Many individuals new to business transactions often mix up purchase orders and invoices, raising the common question: are they the same?

In this blog, we’ll get into the differences and similarities between purchase order VS invoice.

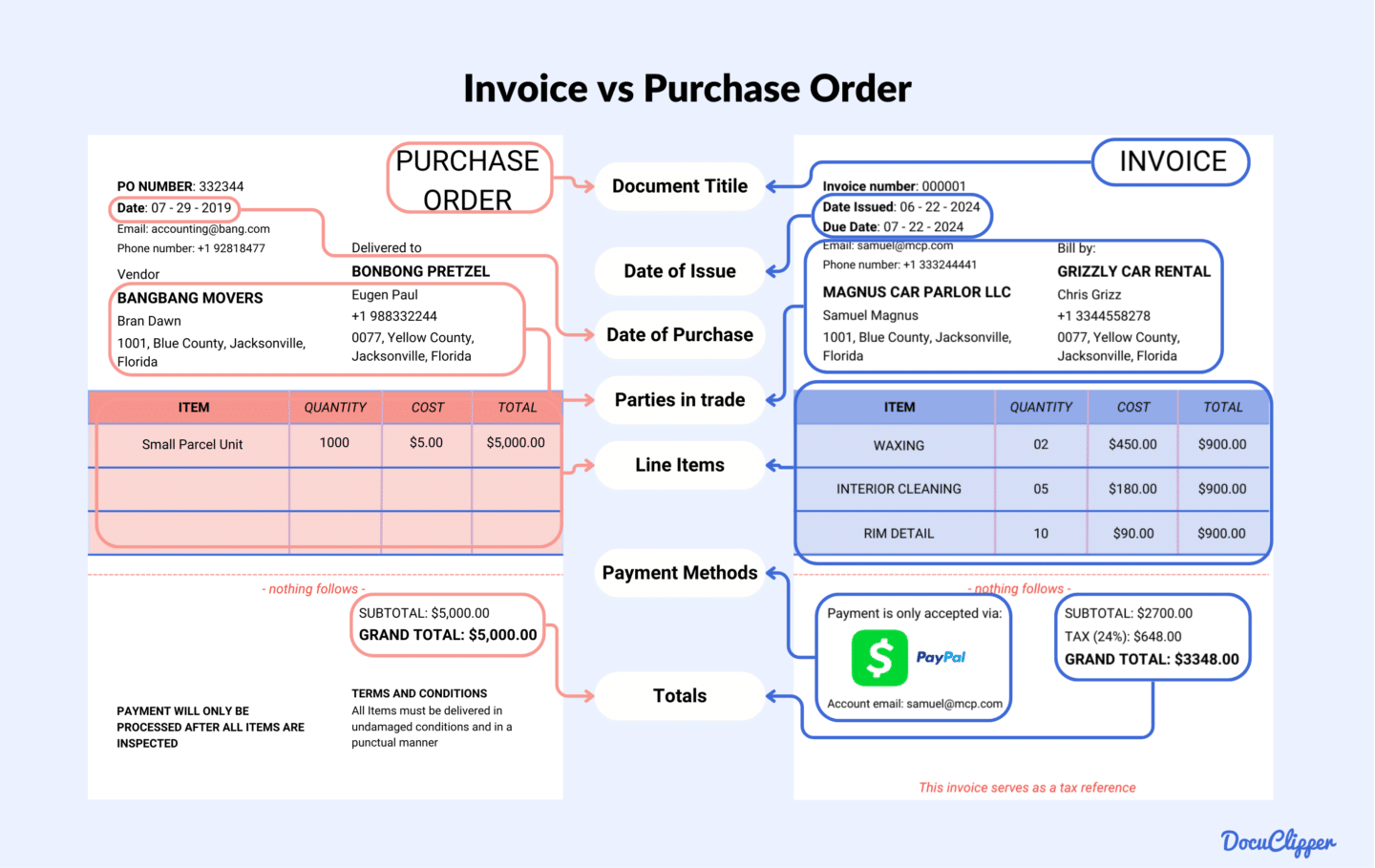

The major difference between a purchase order and an invoice is that a purchase order is made by the buyer requesting goods or services,

A seller procures an invoice once the delivery of Goods from the Purchase Order has arrived to request payment for those goods or services.

