It may sound like extra work but bank statement reconciliation is a critical financial process involving the comparison of one’s bank statement with their personal or business accounting records.

This practice ensures accuracy, highlights any discrepancies, and confirms that every transaction is accounted for correctly.

Regularly reconciling bank statements is vital for both personal and business accounts, serving as a cornerstone for sound financial health. It can be likened to a regular health check-up for your finances, pinpointing any issues before they become severe problems.

Reason #1: Finding Financial Data Inaccuracies

One of the main answers to the question of why is it important to reconcile your bank statements is discovering inaccuracies in financial data early on can prevent small errors from snowballing into concerning issues.

Regular bank reconciliation helps in identifying mistakes like double billings or missed payments, ensuring that your financial records accurately reflect your actual financial status.

This precision is crucial for maintaining trust in your financial reporting and making informed decisions based on accurate data.

Reason #2: Accurate Financial Reporting

Banks are not always perfect with their information. That’s why accuracy in financial reporting is essential for the health of any business or personal finance.

You can guarantee that your financial statements provide a true and fair view of your financial position when you’re checking regularly.

This reliability is critical for stakeholders, investors, and for making strategic business decisions, as well as for personal financial management and planning.

Reason #3: Save Time Resolving Problems

Addressing discrepancies early on can save a significant amount of time and effort that would otherwise be spent untangling issues from months or years back. It prevents from making problems from escalating and dealing with a whole mess.

Regular reconciliation allows for timely corrections, simplifying financial management and minimizing the need for complex problem-solving later.

Reason #4: Keep Accurate Tax Reports

Keeping your tax records precise is a clear advantage of regularly matching your bank statements. This method makes sure every financial transaction is correctly noted, helping to avoid any issues when filing taxes.

Getting your taxes right is necessary to prevent extra charges from the government. These records can also be used when there are allegations of fraud to cooperate during investigations.

Reason #5: Reduce Fraud and Theft

Regular reconciliation acts as a deterrent to fraud and theft by closely monitoring transaction activities. Identifying unauthorized transactions quickly can help in taking immediate action, reducing potential losses.

Businesses can be vigilant in safeguarding their financial assets and ensuring the security of their financial transactions.

Reason #6: Avoid Costly Penalties and Fees

Catching and correcting errors or discrepancies earlier can avoid overdraft fees, late payment penalties, and other charges that may arise from inaccuracies in your accounts.

Regular bank reconciliation ensures that your financial records are in order during tax season, helping you manage your finances more efficiently and avoid unnecessary expenses through tax obligations

Reason #7: Validate Data Entry

Regular reconciliation helps validate bookkeeping data entry, ensuring that every transaction is accounted for and correctly categorized. This step is crucial for maintaining accurate and reliable financial records, which are essential for effective financial management and analysis.

If you have manual data entry practices, this is necessary as it is prone to mistakes. An accurate alternative is using OCR bank statement converters like DocuClipper. It processes bank statements in a few seconds with more accurate results than data entry manually.

Reason #8: Improve Budgeting & Financial Planning

An accurate understanding of your financial situation is important for budgeting and planning. Reconciliation provides a clear picture of your finances, helping you to decide on better financial moves.

It can make businesses and organizations more efficient in terms of their costs as financial management can have a grasp on areas to cut losses.

Reason #9: Enhance Cash Flow Management

Effective cash flow management relies on an accurate picture of your financial situation like when you categorize transactions. Regular reconciliation helps identify the timing and amounts of incoming and outgoing transactions, allowing for more precise cash flow forecasting.

This insight is necessary for managing operational expenses, planning for future investments, and securing financial stability.

Reason #10: Improve Audit Readiness

Being prepared for audits with up-to-date and accurate financial records reduces the stress and complexity of the audit process.

Regular bank reconciliation ensures that your financial statements are ready for review at any time, facilitating a smoother audit experience and demonstrating your commitment to financial integrity.

