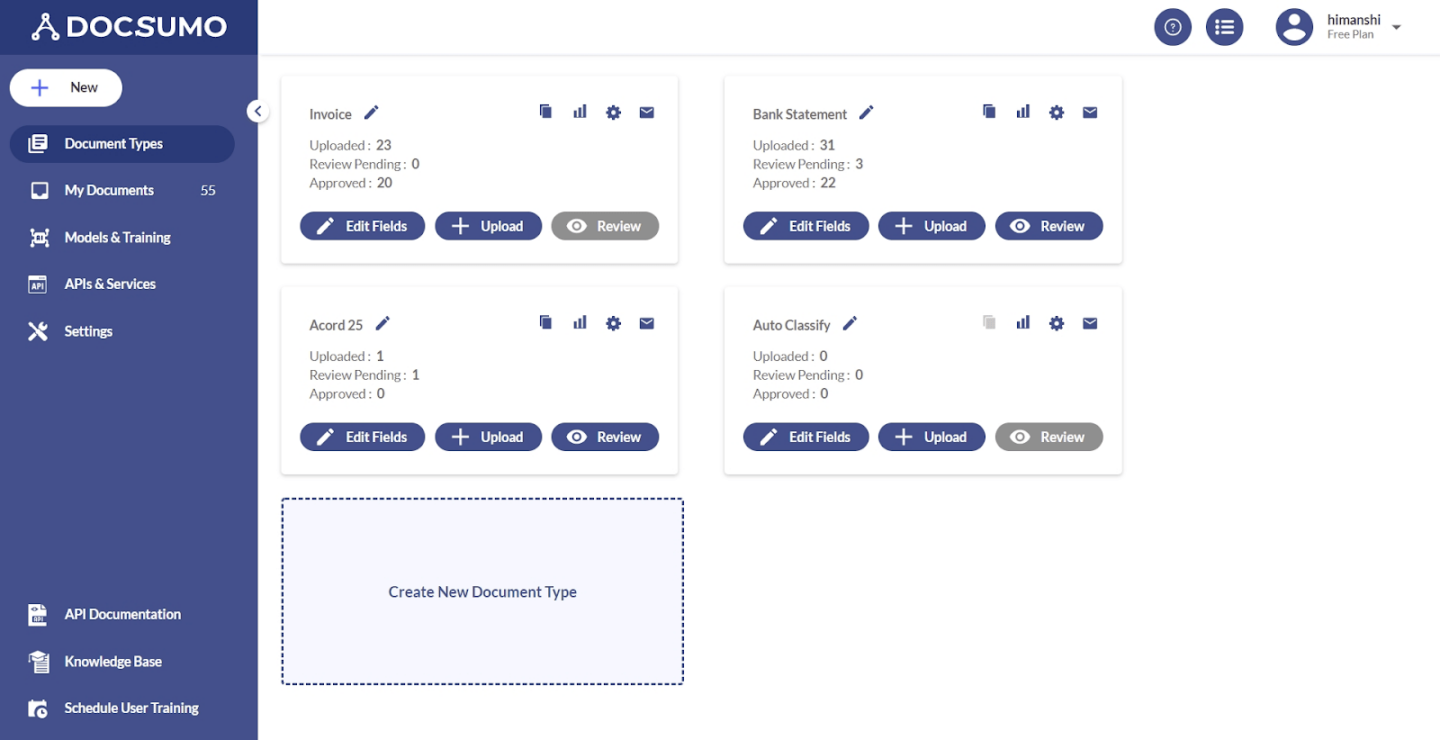

7. Docsumo

Docsumo is a user-friendly OCR tool for small and medium businesses, lenders, and insurers. It’s designed for automate manual invoice processing and OCR data extraction, addressing to financial services across the USA.

Docsumo is an intelligent document processing solution focused on automating accounts payable and purchase order processing. It offers a range of features to streamline financial document management.

