Transform Your Bank Statement Reconciliation with Precision and Ease

Seamlessly reconcile bank statements with DocuClipper’s advanced technology. With DocuClipper accuracy meets simplicity, ensuring your financial data is always in clean and accurate. Say goodbye to manual errors and hello to streamlined efficiency.

TRUSTED BY THOUSANDS OF BUSINESSES ACROSS THE GLOBE

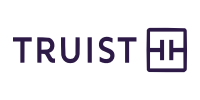

Revolutionize Bank Reconciliation Statement with DocuClipper

Effortlessly reconcile bank statements with unmatched speed and unparalleled accuracy.

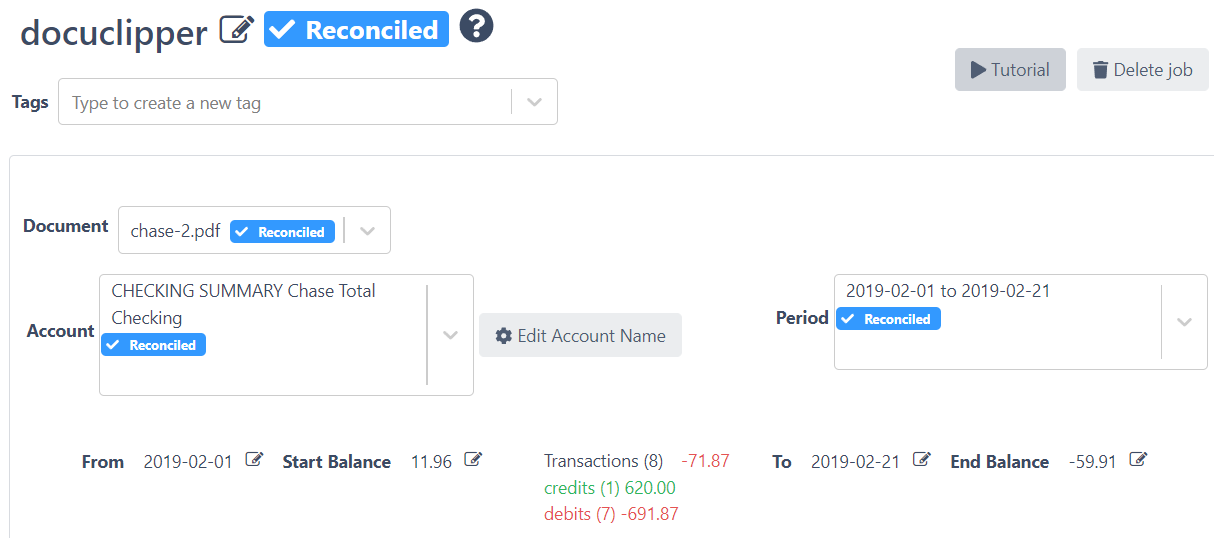

Works for Any Bank Statement

Seamlessly reconcile statements from any bank, ensuring complete financial oversight with ease.

Reconciliation Done in Around ~20 Second

Experience lightning-fast reconciliation, turning hours of work into mere seconds of simplicity.

Great for Verifying Conversion Accuracy

Guarantee impeccable conversion accuracy, ensuring every transaction aligns perfectly.

Ideal for Detecting Fake Bank Statements

Easily identify fake bank statements, a critical tool for financial integrity and trust.

Batch Processing for Same and Different Bank Statements

Efficiently manage multiple statements, both similar and diverse, with our advanced batch processing feature.

Utilize the Most Advanced Bank Statement Converter

Accountants/Bookkeepers

- Efficiency in Data Management: Streamline your workflow with rapid, accurate data conversion, freeing up time for strategic financial management.

- Error Reduction: Minimize manual entry errors with our 99.5% accuracy rate, ensuring reliable financial records.

Financial Investigators

- Detailed and Accurate Reporting: Leverage precise data for thorough financial investigations and analysis.

- Multi-Account Tracking: Easily dissect complex financial statements with multi-account detection, enhancing investigative efficiency.

Lenders

- Quick Loan Processing: Accelerate loan application processing with efficient, accurate financial data extraction.

- Reliable Financial Assessment: Base your lending decisions on highly accurate and quickly processed financial data, reducing risk.

Family Law

- Effortless Financial Management: Simplify complex legal financial matters with automated QuickBooks data entry, streamlining the financial aspects of family law cases..

- Financial Oversight: Ensure precise financial record-keeping with high accuracy, providing clear financial insights for legal proceedings.

See Why Finance Professionals Love DocuClipper

Documents Processed

Customers

Accuracy

Avg. Processing Time

DocuClipper Cleanly Extracted the Data

It is an intelligent product that eliminates ugly Adobe "Save as" output woes. It was easy to use and offered a number of surprisingly well-thought-out features.