What is a Purchase Order?

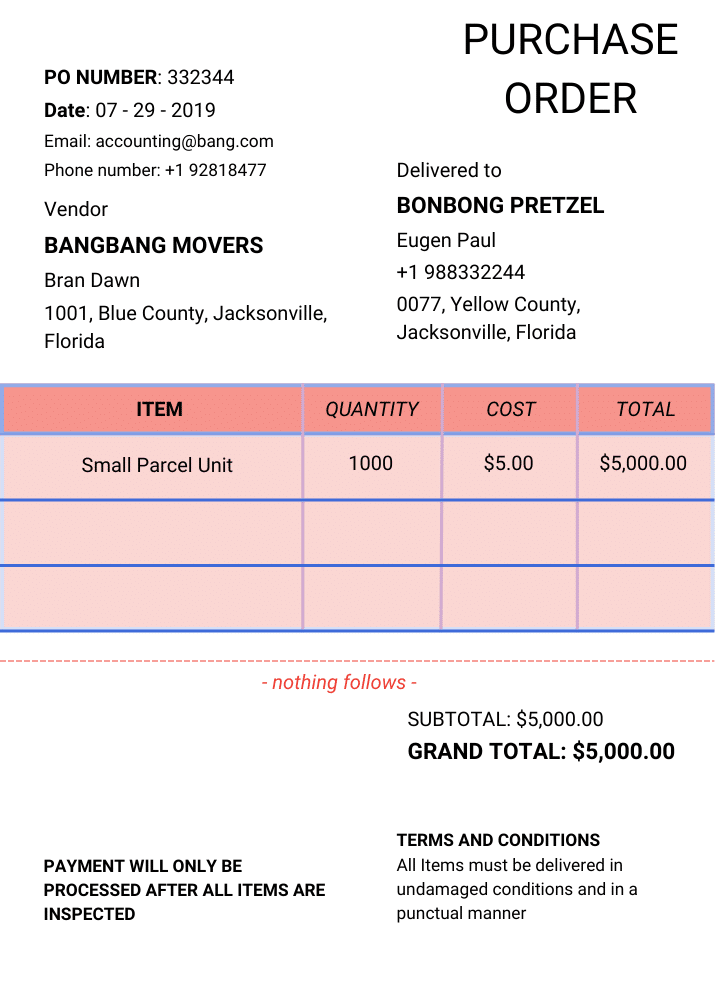

A purchase order (PO) is a legally binding document sent by the buyer to a supplier to request goods or services.

It specifies such as quantities, prices, and terms of purchase.

Once the seller accepts your PO, it becomes a contract that both parties must follow.

This ensures a clear agreement on the goods or services to be provided and their cost. This might also involve the conditions and specifications of the goods and services, such as quality and grading.

What is an Invoice?