Reason #11: Peace of Mind

Perhaps the most significant benefit of regular bank reconciliation is the peace of mind it offers. Knowing that your financial records are accurate and up-to-date provides confidence in your financial health and decision-making.

This allows you to focus on other aspects of your business or personal life, secure in the knowledge that your finances are in good order.

What is Bank Reconciliation?

Bank reconciliation is the process of verifying that your accounting records (in your ledger or accounting software) match the transactions listed on your bank statement.

This process involves checking each transaction individually to ensure that amounts are correct and that they are recorded in the correct account.

Why is Bank Reconciliation Important in Business Accounting?

In business accounting, bank reconciliation is important for maintaining accurate financial records. It helps in detecting and rectifying errors, fraud, or unauthorized transactions, which can significantly impact a business’s financial health.

It also supports compliance with accounting standards and tax laws, making it an essential practice for businesses of all sizes.

For non-accountants, learn the differences between bank statement vs bank reconciliation.

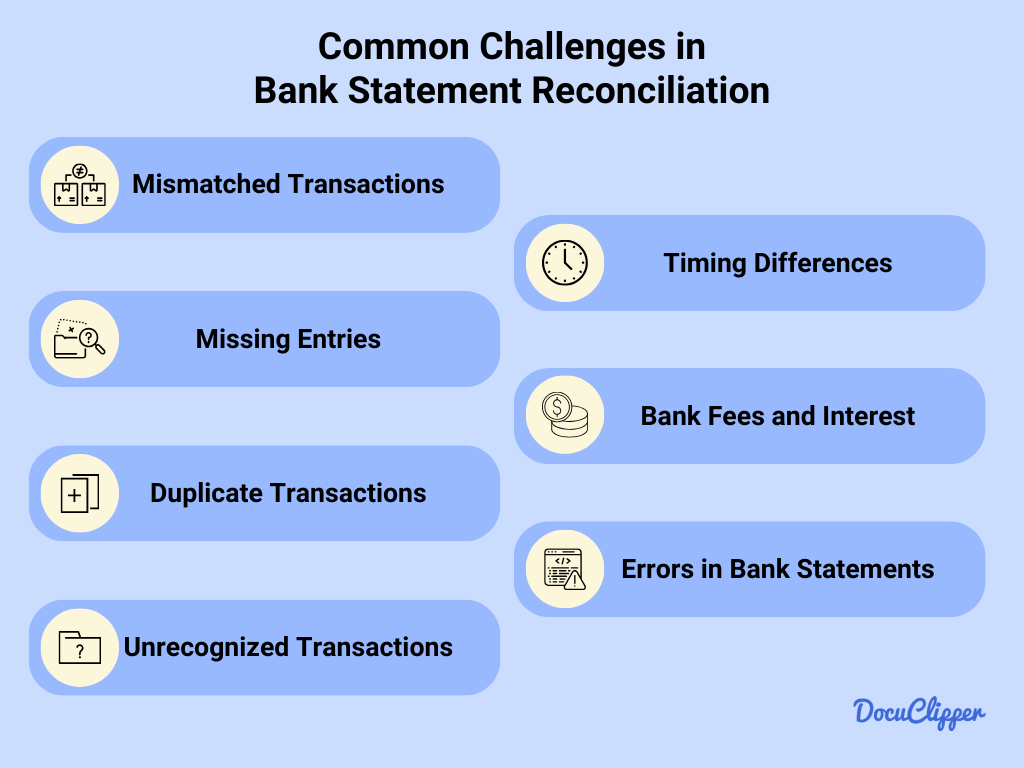

Common Challenges in Bank Statement Reconciliation

Checking your bank statements against your records is important to keep your money matters straight, but it can sometimes be tricky.

Here are seven common problems people run into while doing it:

- Mismatched Transactions: Sometimes, the amounts recorded in your accounting system don’t match the transactions listed on your bank statement. This could be due to errors in entry or differences in transaction dates.

- Missing Entries: Transactions that appear on your bank statement but are not recorded in your accounting records can cause discrepancies. This often happens with automatic bank fees or direct debits that were not anticipated.