DocuClipper saved us a lot of time

DocuClipper has helped us eliminate several manual data entry processes, saving us a lot of time.

Frequently Asked Questions about Bank Statement Reconciliation

Bank statement reconciliation is the process of comparing your internal financial records against your bank statements to ensure they align correctly. It’s crucial for detecting errors, preventing fraud, and maintaining accurate financial records. Regular reconciliation ensures the integrity of your financial data, crucial for informed decision-making and compliance.

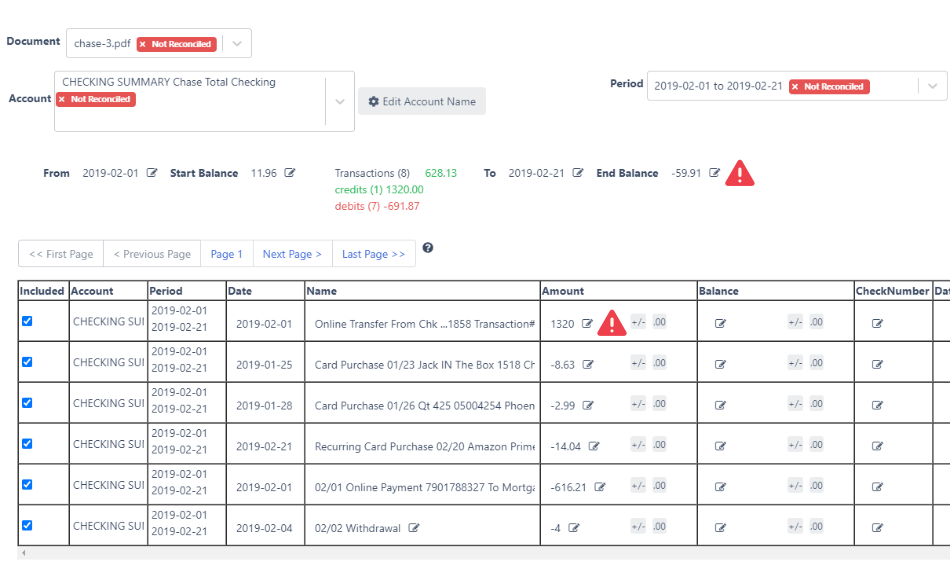

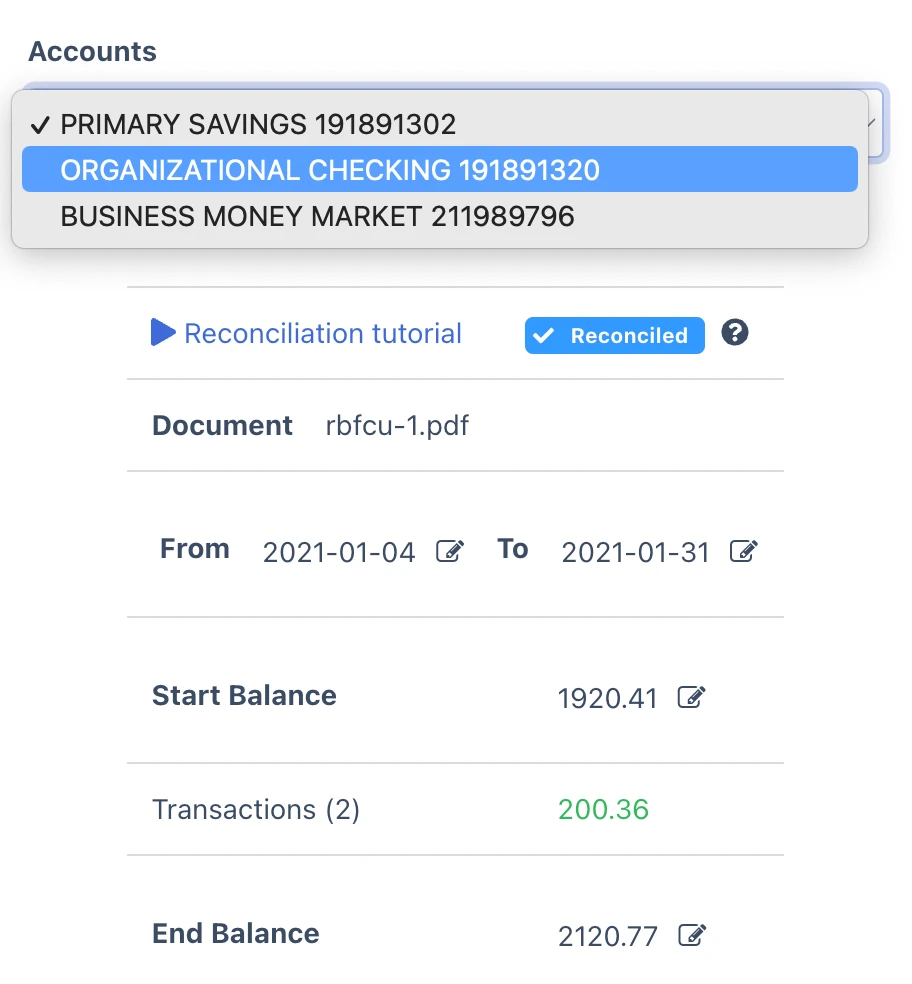

DocuClipper’s reconciliation feature automates the comparison of transaction records with your bank statements. It reads the start and end balances, sums up credits and debits, and checks for consistency. If the transactions align with the statement balances, the statement is marked as reconciled. This automation significantly reduces the manual effort and time involved in the reconciliation process.

Yes, DocuClipper is designed to handle bank statements from a wide range of financial institutions. Our system is equipped to adapt to various formats and layouts, ensuring compatibility with different banks’ statements, making it a versatile tool for businesses of all types.

DocuClipper boasts a high accuracy rate of 99.5% in its reconciliation process. This level of precision is achieved through advanced algorithms and validation techniques, ensuring that your financial records are consistently reliable and error-free.