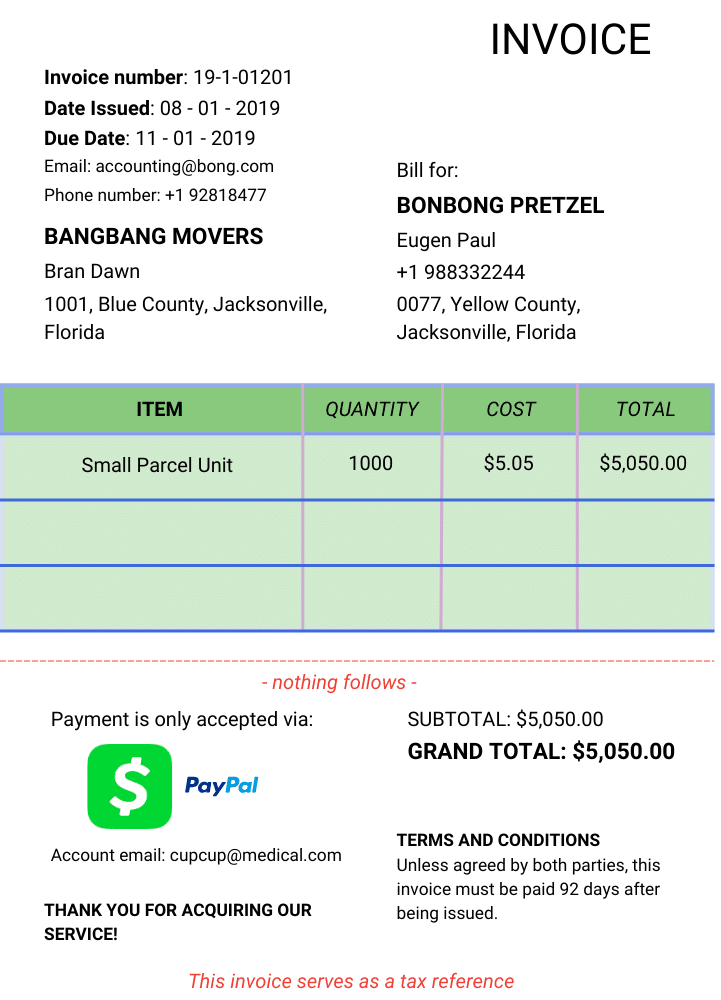

An invoice is a document issued by the seller containing the information of the goods or services provided to a buyer.

It functions as a request for payment, containing the amount due, payment terms, and payment methods.

Usually, invoices include line items of products or services, along with relevant dates and prices.

For your business, invoices are essential for tracking outstanding payments, ensuring timely collections, and maintaining accurate records.

For your customers, invoices offer a clear record of their purchases and associated costs.

It is usually used in B2B transactions, services, or when selling on credit.

Purchase Order vs Invoice: The Main Differences

POs are different from top to bottom, here is the breakdown of their differences:

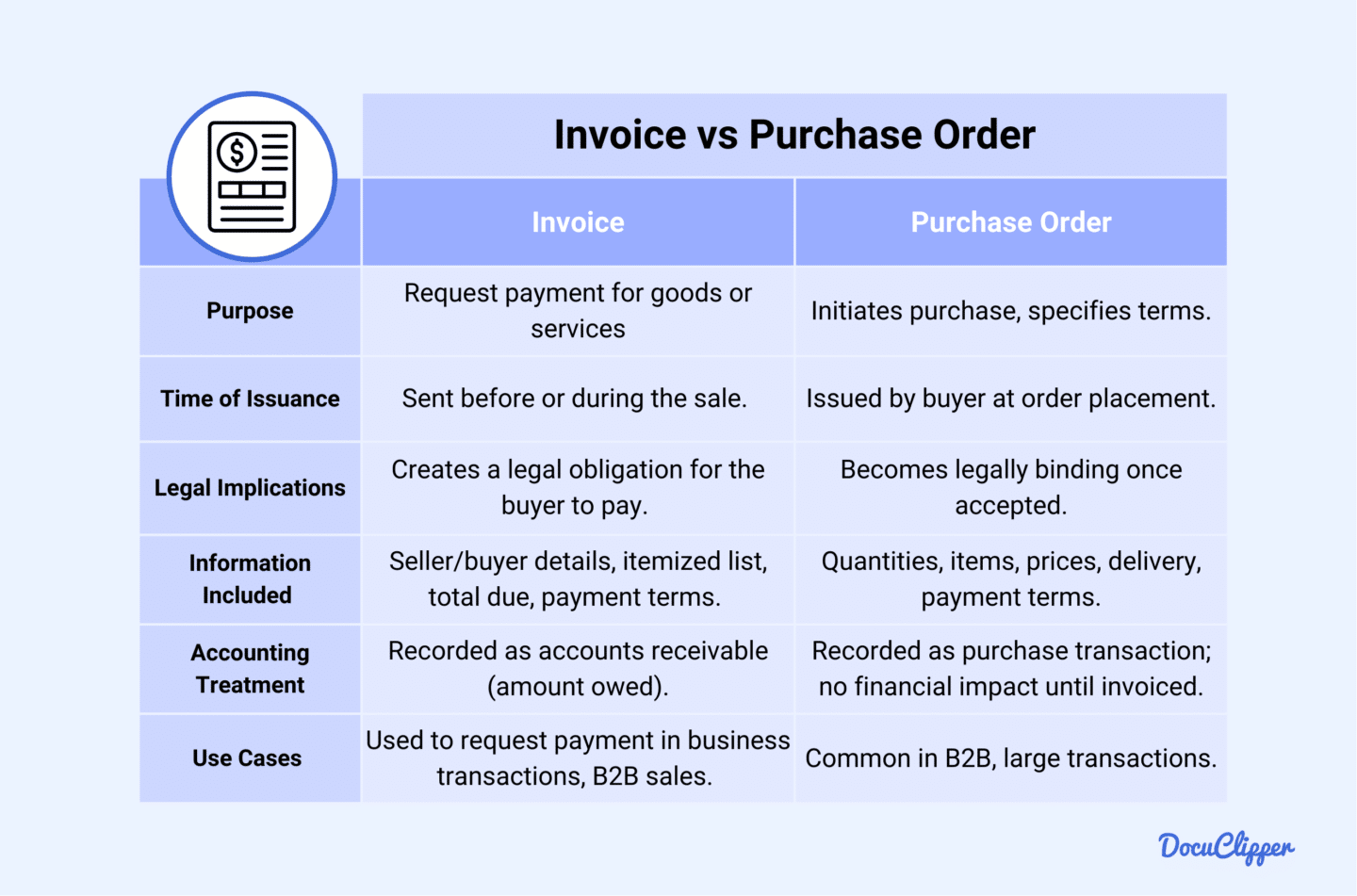

Purpose

- Purchase Order: Used by the buyer, to initiate the purchase of goods or services for the corresponding company.

- Invoice: Used by the seller to request payment from you after the goods or services have been provided.

Issuance

- Purchase Order: Issued by buyer, for the items and services you want to procure from the seller. It is issued at the start of the transaction.

- Invoice: Issued by the seller after the goods or services have been delivered or completed. It records what was purchased and is issued to close the loop in the transaction process.

Information Included in Each Document

- Purchase Order: Includes details such as the quantities, items, or services, the buyer, is procuring from the seller. It also contains the specifications of the goods or services.

- Invoice: Contains information such as the recommended payment methods, tax additions, and due date. It also includes a unique invoice number, details of the goods or services, totals, and due dates.

Legal Implications and Requirements

- Purchase Order: A purchase order becomes legally binding once the seller accepts it. It serves as a contract between the buyer and the seller, containing the terms of the transaction.

- Invoice: An invoice is not a legally binding document but serves as a record of the transaction. It is a request for payment for goods or services rendered, but it does not constitute a contract.

Accounting Treatment

- Purchase Order: Accountants treat purchase orders as recording the goods and services listed as purchase transactions. It does not directly impact financial statements until the invoice is issued.

- Invoice: As a seller and sending an invoice, it’s recorded in your accounting journal as a receivable. When you are a buyer and receive an invoice, it’s recorded in the accounts payable section. Invoices are used to track pending orders and obligations but only impact financial statements once fulfilled.

Use Cases and Scenarios

- Purchase Order: Businesses use these for casual transactions, especially when dealing with large quantities or high-value goods and services.

- Invoice: Used widely in all transactions where payment is required after the goods or services have been delivered. This can be seen in subscriptions.

Why Understanding the Difference Matters for Businesses

POs and Invoices have different functions. Understanding the difference between both is very important as it can affect your business plans, legal obligations, and even customer relations.