- Duplicate Transactions: The accidental recording of a transaction more than once in your accounting system can lead to a confusing difference between your records and the bank’s records.

- Unrecognized Transactions: You might find transactions on your bank statement that you don’t recognize immediately. This could be due to fraud, bank errors, or simply forgetting about a purchase.

- Timing Differences: Some transactions may be recorded in your accounting system in a different period than they appear on your bank statement, especially towards the end of the month. This can make reconciliation tricky.

- Bank Fees and Interest: Banks may charge fees or add interest that you weren’t aware of or forgot to record, leading to discrepancies between your records and the statement.

- Errors in Bank Statements: Though rare, banks can make mistakes too. Transactions might be wrongly recorded or completely missed in the statement, requiring vigilance during reconciliation to catch these errors.

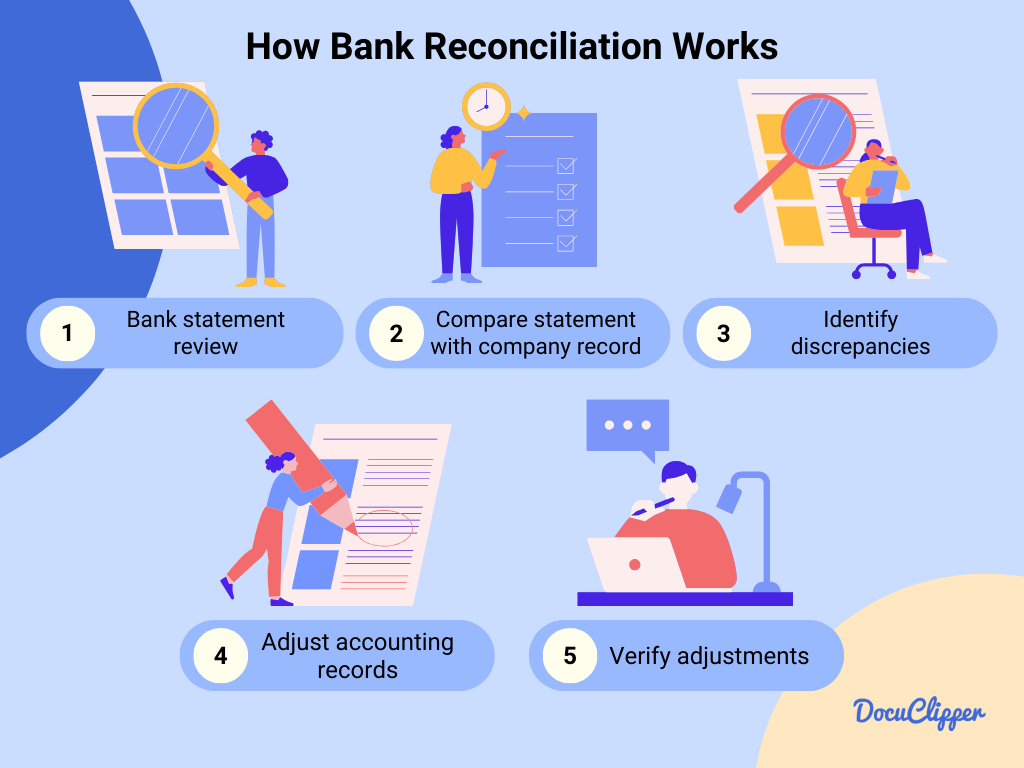

How Bank Reconciliation Works

It may sound complicated but reconciling bank statements is quite simple, especially with the available tools that we have today. Here’s how it typically works:

- Reviewing the balance as per bank statements.

- Comparing the bank’s transactions with the company’s ledger accounts.

- Identifying and investigating any discrepancies.

- Making adjustments in the accounting records to reflect the correct transactions.

- Verifying that the adjusted balances match.