Key Features

- AI-Powered Invoice Processing: Utilizes artificial intelligence to efficiently extract and process data from invoices.

- Purchase Order Matching: Automatically matches invoices to the corresponding purchase orders, ensuring accuracy in financial records.

- Vendor Validation: Employs advanced techniques to confirm the authenticity of vendor information on invoices.

- Accurate Data Capture: Capable of handling a variety of document formats and layouts to ensure precise data extraction.

- Easy System Integration: Designed to seamlessly integrate with existing accounting systems for a synchronous workflow.

Pros

- Efficient in automating data capture for various documents.

- Accurate and supportive in handling large volumes of invoices.

- Easy communication and responsive customer service.

Cons

- Needs to expand its document coverage.

- Sometimes struggles with data extraction accuracy due to invoice diversity.

- API documentation could be more detailed.

- Potential language support improvements.

Pricing

- Growth: $500+/month for startups, including APIs for invoices, POs, ID cards, 3 users, data scores, ML, and Table Vision. Lacks email parsing, validation, custom ML training, table categorization, and auto-classification.

- Business: Custom pricing for specific data capture, includes all Growth features plus bank statements, tax returns, utility bills, 10 users, email parsing, rule-based validation, and custom ML training.

- Enterprise: Custom pricing for enterprises, includes all Business features plus unlimited users, advanced analytics, table categorization, and auto-classification.

8. Envoice

Envoice is a streamlined expense management platform ideal for small and medium businesses, as well as accountants. It automates the bookkeeping data entry by scanning invoices and receipts, making expense tracking and reporting more efficient.

Envoice utilizes OCR technology to efficiently extract data from invoices and receipts, streamlining the accounts payable process. Additionally, it organizes financial data into user-defined formats for better management.

Key Features

- User-Friendly Interface: Designed for ease of use, making navigation and operation straightforward.

- Multi-User Accessibility: Supports multiple users, enhancing team collaboration and efficiency.

- Real-Time Expense Tracking: Enables tracking of expenses in real-time for better financial oversight.

- Customizable Reporting: Customizable reports depending on management needs.

Pros

- Dependable data storage capabilities, ensuring information integrity.

- Seamless integration of email content within billing information, optimizing data management.

- Straightforward and easy-to-navigate platform.

Cons

- Some difficulties encountered in reconciling credit notes during payment processing.

- User experiences indicate challenges in efficiently managing expenses both on the application and website.

- Occasional reports of challenges in system access, affecting operational continuity.

Pricing

- Essential: For small companies, priced at 5€/month, includes 30 free documents then 0.15€ per additional document. Features Collection, SmartExtract, Expense Reports, Automation, Approval, Travel Request. 14-day free trial, no credit card required.

- Business: For team collaboration, priced at 10€/month, includes the same document allowance and features as Essential. Also offers a 14-day free trial.

- Optional Add-ons: ExactExtract at 0.20€ per document, Line Item Extraction at 0.02€ per line item, and Invoicing at 0.15€ per document.