Efficient Transaction Management

Clearly distinguishing between invoices and POs allows you to streamline your procurement and payment processes, reducing errors and delays.

Purchase orders act as a forecast, allowing you to plan for future expenses while still awaiting confirmation through invoice matching.

Invoices are used when are issued and matched, they confirm the amount due, enabling you to manage payments more effectively and maintain accurate financial records.

Financial Planning and Control

Purchase orders and invoices play different roles when planning your finances.

POs help you anticipate expenses and manage budgets by allowing you to predict into future financial commitments, even though the exact amounts aren’t confirmed until the invoices are issued.

Invoices provide a finalized amount due along with a set payment date. This enables you to prepare your payment and promptly allocate funds for your AP obligations.

Legal and Contractual Compliance

Proper documentation of purchase orders and invoices is essential for legal and contractual compliance.

Maintaining accurate records of POs, allows you to ensure that all terms are defined and agreed upon, reducing the risk of legal disputes with suppliers or clients.

Invoices when successfully matched with POs allow you to dispute mismatches of your orders with the goods and services and successfully dispute payments and quantities.

Accurate Record-Keeping and Auditing

POs and invoices can be plus and minus depending on what end you have on the transactions.

Maintaining distinct records for POs and invoices allows you to record accurately both during the audit process, allowing you to see which is your payable and receivable.

This separation ensures that each transaction is documented thoroughly from initiation to payment, facilitating smoother audits.

Improving Supplier Relationships

Accurate and timely submission and issuance of purchase orders and invoices are key to building trust with your suppliers.

When you consistently issue POs and settle invoices late and unclear, you might affect the relationship and produce delays and disputes in your and your client’s (supplier or buyer) business processes.

Maintaining clear and consistent documentation of all transactions strengthens your negotiating power. With a reliable transaction history, you can use this information to leverage better terms, discounts, or more favorable payment schedules with your suppliers and buyers.

How to Create a Purchase Order

Here are steps to make a purchase order from scratch when you don’t have one in place yet:

- Choose a Template: Having a professional Purchase Order (PO) template that aligns with your business’s branding and requirements. Templates can vary so choose one that fits your industry and legal requirements.

- Add Issue Date: Enter the date when the Purchase Order is being issued. This date is important for tracking the timeline of the transaction and will be used in future correspondence between you and the supplier.

- Assign a PO Number: Assign a unique Purchase Order number for this specific order. The PO number is used for tracking and referencing this transaction in your records, and it helps both parties easily identify and manage the order throughout the procurement process.

- Enter Business Information: Add the full details of both the buyer and the seller. This includes the company names, addresses, phone numbers, and email contacts.

- Detail the Order: Provide in detail all the goods or services being ordered. This should include item descriptions, part or model numbers, quantities, and the prices agreed upon.

- Specify Delivery Date: Clearly state the expected delivery date for the goods or services. This allows the buyer to expect the delivery and prepare the necessary receiving procedures.

- Include Terms and Conditions: Outline all relevant terms and conditions associated with the order. Place terms such as return policies, refund conditions, and quality control check-ups prior to departure.

How to Create an Invoice

Creating a professional invoice is essential for maintaining clear communication, ensuring timely payments, and establishing credibility with your clients.

Follow these steps to craft an effective invoice that reflects your brand and conveys the necessary payment details.

- Brand Your Invoice: Choose an invoice that reflects your company’s branding. Include your logo, company name, and contact information to create a professional and recognizable document.

- Add a Professional Header: Make a professional header at the top of your invoice. This should prominently feature the word “Invoice” along with a unique invoice number and the issue date.

- Identify the Parties: Clearly state the names and contact information of both the seller (your business) and the buyer (your customer).

- Include Invoice Information: Write all essential invoice details, including the invoice number, issue date, and due date. This should also match with your invoice tracking system if you have one established.

- Describe What’s Being Exchanged: List down the goods or services provided. Include everything in detail such as item descriptions, quantities, unit prices, and any applicable discounts.