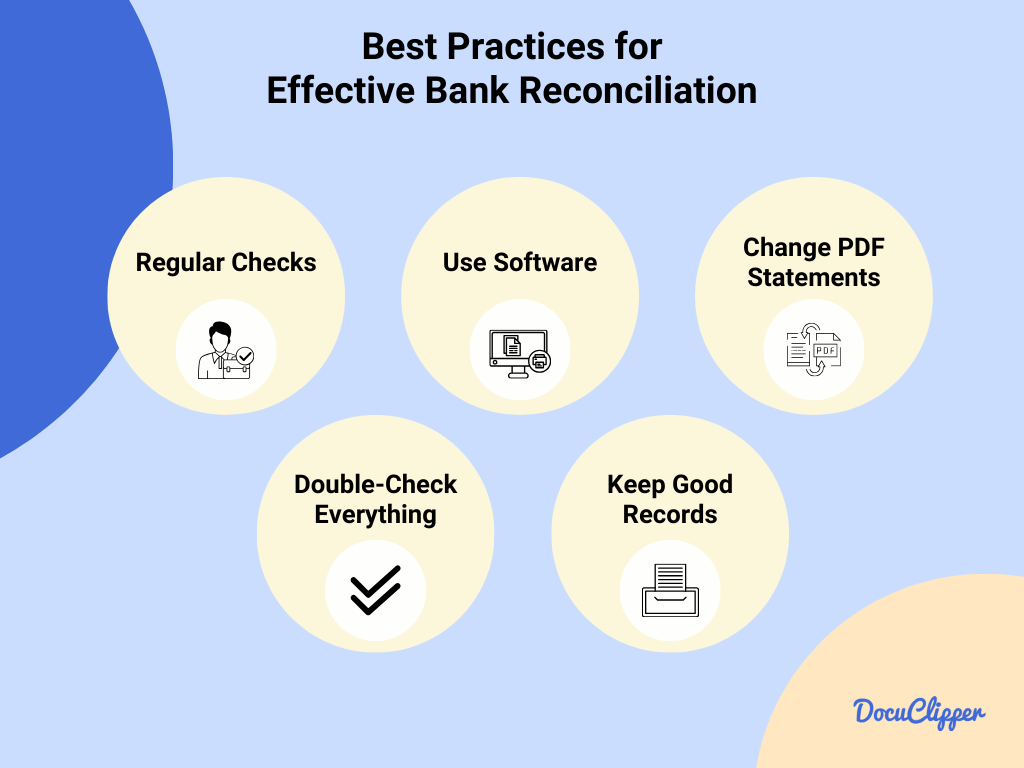

Best Practices for Effective Bank Reconciliation

Keeping your money matters in order is easier when you follow some key steps for checking your bank statements. Here’s a simple way to do it:

- Regular Checks: Make it a routine to look over your accounts often. This helps you catch mistakes early and keeps your records right up to date.

- Use Software: Use programs that can do some of the checking work for you. This can save you time and cut down on mistakes like transaction categorization and reconciliation.

- Change PDF Statements: Process your bank statements from PDFs into Excel, CSV, or QBO files. This makes it easier, for example, to import bank statements to QuickBooks online.

- Double-Check Everything: Always take a second look to make sure all the numbers add up after you’ve matched them.

- Keep Good Records: Write down all your money movements in detail. When you have clear records, matching them with your bank statements is a lot smoother.

Conclusion

Keeping up with your bank statement reconciliation goes beyond just a wise financial habit—it’s an essential protective measure for your financial stability.

It guarantees precision in your financial reporting, supports effective budgeting and planning, and offers the comfort of knowing your financial records are spot on.

By following practices, like transforming bank statements into easier-to-handle formats and using accounting software, you can make the reconciliation process smoother and lay a strong groundwork for your financial health.

How DocuClipper Can Help You Reconcile Your Bank Statements

After reading this blog, you might even feel that reconciling your bank statements is quite a stretch even with the reasons why you should. DocuClipper can help you with that one.

DocuClipper is an OCR bank statement converter that converts PDF bank statements into XLS, CSV, and QBO. It also has features that categorize bank transactions and it is easily linked to accounting software like QuickBooks, Xero, and Sage.