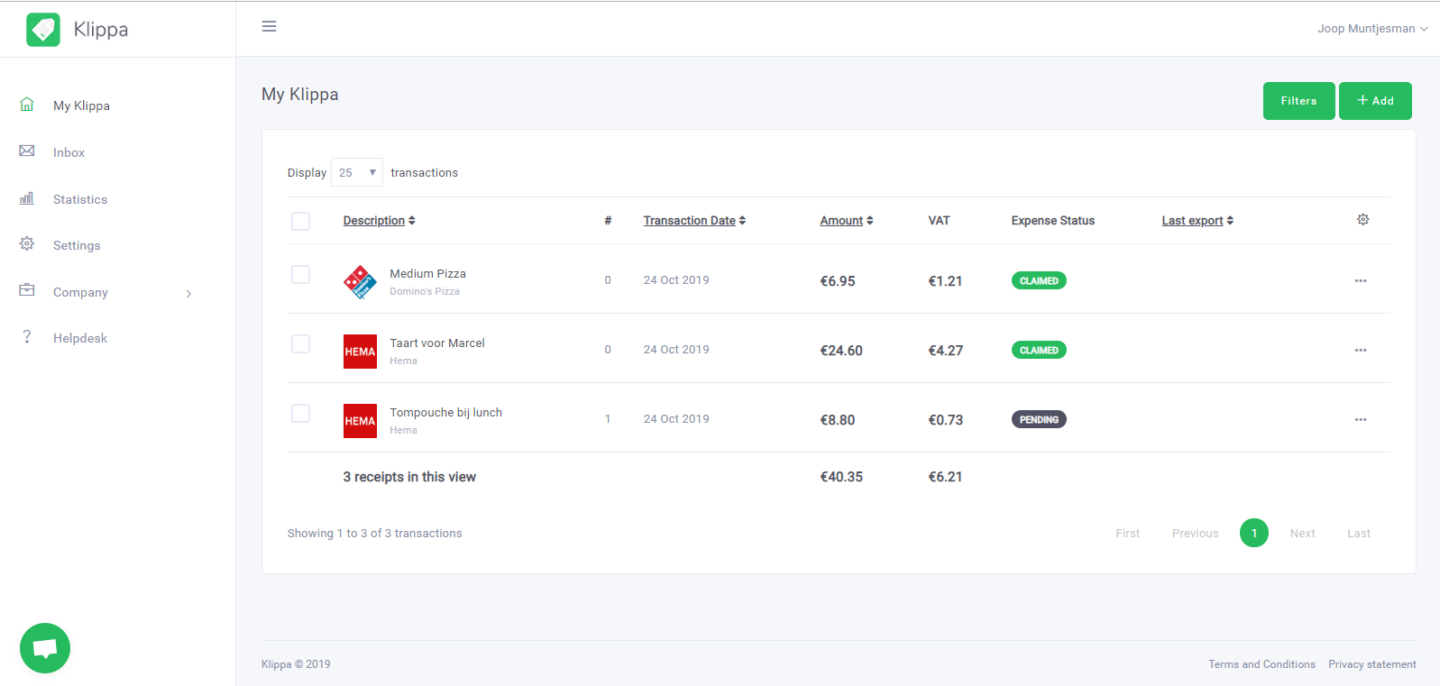

9. Klippa

Klippa employs cutting-edge AI and OCR technology to simplify invoice processing. This technology removes the need for manual data entry, making the process more efficient and reducing the likelihood of errors.

Users can easily submit invoices using Klippa’s App or web application. Invoices can be uploaded by taking a photo with a mobile phone or uploading a scanned document, ensuring a convenient and streamlined experience.

Key Features

- Flexible Submission Options: Invoices can be submitted through the Klippa App or web application, via photos or scanned documents.

- Integration with Accounting Systems: Allows import of creditors, cost centers, and VAT codes.

- Fraud and Error Prevention: Automatically detects duplicate invoices.

- Detailed Insights and Reports: Provides insights on invoice statuses and processing times, with options to export data in various formats.

Pros

- Capable of extracting text from various angles, including 45 degrees and upside down.

- Efficiently extracts line items from printed invoices.

- Provides flexibility in customizing templates for individual customers.

- Excellent customer support and availability for queries.

Cons

- Lack of commercial follow-up post-purchase.

- Limited customization options have been a constraint for some users.

- The selection process can be challenging due to numerous options.

- May not fully support specific requirements and workflows for all users.

Pricing

- Effective: €95 per month for up to 4,000 invoices annually with up to 10 users.

- Premium: €245 per month for up to 12,000 invoices annually with up to 30 users.

- Custom: Tailored AP solution designed to meet your specific needs, with custom pricing available.

What is Accounts Payable?

In simple terms, accounts payable (AP) is like a business’s promise to pay for things it has bought but hasn’t paid for yet. These are like short-term debts to suppliers for things the business has received. Keeping track of these and paying them on time is very important.