- Include Tax Details and Highlight the Total Amount Owed: List any applicable taxes, ensuring the tax rate is specified and correctly calculated. Emphasize the total amount due at the bottom of the invoice, possibly with a bolded font.

- Include Payment Terms and Additional Notes: Clearly state the payment terms, including the due date and acceptable payment methods (e.g., bank transfer, credit card, etc.). Add any additional notes, such as terms and conditions, payment instructions, or policies on late fees and refunds.

Conclusion

In conclusion, the distinctions between purchase orders and invoices are vital for efficient business operations as they can create disorganized record-keeping work when not understood well.

Purchase orders help you manage procurement and forecast expenses, while invoices ensure accurate billing and prompt payment.

Whether you’re managing transactions or preparing for audits, clear and organized documentation will contribute to your business’s success and stability.

How DocuClipper Can Help Businesses with Processing Purchase Orders and Invoices

DocuClipper simplifies invoice processing by using OCR technology to accurately extract data. This automation significantly reduces processing time while ensuring precision. With the ability to convert PDF invoices into formats like XLS, CSV, and QBO, DocuClipper can handle hundreds of invoices in seconds.

It seamlessly integrates with popular accounting software such as QuickBooks, Sage, and Xero, making it an essential tool for efficient and reliable financial management.

FAQs About Purchase Order vs Invoice

Here are some frequently asked questions about purchase orders and invoices:

Is a purchase order the same as an invoice?

No, a purchase order and an invoice are not the same. A purchase order is issued by the buyer to request goods or services and outlines the terms of the purchase. An invoice, on the other hand, is issued by the seller after the goods or services have been delivered, requesting payment for the items provided.

Can you invoice without a purchase order?

Yes, you can invoice without a purchase order, but it depends on the business’s processes and agreements between the buyer and seller. In some cases, businesses may operate without purchase orders, especially for smaller or recurring transactions. However, using purchase orders helps ensure clear communication and reduces the risk of disputes over terms and pricing.

Is the invoice issued after the purchase order?

Yes, an invoice is typically issued after a purchase order. The purchase order is created by the buyer to request goods or services, while the invoice is issued by the seller after the goods or services have been delivered. The invoice details the amount due, and payment terms, and serves as a request for payment based on the original purchase order.

What is the purpose of a purchase order?

The purpose of a purchase order is to formally document and authorize a buyer’s request for goods or services from a supplier. It outlines the specific items, quantities, agreed-upon prices, delivery dates, and payment terms. A purchase order helps ensure clear communication, provides legal protection, and serves as a binding agreement once accepted by the supplier.

Why is PO required?

A purchase order (PO) is required to ensure clear communication between the buyer and seller, detailing the specifics of the transaction, such as quantities, prices, and delivery terms. It provides legal protection by serving as a binding contract once accepted by the seller, helps prevent disputes, and facilitates accurate record-keeping and financial management within the organization.

When should you use a purchase order?

You should use a purchase order when procuring goods or services, especially in business-to-business transactions, large purchases, or when working with new suppliers. Purchase orders are essential when you need to clearly define the terms of the purchase, such as quantities, prices, and delivery dates, and when you want to establish a formal agreement that ensures both parties are aligned.

How are purchase orders and invoices similar?

Purchase orders and invoices are similar in that both documents play crucial roles in the procurement and payment processes. They both detail the specifics of a transaction, including the items or services involved, quantities, and agreed-upon prices. Additionally, both serve as formal records that help ensure clear communication between buyers and sellers, facilitating accurate financial tracking and management within a business.

Does a purchase order need to match an invoice?

Yes, a purchase order should generally match the corresponding invoice to ensure that the goods or services delivered align with what was originally requested. This matching process, often called “three-way matching,” involves comparing the purchase order, the invoice, and the receipt of goods or services. Ensuring these documents match helps prevent discrepancies, avoids overpayments, and maintains accurate financial records.