Absolutely. DocuClipper is scalable and can efficiently handle reconciliation tasks for businesses of any size. Whether you’re a small business managing a few accounts or a large enterprise dealing with complex financial data, DocuClipper can adapt to your specific needs, providing the same level of accuracy and efficiency.

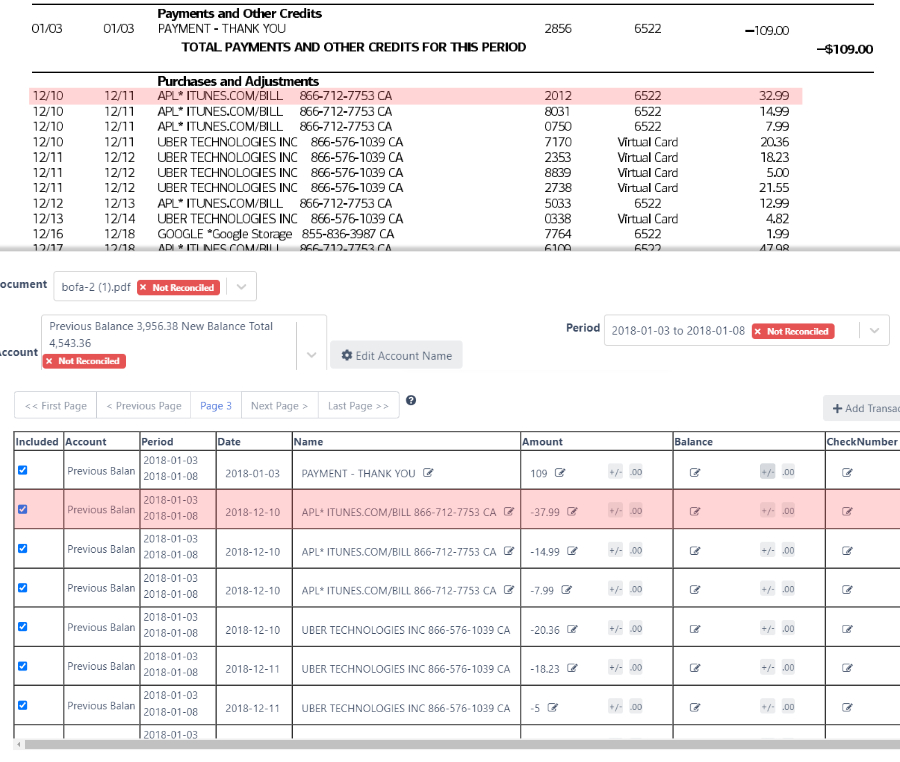

When DocuClipper is unable to reconcile a bank statement, it will display a status of “Not Reconciled.” Users are then required to review the statement to identify and investigate any inconsistencies or mistakes. This process may involve checking transaction entries, start and end balances, and ensuring all transactions are accurately recorded. DocuClipper provides the tools to facilitate this review, but the detailed investigation is conducted by the user.

Yes, DocuClipper can be instrumental in identifying fake bank statements. Since fake statements often have discrepancies or mathematical errors, our reconciliation tool’s ability to detect inconsistencies can flag potential forgeries. If a statement does not reconcile correctly, it may be an indicator that the statement is altered or fabricated, prompting further investigation.

The time saved using DocuClipper can be significant. Traditional manual reconciliation processes can take hours, depending on the volume of transactions. With DocuClipper, the reconciliation process can be completed in a fraction of that time, often in seconds or minutes, depending on the complexity and length of the statement. This efficiency allows you to reallocate valuable time to other critical financial tasks.