Good management of AP means paying bills when they are due. It makes suppliers trust the company, avoids extra fees, and helps the business have enough money on hand. Making sure to pay bills on time while not spending too much is what it takes for businesses to be stable.

What is OCR Software for Accounts Payable

Optical Character Recognition (OCR) offers a transformative solution when streamlining accounts payable. This technology extracts text from scanned invoices and receipts, converting it into editable formats like spreadsheets or Word documents without manual data entry.

OCR delivers data with remarkable accuracy, eliminating tedious data transcription errors and freeing your AP team for more strategic tasks. Moreover, Extracted data formats are customizable to seamlessly integrate with existing accounting systems.

And overall when we compare automated data entry vs manual data entry, it really make sense to select this type of software to streamline processes.

Why is OCR Software for Accounts Payable Important?

OCR is really for accounts payable because it helps process financial data quickly and with minimal mistakes. Normally, entering data by hand is slow and can lead to errors, but OCR does this fast and accurately. This makes sure financial records are correct

OCR also fits well with different accounting systems because it automatically puts financial records in preferred structure. This means the data is easy to work with and understand.

Plus, people using the software can change how they see their financial information. This is helpful because it lets them track and manage their money better. OCR tech is key for accounts payable as it makes handling finances faster, more accurate, and easier to understand.

Get ahead in accounting with AI – our eBook explains all

How to Select the Right OCR Software for Accounts Payable?

When choosing the right OCR software for accounts payable, there are several key factors to consider to ensure you pick a solution that meets your specific needs:

- Industry-Specific Features: Look for OCR software that caters to the unique requirements of your industry. Different industries have various types of invoices and financial documents. A solution that’s tailored to your industry will likely handle your specific types of documents more effectively.

- Test for Accuracy, Cost, and Speed: Ensure high accuracy to reduce errors, choose cost-effective software within your budget, and prioritize speed for efficient accounts payable processing

- Efficient Processing: Choose an OCR software that supports processing multiple documents in a single batch. This eliminates the need for the slow and tedious task of uploading each document individually

- Customizable and Editable Results: Select software that allows you to customize and edit the output format. This flexibility ensures that the final data integrates well with your existing accounting systems and meets your reporting needs.

Conclusion

In 2024, Optical Character Recognition (OCR) software offers significant potential for accounts payable automation. By extracting data from invoices and receipts, OCR can streamline workflows, improve accuracy, and reduce manual effort.

Choosing the right solution requires careful consideration of industry-specific needs, data accuracy, processing speed, and output customization capabilities. Using adequate bank statement extraction software or invoice OCR detector is the most efficient choice.

FAQs About OCR Software for Accounts Payable

Here are some frequently asked questions regarding the best OCR software for accounts payable purposes.

What is OCR tool in accounts payable?

An OCR tool in accounts payable is software that uses Optical Character Recognition to automatically read and convert text from invoices and receipts into digital data.

What is OCR in accounting?

In accounting, OCR is used to scan financial documents, converting them into editable and manageable digital formats, thus reducing manual data entry.

What is OCR in billing?

OCR in billing refers to the use of OCR technology to scan and process billing documents, like invoices, for faster and more accurate data handling.

What is the OCR process of invoices?

The OCR process of invoice involves scanning the invoice, extracting relevant data like amounts, dates, and vendor details, and converting it into a digital format.

What is OCR software used for?

OCR software is used for converting text in scanned documents into digital data, useful in various fields like accounting, data entry, and document management.

Do I need OCR software?

If your business handles a lot of paper-based documents and requires efficient data processing, OCR software can be a valuable tool.

Where is OCR commonly used?

OCR is commonly used in sectors like accounting, banking, legal, and healthcare for efficient document processing and data management.

How to choose OCR software?

When choosing OCR software, consider factors like industry-specific features, AI capabilities, accuracy, cost, speed, document format versatility, fraud detection, and customizable results.